RESEARCH

The Fall 2021 SEMA “State of the Industry Report”

Specialty-Equipment Companies Saw Double-Digit Growth During the Pandemic, but Optimism Is Fading Due to Supply-Chain Problems

By Chad Simon

The “State of the Industry Report” is about what’s happening on the business side of the automotive specialty-equipment market. It reports on different industry trends that may not necessarily fit into the consumer-focused “SEMA Market Report.”

Not to be confused with the annual “SEMA Market Report,” the “State of the Industry Report” is released biannually in the spring and fall and details specific manufacturer and retailer data, sales trends by product category, and popular retail channels and vehicle segments. It explores the industry from a company perspective rather than at the consumer level.

“The ‘SEMA Market Report’ is about understanding the market for parts based on how much consumers are spending and how they are behaving,” said Matt Kennedy, SEMA market research manager. “By contrast, the ‘State of the Industry Report’ is about what’s happening on the business side. It reports on different industry trends that may not necessarily fit into the consumer-focused ‘SEMA Market Report’; however, specialty-equipment businesses should still pay attention to them. It’s about what businesses need to know about the industry versus what businesses need to know about the market.”

The COVID-19 Factor

Society is still dealing with COVID-19, and it’s affecting the industry in a plethora of ways. Although two-thirds of manufacturers reported that they experienced double-digit growth last year, the pandemic has wreaked havoc on both the supply chain and in-store purchases behind the scenes, according to Gavin Knapp, SEMA director of market research.

“Manufacturers have seen strong results over the last two years, but it’s been a bumpier road for retailers,” Knapp said. “Some have adapted well, while others have seen fewer people showing up in their stores.”

The automotive specialty-equipment industry is driven by disposable income, and during the earlier days of COVID-19, there were fewer ways to spend money due to restrictions and lockdowns on travel, live entertainment and restaurants, according to Kennedy. That created an opportunity for consumers to work on their cars, since they couldn’t do anything else. Many of them said they spent more time shopping online and working on their vehicles themselves. Getting into the garage was a way to pass time that might have otherwise been spent on leisure activities.

Despite robust consumer demand, predictions are for flat and slower growth rather than shifting into a decline going forward. That is expected to carry on well into 2022.

“It’s not a reversal of fortune,” Kennedy said. “It’s understanding that there were some unique circumstances that created some exceptional opportunities, and businesses feel they are still in a good position to succeed. If 2020 and 2021 were about capitalizing on how conditions created some unique opportunities for our industry, 2022 looks like people have made those adjustments and are now getting through the rest of the recovery and a return to normalcy.”

Emerging Trends

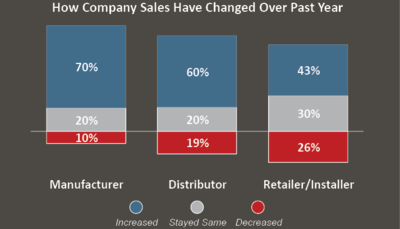

Despite ongoing disruptions to the economy, most specialty-equipment businesses reported increased sales over the past year.

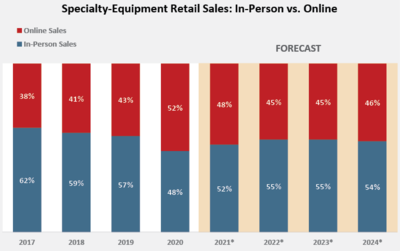

There’s much hype about online retail taking over, but actual economic data suggests that e-commerce is still a small share of total sales, and it’s returning to its historical trend, according to Kennedy.

“Industry sales are ahead of the curve in terms of how much product is sold online because, as a specialty industry, they aren’t always available locally,” he said. “More than half of sales were online in 2020, but now it’s drifting back down toward a 55%–45% balance, which is the trend we were expecting to see prior to the pandemic.”

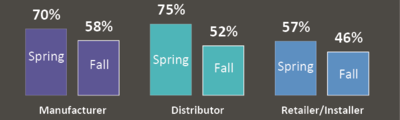

Companies Expecting Sales Growth Over Next Year

Strong optimism earlier in the year has been tempered by growing uncertainty about how soon things will truly get back to normal.

The automotive specialty-equipment industry traditionally has been more highly integrated with online shopping than other parts of retail and has had a healthy online shopping presence for a number of years, according to Knapp. In many cases, there’s still a preference for in-person shopping. Some people prefer to examine products in the store and speak to a salesperson when they go to buy, but it’s also related to the nature of certain products. If it’s a more complicated, expensive and difficult-to-ship item, consumers prefer to purchase in the store.

“Some people might be comfortable buying a part without ever seeing it, because they know exactly what they need and that it’s going to fit and perform how they expect,” Knapp said. “If it’s a product they don’t know how to use, there’s more of a desire to speak to someone who knows more than they do and to see if it’s right for them. Neither of those things is going away.

“We did have a jump in online sales over the past year, but as restrictions ease and comfort levels grow with going back out in person, we expect sales-channel trends to drift back to where they would have been had the pandemic never happened.”

Looking a little further ahead, electric vehicles (EVs) are beginning to make a dent in new-vehicle sales. Several new models will be released over the next few years, but EVs aren’t going to replace gas engines anytime soon, according to Kennedy.

“We project that by 2035, 45% of new vehicles sold will be some form of alternative fuel—excluding the population currently on the road, which will take a while to cycle out—a quarter of which will be fully electric,” he said.

A Shift Toward Light Trucks

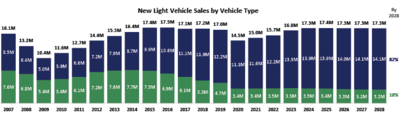

New Light Vehicles Sales by Vehicle Type

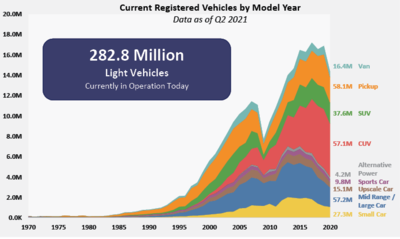

Back in 2007 and 2008, passenger cars and light trucks (CUVs, SUVs, vans and pickups) each represented about half of all new light vehicles sold in the United States. By 2020, the share of light trucks grew to roughly 76%. That growth is expected to continue in the coming decade. Much of the increase can be attributed to CUVs. Source: 2021 Wards Intelligence, a division of Informa. Data as of October 2021. Source: SEMA Member VIO Program/2021 Experian, Data as of June 30, 2021.

Vehicle sales continue to shift from cars toward light trucks, which include pickups, SUVs and CUVs. That trend does not look to be going away, according to Knapp.

“The vehicle landscape is changing dramatically,” he said. “Eighty percent of new-vehicle sales—especially for the Detroit OEMs—are light trucks, but the CUV space is where the big growth is happening. Pickups and SUVs are great sellers, but in terms of new-vehicle sales, consumers are switching from sedans to crossovers. In the specialty-equipment market, it’s interesting to see if people who move into the CUV space treat them more like trucks or SUVs, where they install towing equipment, racks and other utility features. Maybe they buy wheels and tires more equivalent to the truck space than you would see in the car space. There could be a boom for our industry if people start to take advantage of the utility aspect of these vehicles.”

Toyota and Volkswagen are also drifting toward crossovers as the jack-of-all-trades family vehicle with the potential to be treated as a utility vehicle, according to Kennedy. In 2000, 1% of Volkswagen’s new-vehicle sales were light trucks. In 2020, it’s increased to 58% because of the shift toward CUVs. These trends are still very much in play and affect how the vehicle landscape is supposed to evolve.

Common Upgrades

Light trucks (pickups, SUVs, CUVs and vans) are becoming a larger share of the overall vehicle population as OEMs shift their production away from passenger cars to more profitable light-truck platforms. This has been largely driven by the popularity of CUVs. Source: SEMA Member VIO Program/2021 Experian, Data as of June 30, 2021

The specialty-equipment market is vast. Just about any part of a vehicle can be customized and improved, and consumers are buying everything across the board, according to Knapp. All of the product categories seemed to get a boost over the past two years while people were willing to spend money. Even some of the softer categories in previous years, such as mobile electronics and stereos, also saw jumps in sales.

“We often think of wheels and tires as the gateway drug to the industry, where they are easy to do and make a difference for your vehicle,” Knapp said. “Some consumers are focused on look and feel, while many others are focused on performance. There are classic vehicles, restorations and hot rods. The types of products sold in this industry are all over the place.”

Industry Outlook

Online specialty-automotive sales have been growing over the past few years as more and more businesses get the hang of selling on the web. But the unique circumstances of 2020 pushed more sales online than normal.

Despite healthy sales numbers over the past couple of years, there is a tempering of optimism due to supply-chain issues and having enough product to sell, according

to Kennedy.

“The demand is still expected to be there,” he said. “We’ve seen many different shifts in how products are sold and what vehicles are popular over time, but that drive to make a vehicle your own is not going anywhere. Consumer demand is still going to be what drives this industry.”

The shortage in hourly labor at the lower end of the pay scale is also affecting most businesses. The automotive specialty-equipment industry can be tough for hiring quality employees, and some companies are struggling a little more than usual, according to Kennedy. However, many of them might have already done some hiring in 2020–2021, while others are looking to hire now, which makes it tough for them when there is more competition from the same labor pool.

The “SEMA State of the Industry Report—Fall 2021” is free and a benefit of SEMA membership. Along with a host of other free industry reports, it can be found at www.sema.org/market-research.

The SEMA market research team is available to help the industry directly. Contact Matt Kennedy at mattk@sema.org or call 909-978-6730 for questions about how to interpret and utilize the data found in the “SEMA State of the Industry Report—Fall 2021.”

“We believe it’s important that businesses are able to make good decisions based on the information we put out there, and we encourage folks to contact us if they need help making use of it,” Kennedy said.