RESEARCH

The Latest SEMA “State of the Industry Report”

Market Research to Inform Business Planning After a Year of Disruption

By Mike Imlay

does the industry now stand? The latest SEMA “State of the Industry

Report” looks at how the aftermarket weathered disruptions and is

poised for renewed growth this year and beyond.

Back in late 2019, the trendlines looked good for the automotive specialty-equipment industry. Then, of course, the 2020 pandemic threw the world into confusion. As lockdowns swept the United States, uncertainty gripped virtually every market sector, including the aftermarket. With the pandemic ebbing, it’s a good time to assess where the industry finds itself and where it may be headed. Enter the latest SEMA 2021 “State of the Industry Report,” now available from SEMA Market Research.

Seeking to bring some clarity to a jumbled financial picture, the report is based on a statistical survey of aftermarket manufacturers, distributors and retailers/installers who were asked a series of questions touching on their overall economic health as well as their expectations and outlooks for the coming year. Government data encompassing broader American consumer and automotive-sector trends was also tapped for comparison with industry benchmarks.

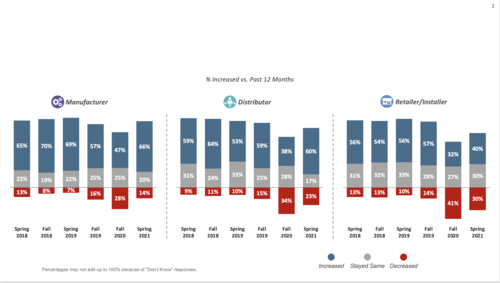

Company Sales Performance Over Time

the aftermarket’s manufacturing, distributor and retailer/installer

sectors have all largely weathered the COVID-19 disruption. As

companies continue to recover, many are experiencing strong sales

growth.

“This is a study that we do twice a year to gauge the state of the industry, how aftermarket sales are doing, and other metrics that are of interest to SEMA members,” said SEMA Market Research Manager Kyle Cheng. “For this report, we were especially interested in how the industry did after a lot of disruption. Now that we’re further removed from the initial shock of the pandemic, the data is reflective of where our businesses stand as we return to some sort of normalcy.”

According SEMA Senior Director of Market Research Gavin Knapp, the study was designed as a comprehensive view of the aftermarket.

“We looked across the industry at different business types, from manufacturers to retailers, distributors and other business models,” he said. “Wherever they are in the industry, whether they focus on classic cars or musclecars or whether they’re in the performance or accessory world or even the racing world, our goal was to bring them all together and get their input for our ‘State of the Industry’ research.”

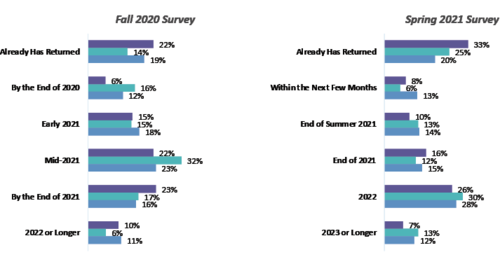

When Companies Expect Industry To Return to Pre-Pandemic Levels

aftermarket companies believe there is still work to do before the

industry fully recovers. However, the aftermarket is showing more

optimism about rebound than it did last fall.

A Year of (Mixed) Growth

Perhaps the report’s biggest takeaway is the impressive aftermarket sales growth that followed the widespread U.S. lockdowns shortly after COVID-19 hit.

“Obviously, the elephant in the room is that sales have really performed and that many companies have really killed it,” Cheng said. “We’ve heard anecdotally from a lot of them that they’ve seen record sales, and the data largely supports that across the industry. That’s not to say that some companies out there—particularly retailers—weren’t hit fairly hard in sales, but most companies are showing pretty good sales growth compared to where things were last fall.”

For many companies, the surge in sales came as an unexpected windfall, Knapp added.

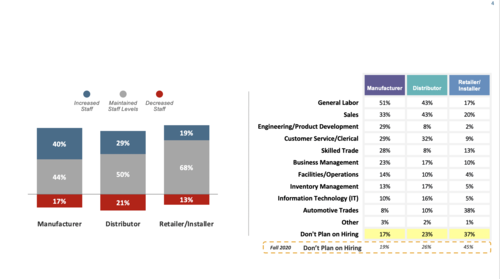

How Total Number of Staff Changed Over Past Year

degree of job losses, most companies managed to maintain and, in

some cases, even grow their staffs over the past year.

“The pandemic shutdowns brought a lot of disruption over the last year, and we would’ve expected a year ago that there would be some serious ramifications for the industry in terms of sales,” he said. “But while companies were really worried last spring and even took a sales shock, the outlook was much better by fall. Now we’re seeing even more increases. We’re at a point where a majority of companies report doing as well as or better than they did in 2019 over this past year.”

That specialty-equipment sales growth mirrors an overall trend in the automotive sector at large. In March 2021, U.S. government data indicated that consumer spending at motor vehicle and parts dealers had hit $135.5 billion—the highest number ever recorded. By the following month, that figure had climbed even higher to $139.5 billion.

“This record spending is helping our market recover a lot faster,” Cheng noted. “On top of that, automotive parts production, which was disrupted in the beginning of the pandemic, is now reaching really high capacity and producing more parts than it had in the last 20 years.”

Overall, aftermarket manufacturers saw the steadiest sales growth, while the industry’s retailers experienced a more mixed outcome.

“In a recession, we would typically expect a lot of hurt across all industries and sectors of the economy, but this was very sectorial,” Knapp observed. “Certain industries were hurt a lot, others not so much. Luckily for us, our industry was one that fared very well. But even within our industry, there were a lot of differences.”

On the manufacturing side, business remained good as long as consumers were buying parts and manufacturers could crank them out and ship them. But Knapp explained that the inherent structure of retailing sometimes worked against resellers and mom-and-pop shops.

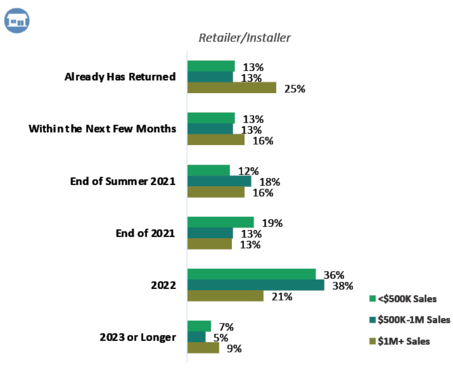

“For example, people were afraid during lockdowns—and sometimes are still afraid now—to go into a brick-and-mortar store,” he said. “We also saw a lot of differences in results, depending on the size of a business. Larger businesses came through very well and have by this point not only recovered but are likely to say they’re growing, but there is a larger proportion of smaller businesses who say they got hurt over the year and are still feeling it.”

The ability to source products from multiple suppliers and to sell online helped many businesses (notably manufacturers) weather the storm. Leveraging social-media channels also seemed to bolster retail sales for many. While the downturn was generally tougher on retailers, fewer than a third of those surveyed for the “State of the Industry Report” said they suffered losses over the past year. In fact, a relatively healthy 40% said they grew their sales—some by double digits. Without minimizing the pain of the smaller businesses that struggled, the aftermarket retail segment in general demonstrated remarkable resiliency.

“If you think about how things looked a year ago, again, those numbers are better than we might have expected,” Knapp said. “While we can say the pandemic hurt more retailers than it did manufacturers or other types of businesses, it certainly wasn’t uniform.”

Expect Industry to Grow Next Year

sales noticeably influences expectations for industry

recovery.

The Industry Is Hiring

After some industry job losses last year—with 17% of manufacturers, 21% of distributors and 13% of retailers reporting staff decreases—the good news is that the industry is looking to hire in the coming months. Moreover, the positions that aftermarket businesses seek to fill are broad and varied.

“Companies across the board are certainly looking for more general-labor-type people to work in warehousing, shipping and areas like that,” Knapp explained. “However, a lot of companies on the manufacturing and retail sides are also looking at other jobs, such as sales. As things ramp up, there will also be engineering and product-development-type jobs as well as other skilled positions to move products out the door. In fact, 83% of manufacturers expect to increase staffing in the next 12 months or so. That’s big.”

Cheng added that the industry has made significant progress in bringing back jobs thus far.

“Within a period of a couple of months, we had recovered about 80% of the jobs that were lost over the past year,” he said. “It’s that last 10% to 20% that is going to take some time to fully bounce back from, and when we look at companies’ opinions on when the industry will be back to pre-pandemic levels, most are looking at the end of 2021 as the goal.

When Industry Will Return to Pre-Pandemic Levels

industry will be back to pre-pandemic levels by the end of

2021.

“Along those lines, the pandemic disrupted a lot of supply chains, so companies are looking at ways to repair and rebuild that infrastructure or find alternative pathways. In order to do that, you need a lot of staff and resources. That could also mean a lot more business opportunities. A lot of companies relied on international suppliers that were disrupted severely, so new ways to source parts will be an important issue for the future.”

Out of the Storm?

Taking into account the sharp ups and downs of the past year, the various uncertainties still playing out in the overall economy and the business challenges ahead, what’s the prognosis for the industry? Are the economic winds blowing favorably again for the aftermarket?

“I think the overall story is pretty good,” Cheng answered. “Our companies are doing pretty well. They’re optimistic for the future. Still, there is a fair degree of economic uncertainty. Companies are kind of figuring out where the economy is and where it will be in the next couple of months. Obviously, the virus situation has gotten a lot better, but there’s still some concern that about that, too.

“Another factor is consumers. Over the past year, they have spent a lot of money on our industry, as we see from the government data, but will they continue to funnel money into our industry at the levels they have lately as we return to normal? That’s going to be an important question moving forward. All indications are yes, but consumers will have more options. Of course, enthusiasts will always find ways to invest in the aftermarket.”

Knapp agreed.

“Keep in mind that as we look at expectations for this year, we see that 70% of our manufacturing and 57% of our retailer respondents said they expect to grow,” he said. “Only a very small portion expect to see declines this year, so optimism for sales in 2021 is really strong across the industry right now.”

Get the Latest Research

To download your free copy of the 2021 “State of the Industry Report,” visit the SEMA Market Research webpage at www.sema.org/market-research. While there, be sure to check out the many other research reports that can help your business succeed and prosper in 2021 and beyond.