SEMA News—December 2021

RESEARCH

New SEMA Research Sheds Light on Emerging Vehicle Trends

Five Things to Know About the Shift to Alternative Power, Electrification and More

By Mike Imlay

Anyone following the headlines knows that the automotive industry is entering an era of transformation, with virtually every major automaker now intent on vehicle electrification. Add to that the rapid deployment of advanced driver-assistance and related autonomous driving technologies, and it’s easy to believe that a brave new world of green transportation is barreling toward us. But are the headlines overly optimistic? How fast will industry transformation come? What challenges or opportunities will today’s emerging technologies pose for the aftermarket?

The new “Emerging Trends: Electrification, Alternative Power and Advanced Technology” report from SEMA Market Research goes beyond the headlines to offer realistic projections about the new technologies promising to transform the automobile.

Dig a little deeper, and you’ll learn that sales of alternative-power vehicles currently represent just 5% of all U.S. light-vehicle sales—and likely won’t reach even 45% saturation until 2035. Moreover, three-quarters of Americans still prefer gas- or diesel-powered vehicles and have concerns about alternative-power charging infrastructure, driving range and costs. What’s more, American consumers express significant reservations when it comes to self-driving vehicles.

Those are just a few of the takeaways found in the newly released “Emerging Trends: Electrification, Alternative Power and Advanced Technology” report from SEMA Market Research. The report is designed to help specialty-equipment companies make better sense of rapidly evolving vehicle ecosystems and their implications for the automotive specialty-equipment industry.

“We’re excited about this report because we’re not just talking about technologies somewhere out there in the future, but changes that are beginning to happen now,” said SEMA Market Research Director Gavin Knapp. “One of our goals is to help SEMA members understand how the automotive market is evolving and adapting. Unfortunately, there’s a lot of hype in the media, with people making predictions that aren’t necessarily reasonable. We’re presenting what we think is a more real and rational assessment of where things are going over the next 10 to 15 years.”

ALTERNATIVE-POWER VEHICLES SALES ARE GROWING

In 2020, alternative-power vehicles comprised only 5% of total light-vehicle sales. That is projected to grow to 45% by 2035. Hybrid powertrains are currently the top sellers, but electrics are expected to eclipse them by 2026.

The 70-plus-page report analyzes the current vehicle landscape, the outlook for electric vehicles (EVs) and their adoption in the United States, some anticipated electric and hybrid models, the impact of EVs on the aftermarket, and a host of other emerging technologies and trends. Some of the report’s most interesting factoids include:

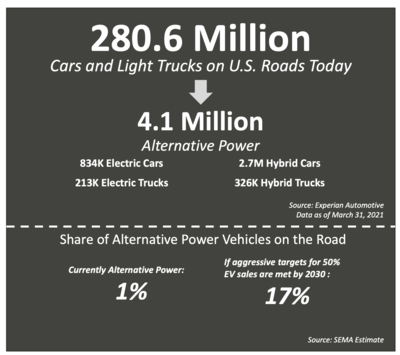

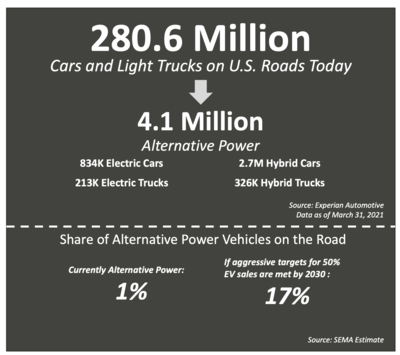

- There are currently 4.1 million alt-power vehicles on U.S. roads today. That represents 1% of light vehicles in operation.

- While their sales are growing, the shift toward EVs faces significant hurdles around range, charging and electrical power generation.

- As sales of electric and other alt-energy vehicles increase in coming years, it will take a while for current vehicles to cycle out of operation. The average age of a vehicle today is just over 12 years.

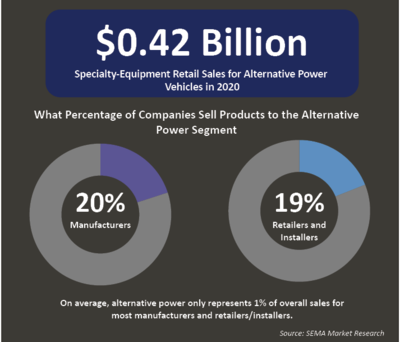

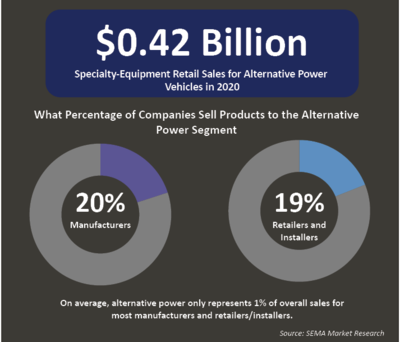

- Alternative power currently represents a very small share of specialty aftermarket sales but will be more important as their presence grows. In 2020, alternative power accounted for only a 1% slice of specialty-equipment retail sales.

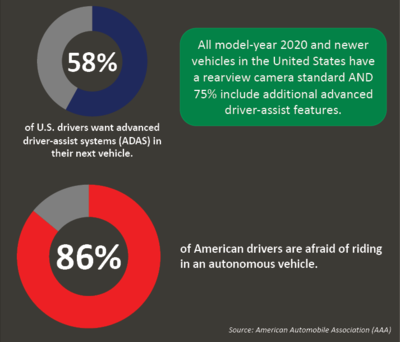

- Automakers are accelerating their integration of advanced technologies into vehicles to increase safety and comfort on the road. That has opened potential growth opportunities for the aftermarket in the upfitment of older vehicles.

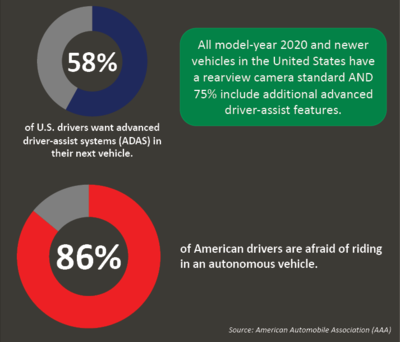

- While 58% of drivers want more safety features, 86% say they are afraid of fully autonomous vehicles. They cite safety and liability as their biggest concerns.

Building on the above findings, the following are five key things the aftermarket needs to know about emerging automotive trends.

ALTERNATIVE POWER IS NOT TAKING OVER ANYTIME SOON

There are currently 4.1 million alternative-power vehicles on U.S. roads today—just 1% of light vehicles in operation. Even with the most ambitious projections for EV sales, traditional combustion engines will dominate American highways for some time to come.

1. The Automobile Market Is Going Electric

The trend is unmistakable: Vehicles are changing. Electric and hybrid powertrains are gaining popularity, and automakers are trumpeting bold electrification plans. Out of the top 20 global automakers, which together represented around 90% of new-car registrations worldwide in 2020, 18 are already at work widening their portfolios of alternative-power models and scaling up production of EVs. On top of that, new vehicles of all types are increasingly equipped with advanced innovations for safety and comfort.

Consumers are warming to these advances as well. While environmental concerns no doubt motivate many hybrid and pure-electric purchasers, the appeal of today’s alternative-vehicle platforms runs deeper. Newer electrics boast characteristics that even a performance enthusiast can love.

“Tesla’s Plaid version of its Model S can go 0–60 in 1.9 sec. and cover a quarter-mile in less than 10 sec.,” observed SEMA Market Research Manager Kyle Cheng, who compiled the report. “If you were ever to put it on a dragstrip at those speeds, you’d have to have a parachute—so you wouldn’t even be allowed to run that car. The point is, you get a lot of performance bonuses with electrics—particularly at lower speeds—that you don’t typically see in a consumer-friendly traditional car.”

But there is more at play here than rising consumer interest in new-tech vehicles. On the manufacturing side, automakers are seeing a host of market incentives to accelerate production—not all of which are immediately apparent to the public.

THE AFTERMARKET IMPACT OF ALT POWER HAS BEEN LIMITED

In 2020, alternative power accounted for only 1% of specialty-equipment retail sales at $.42 billion. As more electric models are released—particularly in enthusiast segments such as pickups—the industry will face strong impetus to adapt to the changing landscape.

“Alternative vehicles get media coverage,” Knapp explained. “You hear a lot about government regulations or goals. You hear a lot about going green and environmental concerns pushing them. But the reality is that there are other driving forces as well. The biggest one is economic.

“If you compare an electric vehicle against an internal-combustion vehicle, there are just a whole lot fewer parts to deal with. That means a company assembling a vehicle can have a much simpler assembly line. It can have a much simpler parts-procurement system and supply chain, which means it can save a lot of costs.

“Secondly, the market cap—the valuation of Tesla and its stock price—is astronomical. It’s not directly related to the business, how many cars the company makes or how much money it makes. The market mindset right now is to push those types of stocks, and all the car companies want in on that, so they’re going to position themselves as electric or alt-fuel vehicle companies to gain access to that capital.”

Based on their stated North American goals through 2025, all major automakers plan on increasing the electric and hybrid models in their lineups. Ford will commit $28 billion toward EVs through 2025, while GM is investing $27 billion toward offering 30 different EV models globally over the same period. Volkswagen, Toyota, BMW, Audi, Volvo and others have announced ambitious programs of their own.

TECHNOLOGY IS INCREASING, BUT AUTONOMOUS IS STILL FAR AWAY

Although there’s significant desire among consumers for advanced driver-assistance systems (ADAS) that enhance safety and comfort, buyers are much less enthusiastic about full vehicle autonomy. Meanwhile, ADAS is opening up aftermarket growth opportunities in the area of enhancing older vehicles.

In the longer term, GM says that it will eliminate light-duty diesel and gas powertrains by 2035 to 2036. In that same time frame, Subaru promises that it will offer hybrid or electric variants for every model in its lineup, and Jaguar hopes to reach zero tailpipe emissions for its vehicle lineups. By 2050, Nissan, Mazda and Mitsubishi all expect to reach net-zero carbon emissions. The list of automaker examples goes on, but the trend is clear.

Of course, the Biden administration has also set its own target goal of 50% of the new-vehicle sales becoming electric, plug-in-hybrid or fuel-cell propelled by 2030.

2. The Transition Will Be Incremental

With clean(er)-emissions platforms and OEM pronouncements making headlines, you could easily get the impression that full vehicle electrification will soon be the norm, but the data suggests otherwise. Despite changing consumer sentiment, media narratives, OEM objectives and government incentives, the production and uptake of electric and hybrid platforms have been slow to date. Moreover, SEMA market research indicates that the shift away from internal-combustion vehicles will be gradual over decades, not years.

Of the more than 280 million vehicles presently in operation in the United States, a mere 4.1 million fall into the alternative category, with sales concentrated mainly in California, the west, and a few scattered metropolitan areas. As of 2021, alternative powertrains accounted for just 6% and 2% of Ford and GM sales, respectively. Among automakers worldwide, only Toyota can claim double-digit sales at 24%.

Knapp said that the definition of the term “alternative” matters here. More often than not, OEM sale figures reflect the full range of alternative platforms, including gasoline hybrids.

“So we’re not talking about just pure electric,” he said. “We’re talking some use of internal combustion, too.”

“Right now, no one’s really selling alternative power like Toyota, which has been investing in its hybrid platforms for a while,” Cheng added. “The Prius has been out almost 20 years now, and a lot of Toyota’s sales have come from that. But outside of that model, its alternative-vehicle sales are pretty low, so when we hear companies forecasting big jumps in alternative sales, they’re going to have to make some pretty drastic shifts to get there.”

“It would mean stopping everything they’re doing today and doing something different in the course of the next five, eight, 10 years, depending on what they’re projecting—and that’s probably just not reasonable,” Knapp agreed.

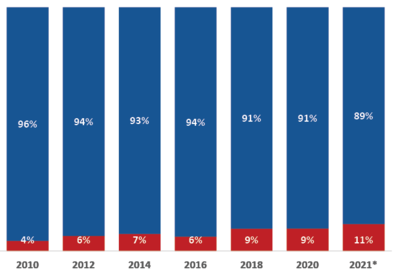

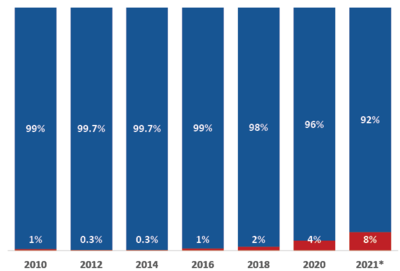

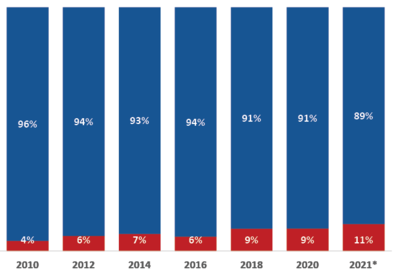

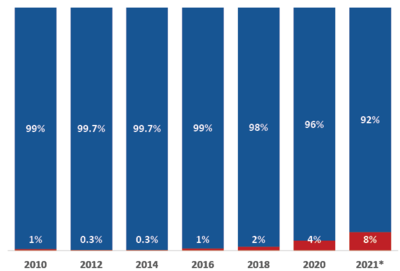

POWERTRAIN SALES BY VEHICLE TYPE (PASSENGER CARS)

POWERTRAIN SALES BY VEHICLE TYPE (LIGHT TRUCKS)

Over the last decade, alternative-power vehicles in the United States typically have been small passenger cars. However, that is expected to change as automakers shift production toward the light-truck category. The question for the aftermarket: Will enthusiasts modify their alt-powered trucks as they traditionally have? Source: 2021 Wards Intelligence, a division of Informa. Data as of August 2021.

Moreover—alternative-vehicle sales notwithstanding—the average vehicle lifespan in the United States stands at approximately 12 years. Just doing the arithmetic tells you that with millions of internal-combustion vehicles already or soon to be on the road, they will dominate the landscape for years to come.

In the meantime, full vehicle electrification faces a number of hurdles beyond the automakers’ ability to churn out platforms. As Knapp pointed out, consumers haven’t yet bought into the newer technologies for several reasons.

First, there’s simple human nature and the hesitancy to abandon what one is used to. After all, internal combustion has become ingrained in the American psyche for more than 100 years as a standard and reliable technology. What’s more, without financial incentives or government subsidies, alternative-powered vehicles can be more costly to purchase and maintain over time than their gasoline-propelled cousins. But perhaps the biggest obstacle is convenience: Charging infrastructure and vehicle range are limited and don’t mesh with today’s consumer lifestyles.

“If you own a home and you can install a 240-volt Level 2 charger at your house, then you can charge your car completely overnight,” Knapp said. “If you can’t install that charger and have to use the regular 120-volt unit, it can literally take three or four full days to charge an electric from zero to full, and if you’re living in an apartment or a condo situation, you may not have any way to plug in at home, meaning you’d be completely dependent on finding chargers elsewhere. Of course, that also means sitting someplace random for an hour to charge.”

Today, there’s a developing infrastructure for alt-power consumers in large cities or along major highway corridors. However, those in non-urban areas or drivers who take long trips must consider the location of charging (or hydrogen and natural gas) stations and the stop time involved—not to mention their vehicle’s make and model.

“With a supercharging station, a Tesla can charge relatively quickly—20 to 40 min. for a good or almost full charge,” Cheng said. “Not every car is like that—especially the entry-level models that actually restrict the flow of electricity they can take in and so take longer to charge. When you pull up at a gas station, you can be done in five to 10 min. at most. But imagine having to wait in line with others if you suddenly need to charge your car.”

EVs suffer other limitations as well. They’re cleaner to run, but producing and “fueling” them is not as “green” as one might think. Manufacturing them creates roughly the same amount of greenhouse gases as traditional cars and trucks. The raw materials for their batteries often come from third-world countries whose mining practices are less environmentally sound. Their batteries also utilize toxic chemicals harmful to the ecosystem, and producing the electricity to charge them actually releases more greenhouse gases than processing gasoline. In short, the U.S. electrical grid is not ready to deal with a nation of electric cars in every garage.

Further complicating matters is the vexing chip shortage that’s likely to slow OEM production lines through 2022.

“Alternative-power vehicles tend to be even more technologically advanced than traditional cars, so they’re being hurt even more by the shortage,” Cheng said. “New electric vehicles such as the F-150 Lightning, the Tesla Cybertruck and the Hummer EV pickup have all gotten pushed back further and further. Until OEMs can rebuild the supply chain for a lot of these components, it’s probably going to be very disruptive for the electric market for a couple of years.”

Both Knapp and Cheng were quick to add that none of this should be seen as a disparagement of alt-powered vehicles. Automakers see them as the wave of the future, and they ultimately plan to overcome the industrial and scientific challenges involved. The only question is the speed at which OEMs and the aftermarket can adapt, innovate and win consumers over to the emerging technologies.

3. The Aftermarket Impact Has Been Limited

To date, electric and hybrid vehicles have had minimal impact on the specialty-equipment industry. Interestingly, SEMA market research found a near half-and-half split between alt-power vehicle owners who are automotive enthusiasts (48%) versus non-enthusiasts (52%). Given the small percentage of automotive consumers currently embracing those platforms, that makes for a very small enthusiast market. Overall, the specialty-equipment market sizing for EVs and hybrids is estimated at $0.42 billion, representing just 1% of aftermarket sales.

Top sellers in the category include exterior appearance upgrades; headlights and taillights; floormats and interior appearance products; maintenance oils, additives, waxes and cleaning products; mobile electronics such as TV and video cameras, and wireless and smartphone integration items; and interior lights, seats and upholstery products.

SEMA’s research suggests that, with the emerging technologies being so new and with so few alternative powertrains on the road, specialty-equipment companies haven’t yet figured out the best ways to engage with the segment. In addition, the new powertrains impose limitations on the integration of the aftermarket performance parts that traditionally drive enthusiast sales.

On the shop side, few businesses report investing much to improve tooling, equipment or employee training to address the alt-power segment. That will present both challenges and opportunities for the aftermarket as the segment grows.

4. Trucks Will Be Key to Alt-Power Acceptance

Light trucks have always been a prime category for the aftermarket, and the good news is that they will remain so as OEMs grow their alternative-vehicle lines. In its prior “SEMA Light Truck Market Snapshot” report, SEMA Market Research noted that automakers have rapidly expanded their light-truck lines to meet increased consumer demand, especially for pickups and crossover utility vehicles (CUVs). Thanks to the American predilection toward light trucks, auto producers are now at work extending that trend into the alt-power market.

“Overwhelmingly, new-vehicle sales are in the truck category—pickups, CUVs and SUVs,” Cheng said. “But up to this point, we’ve mostly seen alternative vehicles as very much entry-level, early-adopter vehicles such as the Chevy Bolt and the Toyota Prius. As we go forward over the next few years, there are estimates that we could see more than 100 new alternative-power vehicle models, and they will largely have to move toward the truck category.”

“Obviously, there have been some really high-profile examples of [electric] pickups being announced, even though no automaker seems to have been able to get one on the road just yet,” Knapp added.

He pointed to the Ford F-150 Lightning, Rivian R1T, GMC Hummer EV Pickup and Tesla Cybertruck as harbingers of the market’s direction. Knapp further predicted that such vehicles will open up a much wider range of opportunities for the aftermarket and grow the industry’s participation in the alt-power space.

5. Vehicle Electrification Goes Beyond Powertrains

The “SEMA 2021 Emerging Trends” report devotes an entire section to an assortment of new technologies that fall under the banner of vehicle electrification. Each year, the complexity of technologies found in new vehicles grows, with McKinsey estimating that the size of the global market for automotive software and electronic components will almost double in this decade, jumping from $238 billion in 2020 to $469 billion in 2030.

“This is another trend that is affecting all vehicles, regardless of whether you have an internal-combustion engine or an electric motor,” Knapp said. “Really, cars are becoming computers on wheels. Every system—whether it’s the motor, the braking, the steering and so on—is becoming interconnected with these computers and electronically controlled and monitored. This is a big shift that is going to change the way our industry works and the way we work on cars.”

Key among the new technologies is advanced driver-assistance systems (ADAS) and the push toward full vehicle autonomy, both of which involve increasingly complicated arrays of cameras, sensors, radar, LIDAR and computerized hardware and software.

“What we discovered in our research is that a lot of people want the technologies that can keep them safer,” Cheng said. “Almost 60% said they wanted ADAS in their next vehicle, and our report breaks down the OEM installation rates of different ADAS features on newer vehicles.”

Consumer attitudes are reflected in survey results that show 20% of new-car purchasers specifically seeking out ADAS-equipped vehicles, and 43% saying they just happened to buy a model in which the features came standard. The top three reasons for purchasing ADAS-equipped vehicles were “to keep me and my family safe” (60%), “to make my life easier” (55%), and “replacing an old vehicle with a safer option” (42%).

“ADAS is one thing, but people are not as friendly toward self-driving automobiles,” Cheng said. “The vast majority, or 86%, said that they’re actually afraid of self-driving technology. Although we hear a lot about it in the media, nobody really wants it yet. They have a lot of concerns about safety and reliability.”

Cheng also noted an unusual dynamic in the market.

“A lot of investment firms are devoting a lot of money into vehicle autonomy developers that don’t realistically have a model toward profitability,” he said. “They’re doing a lot of testing for something consumers don’t really want. It’s an interesting divide.”

In addition to ADAS and autonomous vehicle technologies, vehicle connectivity will also become a major focus of automakers as they move forward with vehicle-to-vehicle and vehicle-to-infrastructure communications. The report explains these new technologies as well as their implications for the specialty-equipment industry, which will include issues of cybersecurity and properly integrating product with advanced vehicle systems.

Summing it all up, the “SEMA 2021 Emerging Trends” report covers a lot of ground, breaking down complex technologies, automaker trends and consumer attitudes. Its readers will find a wealth of solid information devoid of both grandiose speculation and “Chicken Little” predictions.

“We wanted to put out research focused toward our membership to present a balanced understanding of the very real changes going on right now,” Knapp concluded. “There is absolutely growth that is going to happen continuously from here on forward with alternative-power vehicles, electrics, hybrids and other emerging technologies. This isn’t a flip-the-switch situation where suddenly the gas engine is dead or banned, but the aftermarket does need to anticipate what’s coming and think creatively about how we can engage with these trends and our future customers.”

Get the Full Report

To download your free copy of SEMA’s new “Emerging Trends: Electrification, Alternative Power and Advanced Technology” report, go to www.sema.org/research.

SEMA Businesswomen’s Network (SBN) members are invited to meet Katie Lyon—this year’s SBN Jessi Combs Rising Star award recipient—as she joins the SBN for a Facebook live chat on December 1, at 12:00 p.m. (PST).

SEMA Businesswomen’s Network (SBN) members are invited to meet Katie Lyon—this year’s SBN Jessi Combs Rising Star award recipient—as she joins the SBN for a Facebook live chat on December 1, at 12:00 p.m. (PST).

The SEMA

The SEMA