SEMA News—June 2019

BUSINESS

By Douglas McColloch

The New State of Hot Rodding

What’s Hot, New and Trending for 2019 and Beyond

The Las Vegas Convention Center’s Central Hall—also known as Hot Rod Alley—was a hub of activity at the 2018 SEMA Show. Recent sanctioning-body reclassifications have greatly expanded the hot-rod market segment and, with it, the opportunity for ever more imaginative and innovative builds on an expanding number of vehicles. The Las Vegas Convention Center’s Central Hall—also known as Hot Rod Alley—was a hub of activity at the 2018 SEMA Show. Recent sanctioning-body reclassifications have greatly expanded the hot-rod market segment and, with it, the opportunity for ever more imaginative and innovative builds on an expanding number of vehicles. |

If the SEMA Show comprises the body of the automotive aftermarket, Hot Rod Alley might well be said to be its beating heart. For decades, the hot-rod and performance-street segments have led the aftermarket in leading-edge engine, drivetrain and suspension technologies. Given recent industry and technological trends, the hot-rodding market segment only figures to increase in popularity and sales in years to come. As it stands, the hot-rodding segment is an integral part of a $1.26-billion industry, according to the latest available report from the Hot Rod Industry Alliance (HRIA).

While the ’32–’48 roadsters of old may be rodding’s most iconic rides, the definition of what constitutes a “hot rod” has expanded in recent years—in particular since the Goodguys Rod & Custom Association revised its eligibility list in 2018 to include vehicle makes and models up to the ’87 model year in its nationwide show series. Pickups and musclecars, to name but two, are once-neglected categories that now qualify for hot-rod status—and they are, in fact, two of the hottest segments in the market at present.

As with any enthusiast-driven vehicle segment, hot rodding faces a number of challenges in the coming years, while also presenting some intriguing opportunities for future growth. For this article, we contacted some two dozen industry insiders representing manufacturers, fabricators, racers, retailers, media and enthusiasts. What follows is a compilation of their insights.

The State of the Industry

A hint of future trends, perhaps, the ’19 Chevy Camaro eCOPO concept debuted at the 2018 SEMA Show sporting an all-electric powertrain said to generate 700 hp and 600 lb.-ft. of torque. A number of experts we consulted expect to see an increasing number of “electro-mods” in the coming years. A hint of future trends, perhaps, the ’19 Chevy Camaro eCOPO concept debuted at the 2018 SEMA Show sporting an all-electric powertrain said to generate 700 hp and 600 lb.-ft. of torque. A number of experts we consulted expect to see an increasing number of “electro-mods” in the coming years. |

Overall, the experts we consulted overwhelmingly agreed that the state of the hot-rod aftermarket is robust and has been on an upswing for most of the past decade. Brian Brennan, network director at Motor Trend Group, said he detected “a noticeable comeback that began about five years ago.” Josh Henning, director of operations and business development at Roadster Shop, said he’s seeing the entry of “more new customers, age groups and interests than I have ever seen in the past 20 years.” Vintage Air Executive Vice President and former HRIA Chair Rick Love has seen a steady increase in growth, adding that “it’s encouraging when I see some of our warehouse distributors stocking up on inventory. That’s an indication that they see a strong market ahead for them, too.”

While agreeing that the state of the industry is strong, Goodguys Gazette Editor Damon Lee sees a gradual change overtaking the market: “The traditional pre-’48 hot-rod market has likely hit a plateau, but we are still seeing great growth in ’60s-and-newer vehicles that fall under the broader definition of a hot rod. Those different types of cars bring different needs with them, and we see the market shifting, adapting and evolving to better

serve them.”

New Trends: Classic Old Pickups, Brand-New Tech

Across the board, the experts we consulted agreed on one of the hottest segments in hot rodding, and one that seems to be driving a lot of growth: pickups. Brennan pointed to the ’73–’87 Chevy as the hottest at present, with ’48–’52 and ’67–’72 bowties close behind. Love concurred.

“For a while, the ’73–’87 Chevy wasn’t all that popular,” he said. “Now, those square-body pickups have just boomed in popularity, and I think that’s going to extend to the ’88–’93s and later models.”

Pickups are still among the hottest platforms in the hot-rod/performance-street market segment. This restomod ’71 Chevy K-Blazer was a highlight of the 2018 SEMA Show and neatly encapsulates builders Mike and Jim Ring’s current views on the direction of the market: “Seventies trucks are where it’s at.” Pickups are still among the hottest platforms in the hot-rod/performance-street market segment. This restomod ’71 Chevy K-Blazer was a highlight of the 2018 SEMA Show and neatly encapsulates builders Mike and Jim Ring’s current views on the direction of the market: “Seventies trucks are where it’s at.” |

InGear Media head Todd Ryden said that ’70s and ’80s pickups are “absolutely on fire.” Edelbrock President and CEO Don Barry agreed that the segment is “in hyperdrive.” And John McLeod, owner of Classic Instruments and former HRIA chair, noted that older trucks provide an attractive build platform because the entry price is low and good parts are available.

Within the truck segment itself, “the most popular modification is suspension—and air-ride in particular,” said Scott Nelson, operations manager of C-10 pickup specialist GSI Machine & Fabrication. “Advancements in chassis design and air management have really evolved and lent themselves to a more hassle-free and user-friendly experience.” Also garnering notice was the LS engine platform, which Barry observed “is super-hot right now and not going away anytime soon.”

Another growing market segment that nearly all of the experts pointed to is embodied by the trend of applying newer technologies, such as electronically controlled engines, modern comfort features, wireless communications and the like to older vehicle platforms. To Nitro Cool Owner Shawn Parker, the single biggest change in the hot-rod market in recent years has been the wholesale acceptance of ECM-controlled engine assemblies.

Love pointed to the increase in products that enhance the driving experience, particularly with older, rough-riding vehicles. “Those musclecars of the ’60s were famous for having all kinds of horsepower and absolutely terrible braking systems,” he recalled. “Products that improve the overall driving experience are what’s really fueling the growth.” Henning concurred.

“Without a doubt, the leading trend we are seeing on a daily basis is toward modifications that first and foremost enhance the driving experience, to get people enjoying their vehicles faster,” he said. And Trevor Hobson, national sales manager at VSF Racing, said: “We’re seeing a lot more electronics-related upgrades, whether it is fuel injection, power steering, performance management or interior amenities.”

Sixties-vintage musclecars, once excluded from the hot-rod designation, are now show-eligible and, according to our experts, are driving a great deal of current market growth. This LS3-powered ’69 Camaro built by Kyle Tucker was the winner of SEMA’s 2018 Battle of the Builders competition. Sixties-vintage musclecars, once excluded from the hot-rod designation, are now show-eligible and, according to our experts, are driving a great deal of current market growth. This LS3-powered ’69 Camaro built by Kyle Tucker was the winner of SEMA’s 2018 Battle of the Builders competition. |

The experts also agreed that build quality has improved markedly in recent years. Love pointed to “the sheer quantity and quality of reproduction parts, body parts and trim parts that are available now. They have really improved across a whole range of makes and models, and I think that’s fueled a lot of growth.”

In a related vein, Mike and Jim Ring, co-founders of Ringbrothers, explained how advances in computerization have helped to drive the growth of high-quality components: “A couple years ago, we dabbled in scanning and designing body parts for our builds using CAD and then CNC-machining plugs for carbon parts production. The process adds a level of precision to the body that is impossible to achieve by hand.”

Parker also noted changes in enthusiasts’ buying habits and how they have affected build priorities. “The quality of the builds across the board over the past 10 years has been revolutionized,” he said, “I think that’s because a lot less money is being spent on things that used to be high-ticket items. The LS drivetrain, for instance. Nowadays, $2,500 buys a very good used, guaranteed 5.3L/automatic combo, so the guys are spending less on things like that and more on fit and finish items.”

Short-Term Challenges: Taxes, Tariffs and Staffing

A government initiative that a number of the experts felt could have an impact on the market for 2019 and beyond is the potential fallout from the 2018 Supreme Court decision (South Dakota vs. Wayfair) that allows states to charge sales tax from out-of-state sellers, even if the seller has no physical presence in the taxing state.

“We’re seeing a lot of changes in tax codes being enacted in various states, and distributors and manufacturers will now have to start collecting sales tax, submitting that tax and submitting tax returns,” Love said. “It’s another clerical accounting layer that’s being applied to the industry, and it’s going to be a challenge because it’s not something that’s easy to do.”

While pickups and ’60s pony cars may be the rage at present, there’s still plenty of room in the rodding segment for old-school roadsters like this ’36 Ford built by Jason Graham. Powered by an injected 347ci small-block, it was a finalist at SEMA’s 2018 Battle of the Builders competition. While pickups and ’60s pony cars may be the rage at present, there’s still plenty of room in the rodding segment for old-school roadsters like this ’36 Ford built by Jason Graham. Powered by an injected 347ci small-block, it was a finalist at SEMA’s 2018 Battle of the Builders competition. |

While bigger companies may be able to accommodate the state mandates with their existing organizational infrastructure, smaller to midsize companies may face logistical challenges and increased expenses.

“If you’re a smaller company, you’ll either have to contract out to a firm with software tied in that will help you through that, or you’re going to have to hire someone to help you navigate your way through the process,” Love said. “I think a lot of people in the industry—and consumers—don’t realize how much change this is going to bring.”

McLeod echoed that sentiment, saying that the new tax mandates “will change the industry as we know it today.” Hobson claims it’s “the biggest change we’ve seen over the last year, and it will be interesting to see how it plays out over the next 12 to 24 months.”

The experts could not reach a consensus on the market effects being felt as a result of the ongoing United States-China trade war, with roughly equal numbers claiming that their businesses had been either helped or handicapped by the imposition of tariffs. However, all agreed with the sentiments expressed by Barry, who felt that the dispute has cast a question mark over much of the industry.

“I’d like to see this ironed out so that we can put this behind us and say we don’t have to worry about this anymore,” he said.

Another challenge that many companies face in a growing economy with low unemployment is staffing. Henning considered this his company’s biggest challenge in order to keep up with greater demands from a changing customer demographic. The Rings pointed out the challenge of staffing and retaining young talent in their rural location, adding that they’re working with local trade schools to find solutions. McLeod agreed, saying that employee retention is key to expanding business.

The Next Generation: The Millennial Wave

From the ’60s onward, interest in hot rodding has been driven primarily by a now-dwindling Baby Boomer enthusiast demographic, and one challenge facing the industry is the ability to attract a new generation of builders to the hobby.

“This has to be one of our biggest concerns,” Love said, noting the success of SEMA and HRIA youth programs at attracting new hobbyists. Danny Agosta, Steel Rubber Products automotive project coordinator, has noticed a demographic change sweep the segment over the past decade.

“One of the biggest changes I see in the market is the continued growth of Millennials,” Agosta said. “I’m 29, and I remember when I was in my early 20s, I didn’t see many people my age. Now I do.” Henning said that “it’s encouraging to see such an influx of first timers,” and Ryden also noted the growth of newer custom-car shows that are aimed at a younger enthusiast demographic.

“Roadkill Nights draws thousands,” Ryden said. “Their Hooptie Challenge is all younger guys working with what they can find to go fast, and LS Fests all seem to draw younger rodders. Take in the Hot Rod Hill Climb, Vintage Torque Fest, Lone Star Throwdown, C10s in The Park and other shows, and you’ll see nothing but younger guys playing with old technology.”

Barry additionally noted the continued strong appeal of drifting among younger enthusiasts on a limited budget.

“It’s mostly young kids who don’t have that much money,” he said. “They tend to self-fund their own cars, but they’re making it happen—and now the sport is getting big. It may still be under the radar of some of the bigger corporate sponsors, but it’s giving younger people an opportunity to get into the sport and have fun with it.”

Love saw an additional reason for optimism, pointing to the growing popularity of pickups and later-model vehicles that can be had for reasonably low prices, which in turn could give younger builders on a budget an entrée to the hobby.

“The price of admission for a pickup is a lot less than a lot of the more-expensive cars,” he said. “I think that a lot of late-’80s GM cars—the Monte Carlos and others that older enthusiasts kind of overlooked—are starting to become more popular now with younger hobbyists.”

Lee added that “one reason Goodguys opened up our events to vehicles through ’87 is the availability of those vehicles and the ease with which enthusiasts can make them strong performers with bolt-on parts.”

Looking Ahead: The Changing Hot-Rod Marketplace

Which leads us to ask: What actually qualifies as a hot rod in the 21st century? The answer, it would seem, is anything on four wheels that builders want to customize.

“From dusty barn finds to four-door fullsize cruisers, slammed Suburbans or Mustang IIs, restified musclecars, Tri-Fives and ’30s rods, they’re all being done,” Ryden observed. “Today, we get to see them all.”

Henning sees market evolution as inevitable: “As the customer base changes, the projects and types of vehicles they’re interested in will change as well—not just in genre or year/model but also the intended use. Builders’ individual needs will make it harder to label or categorize builds or styles.”

Nearly all of the experts we consulted agreed that the new-tech-for-old-iron trend will continue into the foreseeable future. “There seems to be no shortage of new products to be developed,” observed David Hays, owner of Hot Rod Innovations.

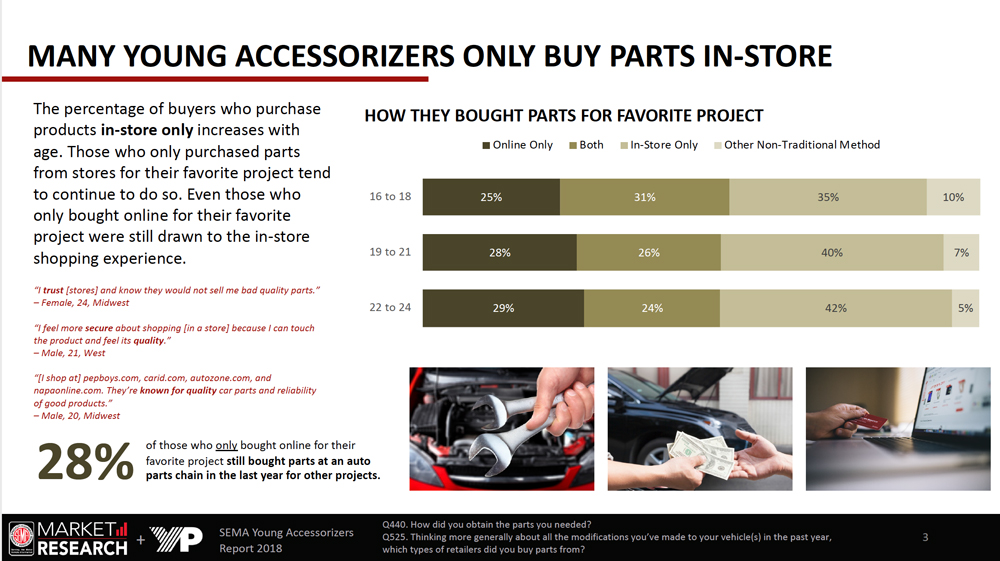

According to the latest HRIA market survey, nearly half of all classic-car owners rely on internet searches when shopping for parts. In that vein, many of the experts agreed that a healthy online presence—including social media—will likely be an integral part of any future business model.

“Millennials grew up shopping online,” Agosta reminded. “Many use the internet exclusively to research and order parts.”

Love agreed on the need for an online public profile: “We have a presence on social media, and that’s absolutely crucial to our business.”

On the other hand, Trent Campbell, president of CarBuff Network, cautioned against overreliance on social-media as sites such as Facebook and Instagram continue to grow their user bases.

“Platforms that have worked well for the last 10 years are becoming crowded, making it difficult to create and maintain brand awareness,” Campbell said. He sees old-school relationships and networking as critical to creating a solid brand and said that the industry’s traditional word-of-mouth communications model will always play a key role in the automotive aftermarket.

One relatively new market segment that’s already attracting interest, and which has the potential for tremendous future growth, is electrification. The idea of a hot rod without an internal-combustion engine may seem like heresy to some, but the advent of electric hot rods is upon us, Brennan noted, saying that “we will see more and more examples in the next few years.” As examples, he pointed to Chevrolet’s eCOPO Camaro concept, which was unveiled at the 2018 SEMA Show, as well as a Tesla powertrain in a ’49 Mercury as example of the new-tech/old-car paradigm that was one of the Show’s biggest draws.

Parker concurred: “A lot of it will be legislated, so some of those changes will happen whether we like them or not, but as EVs grow in popularity and successive generations of Priuses get better, we will eventually see the adoption of these newer technologies.”

But Barry noted the volatility surrounding the still-evolving EV market to suggest that the transition to electric rods is likely to happen slowly: “That side of the market is still trying to figure itself out, and it has its own set of challenges. I think that’s why internal-combustion engines are going to be here for quite a while.”

Resources for Hot Rodders

Hot Rod Industry Alliance: SEMA’s Hot Rod Industry Alliance is a council dedicated to preserving the hobby and promoting the industry. To learn more about how your business can get involved and benefit from the community, visit www.sema.org/hria.

SEMA Action Network: The SEMA Action Network (SAN) is a nationwide partnership between vehicle clubs, enthusiasts and members of the specialty auto-parts industry who want to promote and preserve their hobby. Founded in 1997, SAN was designed to raise awareness of legislative threats to the hobby and to promote more favorable legislation. To learn more and join, visit www.semasan.com.