RESEARCH

The SEMA “2021 Retail Trends Report”

Taking a Closer Look at Who’s Buying What (and How) From the Aftermarket

By Mike Imlay

After the ups and downs of the past two years, it’s reassuring to know that consumer spending in the automotive sector continued at a healthy pace. In fact, the sector remains the single biggest retail segment in the United States, accounting for 20%—more than $1.2 trillion—of retail spending in 2020, according to the latest “2021 Retail Trends Report” from SEMA Market Research.

After the ups and downs of the past two years, it’s reassuring to know that consumer spending in the automotive sector continued at a healthy pace. In fact, the sector remains the single biggest retail segment in the United States, accounting for 20%—more than $1.2 trillion—of retail spending in 2020, according to the latest “2021 Retail Trends Report” from SEMA Market Research.

Released late in the fourth quarter of 2021, the 50-page report highlights U.S. retail spending and presents new findings on the retail side of the specialty-equipment market, including specialty-automotive shopping behavior and trends. Although issued as a 2021 report, it is designed to provide context about the market to aftermarket retailers as they enter the new year.

“Unlike other recessions where the economy slows more uniformly and then comes back slowly, the 2020 recession was more sudden as things shut down and then came back quickly, particularly in the goods sectors of retail,” said SEMA Director of Market Research Gavin Knapp. “Fortunately, that’s where our industry lives. In March or April 2020, you would’ve thought our market was going to be really devastated this year, but the first half of 2021 showed really strong sales across all retail and specifically within our market, so with this report, we look broadly at U.S. retail and see how the automotive market plays into that.”

Retail represents a huge sector of the U.S. economy, accounting for more than $6.2 trillion in 2020 spending, and while consumer shopping habits have changed somewhat over the past couple of years, the good news for brick-and-mortar and independent retailers is that traditional retailing channels remain strong.

“This report will help our industry’s businesses better understand automotive aftermarket retail trends by product and retail channel as well as consumer and shopping behavior,” said SEMA Market Research Manager Matt Kennedy, who oversaw the report’s creation. “Our expectation is that as we move forward, and as consumers are more and more comfortable going back into stores, our smaller businesses are going to be able to once again do what they do best and compete by adding value versus competing on price.”

For retailers eager to plot their course ahead, the report offers several noteworthy takeaways.

1. The Aftermarket Is an Online Sales Leader

THERE’S NO ONE WAY PEOPLE BUY SPECIALTY-AUTOMOTIVE PARTS

Specialty-equipment consumers utilize a variety of sources for researching purchases and tend toward “mixed-mode” buying between brick-and-mortar and web channels. The recent pandemic pushed some toward buying exclusively online, but this is seen as a temporary shift.

The automotive specialty-equipment industry is ahead of other sectors in online sales, with just over half of the $47.89 billion spent on specialty parts in 2020 going through online retail channels. However, SEMA’s market research forecasts that online retail sales will see a post-pandemic leveling off, then return to their historical trendline over the next couple of years.

“Certainly online purchasing has become a bigger and bigger part of the buying experience in every sector, but interestingly, it’s not really as big as most people seem to think across the whole U.S. retail market,” said Knapp.

In reality, e-commerce accounted for just 14% of the American retail pie in 2020. That figure is up from 11% in 2019—a sudden jump fueled mainly by the pandemic but still a small fraction when compared to overall retail-sector sales.

“One of the things we highlight in our report is how far ahead of the curve our industry is,” he said. “Online sales in our market actually approach 50% and even saw an additional jump in 2020.”

Kennedy added that bigger retailers often had an advantage during the pandemic lockdowns.

“They had a much easier time shifting their sales online, since they already had built-in e-commerce platforms and could say, ‘If folks can’t come into our stores, they can just buy online,’” he said. “Retailers on the smaller side tended to lack the same capabilities—think of the single-location shop with few employees and resources to build an online store. When we look at how things shifted during the pandemic, we do see that there was some hit to in-store specialty retail while other businesses definitely saw growth online.”

The “2021 Retail Trends Report” contains numerous charts and statistics to offer context on how the pandemic affected all types of retailers. For example, a pre-pandemic survey of independent retailers indicates that 73% of them were already feeling greater competition from large online retailers in 2019. During that time, 62% adapted by increasing their social-media presence, and 57% put more effort into personalized service. Among other tactics, 47% added or updated a website, and 33% refocused on a specific niche. Such strategies may have proved useful when COVID-19 disrupted the marketplace.

2. Retailers Face a Shifting Automotive Landscape

For their long-term planning, specialty-equipment retailers will want to pay close attention to the evolving makeup of the American vehicle fleet.

“We know that purchasing a car is a key trigger for people to start accessorizing and modifying,” Kennedy explained. “About 50% of consumers who accessorize start doing so within six months of buying a vehicle, whether that vehicle is new or used, so one important trend to keep track of is what’s going on with vehicle sales and the vehicle population at large.”

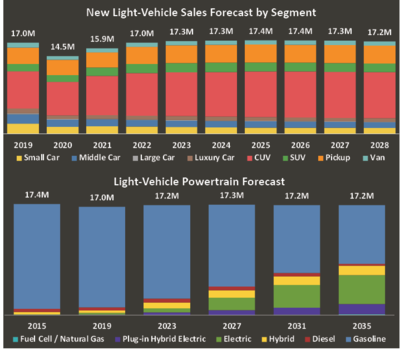

The “2021 Retail Report” details a shift away from traditional cars as OEMs—guided by consumer tastes—increase production of light trucks, including SUVs and CUVs. Already well underway, the trend is so pronounced that the light-truck category is expected to represent 80% of all new-vehicle sales by 2028, with CUVs set to dominate.

This transformation in the vehicle landscape will obviously impact the types of products that retailers will wish to stock. However, the growth of the CUV segment may present some interesting challenges. Will buyers outfit them much as they do pickups for utility, payload and adventuring? Or will they enhance them more as generic commuter vehicles? Retailers who get the answers to those questions right will gain a decided edge.

3. Alternative Power Is Gaining Market Share

A related trend to watch is the increasing number of alternative-fuel vehicles (e.g., hybrids and battery electrics). Right now, they comprise a small but growing share of new vehicles sold and are expected to account for 25% of new sales by 2028 and 45% by 2035.

Further, while hybrids make up the largest share of today’s alternative-powertrain offerings, those platforms will be dwarfed by battery electrics within the decade. By 2035, full electrics are expected to account for 26% of powertrain sales, with hybrids and plug-in hybrids trailing at 9% each. As the report notes, however, “The flip side of this is that internal combustion engines will remain the majority of vehicles sold and an even bigger majority of those on the road.”

Both Knapp and Kennedy expect alternative powertrains to open new opportunities for the aftermarket. In the early years of electrification, vehicles leaned toward unexciting commuter designs, but the desire for personalization is bound to grow with the introduction of alt-power trucks.

“The drive to make a vehicle one’s own is not going away,” Kennedy said.

4. Specialty-Equipment Consumers Prefer “Mixed-Mode” Buying

Despite the aftermarket’s lead in e-commerce, specialty automotive consumers most commonly buy their parts in a “mixed-mode” fashion—i.e., making purchases both in-person and online. In addition, “buy online, pickup in-store” behavior also appears to be gaining traction.

Among the statistics presented in the “2021 Retail Trends Report,” 51% of aftermarket consumers followed a mixed-mode pattern of shopping in 2019. That figure dropped to 42% in 2020—presumably due to the pandemic driving shoppers away from brick-and-mortar outfits. Consumers who prefer online-only purchasing currently represent 34% of the aftermarket customer base, up 13% from 2019. Those who describe themselves as in-person-only shoppers represent just 24% of aftermarket consumers, down 4% from 2019.

“Unlike repair and replacement, where you just want to find something that meets the OEM specs, in the specialty-equipment market, it’s all about meeting your own specs,” Knapp said. “That means people are always asking, ‘What kind of performance does a product add? What is it that I should look for? What brands am I comfortable with, and what do I gravitate toward?’ So really, our physical retail market is about connection with the customer. It’s the ultimate point of sale for most products from our industry.”

“We also see that the people who end up purchasing in-store tend to do a lot more research and interaction with others, getting advice from friends, family or from salespeople,” Knapp added.

The report devotes sections to consumer profiles ranging from enthusiasts to non-enthusiasts, along with do-it-yourself (DIY), do-it-for-me and other types of customers, and then correlating them with preferred buying modes.

5. Chemicals, Wheels and Tires Are Consumer Gateways

RETAILERS FACE A CHANGING AUTOMOTIVE LANDSCAPE

Shifts in the types of vehicles consumers buy will impact the specialty-parts retailers should plan to carry. Car buyers have been transitioning toward trucks and CUVs for some time now, with alternative powertrains expected to trend upward through 2035.

For many consumers, high-performance chemicals along with specialty wheels and tires represent the “gateway drugs” that can lead to more ambitious modifications to their vehicle’s appearance, performance and handling. Because those products are most frequently bought in-person, they offer prime opportunities for a retailer to forge consumer relationships.

The report divides specialty products into three categories: appearance and accessory items, performance and handling product. In the first category, the list is topped by chemicals, exterior body items and utility accessories, with consumers spending average annuals of $7.41 billion, $5.56 billion and $3.53 billion, respectively. In the remaining two categories, consumers spend an average of $6.09 billion on wheels and tires and $5.11 billion on suspension, brake and steering products. By comparison, drivetrain, engine/electrical and ignition, and internal engine cooling products come in at $3.40 billion, $1.88 billion and $2.12 billion, respectively.

Ultimately, the “2021 Retail Trends Report” contains a wealth of information.

“We know that the last two years have imposed a lot of disruptions with COVID-19 and its consequences, and those certainly have had broad implications for the retail market,” Knapp said. “There were some sectors such as services, food and travel that were hit really hard. We’re fortunate that our companies and retailers generally fared better and are mostly optimistic about the coming year. This report is designed to help our retailers succeed as we continue to move toward a ‘new normal.’”

The automotive sector represents the single largest retail segment in the United States, and the recently released “SEMA 2021 Retail Trends Report” aims to help aftermarket retailers of all sizes understand current economic shifts to chart a post-pandemic course.

Stay On Top of Market Trends

As the industry moves into the post-pandemic world, market and economic trends information is more vital than ever for business planning. For your free download of the 50-page “2021 Retail Trends Report,” visit the SEMA Market Research webpage at www.sema.org/market-research.