RESEARCH

Moving Past a COVID-19 Economy

SEMA’s “Future Trends Report” Charts the Benchmarks to Recovery

By Mike Imlay

businesses are in search of recovery. The latest SEMA

“Future Trends Report” maps out the aftermarket’s road

back to “normalcy.”

Nearly halfway into 2021, the disruptions of last year’s COVID-19 pandemic are still having a pronounced influence on the current economic climate. The questions on everyone’s mind are when we might finally return to a sense of normalcy and what that “new normal” will look like. Released early this year, the “2021 Future Trends” report from SEMA Market Research offers a much-needed barometer as the economy recoups its momentum.

The report takes a deep dive into such market-driving forces as the pandemic, the state of the economy, consumer spending, auto-sector trendlines and aftermarket health. It then forecasts three scenarios for recovery and their consequences for specialty-equipment businesses.

“Obviously, 2020 was a strange year with the pandemic and such. So going into 2021, we looked into all the information and data out there about the pandemic, about the virus,” said Gavin Knapp, SEMA director of market research. “There were projections about vaccine rollouts. There was lots and lots of data about the economy and what it was doing. There was data about the automotive sector and, of course, data about our industry. But if you were to search for all that, there are a lot of different places to look and it’s a lot of effort to go through. What we did was collect this information to see how all these things are playing out together over one, two and three years. This provides our industry a one-stop look at how we expect everything will interact to affect our industry.”

The research encompassed governmental data as well as information supplied by independent consultants and other industry sources. The following are three of the report’s main findings:

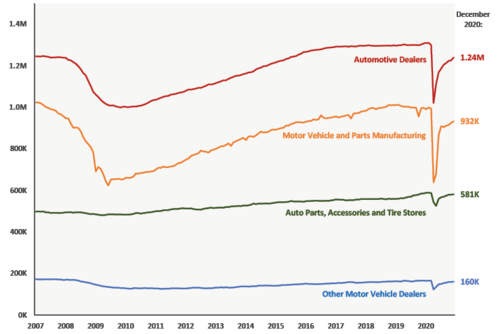

of the jobs it lost during the pandemic. In comparison, it took

almost eight years for the industry to recover all its job losses

from the 2009 Great Recession. Source: U.S. Bureau of Labor Statistics (BLS), “Data Retrieval: Employment, Hours, and

Earnings (CES).” Data as of January 8, 2021.

The “COVID-19 Recession” Is Markedly Different Than Others

The current recession is historically unique, not only due to its causation but also in how it has affected each sector of the American economy.

“This has been the sharpest, deepest but also the shortest-lived recession in U.S. history,” said SEMA Market Research Manager Kyle Cheng, who oversaw the report’s compilation. “Over the past 100 years our recessions have usually been caused by some kind of financial issue, for instance a liquidity crisis. This one was entirely caused by a virus. With governments attempting to contain its spread and consumers generally fearful of spending money, we experienced a lot of economic disruptions.”

“It’s important to look at the differential impact that this pandemic has had,” added Knapp. “If we look at some of the traditional economic indicators, such as a downturn in employment, throughout the pandemic we definitely saw a spike, particularly very early on. The difference is the spikes were very sectoral in terms of the businesses and job types that were hard hit. Hospitality sectors, travel, tourism, bars, restaurants—those businesses experienced high losses. But many other sectors were able to continue going about regular service.”

That phenomenon kept money flowing to a variety of consumers. And with certain areas of habitual spending suddenly closed to them, those consumers diverted their money to other pursuits.

“They had some pent-up pocket change, which was good for industries like ours where people could spend more on their hobbies,” said Knapp. “In our case they spent on fixing up their project cars.”

Unlike other recessions, many Americans were also able to save money at higher-than-usual rates during the pandemic. This translates to a pent-up readiness for economic recovery.

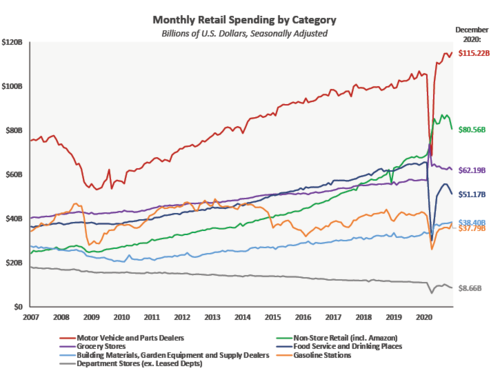

saw a sharp downturn early in the pandemic. However, the

automotive sector fared better than most due to the

“essential” designations of many of its businesses, along with

consumers taking on vehicle upgrades and projects. Source:

U.S. Census Bureau, “Advance Monthly Retail Trade

Report/Monthly Retail Trade.” Data as of January 15, 2021.

The American Economy Is Already Rebounding

As alluded to above, the economic rebound has been underway for some months now. But how quickly the recession ends depends on how rapidly several key milestones occur.

“Our intent with this report was to look into our crystal ball,” said Knapp. “Now, there’s no way that we can predict the exact future for our industry, but we can come up with several realistic scenarios of what’s likely to happen. These scenarios are based on many input factors: the virus, the vaccine, the economy, auto industry trends and consumer demand. So within the report, we’ve developed an ‘optimistic’ scenario, our likely scenario, and a ‘pessimistic’ scenario. And each one outlines from 2021 to 2023 what we believe is going to happen in terms of the economy, the auto industry and the specialty-equipment market.”

While a typical recession runs between five and 10 years, Cheng believes current trendlines indicate a much shorter duration this time. “You can already see it. Just look at employment in our sector. By February we recovered 80% of jobs in our industry and the broader auto industry. We’re probably looking at three to four years by which time our economy should be moving at a pace where we’re recovered, although the [residual] damage will be more longer term,” he said.

So what are some indicators to watch for? “A return to normal business operation goes hand in hand with what scientists call herd immunity,” answered Cheng. “When we reach that, and restrictions start to lift, we’ll see much more normality. Another area that that we highlight as a factor is the recovery of the service sector—hotels, restaurants, and those kind of businesses that have been the most disrupted by the pandemic.”

Other positive signposts will include the return of in-person sports and entertainment events along with nationwide employment recovery. In the report’s most optimistic scenario, there’s a 20% chance of all these factors congealing by 2022. In a more restrained projection, there’s a 25% chance it will take up to four years to hit all these benchmarks. The projected scenario, however, is a 55% likelihood of a three-year recovery period, ultimately leading to 4% industry growth over 2019 levels by 2023. Importantly, no matter what the scenario, the aftermarket as a whole is poised for a quick rebound.

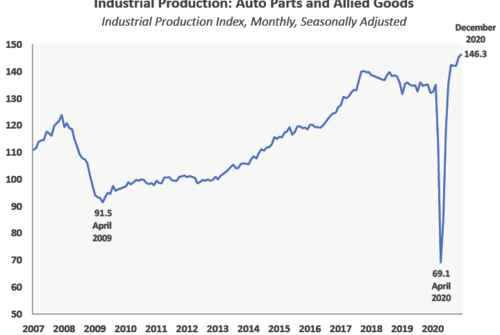

been mixed. The pandemic tended to hit retailers harder

even as manufacturers held steady or grew. However, by the

beginning of 2021, the industry was largely regaining its

footing. Source: SEMA Market Research/Board of Governors

of the Federal Reserve System, “Industrial Production and

Capacity Utilization.” Data as of January 15, 2021.

COVID-19 Will Have Longterm Impacts on Business

The pandemic forced businesses to grapple with unprecedented supply-chain issues, with many suppliers having to rethink their “just-in-time” approaches. Consumers, also, had to turn to alternative sources for products and services. In addition, companies had to adapt their policies, procedures and internal infrastructures to accommodate remote workers and new health and safety standards. Trade, sporting and entertainment events went virtual. Having learned to adapt to so many new ways of doing things, it’s only intuitive that many businesses will continue to leverage the innovations to some extent going forward.

In the business press, many have notably speculated on a permanent jump in online shopping. Whatever implications the recent e-commerce surge may hold for other industries, however, Knapp believes changes in the aftermarket will be modest.

“Obviously throughout the pandemic, as some traditional brick-and-mortar retail was closed, we saw a jump in e-commerce across the whole U.S. market,” he observed. “But people would probably be surprised to hear that online sales actually make up less than 15% of total retail sales in the U.S. They probably believe it’s more like 50% to 80%. And generally it’s not our sector. The specialty-equipment market has actually already been much higher in e-commerce and online sales. Closer to 40% of our sales already come through online sources.”

“We expect that to bump up a little throughout this period of pandemic, although it certainly won’t overtake our brick-and-mortar retail. We see a lot of continued interest from consumers in our sector, in the brick and mortar side, in being able to see and touch things. Once things open up, and people feel more comfortable going back into stores to car shows, we expect them to go right back to those in-person ways.”

None of this is to detract from the fact that many aftermarket businesses experienced hardship during the pandemic. Overall, however, both the essential nature of the industry and its ability to adapt quickly to the unprecedented disruptions spared it from the deep hits other sectors took. In fact, a large portion of aftermarket businesses—particularly manufacturers—posted growth as Americans indulged their automotive passions to cope with lockdowns. But will the newfound consumer enthusiasm stick?

“It’s going to be an important question for our industry whether consumers continue to spend at record levels on auto parts or if they shift gears over the next year to things they haven’t been able to purchase. But we’re optimistic,” said Cheng.

And, said Knapp, there’s good reason for that optimism. “Back in April 2020 we surveyed our industry and they were feeling the pain and worried about the year ahead,” he said. “But by the end of 2020, a huge chunk of companies not only said they were OK, but had increased their sales levels over the previous year. That really shows the resiliency and the bounce-back our industry made from that low point during the pandemic and its restrictions.”

Optimistic Scenario

20% Chance

Pandemic: 100–200 million vaccinated by late October 2021. Herd immunity by late Q2 2021.

Business & Operations: Normal business operations resume by mid or late 2021. In-person events return by July 2021. Some safety measures likely required through September.

Economy: 2–3 years for economy to fully recover. Full employment at end of 2022.

Our Industry: Industry jumps 10% from 2019 to reach $50.9 billion in total sales in 2023.

While predicting the future is always an iffy proposition, one “optimistic” scenario could see a 20% likelihood of aftermarket sales growth that reaches $50.9 billion in 2023.

Projected Scenario

55% Chance

Pandemic: 100–200 million vaccinated by end of 2021. Herd immunity by Q3–Q4 2021.

Business & Operations: Normal business operations resume by end of 2021 or early 2022. In-person events return by September 2021. Some safety measures required until end of year.

Economy: 3 Years for economy to fully recover. Full employment at end of 2023 or early 2024.

Our Industry: Industry grows 4% from 2019 levels to reach $48.1 billion in total sales in 2023.

Currently, SEMA Market Research’s projected scenario is a three-year economic recovery leading to 4% industry sales growth that reaches $48.1 billion in 2023.

Pessimistic Scenario

25% Chance

Pandemic: Vaccines delayed or ineffective. No herd immunity until well into 2022.

Business & Operations: Normal business operations return by mid or late 2022. In-person events return in mid-2022, with safety measures required until the later part of 2022.

Economy: 3–4 years for economy to fully recover. Full employment not until 2025.

Our Industry: Recovery is slow, with total sales at $45.3 billion by 2023. A 2% drop from 2019.

A more sluggish scenario would be an economic recovery lasting up to four years. This could lead to industry sales reaching just shy of their 2019 levels when 2023 rolls around.

Get the Full Report

To download your free copy of SEMA’s latest “Future Trends Report,” go to www.sema.org/market-research. While there, be sure to check out the numerous other reports that can help keep your business growing.