BUSINESS

Backcountry Business Tips

The Global Popularity of Overlanding Presents Numerous Opportunities for the Aftermarket.

By Douglas McColloch

First popularized in Australia and sub-Saharan Africa, overlanding is a growing part of a $112 billion adventure tourism market that is forecast to generate more than $1 trillion annually by the end of the decade, according to a recent study published by Allied Global Insights. The SEMA Show’s annual Overland Experience exhibit provides companies with an in-depth look at what parts, products and build priorities are moving the market.

Once the province of outback adventurers in Australia and southern Africa, overlanding has gone global since the birth of the 21st century. The term may mean many things to many people, but it’s generally a form of vehicular adventure travel where the journey, not the destination, is the ultimate goal. Regardless of definition, it’s a rapidly expanding component of a $112 billion adventure tourism industry that’s projected to surpass $1 trillion by the end of the decade, according to a recent study published by Allied Global Insights.

But capitalizing on the growth of overlanding requires a detailed knowledge of the sector’s consumer base, its lifestyle habits, its purchasing priorities and its preferred marketing channels. A recent SEMA Education webinar, “The Globalization of Overlanding: How Manufacturers and Retailers Can Capitalize on the Worldwide Overlanding Phenomenon,” explored the subject and included practical advice on how companies can leverage this expanding sector to build brand awareness and to drive future sales. Moderated by Lindsay Hubley, managing partner of Lodestone Events, the company that operates Overland Expo, the discussion featured observations and insights from Scott Brady, CEO of Overland International. He is also the co-founder of Overland Journal, publisher of Expedition Portal and a longtime overlander who has circumnavigated the globe by motorized vehicle on three different occasions.

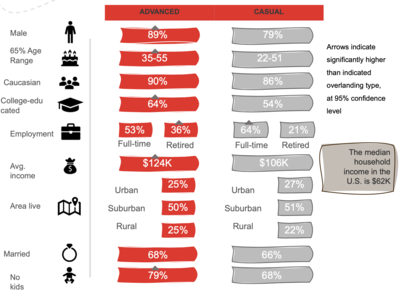

In the aggregate, overlanders tend to skew slightly older, are college educated, reside in the suburbs and are high-income earners. Most have no dependent children living with them, giving them even greater percentages of disposable income to spend on their hobby.

Out of The Pandemic, an Explosion of Growth

“When the pandemic first broke out in 2020, it slowed down international travel,” Hubley opened. “With that slowdown, folks in the States fell in love with the American road trip again, so we’ve seen an explosion of growth—not only in overlanding but in all outdoor recreation. Today, consumers are seeking new adventures, and they seek activities that allow them to social distance—and overlanders love to social distance.”

The effects of the pandemic and its aftermath on consumer behavior have been profound and long-lasting. According to a recent consumer survey from conservation nonprofit LeaveNoTrace, nearly 40% of consumers said they expect COVID to alter their recreational choices for the continued future. Among the changes in behavior cited were an increase in outdoor recreation, including more frequent use of public lands.

The growth in outdoor tourism seems to be impacting nearly every related sector of the industry. According to the Recreational Vehicle Industry Association, RV shipments grew by more than 20% in 2021 from the previous year, and one-third of leisure travelers who had never previously engaged in camping now express an interest in the activity. Related to that, campsite bookings soared in 2021, thanks to online booking sites such as Pitchup and HipCamp. In the overlanding sector, Overland Expo reported event audience growth of 20% year over year in 2021, and the Expo’s digital audience has grown 30% over the past three years. Expedition Portal has seen similar growth.

“We were lucky that a lot of people were at home during the pandemic and seeking out overland and vehicle-based travel,” Brady said. “We saw a total impression over the year 2020 of 40 million individuals. This is a big audience.”

How big? Overland Journal’s online research suggests an overall market of some 12 to 14 million overland enthusiasts in North America alone.

“We have great analytics tools that help us to understand the size of that audience, “Brady said. “These are people who think about the term and who make purchase decisions based on that.”

Major retailers are starting to tap into this increase in demand. In 2021, lifestyle retail giant REI launched REI Adventures, a website that allows users to plan and book all sorts of turnkey adventure trips ranging from easy family day trips to more strenuous, multi-day backcountry outings. The company also launched a division dedicated to car camping on its website “where you can purchase tents and other overland components,” Brady noted. Finally, would-be outfitters can find support at www.overlander.com, a new website specializing in selling overland-related products for the most popular vehicle platforms.

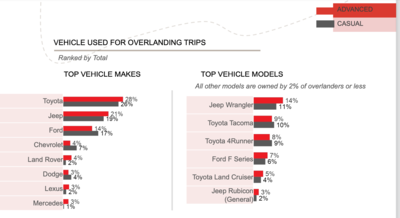

Among vehicle types, Toyotas are the leading choice of platform for overlanders, though Jeeps have gained popularity due to models such as the Gladiator pickup and the four-door Unlimited. Larger trucks and SUVs are gaining cachet as well due to their higher load-carrying capabilities.

Who Overlanders Are and What They Do

As adventure travelers, overlanders incorporate numerous lifestyle activities into their travels. According to a recent reader survey from Overland Journal, more than a quarter of overlanders participate in hiking (28%), followed by exploration of cultural/historic sites (17%), mountain biking (12%) and photography (11%). Fishing, hunting, paddle sports and rock climbing are also enjoyed, and companies that manufacture and/or sell products that supplement those lifestyle activities are well poised to grow their brands via overlanding.

Overlanders also use their vehicles to access some of the most remote locations on the planet.

“Remoteness is a key component,” Brady said. “We look for places that are farther away from the crowds, and we’re often looking for new cultures and new experiences. That often involves crossing borders, either between states or between countries, and camping is a big component of this.”

“Also, when we say ‘remote,’ we don’t mean ‘uncomfortable,’” Brady continued. “That’s why you’ll often see overlanders with fairly comprehensive camping kits—because they intend to be in the backcountry for days or weeks at a time.”

Again, companies that can serve the growing consumer demand for camping-

related products can leverage that demand for future growth.

In general, overlanders break down into two different types: “advanced” overlanders, who venture long distances into the outdoors on a regular basis and for extended periods of time, and “casual” overlanders, who tend to be weekend-warrior types who travel less frequently and over shorter distances.

Perhaps most importantly for companies in the specialty-equipment market, both types of overlanders are high-income earners relative to the U.S. population at large, according to research conducted in 2021 by Overland Expo. Both types of overlanders report annual incomes in excess of $100,000 (the median U.S. household income is slightly more than $60,000), and big majorities of both types have no dependent children living with them, giving them even more disposable income that they can spend on their hobby.

Both types are overwhelmingly male, married, and reside in suburbs. Advanced overlanders (average age 35 to 55) tend to be older than their casual (22 to 51) counterparts and are more likely to be college-educated. Advanced overlanders comprise roughly 60% of the segment, with casuals accounting for some 40%.

Overlanders first get involved in their hobby due to a variety of factors. Advanced overlanders are more likely to have been exposed to the practice as children and “grew up doing it” (40% of respondents). Casual overlanders tend to get involved after hearing about the activity from family and friends (25%) or from influencers on social media (12%).

No matter how people are first introduced to the activity, however, word of mouth can be a valuable tool for manufacturers and retailers to promote overlanding to new hobbyists, as Brady explained: “Peer influencing is really key, because overlanding leads to storytelling. When a friend is telling other friends about an adventure, that sparks their interest. As retailers and manufacturers, learning how to connect people to those stories is important because it increases the interest in wanting to go.”

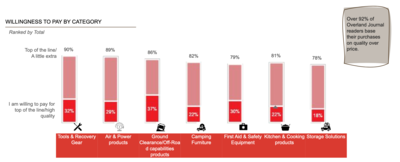

By a wide margin, overlanders say they are willing to pay premium prices for their products, prioritizing quality over economy. Among advanced overlanders, off-road capability is the most immediate build priority, while more casual overlanders opt for camp gear as a first choice.

How They Think and What They Drive

As a rule, overlanders tend to be environmentally minded consumers who are interested in products that use sustainable components and manufacturing methods, that offer products which can be re-used and repurposed, and which avoid waste and single-use applications.

“When we talk about an ‘overlander mentality,’ we’re talking about what makes this consumer tick,” Brady said. “That’s important for manufacturers and retailers to take a look at. [Overlanders] are interested in minimizing their impact to the environment, and the customer who comes into your retail store or who you’re making components for is going to be sensitive to that, so making products that will reduce the impact when we’re out on the trail, such as locking differentials or a good-quality tire that’s appropriate to the terrain, these are good things to suggest to this consumer.”

For companies in the process of formulating branding and marketing strategies aimed at the overland consumer, a handy benchmark is Tread Lightly!, the nonprofit organization dedicated to teaching and promoting responsible vehicle travel over public lands.

“It’s an important organization within both the four-wheel-drive and overland industries,” Brady said. “We encourage aftermarket manufacturers and OEs to make sure their messaging reinforces Tread Lightly! principles, because there’s a consequence for not following them.”

When it comes to choosing a vehicle as a build platform, overlanders look for durability, reliability and global parts availability. For that reason, Toyota has been the prominent brand, Brady observed. But a shift has occurred as overlanding has gained followers in the United States, and Jeep is now a major player—the four-door Wrangler and Gladiator pickup, in particular, having strongly impacted the market.

“When we started Overland Journal, Jeeps were only around 2% of the market,” Brady said. “Now it’s one of the most popular brands in the space.”

The bigger shift for companies to know, though, is toward larger vehicles, he said.

“We’re seeing a lot more fullsize trucks, and that trend is accelerating, so we’ll be seeing more Tundras, F-250s and F-350s because they have the payload to support all the equipment you’re bringing along.”

A related area of growth, in Brady’s estimation, is in integrated camper/habitat systems such as adventure trailers and pop-up truck toppers, which require higher payloads and tow ratings.

Hubley additionally mentioned the growth of the adventure van sector, such as Mercedes Sprinter and Ford Transit conversions, as a promising segment for manufacturers and marketers.

“We saw a big influx of that at Overland Expo in 2021,” she said, “as well as more equipment for vans and an increase in turnkey van builders.”

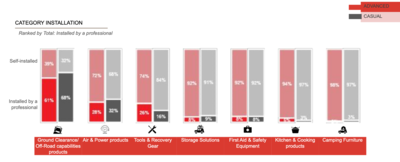

Most overlanding products are owner-installed, with the notable exception of mechanical hard parts that enhance off-roadability, such as gears, lockers, suspension upgrades and tires. For shops specializing in those types of installations, the growth of overlanding represents a potential new revenue stream.

What They Buy and Where They Learn

While there’s a great deal of overlap between the advanced and casual overland demographics, each group has its own unique sets of build priorities. The advanced contingent, being more hardcore in its orientation, gravitates first toward hard parts that can increase ground clearance and off-road capability, such as oversize tires, suspension lifts, lockers, rock sliders, etc.

Casual overlanders, by contrast, prioritize camping gear such as furniture and tents in their shopping preferences.

“It makes sense, given all the new vans and crossovers we’re seeing, and this is important because it represents the growth of new people we’re seeing entering the segment,” Brady said.

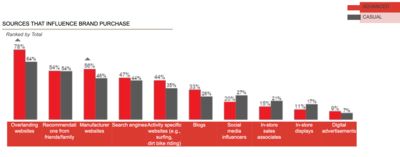

When making purchasing decisions, overlanders tend to rely on fellow members of the overlanding community, such as enthusiast websites, word of mouth, and manufacturer websites. Roughly a quarter of overlanders rely on social media and online influencers for product information, while fewer than one in 10 rely on traditional digital advertising.

Still, both sets of overlanders agree that first aid and safety items are the most essential components they purchase for their vehicles, followed by off-roading parts and camp gear and kitchen items. They also both overwhelmingly favor build quality over price. More than 90% express a willingness to spend either “a little more” or “top dollar” for their builds, and they tend to be rather brand-loyal. More than 90% of overlanders said that specific brands exert an influence on their purchasing decisions.

“It’s something we’ve seen at Overland Journal from the very beginning, and it also reflects the kinds of vehicles that people are buying.” Brady said. “If overlanders are purchasing Land Cruisers and 4Runners and Tacomas, they have a ‘quality and durability’ mindset, and the components they buy for their vehicles reflect that mindset as well.”

Not surprisingly, advanced overlanders make more extensive modifications to their vehicles, but even among the casuals, roughly 85% have performed some kind of modification, so both groups represent a potentially lucrative revenue stream for manufacturers and retailers alike.

While online sales of overlanding products have gained in popularity, retailers still play a major role. Overlanders who are shopping for camp gear such as first-aid equipment, furniture and kitchen/cooking products prefer major brick-and-mortar retail stores such as REI as their go-to parts source.

“People want to see and feel those kinds of products,” Brady said.

On the other hand, online-only retailers are a preferred source for tools and recovery gear as well as air and power products.

Perhaps most importantly for companies in the specialty-equipment market, both types of overlanders are high-income earners relative to the U.S. population at large, according to research conducted in 2021 by Overland Expo.

For information regarding the latest tech, trends and product developments, overlanders are an extremely “wired” demographic, with more than 75% of advanced overlanders and 65% of casuals utilizing the internet (and overlanding websites in particular) as their preferred sources of information. Both also rely heavily on peer-to-peer influencing such as word of mouth as well as manufacturer websites.

Activity-specific websites (dedicated to dirt biking, four wheeling, etc.) are more likely to attract advanced consumers, while social media and in-store displays more strongly impact casuals. Neither group relies much on conventional advertising, with fewer than 10% saying that it influences their purchasing decisions.