SEMA News—January 2021

INTERNATIONAL

Top Tips for Negotiating Agreements With Overseas Distributors

Racing in Victoria, Australia. The Australian market is the second-largest export market for U.S. specialty-equipment companies, according to a 2018 SEMA survey. SEMA regularly hosts business-development trips to Melbourne, Australia. The market is also featured in numerous and upcoming webinars. More information is available at www.sema.org/australia and at www.sema.org/international. Photo courtesy of Dean Mellor, 4x4 Australia |

SEMA-member companies seeking to sell their products globally most often do so through the establishment of a network of distributors in overseas markets. While there are multiple additional methods to getting your products to international buyers—including selling online through e-commerce or do-it-for-me (indirect) methods to market, such as working with export management companies, manufacturers reps or U.S.-based warehouse distributors—this article focuses on the distributor route.

We reached out to two international experts from top global specialty-equipment export markets—Australia and Europe (Sweden)—and asked them to provide insights into the most common questions SEMA members have raised regarding negotiating such agreements.

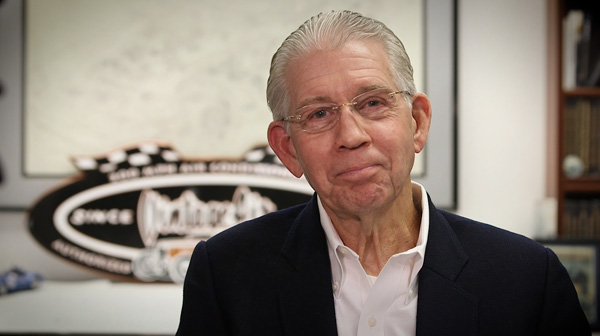

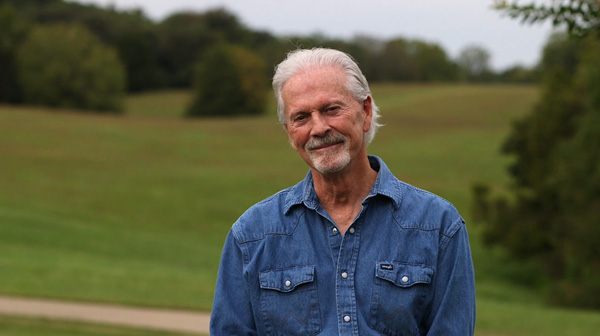

Patrick Fazzone is with the Washington Global Law Group, which has advised U.S. and Australian companies for the past 25 years on how to conduct business internationally. Richard Jacobsson is with Eversheds Sutherland, based in Stockholm, Sweden, and specializes in Swedish and European law as it relates to intellectual property rights, marketing and distribution.

Below is a summary of the insights and advice they provided to U.S. exporters during a recent SEMA webinar. A recording of the entire webinar as well as their PowerPoint presentations are available at www.sema.org/international.

We first asked about the earliest steps in signing with a distributor, and Fazzone recommended that U.S. firms adequately vet their potential customers even before considering the terms of an agreement.

“You definitely need to do your own due diligence on who you propose to do business with,” he said. “You should keep in mind that Australia is a very small market relative to the United States. People know each other, and you don’t want to have your product associated with someone who is either incapable or maybe has a bad track record. You want to check into the [potential partner] company as an important first step.”

Jacobsson noted the importance of getting to know the market and its potential, and Fazzone concurred, explaining that it comes back to not only making sure you have the right partner but also ensuring that you understand what the market looks like so that you can set realistic expectations. Some markets are as big as the one in the United States—in the European Union (EU), for example—but Australia is not, and you need to know what sort of sales are possible.

“You have to manage your sales expectations,” he said. “A common concern that I have seen among U.S. exporters is lower-than-expected sales in Australia.”

What About Exclusivity?

“A key question that comes up all the time is exclusivity,” Fazzone said. “Australian distributors typically want an exclusive arrangement if they can get it. It might be exclusive to a sector or to a state or to a region in Australia—typically the eastern states versus Western Australia. That may or may not be realistic or may not be something you, as an exporter, would feel comfortable granting to a distributor, so there may be other types of arrangements that you could enter into—certain performance requirements or sales targets, for example. If they’re achieved, there may be some sort of understanding, either contractually or otherwise you won’t direct sell to other customers in their territory or sector.

“The distributor may also want exclusivity but may not be prepared to desist from selling competitive products. In that type of scenario, the question is what do you think you could negotiate with the other party? And how much do you think they’d be prepared to give up to sell your products?

“One possible approach might be to try to focus on an exclusive arrangement that identifies one specific, relatively narrow sector in which their product or other products are not competitive. If you can come up with a mutual understanding that focuses and confines the areas of an exclusive arrangement, you might be able to come up with what I would call mutually reciprocal exclusivity.”

Jacobsson agreed, noting that a practical solution can often be to try to find some areas for which you can have mutual exclusivity.

“It could be geographical or it could be different kinds of distribution mechanisms,” he said. “Maybe you can agree on mutual exclusivity regarding distributing products in physical shops but not for other kinds of distribution. There are many different ways you can do this, and I think it’s very much about bargaining power and about the product you are selling.”

On the issue of agreeing to geographic territory, what if a potential customer wants to have exclusivity in a region, an entire country or even multiple countries?

“Typically, Australian distributors want large territories, given the limited population in the country,” Fazzone said. [Australia is the size of the United States but with only 25 million people.] “Obviously, it’s an important consideration for distributors to be able to have as much territory as possible if you define it as geographically extensive. But there are various key considerations that you’d want to look at in deciding how much of a territory to agree upon with an Australian distributor.

“How extensive is the network of the distributor? What are their resources, particularly to purchase and resell? What sectors do they service? SEMA members sell products into various different sectors and subsectors of the economy. To that extent, you obviously have to look very closely at what area or sector a distributor feels it could reasonably service. It’s not unusual to grant separate territories for the eastern states and for Western Australia.

“Another thing I’ve noticed over the years is that many distributors may be reluctant to make a large initial financial investment in a new product, so I think you have to work with them. You certainly want to make sure they have the resources and ability to buy samples for whatever it is that you’re selling and be able to maintain sufficient inventory to market your product appropriately. I think you have to manage your sales expectations in Australia.

“There needs to be some thought in advance to your distribution agreement. You want to be sure it addresses these types of issues to try to make sure your sales expectations are aligned with what the distributor can realistically achieve in Australia. Just getting back to the question of territory, for example, the distribution agreement should be clear on the territory or sector into which the distributor will be selling, and the rights and requirements for selling there.”

SEMA will host the first SEMA Nordic trip to Stockholm, Sweden, over September 2–6, 2021. More information is available at www.sema.org/nordic. Photo courtesy of Speed Pro, a Stockholm customizer |

Performance Requirements

“Performance requirements are naturally something you want to think about,” Fazzone said. “They need to be realistic, and they usually emerge out of the discussions and negotiations with the distributor. There may be performance requirements not only on sales targets and volume of sales but also on advertising and marketing efforts and so forth. And, what if the distributor fails to make sales targets, even if they’re realistic?

“The distribution agreement needs to address that. Will there be a loss of exclusivity? Would that be grounds for termination of the relationship? Those are things for which there is broad latitude under Australian law, but the distribution agreement—which is the private law between the exporter and distributor—needs to be specific. The agreement can also make exclusivity conditional. If you achieve a level of mutually agreed-upon sales, you are my exclusive distributor. If you don’t, then I have the right to sell to others in your territory or sector as well.

“Exclusivity is something that you see in many agreements, but at the same time, you would never agree on exclusivity without any way of getting rid of it. Typically, you would have a performance clause. You could also have a special termination clause allowing the exporter to terminate just the exclusivity clause without terminating the rest of the contract.

“The key is to be mutually comfortable and realistic with performance targets. The distributor will always want to ramp up slowly, while the seller wants results. If the contract sets unrealistic targets, the distributor is not going to be able to meet its requirements. That suggests the exporter should have some knowledge about the market and not just rely on the representations or the conversations with the distributor.”

Gray Market/Parallel Imports

Both experts noted that parallel imports—obtaining the same product from a different source—are allowed and unavoidable in their markets. Fazzone noted that there’s no prohibition on parallel imports in Australia. Customers there are legally able to access or source products that otherwise are handled through a distributor online.

“They could also potentially source your product from other distributors in other countries or territories, and that does sometimes happen,” he said. “There is, of course, remedy if your goods are being counterfeited and sold in Australia, but the mere sale of parallel imports is permitted under Australian law. One has to remember that the distributor will need to find mechanisms to retain its advantage in an environment where there are gray-market imports. One way, of course, is to be able to offer service, support, manufacture, warranties and the like.”

Jacobsson noted that U.S. manufacturers need to take into account EU laws regarding designating exclusive distributorships in Europe (for example, for limiting distribution to one country). It is not possible to “create a strict geographical division within the EU, so you can never have a distribution contract that achieves a total separation of the EU market into different areas of complete exclusivity. Just like in Australia, parallel imports are not prohibited, and it’s also not possible to prohibit, say, a Swedish distributor from reselling the products to Germany.

“If a U.S. company appoints an exclusive distributor in Sweden and also an exclusive distributor in Germany, you cannot prohibit those distributors from selling their products to each other’s markets,” he said. “What you can do is stipulate that the distributor cannot actively sell into a certain area. If a customer in Germany actively contacts the distributor in Sweden, the Swedish distributor is allowed to sell the products, so you will never be able to create 100% strict borders within the EU internal market because parallel imports are allowed.”

Length of the Contract

If you want to have a trial basis for a specific period, the distributor will typically want a longer term. The parties normally review performance periodically, and the frequency may need to be drafted into the contract. The grounds for termination or contract modification also might be provisions that are up for periodic review. The term may not be overly long, but it could be automatically renewable unless terminated by one of the parties. Those are things that arise in negotiations and are important to address.

Intellectual Property Rights Considerations

The distribution agreement should include a license for the distributor to use the intellectual property (IP) that’s embodied within the product that’s being sold to the distributor, Fazzone said. The agreement needs to specify payment terms and the passage of title and risk of loss.

“The agreement also should specify the governing law. Otherwise, other bodies of law could be interpreted into the contract, including the Convention on the International Sale of Goods (CISG). The CISG, applies automatically to agreements between the United States and Australia unless expressly waived by the parties,” he said. “Intellectual property laws are, of course, always an important consideration for sellers, as are the licensing laws in Australia, which has a very robust intellectual property law regime. Australian IP laws are different from the laws in the United States in various respects, and it’s important to understand the differences.

“One important fact to remember is that you have to register in Australia if you want patent protection or trademark protection. You can’t rely on the strength of your U.S. patent rights or your U.S. trademark

registration.”

As in Australia, U.S. corporations cannot rely on U.S. trademarks and patent rights when doing business in Sweden or the rest of the EU, Jacobsson said.

“When entering the EU market, a U.S. corporation needs to assess whether it will be interested in just one or two EU jurisdictions or more jurisdictions,” he said. “If there will never be any ambition to do business in several countries, it may be cost-efficient to simply apply for national IP registrations in the countries in question. However, it will likely be more practical and give more flexibility to start by applying for EU-wide registrations, such as an EU trademark registration. If patent protection is important, it is normally advisable to get help from patent experts based in Munich, which is where both the German and the EU patent offices are located.

“One new and challenging issue following Brexit [Great Britain’s departure from the EU] is that Great Britain most likely will no longer be covered by the EU regulations on IP and related issues. But keep in mind that a lot has happened in the last few years when it comes to intellectual property in Europe. You still have the possibility to apply for, say, a national Swedish trademark, but if you apply for a European trademark, you can get a trademark that is valid in 26 or 27 countries.”

A Distributor or a Commercial Agent? The Difference is Important!

Once you have identified the buyer and are honing in on terms, make sure any contract clearly states that this is a distributor arrangement and not a commercial agent, Jacobsson cautioned. They are not interchangeable, and distributors and commercial agents are treated very differently under European law. In short, a distributor is defined as someone who buys your products and then resells them, and a commercial agent (or manufacturers’ representative) acts as an intermediary and does not buy and sell but rather facilitates the transaction and gets a commission based on the products sold.

If a partnership with a European distributor goes bad, it’s possible that the distributor might claim that it served as your commercial agent (rather than your distributor), at least in Europe. If the contract is vague and the courts agree with that distinction, Jacobsson said, “they will be entitled to a certain minimum termination and statutory termination compensation (up to one year of commission payments). That is something you need to be careful about. But as long as you have a contract saying that you sell the products to the distributor and the distributor resells the products and it’s the distributor deciding on the pricing and other terms, it will be a distribution and not a commercial agency.” (Unless the actual way of doing business would differ from what is stated in

the contract.)

Trade Secrets

American companies need to understand that protection of trade secrets in Australia is not as robust as in the United States, Fazzone cautioned.

“If you have a situation where you’re concerned about reverse engineering and you don’t have a patent, you need to have very strong restrictions in the contract. Australian law will not protect your trade secrets if you don’t restrict their usage contractually,” he said.

Jacobsson said that it’s the same in Sweden.

“When it comes to trade secrets, it’s very difficult to take this kind of matter into a court and be successful, because you have such a heavy burden of proof to demonstrate that the distributor was able to do things because he used your know-how or trade secrets,” he explained.

| Resources | |

| Australian Market

Patrick Fazzone Duncan Archibald |

Opportunities

Fazzone said that there’s something for almost every U.S. company and exporter in Australia, including small- to medium-size enterprises and sellers of niche products.

“There are great opportunities, because it’s a very sophisticated market and it’s 25 million people,” he said. “For distributors able to handle New Zealand as well, it’s 30 million. But the usual cautionary comment is important: Despite the similarities between Australia and the United States, they are different countries with different cultures, different laws, different backgrounds and different heritages. As in any overseas market, you still need to do your homework, avoid assumptions based on your U.S. experience or experience in other markets, and seek appropriate advice on how to proceed.”

Jacobsson said that Sweden and the Nordic market may represent only a smaller part of the EU, but the Nordic countries are very much oriented toward international trade.

“They are countries with a history of internationally successful corporations such as Ikea, H&M and Spotify,” he said. “Companies and consumers are generally open-minded and receptive regarding products and services from U.S. exporters. Sweden, and particularly its largest city and capital, Stockholm, has a long history of being a place where many international corporations have established their headquarters for Northern Europe. Following the collapse of the Soviet Union in 1991, Stockholm developed as a hub for business and investments into the Baltic States [Estonia, Lithuania and Latvia]. Once a U.S. exporter has established business in one EU-member state, it is easy from a legal point of view to also go to other EU-member states, since most legislation is harmonized within the internal EU market. However, there are still some areas, such as employment, where the law may still be very different from country to country.

SEMA News thanks both experts. Their sage advice boils down to the need to spend the time at the beginning of working with a new distributor to make sure that expectations are aligned, that sales goals are agreed to, that you adequately support your customer to create a win-win situation while protecting your international property rights and retain your ability to end or alter a partnership that doesn’t achieve the pre-set performance goals. It’s worth it!

| SEMA International Programs |

More information is available at www.sema.org/international or email lindas@sema.org. More information is available at www.sema.org/international or email lindas@sema.org. |

Thank you to the U.S. Department of Commerce’s International Trade Administration; Elizabeth Couch in Washington, D.C.; and Eduard Roytberg in Ontario, California, who provided ongoing support for the seven SEMA “2020 Best Practice” webinars. Recordings and PowerPoint presentations for the sessions are available at www.sema.org/international.

Thanks also to Duncan Archibald, commercial specialist at the U.S. Consulate in Sydney Australia, and Nancy Bjorshammar, U.S. Embassy in Stockholm, Sweden.

Join SEMA for future business-development trips to Sweden, Australia and the Middle East, where you will experience firsthand the specialty-equipment scene in those top markets for U.S. exports and have the opportunity to meet with pre-vetted buyers.