SEMA News—December 2022

INTERNATIONAL

SEMA Delegation Warmly Welcomed in Europe

First SEMA Nordic/Europe Business Development Program a Success

By Linda Spencer

The SEMA Business Development Program U.S. delegation attended an American Car Cruise, which takes place the last Friday night of each summer month. American vehicles from the ’30s–’90s lined the street, and enthusiasts with vehicles such as those pictured above cruised down Sveavägen, a main Stockholm, Sweden, thoroughfare.

Thirty-five SEMA members from 18 companies spent a week in Stockholm, Sweden, this past summer networking with trade buyers from throughout Europe. The week included exhibiting at two events—one trade-only and the other a large consumer and trade event hosted by one of Sweden’s largest distributors.

“The Nordic region is a great automotive enthusiast market,” noted Barry Adler, president of Quick Time Performance. “Their love for U.S. cars and trucks makes for great business opportunities.”

While the program was initially planned to be a gathering with buyers from the Nordic countries (which include Sweden, Norway, Denmark, Finland and Iceland), trade buyers attended from throughout Europe, including the United Kingdom, Switzerland, Germany and Netherlands. The U.S. delegation had the opportunity to meet both formally and informally with the visiting resellers at a trade-only day as well as a consumer event. Rounding out the week, the U.S. companies attended the famed Sveavägen Car Cruise and spent a day visiting retailers, wholesalers and installers with one route focusing on performance upgrades for street and racing and the other visiting shops focused on classic vehicles and restoration.

Pictured is Liz Couch, international economist—Automotive Team, U.S. Department of Commerce, Washington, D.C. Couch, SEMA’s liaison with the U.S. Department of Commerce, has attended nearly all of the SEMA business development programs and arranges the panel of U.S. government officials at each of these events—bringing together U.S. Embassy staff handling commercial affairs and other government officials, such as those charged with improving the protection of global IPR rights of U.S. companies.

Todd Payne, director of sales for Magnuson Superchargers singled out a main highlight of the trip for him—the day of touring trade buyers’ facilities in the greater Stockholm area. “The shop visits were well planned and provided a great spectrum of the Swedish automotive culture and their strong affinity for American muscle and Americana as a whole.” He added, “I attended with high expectations for the quality of this venture and they were exceeded.”

“Even though I had been to Sweden and have an existing customer, this really opened my eyes to the size and enthusiasm of the market,” said Tom Davis, UK and European business development manager for VP Racing Fuels. For him, the opportunity to exhibit at a consumer event hosted by Hansen Racing was extremely valuable as “it gave me insight into what the actual end user wants and their thoughts/experiences.”

Aleksander Moos, commercial specialist, U.S. Embassy, Copenhagen, Denmark.

Robert Scheid, vice president for McLeod Racing LLC, spoke more broadly of the program’s importance for his business. “Meeting face to face with potential new distributors was just one of the highlights of the trip. Also getting to visit key distributors, attend the famous Sveavägen Car Cruise, and other key events built the foundations for growing our business in the region exponentially.”

Performance Analysis Owner Mark Whitney noted that the trip is for companies already active in a market as well as those new to the region or exporting more generally. “These trips put you face-to-face with vetted buyers in the region. For first-time exporters, a company new to exporting and even seasoned exporters, the SEMA trade events are the best way to do what we do best, promote our products.”

Rachel Bae, regional U.S. intellectual property attaché, U.S. Mission to the European Union, Brussels, Belgium, provided an overview on property rights protection in the Nordic region and throughout Europe. One of the first steps for a company is to ensure that trademarks and other property rights are protected in the markets in which they seek to do business. Creating a priority list of these countries and/or regions in which these protections should be secured is key. Bae mentioned that there are seven U.S. IPR attachés throughout the world available to provide guidance.

Andy Lamus, vice president of international sales for Dynocom Industries Inc., similarly pointed out the benefits to his company: “New contacts, market knowledge, real on-the-ground experience and the opportunity to talk, one-on-one, to the players in this market.”

The region was new, saleswise, to a number of the participants, including Radflo Suspension Technology. Glenn Classen, CEO and president of Radflo Suspension Technology, has participated in a number of previous business development programs with SEMA, and is actively exporting to a number of global markets, but was new to the Nordic region. “I was impressed with the knowledge and enthusiasm shown by the vendors and attendees to the show.”

Barry Adler (center), president of South Carolina-based Quick Time Performance, and a repeat participant on the SEMA business development program, commented, “The Nordic region is a great automotive enthusiast market. Their love for U.S. cars and trucks makes for great business opportunities.”

The wholesale distribution system for parts for American vehicles and automotive specialty products in Europe, and the Nordic region in particular, is quite established and growing. The delegation met with many large wholesalers during the trip and visited two of the distributors’ facilities, the latter of which featured a heavy use of robotics to keep up with the demand. “The availability of parts and components into the market by local companies was impressive,” noted Classen.

Participants commented on the benefits of spending the time and funds needed to visit key markets and to meet with potential or current customers in person. “Deeper knowledge into the Northern European automotive aftermarket was gained by firsthand accounts through one-on-one interviews with buyers, workshop visits in the local area, and an American-flavored car show that can only be earned by showing up,” said David Reyna, international accounts manager for DeatschWerks Fuel Systems. A number of participants signed sales agreements during the trip. The vast majority expect that the leads they developed during the program will equate to sales in the short-term. Still others are planning to further research the market to determine whether it will be a good fit for their products.

Nancy Bjorshammar (left), commercial specialist, U.S. Embassy, Stockholm, Sweden; Johan Bjorkman (second left), commercial specialist, U.S. Embassy, Stockholm, Sweden; and Liz Couch (second right), international economist—automotive team, U.S. Department of Commerce, Washington, D.C.; and Tom Davis (right), UK and European business development manager for VP Racing Fuels. The U.S. government officials participated in a briefing on the European market for the U.S. delegation, including information on the market, such as car registration figures, population and per capita income, information on the specialty market, and enthusiast events in each of the five countries. The U.S. officials also met one-on-one with the U.S. delegation during the weeklong event.

The SEMA Nordic program is the fifth venue for the SEMA overseas business development programs, with each market chosen by the association based on a number of factors, including the current and potential sales of specialty products, sizable local interest in customizing, and the disposable income to afford this discretionary expense. This first program in Europe was added as the 25th business development program as Sweden, the Nordic region and Europe more broadly fit these criteria.

“As the European and Nordic markets continue to grow, and their demand for American brands remains relentless, this trip proved extremely valuable for international veterans and the newcomer alike,” noted Injen Technology Global Business Manager Jay Crouch. “Over the years, we’ve found that the SEMA international trips allow businesses like ours to network with key buyers in one place and get a real pulse for the region’s marketplace. We’re able to see how the local shops evolve on a yearly basis and how the market trends begin to shift before it happens,” added Crouch.

Mark Cornwell (right), vice president, new business development and specialty markets for Wilwood Disc Brakes, stated it was “hard to believe the commitment and following of American classics and hot rods in this region. It was awesome to meet with key players and listen to understand their needs. Another great SEMA export event—was a win, win, win for SEMA, manufacturers and the Nordic people.”

“The automotive-enthusiast scene in Stockholm and the surrounding region is alive and well,” commented Tim McCarthy, founder and CEO of Hushmat and a first-time business development program participant. “It was exciting to see the cruises and enthusiasm right in front of our eyes. If you did not know you were in Sweden, you would have thought you were standing at a car cruise right [in] Kansas City.” Ryan McDonald, sales manager for Custom Autosound, put it succinctly: “The Swedes aren’t just enthusiasts, they are car crazy!”

“Hard to believe the commitment and following of America classics and hot rods in this region,” added Wilwood Disc Brakes’ vice president of new business development and specialty markets Mark Cornwell. “It was awesome to meet with key players and listen to understand their needs.”

This was FUELAB’s first overseas trip with SEMA. President Brian Paitz (right) joined the SEMA delegation that was comprised of both veteran travelers, expert exporters, and those new to exporting.

The U.S. Department of Commerce’s (DOC) International Trade Administration (ITA) once again greatly enhanced the business development program experience for SEMA-member manufacturers, providing grants to trip participants to defray the cost of participating on the trip, and providing officials and briefings comprised of officials from the United States through the Market Development Cooperator Program (MDCP). This ITA program has a longstanding partnership with SEMA, which began in 2011 and since has provided $1.1 million in federal funds and technical assistance to assist U.S. companies in growing their export sales. The ITA’s efforts in the SEMA business development programs, including this program in Stockholm, have been coordinated by Brad Hess, director of the market development cooperator program, and Liz Couch, international economist—Automotive Team, U.S. Department of Commerce (DOC), Washington, D.C.; and the DOC lead on the SEMA-MDCP partnership.

Rogers Myers (left), co-founder of Custom Autosound Mfg., and Ryan McDonald (center), sales manager for Custom Autosound Mfg., along with other participating U.S. companies, exhibited in this one-day trade-only table-top display and reception. They also met with more than 1,000 attendees and saw hundreds of American project vehicles. Noted McDonald, “The Swedes aren’t just enthusiasts, they are car crazy!”

Other U.S. officials participating in the inaugural SEMA Nordic program include Nancy Bjorshammar, commercial specialist, U.S. Embassy, Stockholm, Sweden; Aleksander Moos, commercial specialist, U.S. Embassy, Copenhagen, Denmark; Joseph Lin, economic unit chief, U.S. Embassy, Stockholm, Sweden; and Rachel Bae, regional U.S. intellectual property attaché, U.S. Mission to the European Union, Brussels, Belgium.

The following photos were taken at the 2022 SEMA Nordic Business Development Program.

Companies participating in the 2022 SEMA Nordic trip:

- aFe Power

- Bed Wood and Parts LLC

- Borla Performance

- Custom Autosound Mfg.

- DeatschWerks Fuel Systems

- Dynocom Industries Inc.

- FUELAB

- HushMat

- Hypercraft

- Injen Technology

- Magnuson Superchargers

- McLeod Racing LLC

- Performance Analysis

- Quick Time Performance

- Radflo Suspension Technology

- United Engine & Machine Co.

- VP Racing Fuels

- Wilwood Disc Brakes

Jay Crouch (left), director of global business for Injen Technology, and Ron Delgado (second left), president for Injen Technology. Injen participated in the first SEMA overseas business development program to China and most trips since then. “Injen Technology looks forward to the SEMA international events every year,” noted Crouch, “and without fail, SEMA delivered beyond expectations with the Nordic trip. This is key to growth for any region, and SEMA provides this to their members at a cost that is outweighed by the tremendous ROI.” The company typically adds additional days either before or after the program to follow up with current or potential buyers or to use the opportunity to measure vehicles not present in the U.S. market to create product.

Andy Lamus (left), vice president of international sales for Dynocom Industries Inc., was one of 35 SEMA members from 18 companies who participated in the four-day program, which included receptions, briefings, exhibiting and site visits to resellers and installers. Lamus noted that he most valued the “new contacts, market knowledge, real on-the-ground experience, and the opportunity to talk one-on-one with the players in this market.”

Mark Whitney (center, white shirt), owner of Performance Analysis, noted, “These trips put you face to face with vetted buyers in the region. The opportunities provided by these trips cannot be duplicated by just traveling to a country. For first-time exporters, a company new to exporting, and even seasoned exporters, the SEMA trade events are the best way to do what we do best—promote our products.”

Christopher Sulprizio (right), vice president of United Engine & Machine Co., participated in his company’s first overseas trip with SEMA, though he has traveled numerous times to the nation. It was a great opportunity for the company to visit current customers and to meet additional resellers from throughout Europe.

Tom Davis (right), UK & European business development manager for VP Racing Fuels, said, “It was a fantastically well put-together event and agenda. Even though I had been to Sweden and have an existing customer, this really opened my eyes to the size and enthusiasm in the market. The Hansen Day was great as it gave me insight into what the actual end user wants and their thoughts/experiences. If you are a U.S. business that isn’t working in the Nordics already, then I believe you are missing a fantastic opportunity.”

Robert Scheid (second left), vice president for McLeod Racing LLC, has participated in most of the SEMA business development programs and takes pre-trip and post-trip preparation seriously. He contacts current and potential customers before leaving the United States, sets up additional meetings while in a country, and makes sure to follow up promptly with all leads and inquiries upon returning to the States. Scheid and other experienced exporters have been an invaluable resource to SEMA-member suppliers that are newer to exporting and/or the SEMA business development programs. “Meeting face-to-face with potential new distributors was just one of the highlights of the trip,” noted Scheid. “Also getting to visit key distributors, attend the famous Sveavägen Car Cruise, and other key events, built the foundations for growing our business in the region exponentially.”

Todd Payne (left), director of sales for Magnuson Superchargers. Magnuson has participated in both of the 2022 SEMA business development programs and the first since international travel became possible post-COVID. “The inaugural SEMA Nordic trip was well worth the wait,” noted Payne. “The business owners I met with during meetings were engaged and prepared to discuss their unique markets. The shop visits were well planned and provided a great spectrum of the Swedish automotive culture and their strong affinity for American muscle and Americana as a whole. I attended with high expectations for the quality of this venture and they were exceeded.“

Glenn Classen (left), CEO and president of Radflo Suspension Technology, has participated in previous SEMA business development programs. His company has a strong overseas presence. Classen signed up for this inaugural trip to the region—one in which his company is not currently active—as a first step in exploring the Nordic market.

Jeffrey Major (left), CEO of Bed Wood and Parts LLC, and Amanda Major (second left), vice president of risk management for Bed Wood and Parts LLC. Resellers are always eager to see new products and companies come to the market. This was Bedwood’s first overseas trip with SEMA, and they experienced both the camaraderie among delegation participants and the eagerness of the European specialty-equipment market to meet with the visiting Americans.

David Deatsch (left), president of DeatschWerks Fuel Systems, and David Reyna (second left), international accounts manager for DeatschWerks Fuel Systems. Noted Reyna, “Happy to attend the 2022 inaugural SEMA Nordic event in Stockholm, Sweden. Deeper knowledge into the Northern European automotive aftermarket was gained by firsthand accounts through one-on-one interviews with buyers, workshop visits in the local area, and an American-flavored car show that can only be earned by showing up.”

Timothy McCarthy (left, red shirt), founder/CEO for HushMat. The SEMA Nordic trip was HushMat’s first business development program. McCarthy returned with insight into the market and a new customer. “There is tremendous potential in the Nordic/European region, as virtually every product sold in the sound-deadening and insulation-materials category is manufactured in either Russia or China,” commented McCarthy. “There is a need for American-manufactured technology that is designed to reduce noise and heat inside the vehicle. We are very excited to announce our distribution relationship with the Hansen Racing team in Sweden and look forward to bringing our technology to the automotive enthusiasts in this region.”

Nancy Bjorshammar (left), commercial specialist with the U.S. Embassy, Stockholm, Sweden, speaks with Joshua Abbott (right), global sales manager for Borla Performance Industries Inc. Borla Performance, which has participated in nearly all of the SEMA business development programs, was one of 18 SEMA-member manufacturers traveling on the inaugural trip to Sweden. Other venues for international business development programs are Australia, China, the Middle East and Russia. The most recent trip was the first to Europe. The U.S. government representatives from the region participated in a briefing for the U.S. suppliers and met one-on-one with each of the American companies.

Pictured: Casey Lewis (left), account executive for Hypercraft, and Shaun Hill (right), CRO for Hypercraft. The U.S. suppliers exhibited at both a trade-only event as well as a consumer event (pictured above) at Hansen Racing featuring 1,000 consumers, hundreds of customized American vehicles and a BBQ.

The U.S. delegation exhibited at a large consumer event hosted by Hansen Racing, one of the biggest distributors in Sweden. Here, William Hansen (center) was just presented with a SEMA Ambassador license plate from Bill Miller (far right), SEMA senior vice president of operations.

Jenny Amado is aFe Power’s export account manager. The company has attended a number of SEMA overseas business development programs and is actively selling abroad. “The Nordic trip was eye-opening, many opportunities to explore,” commented Amado. “We at aFe will be focusing on how we can best service this region and focus on development.”

The U.S. delegation spent a day visiting retailers, wholesalers and installers, including this shop on the outskirts of Stockholm.

Right to Repair: U.S. Rep. Bobby Rush (D-IL) introduced the “Right to Equitable and Professional Auto Industry Repair (REPAIR) Act.” The SEMA-supported legislation (H.R. 6570) aims to ensure the preservation of consumer choice, a fair marketplace, and the continued safe operation of the nation’s 288 million registered passenger and commercial motor vehicles. As vehicle technology continues to advance, new barriers to a competitive auto servicing marketplace are emerging. These barriers limit consumer choice in where to service, repair and modify motor vehicles and increase servicing costs. The REPAIR Act, if enacted into law, will reduce these barriers, putting consumers’ interests first. The bill is backed by SEMA, the Auto Care Association, the Automotive Aftermarket Suppliers Association and the CAR Coalition.

Right to Repair: U.S. Rep. Bobby Rush (D-IL) introduced the “Right to Equitable and Professional Auto Industry Repair (REPAIR) Act.” The SEMA-supported legislation (H.R. 6570) aims to ensure the preservation of consumer choice, a fair marketplace, and the continued safe operation of the nation’s 288 million registered passenger and commercial motor vehicles. As vehicle technology continues to advance, new barriers to a competitive auto servicing marketplace are emerging. These barriers limit consumer choice in where to service, repair and modify motor vehicles and increase servicing costs. The REPAIR Act, if enacted into law, will reduce these barriers, putting consumers’ interests first. The bill is backed by SEMA, the Auto Care Association, the Automotive Aftermarket Suppliers Association and the CAR Coalition. Outdoor Recreation: The U.S. Senate Energy and Natural Resources Committee unanimously passed the bipartisan “America’s Outdoor Recreation Act of 2022,” S. 3266, a package of public lands and recreation legislation designed to increase access to the outdoors, streamline and simplify land management processes, and improve America’s recreation infrastructure. The legislation includes provisions to improve the permitting process for outfitters and guides who work on public lands, and it streamlines the process and expenses associated with obtaining special recreation permits. The bill includes a travel management provision that directs the U.S. Bureau of Land Management (BLM) and U.S. Forest Service to make maps available to the public depicting where vehicles are allowed and where they are prohibited, as well as to update them periodically to ensure the maps do not become outdated. In carrying out this section, agencies are required to increase opportunities for motorized and non-motorized access and experiences on federal land.

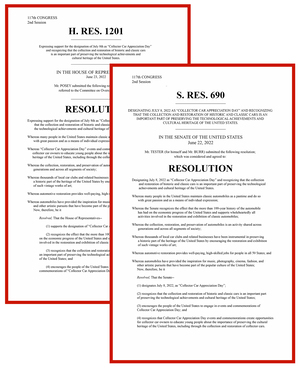

Outdoor Recreation: The U.S. Senate Energy and Natural Resources Committee unanimously passed the bipartisan “America’s Outdoor Recreation Act of 2022,” S. 3266, a package of public lands and recreation legislation designed to increase access to the outdoors, streamline and simplify land management processes, and improve America’s recreation infrastructure. The legislation includes provisions to improve the permitting process for outfitters and guides who work on public lands, and it streamlines the process and expenses associated with obtaining special recreation permits. The bill includes a travel management provision that directs the U.S. Bureau of Land Management (BLM) and U.S. Forest Service to make maps available to the public depicting where vehicles are allowed and where they are prohibited, as well as to update them periodically to ensure the maps do not become outdated. In carrying out this section, agencies are required to increase opportunities for motorized and non-motorized access and experiences on federal land. Collector Car Appreciation Day: The 13th annual Collector Car Appreciation Day (CCAD) took place on Friday, July 8, 2022. Both the U.S. Senate and the House of Representatives introduced resolutions (H. Res. 1201/S. Res. 690) to focus attention on the vital role automotive restoration and collection plays in American society. Thousands of Americans gathered at car cruises, parades and open houses at SEMA-member companies to celebrate the nation’s automotive heritage. The day is also international in scope, as many Canadian provinces passed resolutions and hosted events. The next CCAD is set for July 14, 2023.

Collector Car Appreciation Day: The 13th annual Collector Car Appreciation Day (CCAD) took place on Friday, July 8, 2022. Both the U.S. Senate and the House of Representatives introduced resolutions (H. Res. 1201/S. Res. 690) to focus attention on the vital role automotive restoration and collection plays in American society. Thousands of Americans gathered at car cruises, parades and open houses at SEMA-member companies to celebrate the nation’s automotive heritage. The day is also international in scope, as many Canadian provinces passed resolutions and hosted events. The next CCAD is set for July 14, 2023. Alaska—License Plate: Alaska Governor Mike Dunleavy signed into law SEMA-supported legislation to allow the display of only a single, rear-mounted license plate for all passenger vehicles. Under the previous law, vehicles were required to display two license plates. The new law is estimated to save the state more than $300,000 per year.

Alaska—License Plate: Alaska Governor Mike Dunleavy signed into law SEMA-supported legislation to allow the display of only a single, rear-mounted license plate for all passenger vehicles. Under the previous law, vehicles were required to display two license plates. The new law is estimated to save the state more than $300,000 per year. Arizona—Restoration: Arizona Governor Doug Ducey signed into law SEMA-supported legislation to allow full restoration of pre-’81 vehicles, including temporary removal of the vehicle identification number (VIN) when necessary. The new law allows for the removal and reinstallation of a VIN if the vehicle was manufactured before ’81 and if the removal and reinstallation is reasonably necessary for repair or restoration.

Arizona—Restoration: Arizona Governor Doug Ducey signed into law SEMA-supported legislation to allow full restoration of pre-’81 vehicles, including temporary removal of the vehicle identification number (VIN) when necessary. The new law allows for the removal and reinstallation of a VIN if the vehicle was manufactured before ’81 and if the removal and reinstallation is reasonably necessary for repair or restoration. At age 17, Duran Morley was involved in a high-speed motorcycle accident. “My motorcycle caught fire,” he said. “I’m lucky to be alive.”

At age 17, Duran Morley was involved in a high-speed motorcycle accident. “My motorcycle caught fire,” he said. “I’m lucky to be alive.”