TRENDING

SEMA MAGAZINE

INDUSTRY NEWS

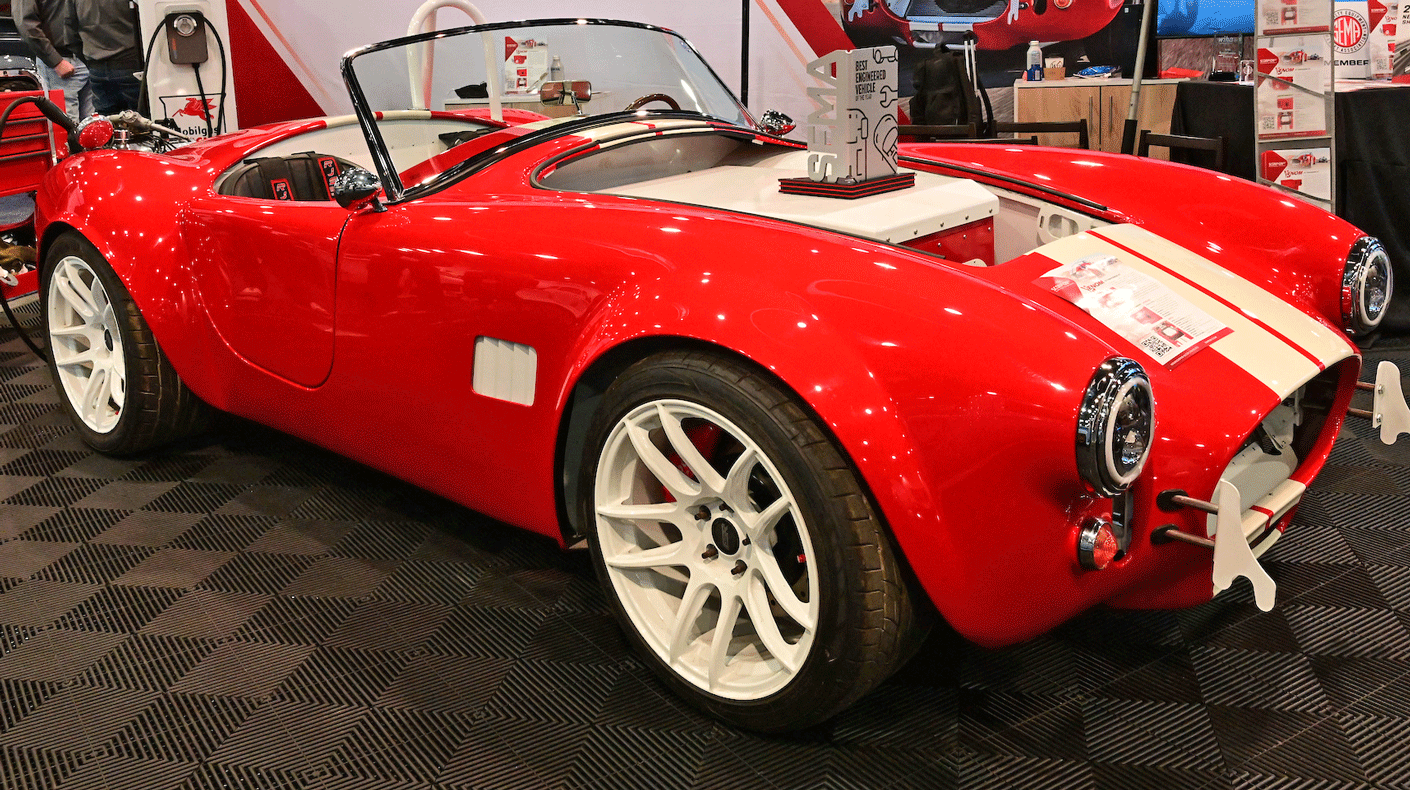

Inside the 2025 LA Auto Show: A Photo Gallery

Experience the sights and scenes from the LA Auto Show, with vehicles and technology that echo the innovation seen at this year's SEMA in Las Vegas.

SPONSORED CONTENT

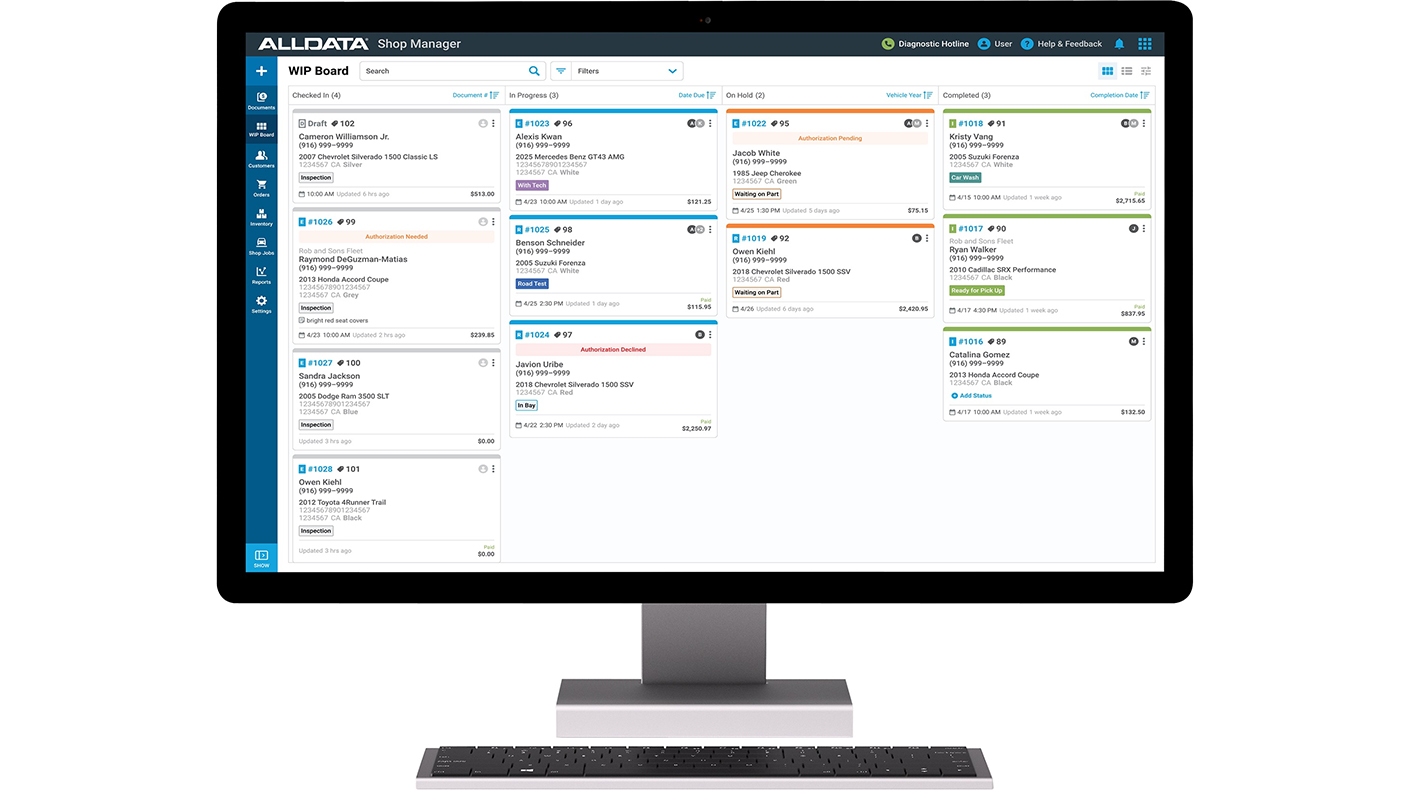

ALLDATA Debuts Next-Level Shop Management System at SEMA Show

ALLDATA Shop Manager Pro, the only shop management platform fully integrated with ALLDATA Repair, offers enhanced functionality to help growing shops scale with confidence.