RESEARCH

The 2021 “SEMA Vehicle Landscape Report”

New Research to Help You Stay Ahead of a Fast-Changing Vehicle Market

By Mike Imlay

surveys the rapidly changing character of America’s

passenger-vehicle fleet and offers vital information to help

target new opportunities for product-development and sales.

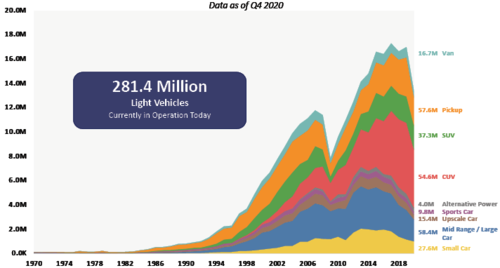

Just about any vehicle can be outfitted with all sorts of aftermarket products. However, with more than 281 million cars and trucks currently on the road in the United States, knowing where the greatest opportunities lay can be challenging. Specialty-equipment businesses will find help in the latest “SEMA Vehicle Landscape Report,” recently released by the SEMA Market Research team. The report examines what’s changing, what categories and vehicle types currently hold the most potential for the aftermarket, and the trends brewing on the horizon.

“There are hundreds of millions of vehicles on the road in the United States, and those cars and trucks are the canvas for our industry and its creativity,” explained SEMA Market Research Director Gavin Knapp. “The focus of this report is to help SEMA members understand what car, truck and other types of vehicle models are selling well, which ones are found most on the road, and which ones therefore offer the most opportunity for our industry.”

“The purpose of this report is also to give our members and the general industry a sense of what vehicles look like right now,” added SEMA Market Research Manager Kyle Cheng, who compiled the report. “We look at key trends, OEM sales, the current makeup of vehicles on the road and so forth. We also build off of original research that we’ve previously done—for example, our annual market report, vehicles-in-operation (VIO) data and future-trends research—to identify what vehicles are really hot for our industry right now, what’s new, and what’s coming down the line.”

The comprehensive report includes sections devoted to a VIO overview; new light-vehicle sales and powertrain projections; the hottest models for specialty-equipment upgrades, modifications and accessories; and the latest vehicle trends and emerging technologies. The report also breaks down trend information by vehicle category, from traditional and sports cars to trucks, SUVs, crossovers and vans. There’s even a section focusing on classics. So what are some key takeaways?

than 281 million vehicles in operation on America’s roadways.

The report charts them by vehicle types and model years to

help provide aftermarket businesses with a picture of where

parts and modification opportunities continue to be found.

OEM Sales are Recovering

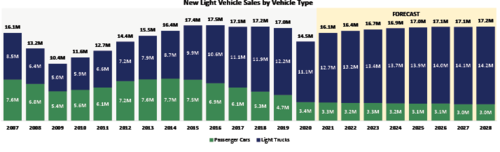

“I’d say one of the one of the takeaways, now that we’re in 2021, is that 2020 was a rough year for a lot of sectors in our economy, and COVID-19 definitely affected new-car sales,” Knapp said. “But, luckily, the impact was not as bad as we would have thought in April 2020, when new-car sales virtually shut down to nothing.

“The year did end in lower sales—down from about 17 million to just above 14 million—but we now see the trend of sales quickly moving back over the next few years toward that 17-million mark that we’ve been running at for the last half decade. In those terms, while there definitely was disruption, it’s pretty short term.”

According to Cheng, the effects of COVID-19 also differed from past recessions in another interesting aspect. In a typical recession, larger vehicles usually take the biggest sales hit as consumers curtail spending and look for less-expensive options. However, the opposite was true during the 2020 downturn: CUVs and pickups kept light-vehicle sales on track.

Trucks Still Dominate the Marketplace

The report notes that pickups did more than buoy OEM sales during the bleak months of 2020. They also continued to command the lion’s share of specialty-equipment sales, accounting for nearly a third of all retail dollars spent in the industry. With overall market sizing estimated at $14.28 billion, they represent the aftermarket’s number-one niche.

“Looking over the last few years, pickup trucks have been a hotspot for our industry and will continue to be hot sellers going forward,” Knapp observed. “In fact, the top-selling models on U.S. roads are all fullsize pickup trucks.”

Among the bigger pickups, the Chevrolet Silverado 1500 and the Ford F-150 stand out as accessorization favorites among consumers. Also topping the aftermarket opportunity list is the Jeep Wrangler, which enthusiasts continue to make one of the most accessorized vehicles on the road today. Top purchases in the truck category include trailer and towing packages; exterior appearance; fender, hood and body upgrades; suspension products; and truck bed liners, among others.

In addition, the category is growing. Among other popular and emerging pickups, the “SEMA Vehicle Landscape Report” cites the Toyota Tacoma, the Chevrolet Colorado and GMC Canyon and the Jeep Gladiator as holding special potential for the aftermarket. The Tacoma, the Colorado and the Canyon are all due for redesigns for 2024, with the Tacoma expected to roll out a hybrid version. The buzz around the Gladiator is a plug-in hybrid version on its way for 2022. In the full-electric realm, the Rivian R1T and the GMC Hummer pickup EV are set to debut this year, with the Tesla Cybertruck expected in 2022.

CUVs Are on the Rise

There are currently 54.6 million registered CUVs in the United States, comprising 19% of the nation’s vehicle fleet. By 2028, CUVs are projected to jump to half of all new-vehicle sales. That makes them America’s fastest-growing vehicle segment—and with good reason. Consumers enjoy the combination of efficiency and function that CUVs embody, even if their styling is at times lackluster.

“When the category first started, it leaned more utilitarian and occupied the lower end of the market,” Knapp said. “But now all of the more high-end, premium brands are moving into the market and creating more upscale models. We’re also seeing a lot of companies positioning their crossovers very much as outdoor lifestyle vehicles, even going off-road.”

Virtually every automaker now offers at least one crossover model, meaning that OEM competition is contentious. It’s therefore difficult to cull even a few hot platforms that the aftermarket can latch onto.

Current top sellers include the Honda CR-V and Toyota RAV4, which have historically done well and are expected to maintain their market positions over the next seven years. However, the Nissan Rogue, Chevrolet Equinox and Traverse, and Toyota Highlander remain strong contenders. Also on the “vehicles to watch” list are the Ford Escape, Subaru Forester and Crosstrek, and Mazda CX-5.

“There are some questions about whether our industry is embracing this crossover market,” Knapp said. “It represents a big opportunity, but there are a lot of models out there, so finding out where the specific opportunities are will be one of the more interesting things to watch in our industry over the next few years.”

Because they’re meant to appeal to a broad audience, CUVs have been less enthusiast-focused than other vehicle types. Up to now, their owners haven’t exactly been clamoring for modifications, either. The overall CUV aftermarket is currently valued at $5.90 billion, a share equaling only 13% of specialty-equipment retail sales. A few of the top aftermarket buys include navigation and driver-assistance systems, floor mats and interior appearance items, racks and carriers, and exterior appearance upgrades.

“Most people wouldn’t consider CUVs to be performance vehicles, but what we’ve noticed in our research and data is that there are more sporty CUVs coming out, such as the BMW X-series,” Cheng explained. “A lot of companies are investing in sleeker, more stylish models. If we’re talking electric, even the Ford Mach-E is technically a CUV with the Mustang badge.

“There are 140 CUV models currently on the road. By the time we get to 2028, there will be more than 175 models being offered. In terms of sheer number of availability, compared to every other segment, crossovers will outpace everything.”

According to Knapp, all those trends create somewhat of a challenge for the aftermarket.

“We know that trucks and SUVs are great platforms for our industry,” he said. “There are a lot of things you can do with them, from off-road to utility-type modifications, racks and towing and so forth. So the question becomes, as these buyers move from traditional sedans into the CUVs, which have the shape and potential to function like SUVs, will they treat them that way? Will they think of them as truck-like and accessorize them that way? Or will they continue to just think of them as a differently shaped car that’s purely functional?”

Sports Cars and Classics Are Popular as Ever

Although not as high-volume as other segments, sports cars also command significant enthusiast audiences, making them industry mainstays. In that niche, it should be little surprise that musclecars rank highly.

“If you look at the traditional cars that are still being made, some of the best-

performing of those really are the sports cars and sporty models,” Knapp said. “While we talk a lot about the shift toward trucks in our report, there’s still a great opportunity in our traditional performance and ‘sporty car’ segments as well—especially with the Mustang, Camaro, Charger and Challenger.”

In fact, as OEMs trim their model lines, SEMA forecasts increased aftermarket opportunities for the remaining performance models with iconic histories. Lesser-volume sporty vehicles—notably the Subaru WRX, Porsche 911 and Mazda MX-5 Miata, to name a few—are also expected to carry on as popular platforms for accessorization.

The icons of yesteryear will also endure, although the definition of a “classic vehicle” is changing. SEMA Market Research applies the term to pre-’74 vehicle models, but by anyone’s definition, the classic-enthusiast base is healthy, growing and filled with loyal aftermarket consumers.

Although classic cars and trucks comprise just a 2% share of aftermarket sales, their owners spend significant time and investment on their vehicles. What’s more, they often prefer enthusiast parts and specialized accessories for their restoration or restomod projects.

Speaking of classics, the report also examines the ratio of older versus newer vehicles found in consumer garages. Most of America’s 280-million-plus cars are less than 20 years old, with about 90% being model-year ’00 or newer and 50% being model-year ’11 or newer. After 10 years or so, the number of vehicles for any given model year begins to drop exponentially as scrappage

rates go up.

Nevertheless, changes in ownership over a vehicle’s lifespan drive consumer engagement with the aftermarket. Whether the models are new or used, most car owners upgrade or modify their vehicles within the first few months after a purchase. The more cars change hands, the better the opportunities for accessorization.

Recessions typically spur consumers to hold onto their vehicles, raising used-car values and putting a strain on supply. Again, however, the COVID-19 downturn was a different story. Although used-car values did hit record highs, sales transactions suffered only a slight dip. That bodes well for the aftermarket as the pandemic subsides.

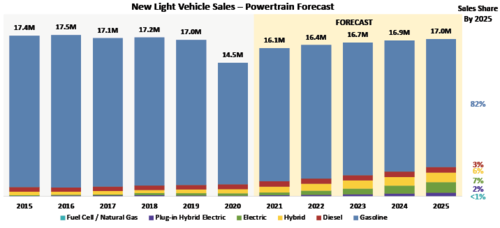

Electrification Is Coming—Eventually

Vehicle electrification, advanced driver-assistance systems (ADAS) and vehicle autonomy have become hot-button issues for the specialty-equipment industry. It’s no exaggeration to say that such emerging technologies promise to reshape the aftermarket in unprecedented ways, but how quickly they will do so is an open question. (See “Artificial Intelligence, Electric Vehicles...and Flying Cars?” on p. 162.)

“There’s a lot discussion of a big shift toward electrics in the media, but it’s going to take a long time for the gasoline-powered cars currently on the road to cycle off,” Cheng explained. “It typically takes a decade before vehicles go out of operation, so there will still be a lot of vehicles for our industry to interact with. The traditional cars that enthusiasts like to modify and work on aren’t going away anytime soon.”

Today there are nearly 4 million registered alternative-power vehicles in the United States, accounting for just 1% of vehicles on the road. States with the highest take-up rate for those platforms include California, Florida, Texas, Washington and New York. Among automakers, Tesla is driving most of the segment’s growth, although other automakers are quickly jumping in. SEMA projects that the top models to watch through ’28 will include the Tesla Model Y, Model 3, Model X and Cybertruck; Toyota Prius; Ford Mustang Mach-E; Chevrolet Bolt EV and E-Van; Honda Insight; and Nissan Ariya.

“There are actually some very interesting electric vehicles coming that should grab our industry’s attention, especially the electric pickups,” Knapp said. “A lot of the electrics are also moving away from the econo-box, early-adopter types of cars and really pushing toward the performance space, but frankly, they’re going to be small in number for awhile, with steady growth over time.”

Cheng added that infrastructure, charging times and costs, along with vehicle range, remain hindrances for consumers.

“Right now, electrics are just more expensive,” he said. “The expectation is that their costs will go down as time goes by, to the point where they’re potentially cheaper than internal-combustion cars. We’re just not there yet.”

Neither are we close to fully autonomous vehicles, which the report also delves into with a look at not only the state of current technologies but also consumer attitudes toward a future of driverless cars. ADAS technologies are here, however, and OEMs are deploying them at a rapid rate. Per NHTSA guidelines, all new vehicles now have rearview cameras. Installation rates for such features as collision warning, advanced cruise control, adaptive pedestrian detection and lane-departure alerts are each close to 70% or more.

“Ultimately, this report will help SEMA members understand what vehicles and technologies are out there now or are coming in the near future so they can better choose what products to make or sell,” Knapp concluded. “We have other resources to help members with their decisions, including our member VIO program, which can provide the number of vehicles on the road by specific models and years. We can also help them with new-vehicle model sales numbers as well as other research, so we encourage members to visit our website.”

For more information on ADAS systems and aftermarket opportunity for them, download the “SEMA Advanced Technology Opportunity Report–2017” at www.sema.org/research.

Get the Full Report

Get the Full Report

To download your copy of the 2021 “SEMA Vehicle Landscape Report,” along with other free SEMA Market Research studies that can help your business, go to www.sema.org/market-research. While there, SEMA members can also access more comprehensive vehicle sales and vehicles-in-operation (VIO) information through SEMA Market Research partnership programs.