Among other themes, manufacturers and builders raised the bar and shattered expectations at this year's event.

By Cristian Gonzalez

Discerning emerging trends isn't always easy. New concepts and innovations sometimes require reading between the lines to understand their full significance. At an event like the SEMA Show, you can find thousands of ideas throughout the Las Vegas Convention Center, many representing underlying themes birthed at the Show. That's the beauty of SEMA. It's so grand and diverse in scope that it offers multiple perspectives on the trends sweeping the industry.

Innovative builds, inventive marketing strategies, new product designs—these are just some of the trend indicators you might pick up on. But the Show's breadth and excitement can also pull you in multiple directions. It's sometimes hard to take it all in. In case you missed some of the noteworthy trends hitting the 2025 Show floor, we have you covered.

BEYOND THE BOX

Exhibitors enjoy pushing the envelope at SEMA. They come to introduce new ideas, often promoting their brand and displaying groundbreaking products via an eye-catching vehicle build. The idea, of course, is to stand out in a Show bursting with energy. At the 2025 Show, Method Wheels did so with unique flair.

The company is known for its aggressive yet sleek off-road-intended wheels and bead-lock rims, and yet when attendees made their way to the booth, they couldn't find a single product on display. Instead, they encountered a large cardboard trophy truck crafted from Method Wheel packaging on a stage hashtagged with #Beyondthebox.

According to Matthew Harris, vice president and general manager of Method's parent company, Custom Wheelhouse, it was a bold yet well-thought-out strategy that aligned with their goals for the Show. "We were nervous," admitted Harris. He and his team were going in with an abstract move, not knowing how it would be received.

The strategy paid off big, just the way they hoped.

Harris explains, "We had never displayed at SEMA previously and we felt that should we display at SEMA in the future, it would have to be different than what we traditionally saw coming out of the wheel and tire space. The other side of the thought process that went into this was the brand itself and how you differentiate the brand."

Method has strong ties to the off-road motorsports world, is aligned with racing entities like SCORE International and has connections to some of the category's top desert racers. The company wanted to deliver a fun concept honoring those partnerships and customers and what they were aiming to build with Method's products. The team decided their booth display should take the form of the pinnacle of off-road motorsports—the trophy truck.

"We wanted to deliver an experience. We wanted to show them not tell them. And our representation of who we are as a brand through this display was a celebration of off-road motorsports and culture," says Harris.

FAR-REACHING IMPRESSIONS

The Method booth was a true example of outside-the-box thinking that took risks to achieve a specific goal. Companies exhibiting at SEMA frequently come with sales or marketing goals in mind, but Method also wanted its booth to make impressions far beyond the convention center.

In recent years, the SEMA Show has become a true driver of social-media engagement, so the opportunities were firing on all cylinders, thanks to the Show's growing appeal to younger demographics. The 2025 event saw the online automotive world flooded with social content, tags and posts showcasing the various booths, vehicles and products. This worked to Method's advantage in accomplishing their SEMA Show mission.

"We didn't bring product because that wasn't the message that we were trying to convey," Harris stated. "[Messaging] was a key component of what we were attempting to do here and having a component that can live beyond the SEMA halls was critical for us. Folks were taking a lot of video and doing interviews with employees at the booth and sharing content that they were developing on the floor. And we were watching, right? Some of these things were being sent to us and we had some visibility."

While attendees could find Method's new wheels proudly displayed in the SEMA Show New Products Showcase, Harris and team were primarily focused on promoting and associating the brand with beyond-the-box thinking in a way that inspires people of newer generations, whether they were at the Show or peeking in on it through their viewscreens.

"I think there are folks that are slightly removed from the core of the industry that are just now discovering it, which is great, and we're just happy to be able to be a part of that. Not just off-road motorsports culture, but automotive culture… It's fun to be a part of what that culture is evolving into."

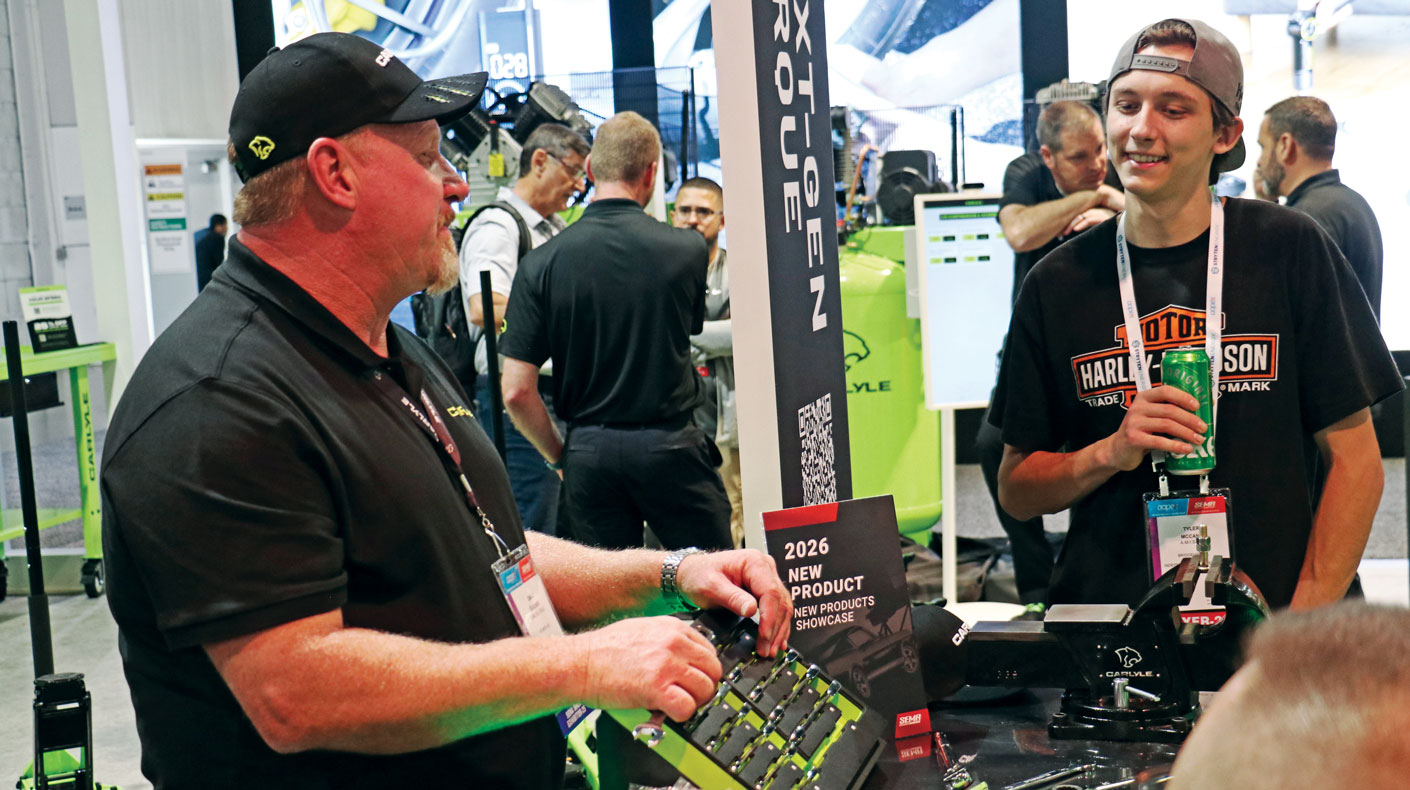

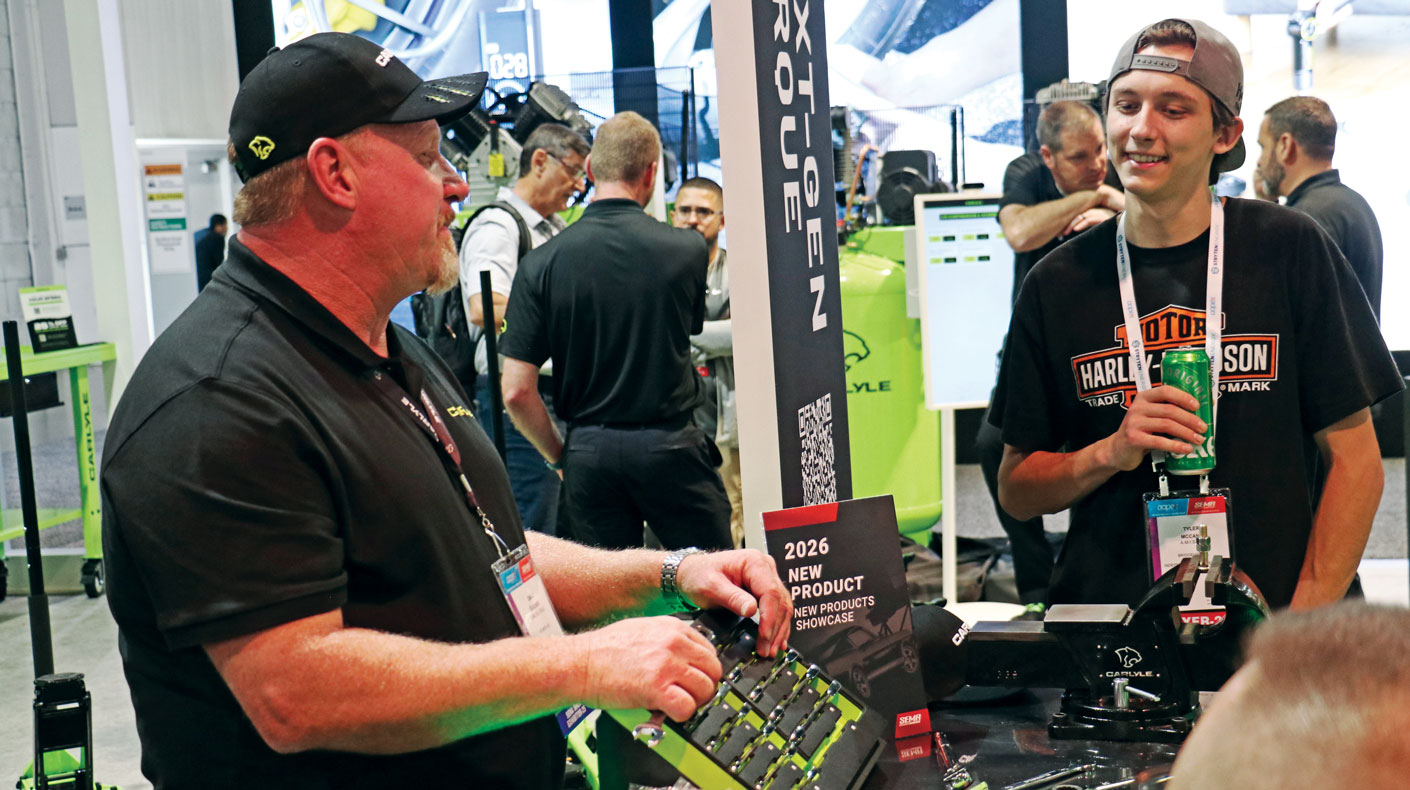

CARLYLE TOOLS

SEMA and the specialty-equipment market have made reaching and inspiring younger consumer-enthusiasts a key priority, and the Show has developed a number of features over the past decade to support those efforts. Simultaneously, exhibiting companies have been tailoring their marketing, brand and products for greater appeal especially to Gen Z.

This past Show, Carlyle Tools, NAPA's in-house tool company, exhibited for the first time under its own name as part of a current rebranding campaign seeking to spark new life into the tool brand. Jessica Diaz, one of the minds behind Carlyle's rebranding, explained that much of their marketing is focused on grabbing a younger audience's attention, noting that they spent three years collecting data before rolling out a new black-and-green brand color scheme that resonated well with young technicians.

Diaz and others at Carlyle echoed industry concerns around technician recruiting, and their relaunch and new campaign signaled their intent to help tackle the issue. "One of our major goals was to connect with future technicians and current technicians. We launched an acquisition program where we were able to take them through different stations to learn more about the product and the brand," said Diaz.

"We understand there's a technician gap," she continued, "and we want to remove some of the barriers to entry. Not only with product but also with a financial reward. So our Max Impact Scholarship awards tech students of any age nationwide $2,500 in a fully stocked toolkit. That's been phenomenal here at the Show. We have been able to speak to a ton of students and also instructors—making sure that we get to spread awareness that if you want to get into this space, Carlyle's got your back."

TECHNOLOGIC

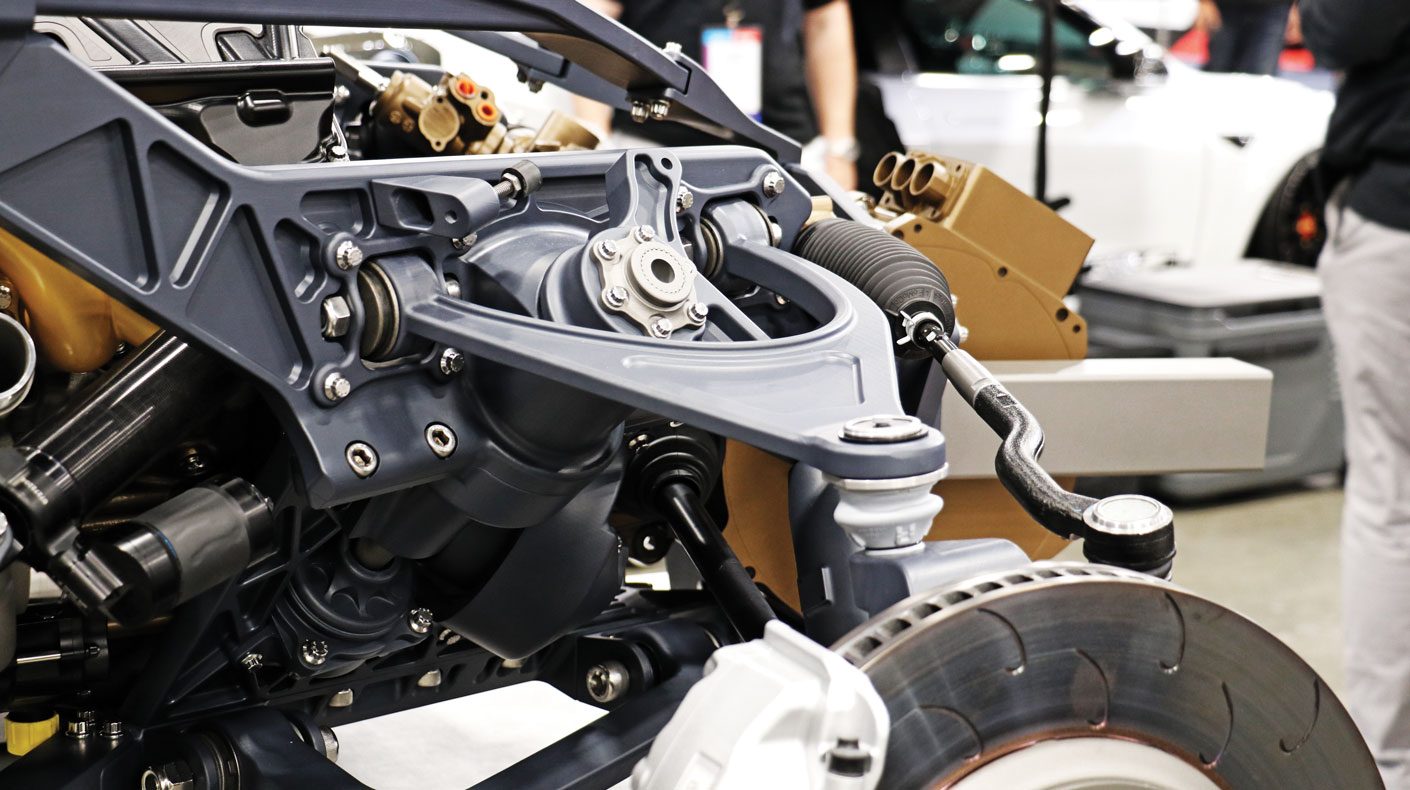

Technology progresses at incredible rates, sometimes alarmingly, but the SEMA Show excels at presenting it in digestible ways that encourage adoption. In fact, technological advancements played a large role in the 2025 Show Week, so we spoke with Jim Moore, SEMA vice president of OEM and product development at the SEMA Garage, to help better explain the emerging tech trends we saw on the Show floor.

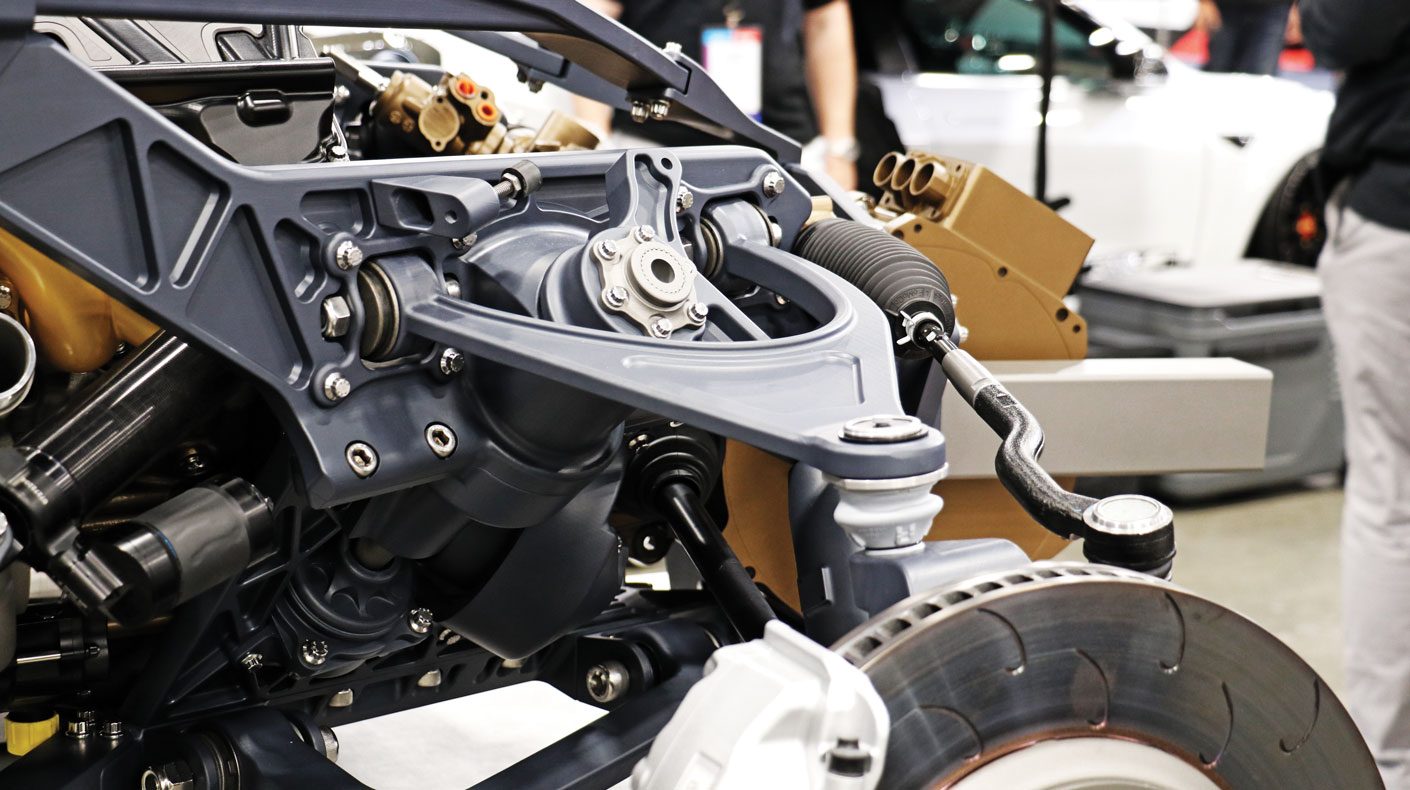

Moore noted that SEMA has always been a hotbed for craftsmanship and well-engineered builds. This Show, however, members of the aftermarket stepped up their game. The build quality of the 2025 event's powerful and unique machines was unmatched. Moore sees this as a byproduct of builders having greater access to better build tools, leading to more impressive project vehicles and products.

"Not long ago there was a huge gap between OEM resources and aftermarket resources," he explained. "We heard things like computer-aided design [CAD] and how OEMs had all this access to cutting-edge design tools. Well, the vast majority of those design tools are now readily available at almost every level… And you're seeing the acceleration of product development on the floor to the point where there's an almost invisible level of parity between an OEM bringing out a product and the aftermarket bringing out a product. Both can bring out a product of equal quality and capability."

Moore went on to address the builds he saw specifically around the FutureTech Studio in Central Hall, which boasted all forms of powertrains and reached into the seven-figure build range. "We had equally as impressive custom builds that were hydrogen internal-combustion platforms. We had a vehicle that launched that's going to be a $1 million vehicle, where it's a hybridized front drivetrain. We saw innovation across the entire board of different powertrains. We saw builders using them in ways that really allowed us to continually see and understand how all of our traditional values—and the boundaries of how you can express those values—were just being expanded upon by new drivetrain technology that was integrating with old-school values of hot-rodding, top-level craftsmanship and level of detail on these builds."

Moore also touched on sentiments toward EV builds this year compared to last year and how attendees are now more accepting than in previous years. This could be partially due to the repeal of the EV mandate, he observed. If new technologies aren't being forced upon people, sentiments can change.

"Driven by the EV mandate [victory], we saw some builders that were really embracing EV and EV conversions. I think there was also more acceptance across the Show floor that EV really can still define all the hallmarks of what is the culture of modification and restomodding and things like that. And I think that SEMA's stance on defeating the EV mandate has actually allowed the market to have a little bit less animosity toward [electrification] because now it feels there's more of a fair playing ground."

AI TAKES ROOT

We would be remiss if we did not touch on how embedded artificial intelligence (AI) tech was across the Show floor. More and more companies are seeing the strength AI can bring to their products and services for their customers and industry members.

In fact, New Product Awards went to two particular entries that utilize AI as a significant part of their structure—REVV ADAS and SPARQ. SPARQ is an OBD-II plug-in module that runs diagnostic checks and speaks to you through an AI-operated application on your phone. It essentially gives consumers a personal mechanic with a scanner. REVV ADAS is an AI-powered software platform working as a calibration tool while also building invoices, claims and rates.

Moreover, all through the North Hall, companies offered products with similar concepts: AI-based software meant to streamline processes and/or bridge communication between various parties involved in a shop repair. While AI is nowhere near Kit- or Skynet-level efficiency, it's a reliable enough tool that brands are offering it, polished and packaged, to better streamline back-office procedures.

With AI-based products becoming more prevalent at SEMA and taking the spotlight through awards, it's safe to say the AI trend is here to stay in the specialty-equipment market. We look forward to seeing where the themes of beyond-the-box thinking, technology and engagement will drive us in 2026.