SEMA News—July 2022

RESEARCH

Examining the Post-Pandemic Rebound

SEMA Market Research Reveals an Industry Primed for Steady Growth in 2023

By Mike Imlay

Despite the many recent economic disruptions, the aftermarket continues to see growth and strong demand. The Spring 2022 “SEMA State of the Industry Report” is designed to help specialty automotive businesses grasp the current landscape and make sound market decisions.

With the final quarter of 2022 approaching and the pandemic largely receding, there’s good economic news for the aftermarket. According to recently released SEMA market research, the automotive specialty-equipment industry continues to enjoy strong growth and is well positioned for the coming year. That and other key takeaways can be found in the “State of the Industry—Spring 2022” report, now available for free download at www.sema.org/market-research.

The 71-page report is designed to help aftermarket operations make better business decisions based on current trends, business metrics and estimates on how sales have changed over the last year. Brimming with fresh data, the report closely examines the ongoing supply-chain disruptions vexing many organizations. In addition, it takes a “pulse check” on industry businesses, along with consumers in general, as they navigate economic uncertainty and significant price hikes on many goods

and services.

While the COVID situation continues to improve, lingering supply issues and inflation are dampening consumer views of the economy and their financial situations. So far, however, this is not slowing spending, which in turn is revving the economy and prices.

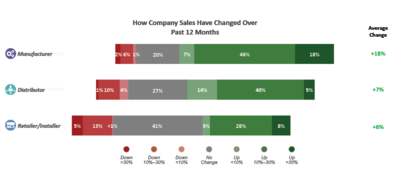

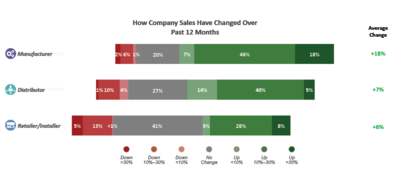

Perhaps most noteworthy, 75% of industry manufacturers, 68% of distributors and 53% of retailers/installers surveyed for the report indicated that sales are now above pre-pandemic levels. Moreover, consumer demand has remained robust for most companies. Amid this strong growth, however, the industry faces headwinds from ongoing supply-chain issues, inflation, economic uncertainty, and the war in Ukraine. Among the report’s other findings:

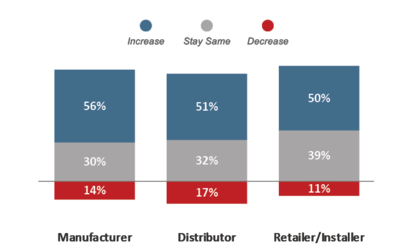

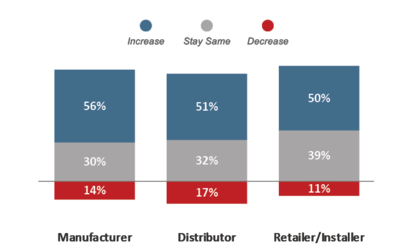

- More than half of industry companies expect continued sales growth in the coming year.

- Supply-chain issues remain a challenge for more than 90% of the industry, and most businesses don’t expect a return to normal until at least 2023.

- The current inflation rate of 8.5% (as of March 2022) is the highest it has been in 40 years, yet consumers continue to spend.

- Despite gas prices being up more than 40% on average from last year, 80% of Americans are still planning road trips this summer.

- Amid record consumer demand, 70% of manufacturers, 56% of distributors and 45% of retail installers have had difficulty filling open positions due to a shortage of qualified applicants.

“I think the biggest takeaway from our research is that companies are saying the demand for their products is greater now than it was in 2019,” said SEMA Market Research Manager Kyle Cheng. “Essentially, we’re looking at industry businesses doing better than they were before the pandemic.”

Unlike the massive sales frenzy that marked the peak of the pandemic, however, the growth going forward is shaping up as calmer and steadier.

“When we looked at how sales performed over the last year, we saw a lot of disruption, both in terms of record sales and then declines,” Cheng explained. “Now sales have started to flatten, and we’re getting back to more normal operations overall, with most companies saying that sales are good, business is good, and things are looking up.”

“When COVID kicked in, it looked like it was going to be really bad times for our industry and the economy overall, but it turned out to be just the opposite,” observed Gavin Knapp, SEMA director of market research. “In fact, these last two years have been really good for a big chunk of our industry.”

Knapp pointed to the industry’s manufacturing segment as particularly benefiting from heightened consumer demand.

“That said, some retail businesses did suffer hurt,” he noted. “There are also some warning signs as we look forward, both in terms of the general economy and specifically looking at the supply chain.”

Expectations for Sales Over Coming Year

The disruptions of the pandemic are starting to flatten, slowing runaway business growth to normal levels. The good news is the industry is still experiencing overall growth, which is bringing optimism for the year ahead.

In regard to demand for aftermarket products, three-quarters of surveyed manufacturers said that sales were better than in 2019, with nearly just as many (74%) reporting the same about consumer demand in general. In addition, 46% said their production levels were also better than in 2019. By contrast, only 35% said their employment levels were better. Finally, just 12% characterized their inventory and supply chains as improved over the same period.

Retailers and installers were somewhat more muted in their responses. On average, 53% said sales and consumer demand were better than in 2019. Even fewer (15%) reported their employment levels as exceeding those of 2019, and only 9% said that inventory and supply-chain conditions have gotten better since then.

Still, such figures represent a healthy reversal from the industry-wide shock brought by the early pandemic.

“Many of the companies that were disrupted by the pandemic—especially retailers—are reporting much less significant sales declines now,” Cheng observed. “In spring of this year, 19% of retailers said that they were experiencing declines. That’s a huge drop from the 41% who reported declines back in the fall of 2020.”

The report also pays considerable attention to broader consumer expenditures and their implications for the aftermarket. It finds that, even amid ongoing economic uncertainty, consumers continue to spend at high levels. Fueled by low unemployment, demand for products and services throughout the American economy remains strong. However, inflation and other factors are expected to tap the brakes and pull consumer demand back to more normal levels going into 2023.

“We’ve run out of government stimuluses,” Knapp explained. “Savings rates have come down, which means people will likely have less money to spend over this year than they did over the last two years. So while things are really good right now, and we’re certainly not looking at a collapse, there are some signs that we might see some real slowing going forward.”

One mitigating factor may be gas prices, which had soared to a national average of $4.20 per gallon by April of this year. So far, motorists appear to be taking the hike in stride. According to surveys, only 10% of them are extremely concerned about the rising costs at the pump. The vast majority are slightly (33%), somewhat (21%) or moderately (18%) concerned. Moreover, freed from pandemic constraints, roughly four out of five Americans are planning road trips this summer, many for significant distances.

“The national average for gasoline right now is insane, considering it usually is about half that of current levels,” Cheng said. “Despite that, consumers are holding on to some lingering habits of the pandemic. People still feel safer traveling by their cars, especially with airline tickets getting more expensive. Travelers are looking at their situations and figuring out what’s best for them, and that usually means driving.”

Perhaps a bigger question for consumers is what they’ll be driving.

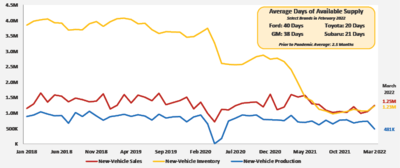

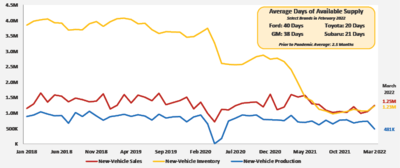

“Right now, goods are obviously expensive, and inflation is at a record high, which affects things related to our industry like used-car prices,” Cheng said. “They were up 35% over 2021 as of March 2022, and new vehicles were up 12.5%.”

Several factors have played into surging car prices. At the pandemic’s beginning, major OEMs slowed production or shut down assembly lines completely, at times furloughing workers. Although the closures were short-lived, they were enough to send automakers into a game of catch-up to meet unexpected demand. In addition, chip and other raw materials shortages have stymied production and pushed new-vehicle costs upward. That, in turn, has driven the value of older models to unprecedented levels. Consequently, many consumers are delaying vehicle purchases of all types.

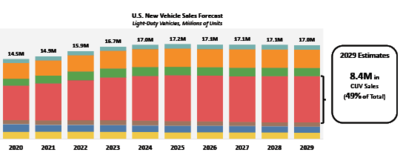

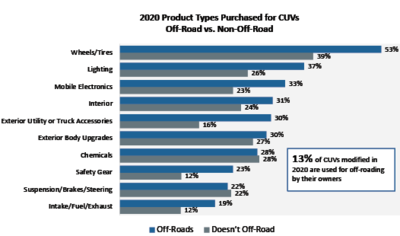

New Light-Vehicle Inventory in the United States

Due to supply-chain issues and chip shortages, among other factors, new-vehicle availability remains extremely tight. This will undoubtedly slow the rate of new-vehicle accessorization but may simultaneously increase the accessorization of older models.

“That brings up the supply chain—the next big thing relating to the economy and our industry,” Cheng said. “We surveyed industry companies and got a lot of detail on the situation. More than 90% are saying that they’re being affected moderately to severely by the supply-chain crunch. Sales are up, but it’s really hard for companies to keep up with demand due to production delays and the inability to get raw components or even the products themselves. Retailers also say they can’t keep up with demand and keep inventory full.”

Although supply-chain issues show every indication of easing over time, most industry businesses are tempering their expectations.

“When we ask companies about their outlook for supply-chain disruption, most think it will bleed into next year,” Cheng said. “Depending on whether they’re manufacturers or retailers, between 48% to 63% of companies expect the disruption to last until 2023 or later. But there’s also a good chunk that just don’t know. Continued consumer demand just makes the whole problem worse because it keeps cycling.”

“Companies are taking a lot of steps in response to the supply-chain issues,” Knapp added. “They’re bulking up their own internal capabilities for things such as manufacturing and even their inventory-holding capacities. They’re diversifying their supplier lists so that they have more opportunities. Some companies are even looking to source more from domestic suppliers rather than overseas suppliers. They’re finding ways to improve their business while also improving their ability to get through this crunch.”

Hand in hand with stubborn supply-chain tangles, both the industry and consumers will have to contend with persistent inflation as they enter 2023.

How company sales have changed over the past 12 months

Without minimizing the hurt that some aftermarket businesses definitely felt, most industry companies reported increased sales numbers over the past year. What’s more, demand for specialty automotive products remains significant.

“Inflation is at a record high,” Cheng explained. “It was 8.5% in March, and the biggest contributors to that happen to be factors that tangentially relate to our industry. It’s weighing on consumers’ minds, even if they do continue to spend a lot of money.”

Aftermarket businesses will also face a labor shortage for the foreseeable future—a double-edged sword that is sustaining consumer demand for product while simultaneously raising business costs.

“We’re really in a state of full employment,” Knapp said. “Anybody who wants a job right now has a job, which means people have steady sources of income and will be looking for outlets to do things.”

On the other hand, Cheng said, “Companies can’t find enough employees to keep up with demand. They need to hire, and they’re having trouble hiring, including in our industry.”

As of May, inflation, supply-chain snags, labor shortages and the war in Europe were raising the specter of a possible recession, but Cheng noted that the economic factors at play today are unlike those that preceded the Great Recession of 2008.

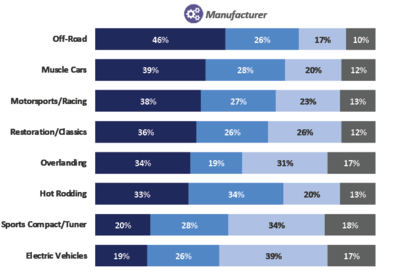

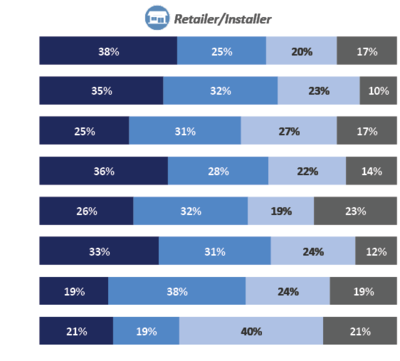

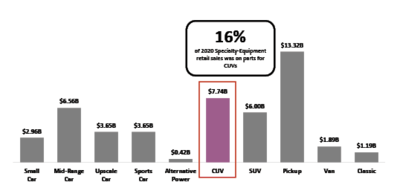

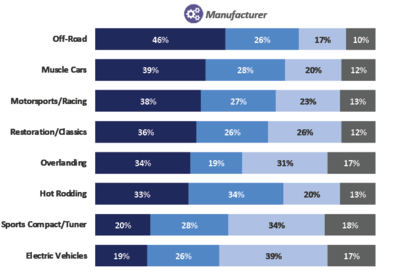

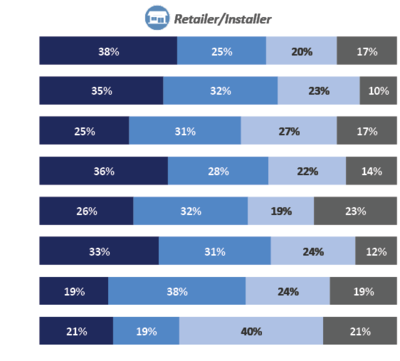

What Segments Does The Industry View as Having the Most Opportunity

Specialty-equipment companies are finding significant business opportunities across a variety of segments. Among these, the off-road and musclecar categories especially stand out.

“No one can ever really know for sure, but based on the sources we consult, a recession is not on the radar—at least not in the short term,” he said.

In fact, Knapp believes that the real story going into 2023 is one of resilience and optimism.

“The interesting thing is that if you looked at April 2020, when things collapsed, and into the summer of 2020, we were all expecting our industry to drop overall,” he explained. “But by the time the end of that year came around, the script had flipped and sales were going gangbusters. Through 2020, we actually ended up right where we would have expected without the disruption.

“At this point in time, our industry is feeling really good in terms of sales and consumer demand, and while we definitely see some potential difficulties ahead, there’s still a general expectation that things will remain good.”

Stay on the Growth Curve

As the industry moves beyond the pandemic, economic trends information is more vital than ever for business planning. For your free download of the 71-page “SEMA State of the Industry Report—Spring 2022,” visit the SEMA Market Research webpage at

www.sema.org/market-research.

While there, be sure to also check out the monthly “SEMA Industry Indicators Reports” for regularly updated economic data affecting the aftermarket.

Yokohama Tire Corporation (YTC) announced that Ray Polentz was promoted to senior director of supply chain and logistics. He will report to Yokohama President and CEO Jeff Barna. Polentz, who works out of YTC headquarters in Santa Ana, California, joined Yokohama in October 2017 as regional distribution center manager. He was promoted to director of distribution operations in July 2018. Before joining Yokohama, Polentz had more than 15 years of supply chain and logistics experience. He previously held senior positions at JCPenney as well as Stein Mart in both operational and transportation roles.

Yokohama Tire Corporation (YTC) announced that Ray Polentz was promoted to senior director of supply chain and logistics. He will report to Yokohama President and CEO Jeff Barna. Polentz, who works out of YTC headquarters in Santa Ana, California, joined Yokohama in October 2017 as regional distribution center manager. He was promoted to director of distribution operations in July 2018. Before joining Yokohama, Polentz had more than 15 years of supply chain and logistics experience. He previously held senior positions at JCPenney as well as Stein Mart in both operational and transportation roles. Hyundai Motorsport announced a change to its senior management, with Sean (Seon-Pyung) Kim taking over the role of president. He replaces outgoing President Scott Noh, who is set to take up a new position at Hyundai Motor Company in Korea. During Noh’s tenure, Hyundai Motorsport secured consecutive world titles in the FIA World Rally Championship (2019 and 2020) and the FIA World Touring Car Cup (2018 and 2019).

Hyundai Motorsport announced a change to its senior management, with Sean (Seon-Pyung) Kim taking over the role of president. He replaces outgoing President Scott Noh, who is set to take up a new position at Hyundai Motor Company in Korea. During Noh’s tenure, Hyundai Motorsport secured consecutive world titles in the FIA World Rally Championship (2019 and 2020) and the FIA World Touring Car Cup (2018 and 2019). World Products appointed Lance Stillwell as its director of operations. Stillwell will oversee the development and manufacturing of World Products’ engine blocks and cylinder heads. In 1997, Stillwell founded parts provider and engine builder Motorsports Unlimited in Terre Haute, Indiana. Today, he has more than 25 years of engine machining experience and in-depth knowledge of World Products’ product line, the company stated.

World Products appointed Lance Stillwell as its director of operations. Stillwell will oversee the development and manufacturing of World Products’ engine blocks and cylinder heads. In 1997, Stillwell founded parts provider and engine builder Motorsports Unlimited in Terre Haute, Indiana. Today, he has more than 25 years of engine machining experience and in-depth knowledge of World Products’ product line, the company stated.