Making Sense of the Latest Economic, Automotive and Consumer Trends That Will Impact Your Business This Year and Beyond

By Michael Imlay

Staying ahead of future trends is an essential element of any strategic business plan. Unfortunately, discerning those trends is not an exact science. Inevitably, a constant flow of unanticipated events and issues get thrown into the mix. However, solid data can help add clarity and insight to the business decisions we make.

Enter the 2024 edition of the “SEMA Future Trends Report.” As questions about economic conditions, automotive-industry trends and consumer sentiment continue to swirl, the report is designed to pinpoint the patterns most relevant to the specialty automotive sector and offer fact-based assessments for the future. This essential planning tool is now available and free to SEMA members at SEMA.org/research.

“The U.S. economy saw some volatility and uncertainty in 2023, and some of those questions remain into 2024,” said SEMA Director of Market Research Gavin Knapp. “Specialty-equipment sales grew at a slower pace for the year compared to the gains that we saw coming out of the pandemic. And although enthusiasts were still pushing to modify and accessorize their vehicles, rising inflation combined with sustained supply-chain issues kept expectations down.”

To get a sense of where things are headed, the report dives into relevant data in three principal areas: the health and outlook of the overall economy, automotive industrial and vehicle trends, and consumer dynamics and spending within the sector.

The Economic Outlook

The report discerns that, overall, there are many positives at play in the current U.S. economy, albeit tempered by a few negatives. The nation saw strength in employment and spending numbers along with slowing inflation coming into 2024. Expectations are that for the first half of the year the economy will continue a slow climb before ramping up in the later half of 2024 and into 2025.

Particularly on the employment front, the 2023 job market remained relatively strong and in line with 2022. Most companies maintained their staff levels, with certain sectors—such as tech—seeing scattered layoffs, and others—like healthcare and hospitality—seeing slight hiring boosts.

Amid this relative stability, however, U.S. job and pay growth progressively declined some from the previous year. Moving forward, the job market is expected to continue slowing toward the latter half of 2024, with economists predicting a minor uptick in unemployment claims.

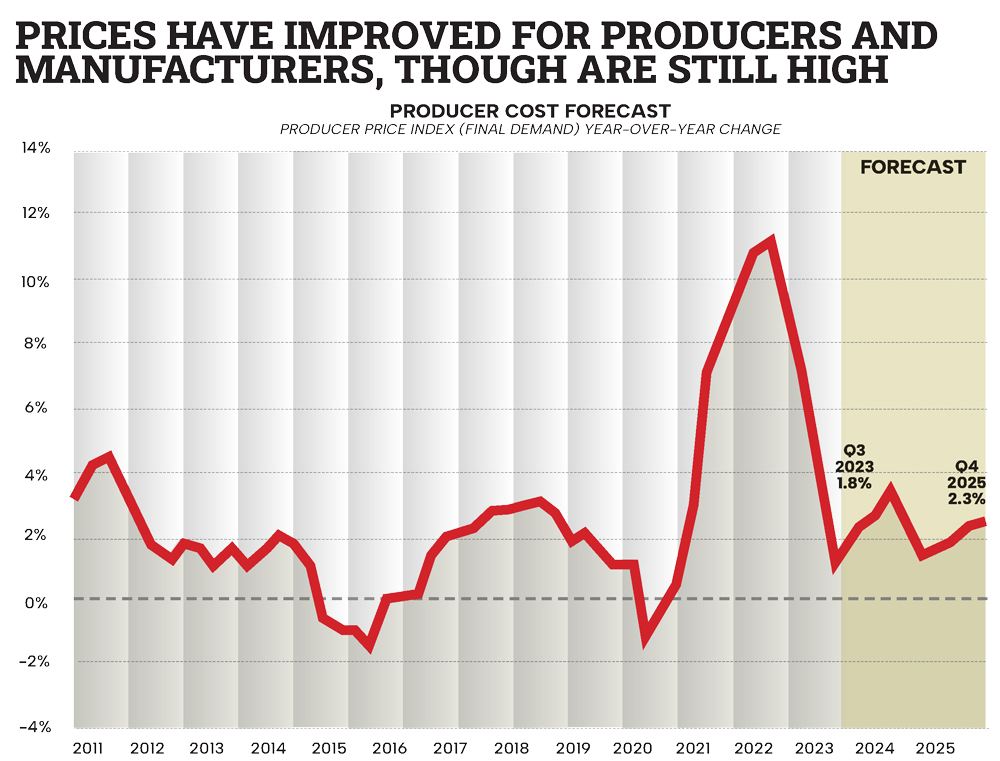

The news on inflation is also generally positive. Fears of continued runaway price hikes have leveled off, and although they are still high, prices are expected to improve throughout 2024. Moreover, the economy’s already-healthy consumer spending figures will likely grow well into 2025.

Nevertheless, says Knapp, “Even though consumers are spending, there are still a lot of question marks out there. Consumer confidence is still pretty low and hasn’t rebounded. It’s weird to see because in a normal cycle after economic uncertainty it would normally spring back. Obviously, some of this [low consumer confidence] is not purely the economy—it factors in other things, like our political climate and the world picture. But, luckily, people are still spending money at the moment, with the only downside being that some of that spending is now going on credit.”

Industry Trends and Opportunities

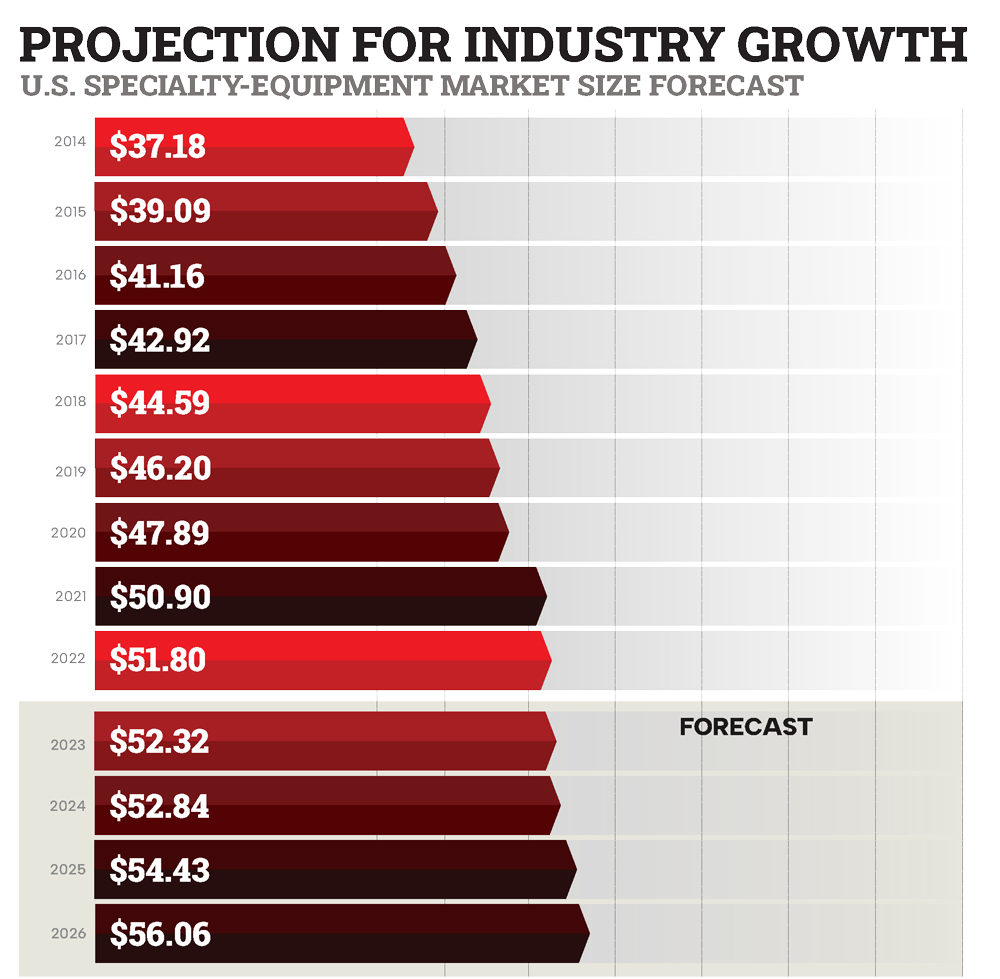

Despite their slower growth rate after their late- and post-pandemic surges, sales of specialty-equipment parts continued to climb over the last year, reaching $51.8 billion. This is a new peak for the industry, and despite some market uncertainties, the “SEMA Future Trends Report” forecasts a similar trendline for 2024 with an eventual return to the industry’s normal annual growth rate in 2025.

This is not to say there won’t be challenges in the near term. By definition, the aftermarket’s fortunes are closely tied to those of the OEMs, which have struggled on multiple fronts since the pandemic.

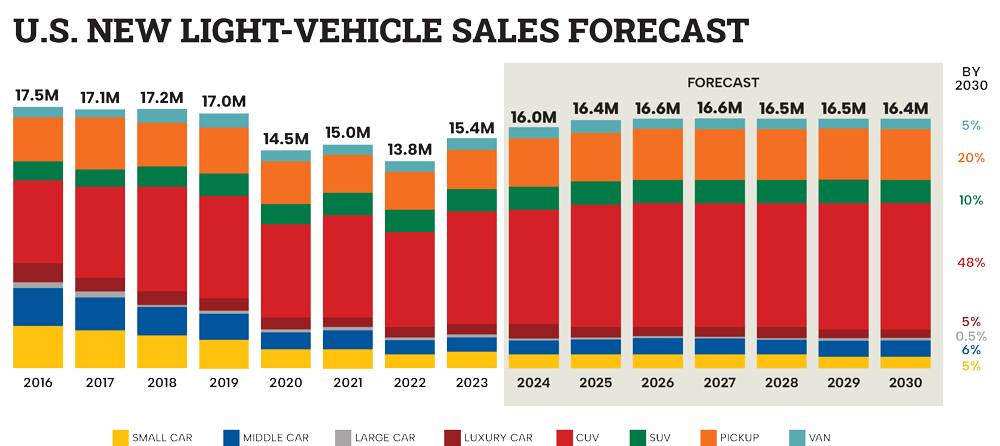

“The number-one vehicle trend to talk about is the COVID-related supply-chain disruptions and the drop in vehicle production and sales over the last few years,” observed Knapp. “Thankfully, that’s working its way out. Over the next few years, we’ll probably get back up to a maximum production of about 16.5 million new vehicles for the United States. That’s not quite the 17-million-plus production of a few years back, but we’re definitely getting back to having a lot more vehicles on the lot now, with virtually full recovery by 2026.”

Indeed, 2023 saw a significant normalization of supply chains with shipping and trucking rates also falling. Although consumer and producer prices remain elevated, the rate of price increases has also slowed. Plus, if inflation continues to slow, the Federal Reserve Board will likely begin easing interest rates later this year, further incentivizing consumers and boosting OEM sales.

As sales recover, Knapp predicts a changing mix of vehicles with fewer variations on dealer lots. “One of the things we’re seeing is a kind of consolidation of vehicle lines. Rather than offering you 100 different options on a vehicle, they’ll offer five option packages to pick from.”

Over the longer term, OEMs will also be shuffling up the overall vehicle landscape. Especially noteworthy: After appearing all-in for virtually full electrification of their fleets by 2035, auto manufacturers are once again re-thinking their strategies surrounding internal-combustion, hybrid and fully electric vehicles (EVs).

“There has been a lot of hype around EVs, and a lot of push for them,” said Knapp. “But we’re coming to a more realistic view of them, both in terms of consumer interest and in the actual ability and requirements to produce them.”

American media has been aflood lately with stories of automotive leaders questioning if government goals for electrification by 2035 are too ambitious. Consumers, apparently, share the sentiment. EVs have not exactly been flying off dealer lots. Recent studies have also shown that, for a number of reasons, many EV owners abandon the technology when it comes time to purchase another car. Nor is it expected that the infrastructure needed to support a nation of EVs will be in place by 2035.

“Supply chains for all of the heavy metals needed for batteries and other necessary components is just not there,” Knapp observed. “There’s also some question that while, yes, you may be eliminating tailpipe emissions, all that pollution is just going somewhere else—like into production.”

“Certainly, EVs are not going away. We’re going to see a lot more of them, just more slowly than predicted. For now, there’s likely to be a lot more push at the entry level to bring the prices down. But it’s also becoming clear that there’s going to be more of a push on hybrids, because OEMs still have to meet tightening CAFE [corporate average fuel economy] standards,” Knapp concluded.

And that’s not the only change affecting the vehicle space, added Knapp. “We’ve shared in other reports before that the OEMs are shifting away from sedans and coupes and moving toward crossovers [CUVs]—vehicles classified as light trucks. Right now, as we look at the Detroit Big Three, less than 10% of the vehicles they produce now are traditional cars. That ‘pseudo truck’ space will continue to be a huge thing for our industry that needs to be weighed and looked at going forward.”

SEMA’s Market Research department will also be closely following powertrain developments. “We’ve seen some interesting flip-flopping occurring,” explains Knapp. “Going back to the ’80s gas crisis, we saw engines get real small. Then as we came out of that in the ’90s and early ’00s, we went back to our big V8s and our big trucks. Now we’re seeing some shift back bringing the gas mileage up with tougher emission standards—fewer cylinders, but also smaller displacements and a rise of power adders like turbos and superchargers for extra power.”

Meanwhile, still other rapidly advancing vehicle technologies are presenting new challenges and opportunities for the aftermarket, most notably autonomous and “self-driving” features. While still a long way from becoming fully mainstream, such emerging tech is bringing a sense of disruption to the vehicle-modification and collision-repair sectors. Once common and relatively simple aftermarket mods, like lifts or new wheel/tire combos, now require more specialized knowledge of the effects on automatic emergency braking, lane keeping and other advanced vehicle safety systems. Even replacing a windshield can demand recalibration of vehicle sensors, cameras and other systems.

The Consumer Front

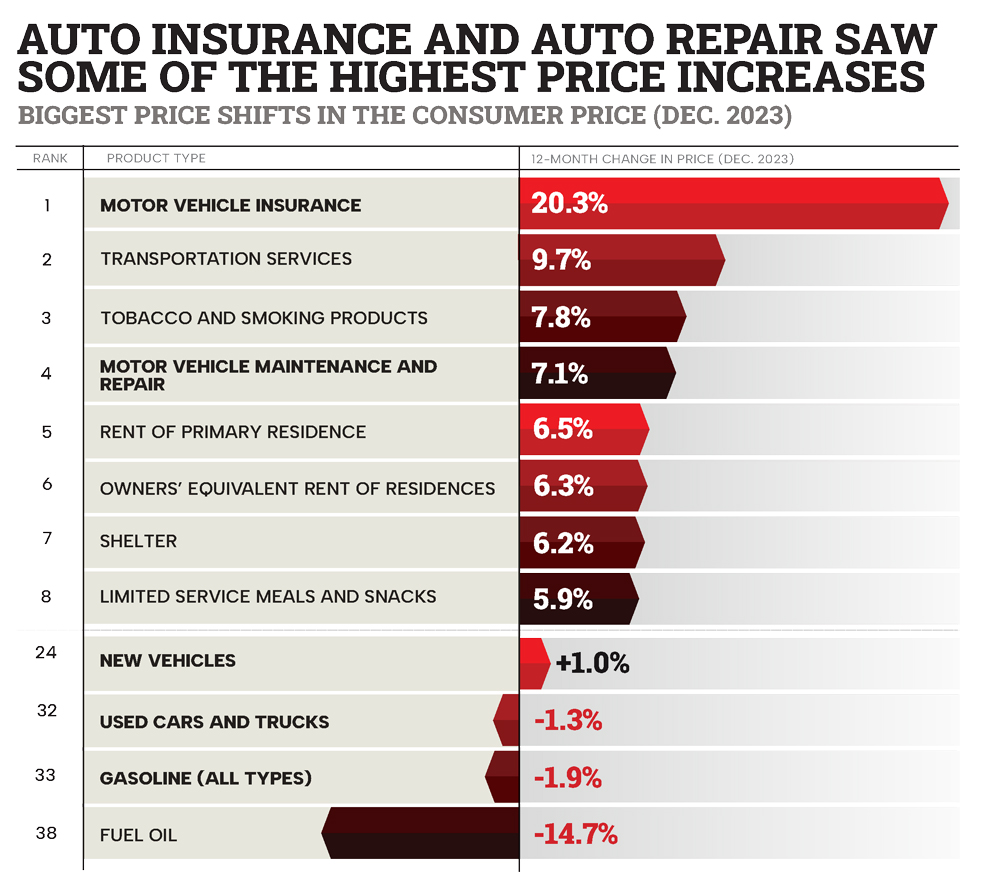

As stated before, consumers overall are still spending, but inflation and worries about the economy have definitely modified their vehicle buying habits. Part of this may be due to the impact of many automotive-related costs on their budgets. Auto financing, insurance rates and maintenance and repair costs have remained high, even as car prices have seemed to plateau. These costs combined with the improved quality of late-model vehicles have encouraged owners to hang onto their vehicles longer. What isn’t diminishing, however, is their love for their cars and trucks.

“One of the continuing trends we’re always looking at is the generational interaction with the automobile,” Knapp explained. “We hear a lot about young people being less enthusiastic about cars, but our research says that’s not true. More than half of the people who buy from our industry and are accessorizing are under age 40. From their 20s into their 30s—that’s a big sweet spot for us. Those consumers still tend to do more aggressive modifications. Yes, when you’re older, you may have more money, but you may not have the energy or inclination to crawl under your vehicle.”

In fact, even with today’s licensing restrictions delaying some teens from driving, on the whole Knapp has found there are more young drivers under age 25 than there were 30 years ago. (For that matter, at the opposite end of the scale, there are also more drivers in the 60–80 age group.)

According to Knapp, the young aftermarket consumer is changing demographically as well, with more females becoming enthusiasts. “The biggest emerging aftermarket opportunity relates to young people, but if you can attract the growing female audience, that’s 50% of the population right there. And we’re definitely seeing more companies doing that. Across all parts of our society now, personalization is huge, from phones to toys and other items. Once you get into a car, why wouldn’t you continue it there?”

The bottom line, said Knapp, is the industry is well positioned for near-term and future growth, despite the question marks raised by the present economy, industry challenges and changing nature of its consumers:

“There are nearly 300 million passenger cars on the road and currently 20%–25% of those are accessorized every year. And every year that number just keeps getting larger. That’s a big opportunity for us.”

Case Study: How SEMA Market Research Contributes to Sound Decisions

Innovation and entrepreneurial spirit drive the development of new specialty-automotive products. But given the investments in design, engineering, tooling and merchandising to bring a concept to market, there’s a certain element of risk.

With this in mind, Melanie Hellwig White, CEO of Visalia, California-based Hellwig Products, recently found herself in a quandary. As a manufacturer, White sees the introduction of new products as key to a company’s growth, but believes it takes more than a “gut feeling” to ensure a successful product unveiling.

“We were working on a new product,” explained White. “I had a specific customer pool in mind and the vehicle years I wanted to target. But was it worth a tooling investment? Manufacturers, especially smaller manufacturers like my company, don’t have a ton of resources. I don’t have a research team that can give me the information I need to launch a product. So I reached out to [SEMA Director of Market Research] Gavin Knapp.”

White knew that SEMA’s Market Research department offers a bevy of tools to members, from comprehensive annual market reports to niche-market studies and other relevant data—all free to SEMA members.

“Gavin has a wealth of knowledge,” said White. “He understood what I was trying to accomplish and pulled vehicles in operation (VIO) data so that I could see if I wanted to make a product in this space. I didn’t know that was the information I needed, but I knew Gavin would point me in the right direction. It allowed me to make an educated decision.”

White’s yearslong experience as a volunteer—including an 11-year leadership stint on the Light Truck & Accessory Alliance (LTAA) select committee (now the Truck & Off-Road Alliance/TORA), along with service on the SEMA Board of Directors—has expanded her perspective on SEMA’s many member benefits.

“SEMA is much more than the Show. The real benefit for me is knowing about all the resources that exist for SEMA members. Being able to tap into those resources is a huge benefit that not everyone knows about,” she said. —Ellen McKoy