SEMA News—June 2022

RESEARCH

SEMA Market Research Releases Its First-Ever CUV Report

The “CUV Market Snapshot” Aims to Make Sense of a Diverse and Rapidly Growing Vehicle Category

By Mike Imlay

The Subaru Outback, which arguably set the stage for the crossover enthusiast craze in the ’90s, soldiers on in 2022 amid a growing market of off-pavement-capable competitors. Photo courtesy of Subaru

When the crossover utility vehicle (CUV) first appeared in the mid-’90s, it seemed like the push-me-pull-you of the automotive market—not quite car and not truly SUV. As such, it raised several questions: Could consumers ever embrace a vehicle whose purpose wasn’t clearly defined and whose styling, quite honestly, wasn’t all that exciting? And, if they did, how would they utilize such an oddity? As a commuter car? A grocery getter or cargo hauler? Some sort of neo station wagon or minivan?

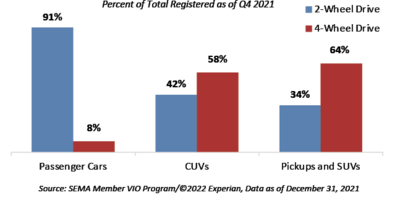

As it turned out, a truck-like vehicle built on a car platform proved to be just what consumers wanted for daily commutes, outdoor adventuring and everything in between. Today, CUVs are the most common vehicle type found on the road, accounting for 45% of automobiles sold in 2021. To help the specialty aftermarket make sense of the category and the growth potential it offers, SEMA Market Research recently released the new “CUV Market Snapshot—Emerging Opportunities” report—its first-ever study focused exclusively on crossovers.

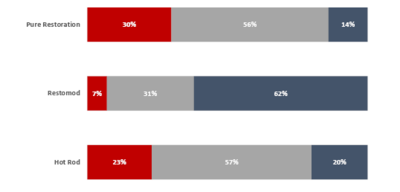

How Modified Vehicles Are Used

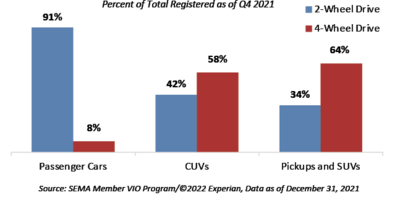

Built on car platforms but generally classified as light trucks, CUVs have traditionally been viewed as large, roomy cars. However, OEMs are increasingly building and marketing crossovers as utility vehicles. With many CUVs now outfitted with four-wheel drive, they are also growing in popularity with off-roaders.

“The reality is that if you’re in the truck market, you need to be paying attention to CUVs,” said SEMA Market Research Manager Matthew Kennedy, the report’s lead researcher. “CUVs represent the fastest-selling type of vehicle in the United States. In 2020, they comprised the second-biggest vehicle segment in terms of specialty-

equipment sales. But the industry still doesn’t really have, I think, a full understanding of what to do with them or how they fit into our world. Our report is all about arming you with what you need to know.”

“For the specialty-equipment industry, CUVs represent the biggest emerging trend right now,” added SEMA Director of Market Research Gavin Knapp. “With so many of these vehicles on the road—and representing nearly half of new-car sales and growing—this is an increasingly important space. We’re seeing people at least beginning to treat CUVs more like trucks. They’re beginning to use them off-road. They’re using them more for utility aspects. All of that combined makes CUVs a big area of opportunity going forward, at least in the short term.”

To create the CUV report, SEMA Market Research mined its existing data from prior “State of the Industry” and market reports. The research team also incorporated relevant third-party data on vehicle sales registrations and other market trends.

“One thing we wanted to do here is define what constitutes a CUV, because it’s often a difficult question to answer,” Kennedy said. “The working definition that we use is a utility vehicle that’s built on a car platform. In contrast, a sport-utility vehicle [SUV] is more typically built on a truck platform. But not every source agrees on which vehicle type falls into which category. It’s occasionally nebulous.”

Growing and Diversifying

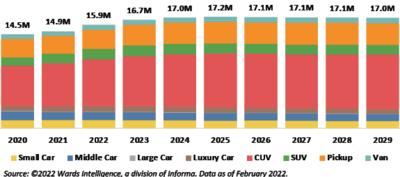

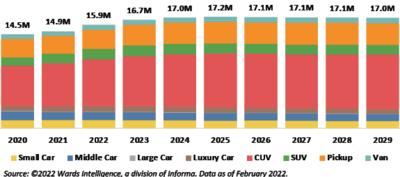

New Light-Vehicle Sales Forecast by Segment

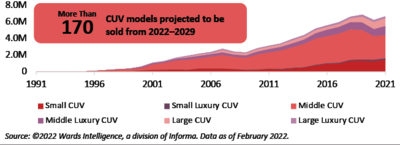

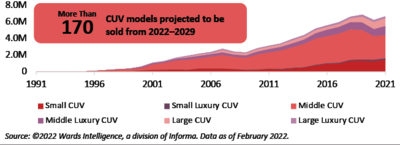

Historical CUV Sales

CUVs were introduced in the mid-’90s and have since become the fastest-selling vehicle segment. With more than 170 different models set to be offered in the next few years, the segment is also highly fragmented. Their sheer number spells expanding opportunity for the aftermarket.

By any definition, CUVs are already a significant market for OEMs and the specialty automotive industry.

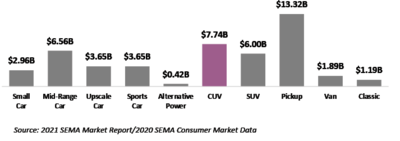

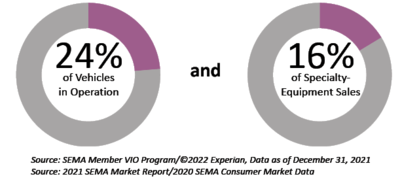

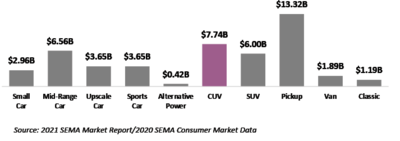

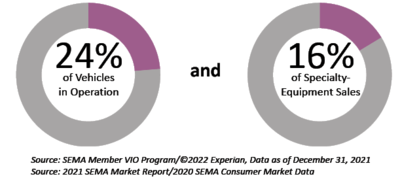

“About $7.74 billion was spent on key CUV parts in 2020, which makes the category number two for our industry,” Kennedy observed. “CUVs also represent up to 24% of vehicles on the road and 16% of specialty-equipment sales in 2020.”

According to Knapp, the problem for the aftermarket is the segment’s wide differentiation and continuous evolution.

“There are about 130 different models on the road right now, and there will be about 170 within a few years,” he explained. “That means you have a lot of models with smaller sales volumes, which can make it hard to decide which to make products for. Which will offer the best opportunity and uptake? Companies will have to sort through all of these different models to figure out which ones to target.”

Back in the early ’90s, CUVs were widely seen as entry-level vehicles—smaller alternatives to their SUV cousins. But all that has changed,” Kennedy said. Today’s market mix includes a proliferation of upscale brands and trim packages tailored for style, performance and off-highway capability.

“One piece of the OEM strategy we’ve seen in play for a while now is making a CUV for pretty much any buyer you care to appeal to,” Kennedy said. “Part of the challenge is that there are so many options out there, making it difficult to target your customer even within each model.”

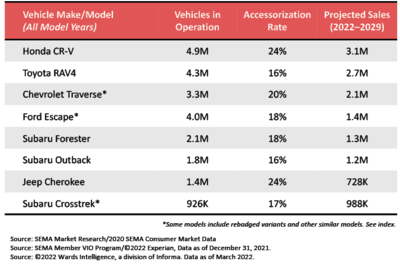

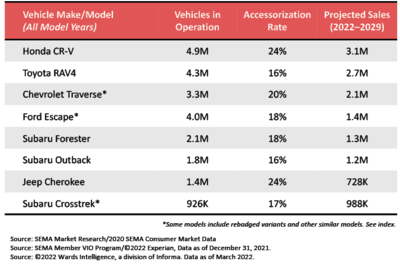

That isn’t to say that some vehicles haven’t already distinguished themselves as opportunity leaders.

“We know that the Subaru Outback, Crosstrek and Forester are models of special interest,” Kennedy said. “The Honda CR-V and Toyota RAV4 are absolutely in there as well, along with the Chevrolet Traverse, Ford Escape and Jeep Cherokee.”

Soft-Roading and Performance

2020 Aftermarket Sales Estimates by Vehicle Segment

CUvs Represent...

Crossovers now comprise the second-largest vehicle segment for the specialty aftermarket, accounting for $7.7 billion in retail sales in 2020. What’s more, there are several CUVs emerging as popular enthusiast vehicles, including models from Jeep, Subaru, Toyota and Honda.

When it comes to putting their CUVs to use, one growing trend among consumers over the past couple years has been what the media has dubbed “soft-roading.”

“Subaru and Jeep have a big off-road culture baked into their brands,” Kennedy noted. “And while CUVs are not envisioned as rock-crawlers or hardcore off-road vehicles, it doesn’t take a lot of modification to get you to the dirt and on a trail with your ATV, dirt bike or whatever you’re hauling. Crossovers are versatile, and many absolutely can go off-road. Plus, as we’ve seen with pickups and even the Jeep Wrangler, the off-roading look is also a thing, with people accessorizing regardless of whether they take their vehicles off-road or not.

“Something else to bear in mind is that CUVs are a relatively new concept. They haven’t really taken their place among pickups on one side or SUVs on the other. But they do exist in this liminal space between car and truck, so we can envision more movement toward making them performance vehicles as well as off-road utility vehicles.”

For the foreseeable future, the aftermarket can also expect to encounter further evolution in CUV powertrains and related technologies.

“This is a category that’s likely to see a lot of electrification in the next couple of years,” Knapp explained. “When you look at the new models that are slated for release over the next three years, most of them are electric or at least have an electric powertrain as an option.”

Kennedy added that hybrids and plug-in hybrids will remain in the mix as well.

“But if you look at how things are projected to move, most of the effort, most of the development, most of the growth will be in battery electric,” he said. “We’re seeing the same play in the pickup and Jeep spaces, where there are certainly pushes to develop electric vehicles that are viable for off-road. CUVs are no exception. There is absolutely testing being done to see if they can make electric crossovers capable off-roaders in a manner that enthusiasts will go for.”

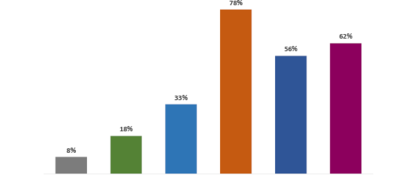

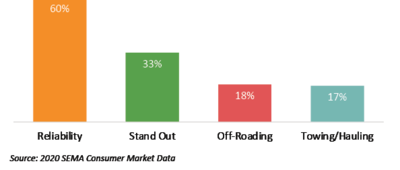

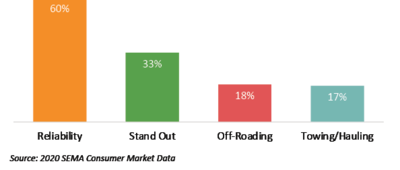

Ultimate Goal for Modifying Vehicle Among CUV Accessorizers

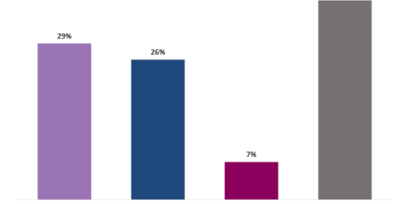

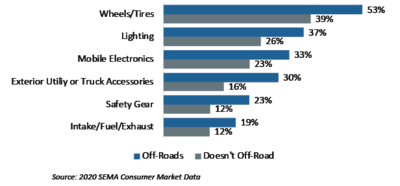

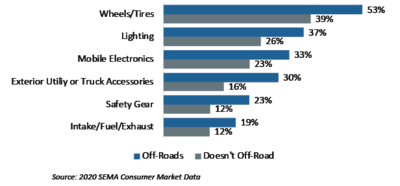

Part Types Bought in 2020–Off-Road vs. Non-Off-Road CUVs

While reliability remains the most common motivation for modification, a significant share of CUV accessorizers seek to stand out in the crowd, hit the trails or turn their vehicles into workhorses. In fact, as interest in outdoor recreation spiked in 2020, many CUVs became toy haulers, camping vehicles and trail runners.

Reflecting the category’s current diversity, CUV owners turn to the aftermarket for a variety of solutions. SEMA Market Research finds that 56% of crossover accessorizers can be classified as non-enthusiasts, while 44% can be described as an enthusiast audience.

“When we asked people what their ultimate goal was for their vehicles, a large number said they modify for reliability,” Kennedy noted. “I’d argue that is good news for the aftermarket. Still, almost one out of five are modifying their CUVs for off-road use, and there’s also a one-in-three contingent that just wants their crossovers to stand out. Then we absolutely have a utility-focused segment in there too, and that group is also prone to buying more parts for their vehicles.”

In regard to the specific aftermarket products sought, the list is topped by maintenance oils, additives, waxes and cleaning products. Consumers also gravitate toward navigation and driver-assistance systems among other safety items.

“The wheel and tire segment is usually a ‘gateway drug’ for our industry overall, and that’s also true for CUVs specifically,” Kennedy said. “Some of that is aimed at performance, some at off-road, but modifications tend to start with wheels and tires. Then you get into things such as upgraded lighting (whether light bars or fog lights) and body upgrades. Behind that, we also see some performance upgrades and suspension modifications.”

Mobile electronics, utility parts, truck accessories and intake, fuel and exhaust products round out the roster of popular aftermarket items, he added.

One hurdle for the aftermarket is the tendency of crossover accessorizers to rely on dealerships for vehicle upgrades and accessories. This may indicate that CUV consumers are still underserved by the specialty-equipment industry. However, the upside is that this audience also tends to research potential purchases through a wide range of channels, with a large percentage consulting experts and sales professionals for advice. This would indicate an openness to aftermarket brands and sellers.

It’s also worth noting that while many specialty-equipment businesses now invest considerably in Facebook, Instagram and other social-media platforms as low-cost marketing channels, only about half of CUV accessorizers turn to those platforms for their inspiration or research. According to Kennedy, the ideal marketing strategy for reaching the CUV audience will include a strong company web presence with detailed product information backed by a knowledgeable and readily accessible sales and support staff.

“Social media isn’t going to be enough to reach everybody,” he said. “More than half of this audience is looking for manufacturer or retail website information and hard data that isn’t so easily found through social media.”

Ultimately, CUVs comprise a vehicle category that still hasn’t shaken itself out, meaning that the aftermarket has both an opportunity and a challenge ahead in defining the segment’s full potential.

“One thing I would underscore is how prevalent and differentiated CUVs are—there’s something for everybody out there,” Kennedy said. “Probably the best strategy right now will be for brands to find the models they want to focus on and then drill down a bit to determine who the target customer is.”

SEMA Hot CUVs for Accessorizaiton

Despite their popularity, CUVs remain a challenging segment for the aftermarket. Their diversity makes the targeting of specific platforms offering high ROI difficult. Nonetheless, SEMA Market Research has identified several models that are currently ripe for accessorization.

Kennedy believes that this extra effort in deciphering the space will prove more than worthwhile.

“Again, when we look at the current philosophies and motivations that people have when modifying CUVs, there’s a pretty solid contingent who want the vehicle to stand out,” he said. “That actually comes in ahead of the utility-focused people. There is a real core of what we call the ‘in-crowd’ who want a CUV. Whether it’s for the aesthetics or it’s to achieve that off-road-ready look, you’re going to find that there’s a solid group of people ready to modify these vehicles.”

Get All the Latest Research

For your free download of the “CUV Market Snapshot—Emerging Opportunities” report, visit the SEMA Market Research webpage at www.sema.org/market-research. While there, be sure to check out the many other SEMA Market Research reports that can help prime your business for success.

Hot Rod magazine Publisher Ray Brock picked up the phone. Mickey Thompson was on the line, calling from Detroit.

Hot Rod magazine Publisher Ray Brock picked up the phone. Mickey Thompson was on the line, calling from Detroit.