Specialty-Automotive Companies Foresee Further Growth Through 2024

By Michael Imlay

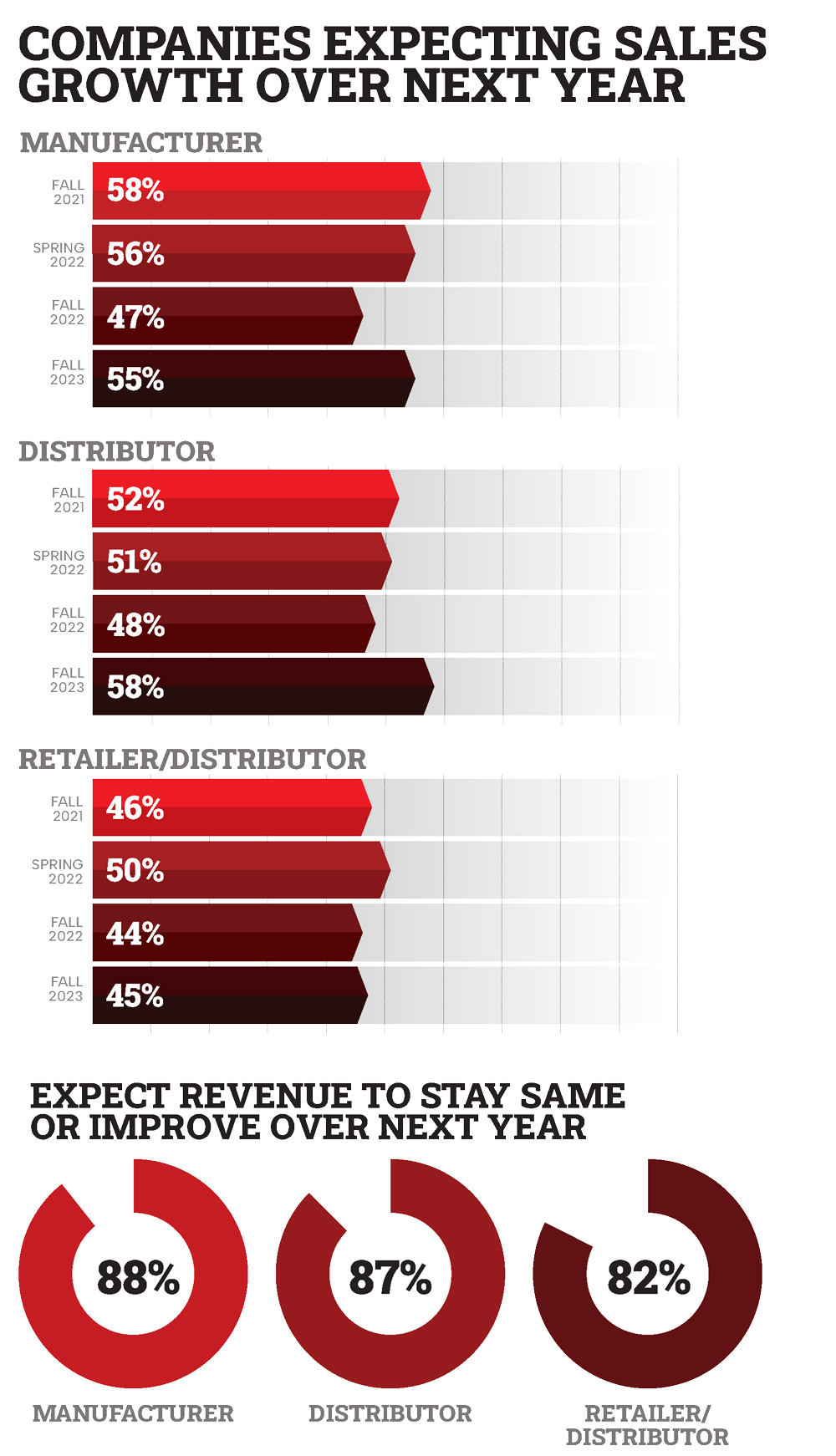

Despite the economic uncertainty of the last year, 55% of automotive aftermarket manufacturers say they expect growth in 2024, up from only 44% last Fall, according to the new “SEMA State of the Industry Fall 2023 Report,” which is now available for download at

sema.org/market-research.

The report is the latest study in the “SEMA State of the Industry” biannual series that explores the current state of the automotive specialty-equipment industry, including how businesses are doing, key industry trends and metrics, challenges and opportunities along with an outlook for this year and beyond.

“Released just prior to the new year, our ‘SEMA State of the Industry Report’ shows that despite inflation and economic unpredictability, including the United Auto Workers [UAW] strike, aftermarket sales continue to grow,” said SEMA Market Research Director Gavin Knapp. “While there has been softening sales for some firms, two-thirds of industry companies are reporting stable or growing sales over the course of 2023.”

Other key findings from the report include:

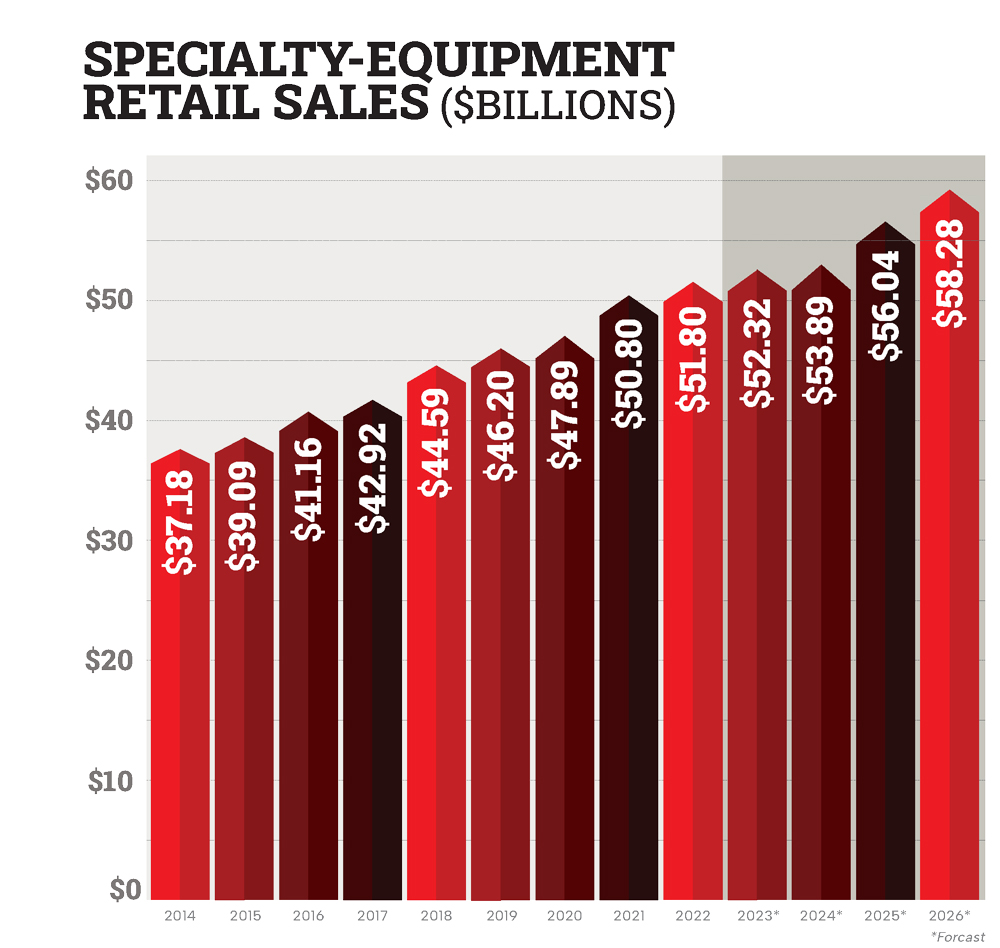

• Specialty-automotive sector sales topped $52 billion in 2023, a new high in an ongoing upward trend.

• Even amid inflation and other market ups and downs, one-third of manufacturers report double-digit growth over the last year.

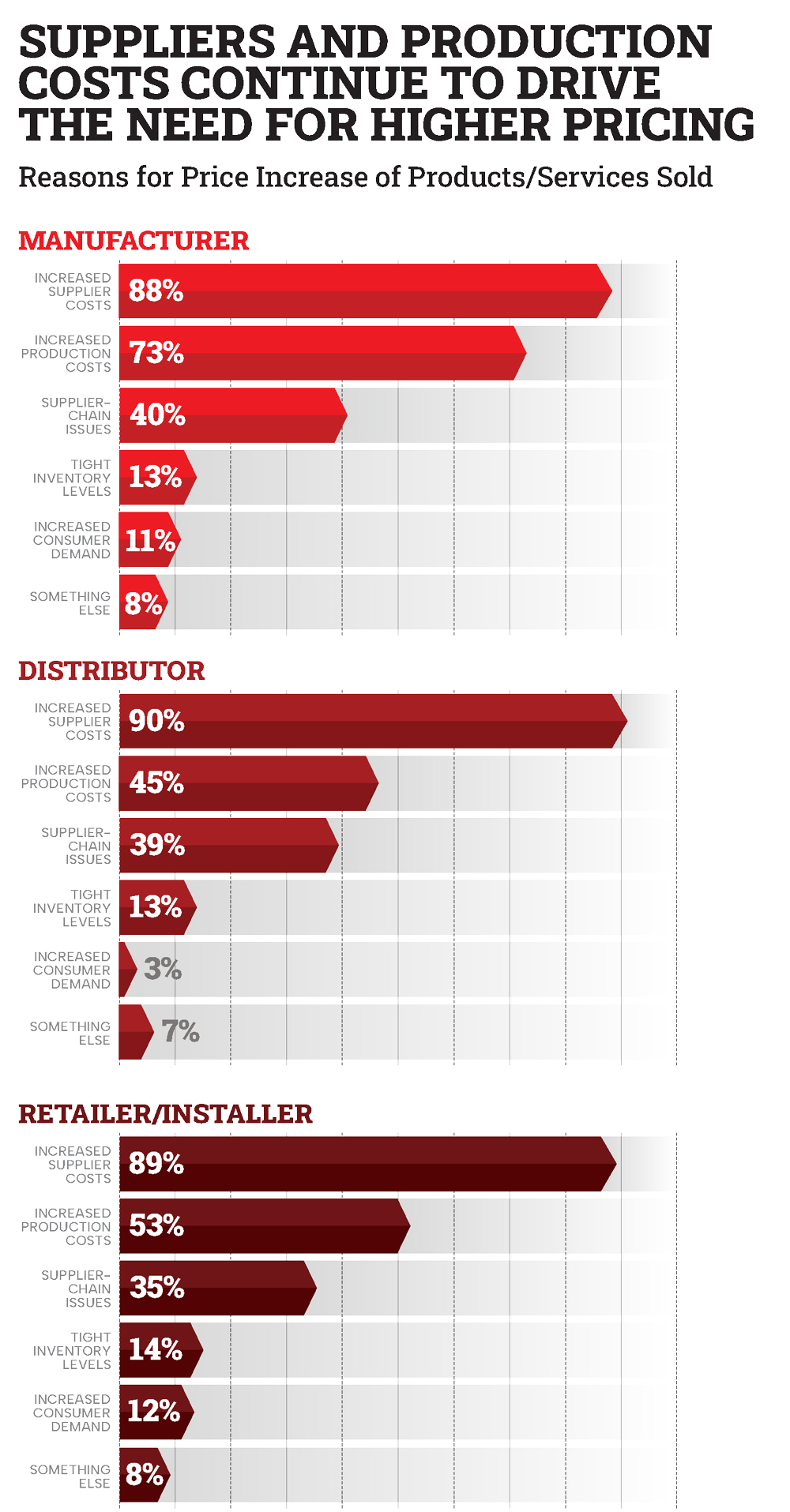

• Inflation continues to impact the industry, with more than half of manufacturers indicating their prices have increased in the last year. Nearly 90% of companies say that increased supplier costs are the key driving factor.

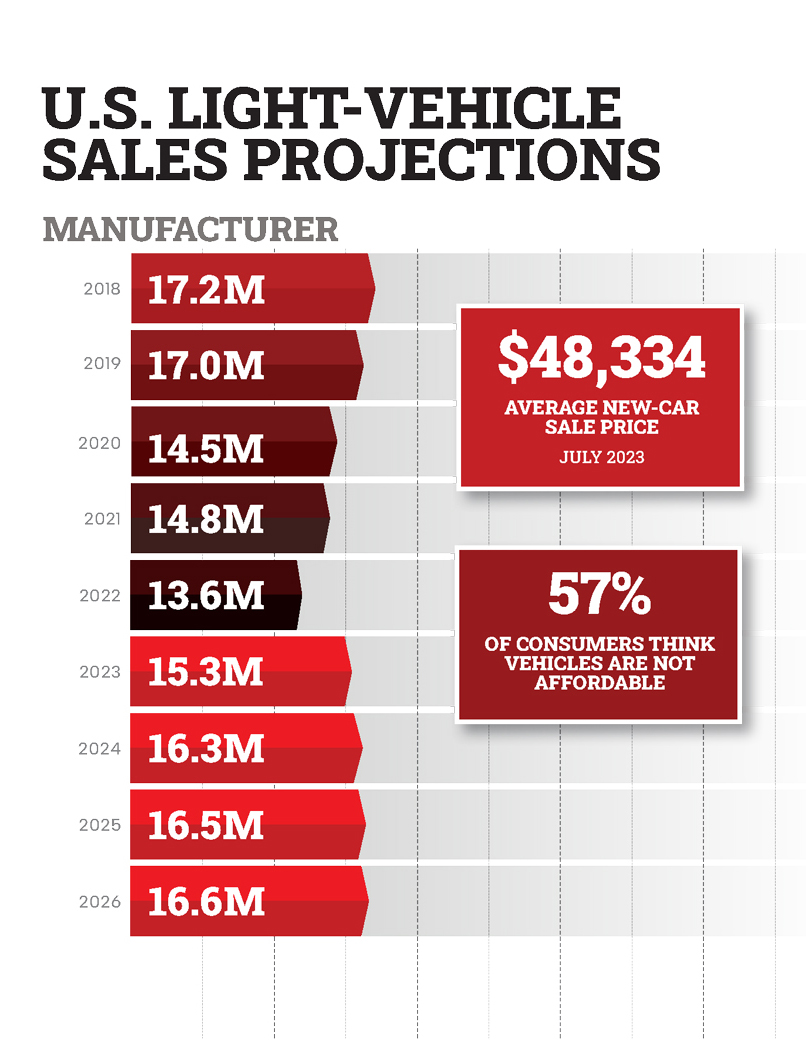

• New-vehicle sales—a principal driver of demand for aftermarket products and services—continue to rebound and are projected to exceed 16 million in 2024.

• The truck sector continues as the top market for the industry, with the majority of manufacturers and retailers viewing the off-road segment as a growth opportunity.

A Report With Purpose

Encompassing 54 pages, the report offers a look at a variety of economic statistics and market trends affecting the aftermarket through detailed charts, graphics and explanations. It is designed to help SEMA-member companies benchmark their performance while staying current with challenges and opportunities emerging within the aftermarket and broader automotive sector. The report also offers important insights into sales changes over

the last year, how businesses are doing generally, and outlooks for the future to aid in strategic planning.

According to Knapp, SEMA’s “State of the Industry” research complements the association’s market reports, which focus on consumer trends and spending habits. By contrast, “State of the Industry” reporting focuses on trends affecting the industry’s actual businesses.

“It’s really about the perceptions of businesses and how things are going for them,” he explained. “Are their sales up or down? What is their optimism for the future? Are they seeing growth trends or declining trends in their sales channels, the vehicles they sell products for, or the products themselves?”

Tracking Industry Performance

Entering 2023, the big question was the extent to which the widespread industry growth seen during the COVID-19 pandemic might continue. Large numbers of businesses posted record numbers as consumers turned to automotive pursuits to get through COVID lockdowns. Armed with government stimulus checks, these consumers also had plenty of money to spend. But as things opened up, consumers gained more options for discretionary spending, including dining and entertainment. Then inflation struck.

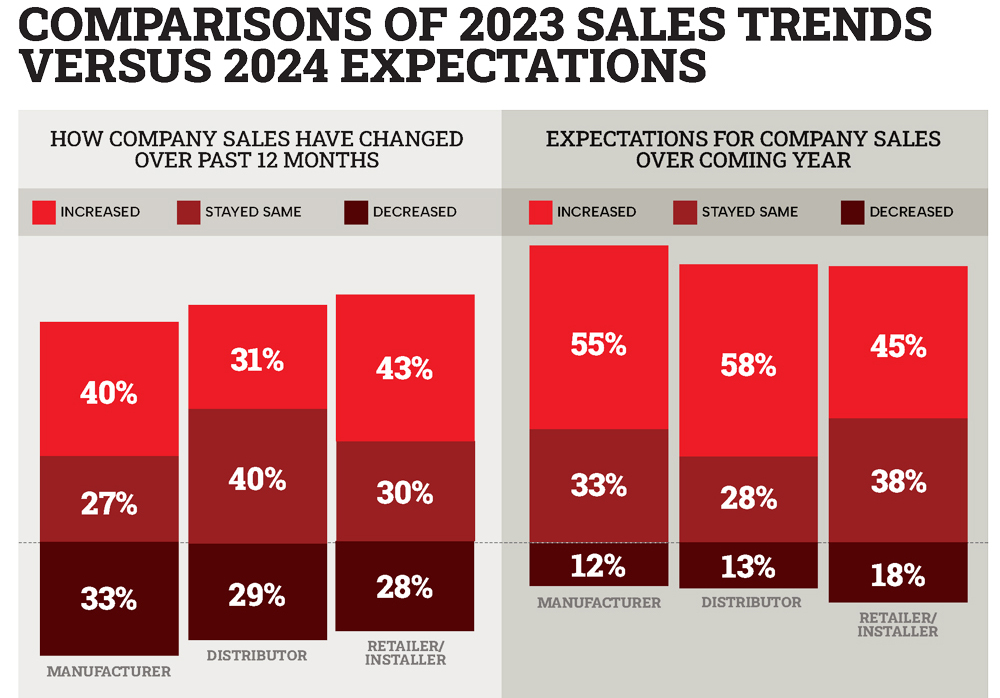

“We’ve seen a lot of disruption across the economy, and there’s been a lot of uncertainty out there,” observed Knapp. “We saw some industry companies give back some of their COVID growth. But overall, the majority of companies either saw growth or remained stable in their sales, which says our market has continued in a positive direction.”

In fact, roughly a third of companies surveyed reported double-digit growth in 2023. “Even as we’re seeing the overall market’s rate of growth slow somewhat, some companies are still doing really, really well—and going forward, most companies are expecting stable, if not increasing, growth in 2024,” Knapp said.

Nor was company size much of a factor in the growth curves. “The big guys seem to be doing slightly better, but they have obvious advantages like name recognition. But there’s not a dichotomous split between big and small companies,”he noted.

That’s not to say that industry businesses won’t face some challenges in the coming months. Inflation remains top of mind, with supplier, materials, labor and other costs forcing many industry businesses into price hikes.

“Most companies say they have increased prices in the last year, and a lot of them still think there will be more increases to come,” noted Knapp.

On the plus side, unemployment remains low and consumers, who seem to have learned to weather supply chain issues and other hiccups in the wake of COVID, continue to spend money. “Of course, if a big disruption hits the economy, that would change things for our industry,” Knapp pointed out.

Growth in Sales Channels

Specialty automotive manufacturer, retail and installer sectors all saw growth across a variety of sales channels in 2023. Although 41% of manufacturers say they increased their direct sales to consumers online, the report finds that the share of manufacturer direct-to-consumer sales nevertheless “remains consistent with previous years.” Overall, the industry sells through both online and in-person channels equally in a 50/50 split. At the retail level alone, in-person sales at a store location still account for 67% of sales, with online sales coming in at roughly half that figure (33%). Even so, the industry’s ratio of online sales dwarfs that of American retailers at large.

“Our industry has been ahead of the game for a long time,” explained Knapp. “Before the pandemic we ran about 50/50 in online purchases versus in-person purchases, with online sales scooting up a little bit during the pandemic. Now it’s come back to what for us seems like an equilibrium state.”

Part of the explanation behind this lies in the nature of the aftermarket consumer. Enthusiasts are knowledgeable consumers—they do their research and know what they want. Online purchasing offers them instant selection and price comparison when they’re ready to buy. Plus, since they enjoy working on their vehicles, they don’t rely as much on professional installers.

This isn’t to say those enthusiast consumers avoid retail outlets altogether. Many purchase online for in-store pickup, getting the instant gratification of grabbing what they need when they need it and getting on-the-spot advice. “Even hardcore enthusiasts like to have those discussions with other knowledgeable people,” underscored Knapp.

Vehicle Trends to Watch

It’s no secret that the aftermarket’s fortunes are closely tied to new-vehicle sales. Whenever a vehicle changes hands it creates the potential for customization. This applies not only to a new car or truck, but the used vehicle it replaces, which is often sold, becomes a hand-me-down, or turned into a project car. Consequently, the “SEMA State of the Industry” report includes a look at what is (or isn’t) selling at American car lots.

According Knapp, rising car prices and interest rates have helped slow new-model sales—a trend that will likely continue through 2024. But even that phenomenon presents the aftermarket with an opportunity.

“You’d think that if there’s fewer people buying new cars, then that would be bad for us, but there’s a flip side to our relationship with auto sales. If people hold off on replacing their current model with something new, then they may want to give their current car a refresh,” he observed. (Of course, older-vehicle modifications may differ somewhat from those a consumer would pursue with a newer vehicle.)

What’s more crucial for the industry to grasp, said Knapp, is the changing makeup of the U.S. vehicle fleet.

“A lot of our industry grew up around the idea of musclecars and traditional cars like coupes and sedans, but those types of vehicles are largely

going away,” he explained. “Most of OEM production and sales are now crossovers [CUVs]. Even though they’re a relatively new vehicle type, they actually now represent half of all vehicles sold this past year and about of quarter of all vehicles on the road. This is the area that our industry needs to focus on because this is the only area for growth right now.”

For awhile it was an open question whether the specialty automotive industry would treat CUVs more as cars or as trucks, but OEM advertising has helped settle that matter.

“We’ve talked to many retailers who say they’re starting to kill it in the CUV market, especially with vehicles like the Subarus,” Knapp related. “OEM commercials are saying, ‘hey, this is our crossover—take it off road.’ They show vehicles on the dirt road equipped with racks and holding kayaks—really pushing that utility aspect.”

“All of that is great for our industry because, from camping to outdoor recreation, we’ve got products that will help you do that. And as long as your mindset is that a CUV is more like a truck than it is a car, that opens up a whole world of possibilities, from lift kits to larger, more aggressive tires, nicer wheels, trailer hitches and more.”

Meanwhile, electric vehicles (EVs) are ubiquitous in the media, but not so much on American roads—and may not be for some time. As of Q3 2023, they accounted for only about 8% of new-vehicle sales. With OEMs increasingly questioning the feasibility of EV mandates, and consumer take-up rates slowing, it’s doubtful that battery electrics will dominate the vehicle fleet anytime soon.

“We are seeing slowing in EV rollouts,” confirmed Knapp. “General Motors recently announced that they’re pushing off production of their EV pickup for a whole year. And if you’re not going to make an EV pickup, that says a lot.”

“Still, the OEMs have to meet CAFE [Corporate Average Fuel Economy] standards and bring fuel economy up. So things like hybrids can help with that since there’s an established consumer interest in hybrids. We’re also starting again to hear a lot more about hydrogen and biofuels as another avenue. And newer internal-combustion vehicles are moving towards smaller, turbocharged engines. So the industry needs to keep aware of this changing vehicle mix.”

In fact, OEMs are even tapping old playbooks in their quest for CAFE compliance, with the reintroduction of midsize trucks a case in point. This class of truck disappeared from the U.S. market over a decade ago, “but now we’re starting to see a new crop of small trucks like the Ford Maverick,” said Knapp. “It’s a sector that is really good for our industry as well as the automakers, and will be another one to watch and see if the consumer demand is really there.”

Projections for 2024

All in all, the industry’s manufacturers, distributors and retailers have reason for optimism in 2024. The manufacturing and retail sectors each averaged 4% overall growth last year. The distributor sector was less rosy with a 1% overall gain, but most distribution companies were stable or growing nonetheless. In fact, 55% of manufacturers, 58% of distributors and 45% of industry retailers expect increased growth this year.

“There was a lot of uncertainty last year at this time, and industry businesses seemed more worried. But they were able to get through the uncertainties, and now they see the way forward,” summed

up Knapp.

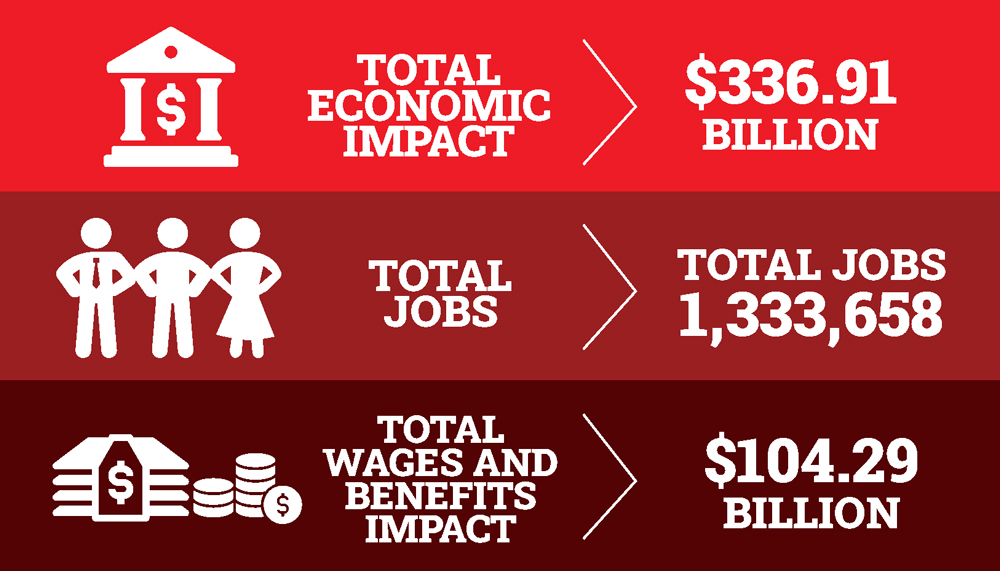

This is not only good for the industry, but for the U.S. economy as well. SEMA’s recent research estimates the industry’s total economic impact at $336.91 billion, accounting for 1,333,658 American jobs taking home $104.29 billion in total wages and benefits.

“When COVID first hit and we went into lockdown, the initial reaction was, ‘Uh oh, we’re in trouble,’” recalled Knapp. “But within a couple of months, companies in our industry were having their best year ever. That actually pushed our industry up, so it’s not surprising to be leveling off. We’re still better off than we were in 2019.”