SEMA News—October 2020

RESEARCH

The “SEMA 2020 Market Report”

A Timely, Free and Indispensable Business-Planning Resource

Given the effects of recent events on the economy, understanding the market is especially crucial for automotive specialty-equipment businesses going into 2021. Now available for download, the new “2020 SEMA Market Report” offers a detailed look at a broad range of vehicle, sales and consumer trends impacting the aftermarket. |

SEMA’s annual market report has always been a valued resource for automotive specialty-equipment businesses as they chart their positioning and growth within the marketplace. Given the current business climate, the recently released “2020 SEMA Market Report” couldn’t be more timely help for understanding market trends as we turn the corner into 2021.

Filled with insights about the health and trajectory of the specialty-equipment industry, the 89-page report includes detailed profiles of aftermarket consumers, comprehensive industry and economic trend data, market sizing for various aftermarket categories, and key statistics surrounding the vehicles currently in operation on the roads. Prepared by SEMA’s market research department, the report is now available for free download at www.sema.org/market-research.

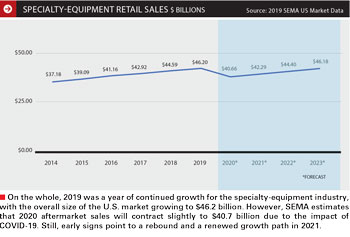

Even though 2020 has altered the vehicle landscape for many, the specialty-equipment market was showing sustained 10-year growth before the COVID-19 virus emerged. Industry retail sales had climbed nearly 4% to a new high of $46.2 billion in 2019 and were well on track for continued gains through 2021.

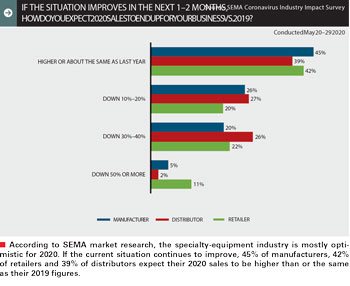

While SEMA now estimates that industry retail sales will likely be down 12% in 2020 due to the pandemic, most economists think the recession hit its lowest point in mid-April. Moreover, SEMA market research found that companies within the specialty-equipment industry remain optimistic about sales moving forward. Although there was a sharp decline in economic activity from March through April, consumers and businesses adjusted to COVID-19 restrictions, and most businesses were reopened in June. By Q4 of 2020, nearly 50% of industry businesses said that they expect their sales to be the same as or even better than their 2019 figures.

“While this year has presented its challenges, the ‘2020 SEMA Market Report’ can help our member companies identify the key areas of interest for consumers and prepare for the growth that we expect in 2021,” said Gavin Knapp, SEMA director of market research. “It’s still early to predict exactly how things will play out over the next couple of years, but the positive news is that we can expect that sales should rise back toward previous levels as the country re-emerges from the shutdown.”

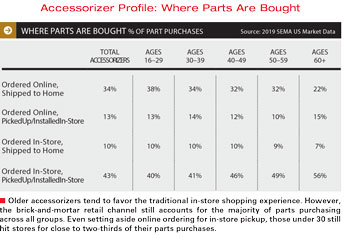

Knapp observed that in-store purchases on the retail side accounted for the largest share of 2019 retail sales, representing almost 60% of the total.

On the whole, 2019 was a year of continued growth for the specialty-equipment industry, with the overall size of the U.S. market growing to $46.2 billion. However, SEMA estimates that 2020 aftermarket sales will contract slightly to $40.7 billion due to the impact of COVID-19. Still, early signs point to a rebound and a renewed growth path in 2021. |

“It is highly likely that online purchases will spike in 2020 due to COVID-19, but SEMA expects that many consumers will return to in-store shopping once restrictions are loosened,” he said. “Meanwhile, word-of-mouth and the web were important sources of ideas and information for consumers researching potential upgrades.

“If there is a possible silver lining in this, many economists were predicting a recession in 2020. The COVID lockdown forced that to happen quickly. Maybe like ‘ripping off the band-aid,’ we’ve gotten through the downturn stage in a matter of months rather than years. It’s likely that mid-April was the worst of the economic recession, and signs point to increasing recovery from that point forward. I expect 2021 and the next few years to continue this recovery growth in our market and related areas, such as auto sales. This may have been the deepest, quickest recession in history, but our future is still bright.”

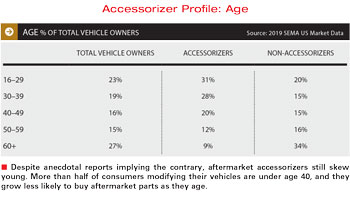

Despite anecdotal reports implying the contrary, aftermarket accessorizers still skew young. More than half of consumers modifying their vehicles are under age 40, and they grow less likely to buy aftermarket parts as they age. |

Methodology

The “2020 SEMA Market Report” was compiled utilizing a broad range of research tools, including interviews with industry sources, consumer surveys,

secondary data sources and published government statistics.

For its consumer market profiling, the study surveyed 29,000 adults across the United States who own or lease an automobile. Among those interviewed, about 8,000 people were identified as having modified or accessorized their vehicles in 2019. The consumer study therefore represents the buying habits of a large cross-section of specialty-equipment purchasers.

In addition, SEMA drew from its monthly “Industry Indicators” reporting, which presents high-level snapshots of the overall U.S. economy, with an emphasis on data affecting the automotive aftermarket. “SEMA Future Trends” reporting also contributed to the market study, taking a deep dive into the economy and the specialty-equipment market to forecast industry changes and evolution over the next few years.

With the COVID-19 situation also factoring into market growth this year, SEMA market research additionally conducted a survey of more than 1,800 professionals within the specialty-equipment industry from May 20–29, 2020. This study provided important insights into the industry’s outlook as it moves past the COVID-19 disruption.

Older accessorizers tend to favor the traditional in-store shopping experience. However, the brick-and-mortar retail channel still accounts for the majority of parts purchasing across all groups. Even setting aside online ordering for in-store pickup, those under 30 still hit stores for close to two-thirds of their parts purchases. Older accessorizers tend to favor the traditional in-store shopping experience. However, the brick-and-mortar retail channel still accounts for the majority of parts purchasing across all groups. Even setting aside online ordering for in-store pickup, those under 30 still hit stores for close to two-thirds of their parts purchases. |

Consumer Profiling

While the main portion of the “2020 SEMA Market Report” focuses on the sales aspects of the marketplace, understanding the consumer is crucial for effectively developing product and selling strategies. To aid in profiling consumers and their buying habits, the report utilizes data from the SEMA Consumer Market Data Project to get accurate pictures of 2019 parts and accessories purchasers. The following are some noteworthy takeaways:

- About 59% of specialty-automotive consumers are under the age of 40.

- Young drivers continue to accessorize their vehicles at high rates. They are more likely to buy performance parts and make heavier vehicle modifications.

- Not surprisingly, online shopping is a significant sales channel, particularly for younger consumers. However, the report found that brick-and-mortar outlets still play a major role in consumer buying habits, with a solid majority of parts still purchased at or picked up in-store.

- A robust online and social-media presence is now a vital marketing tactic for connecting with all types of potential and existing customers.

- The majority of accessorizers continue to be daily drivers who predominately use their vehicles for errands and commuting.

- Accessorizers are more likely to own pickups, upscale cars, sports cars and classics than the rest of the population. Age also plays a factor: Older consumers are somewhat more likely to own pickups, while younger accessorizes are more likely to own mid-range cars.

- Accessorizers are nearly twice as likely as other drivers to own other vehicles such as motorcycles and powersports vehicles, RVs and boats, offering a huge opportunity for cross-selling, cross-promotion and market messaging.

In addition, this year’s report continues to apply the framework that the SEMA market research department recently developed to accurately identify six distinct specialty-equipment buyer types. That framework allows SEMA market researchers to differentiate the motivations and habits that drive each buyer type when they engage with the aftermarket. Those six buyer types are further divided among two groupings, Enthusiasts and Non-Enthusiasts.

Overall, 2019 was a good year for the U.S. economy and capped the longest period of growth in the nation’s history. While there is much uncertainty about COVID-19’s true impact, preliminary data from Q1 2020 suggests that the economy has shrunk 5%. The economy is expected to fall steeply in Q2 but grow robustly for the rest of the year as the U.S. begins to recover. |

As the name implies, Enthusiasts buy more parts, are more engaged with the industry, and tend toward more daring vehicle modifications. However, Non-Enthusiasts actually represent the majority of the industry’s consumer base, with “Commuter-Types” (those who buy parts to maximize driver comfort and mildly personalize a vehicle) comprising a solid 25% of the market.

By contrast, “In-Crowd” buyers (who mostly purchase parts to make their vehicle stand out) account for a 17% market share. “Builders” (who buy because they enjoy working on vehicles) likewise account for another 17% market share. Ultimately, knowing the ins and outs of each buyer type helps all types of aftermarket businesses better target consumers with the right products, marketing and messaging.

When it comes to researching parts, accessory and modification information, consumers as a whole still prefer to search online and consult with others they know before visiting a store. A full 44% reported turning to search engines and review sites to inform their decisions, while 40% said that they turn to manufacturer websites. Consulting with friends and family made the list at 37%.

By contrast, 31% said that they visit stores, shops and dealerships to research their purchases, while 28% said that they consult online videos (those on YouTube, for example). Despite the popularity of social media, Facebook, Instagram and Twitter are far down on consumers’ lists of information resources at 17%, 11% and 7% respectively.

This doesn’t negate the importance of social media, however. While those channels may be less commonly used for immediate product research, the market report finds that they still help aftermarket businesses reach potential customers, reinforce branding and demonstrate the proper installation of products.

According to SEMA market research, the specialty-equipment industry is mostly optimistic for 2020. If the current situation continues to improve, 45% of manufacturers, 42% of retailers and 39% of distributors expect their 2020 sales to be higher than or the same as their 2019 figures. |

Sales Channels

The “2020 SEMA Market Report” found that the specialty-equipment industry continues to enjoy a healthy, wide mix of sales channels. As Knapp observed, brick-and-mortar remains strong, with in-store purchases accounting for the lion’s share of 2019 retail sales (almost 60% of the total). And while it’s highly likely that online purchases will spike in 2020 due to the coronavirus, SEMA expects that consumer purchases will remain a solid mix of in-store and online buying going forward.

In the current balance, online channels have become an indispensable method of researching parts and purchasing more economical, more easily installed products. Nonetheless, SEMA research indicates that sales-channel preferences among consumers can vary widely based on the cost, complexity and local availability of products.

For instance, transmission products and truck bedliners are more likely to be bought from specialty shops, while wax and cleaning products are more often obtained through auto-parts chains and general retail outlets. In the end, online channels may offer convenience and broader selection, but many consumers still value the ability to talk with an expert in person to ensure that they find the parts or items that best suit their needs. For many parts and accessories, the “see and touch” shopping experience is far from dead. But what are they buying?

This is the real meat of the report, and there is an extensive section breaking down industry purchases in dollar values for virtually every conceivable product category. (The roster includes chemicals, lighting, suspensions, drivetrains, trailer and towing components, to name just a few.)

The product categories are organized as “scorecards” that illustrate growth trends since 2016, sales channels in share of dollars, and vehicle segmentation in terms of dollar shares. Ordering, shipping, in-store pickup and installation stats are included as well. To make sifting through all the scorecards easier for readers, they’re grouped into three principal segments: accessory and appearance products (currently estimated to be a $24.51 billion market); performance products ($11.06 billion); and wheels, tires and suspension ($10.63 billion).

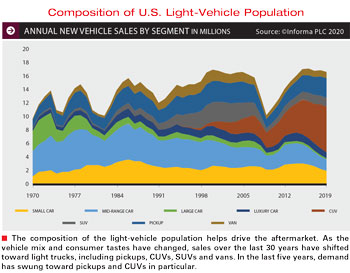

The composition of the light-vehicle population helps drive the aftermarket. As the vehicle mix and consumer tastes have changed, sales over the last 30 years have shifted toward light trucks, including pickups, CUVs, SUVs and vans. In the last five years, demand has swung toward pickups and CUVs in particular. |

Vehicle Trends

Since different vehicle segments obviously inspire different modifications and aftermarket products, the 2020 report includes a detailed look at vehicle trends, including the current composition of the U.S. light-vehicle population, passenger vehicle segmentation by model year, vehicles-in-operation data, and historical sales trendlines. Other sections in the report include market-sizing scorecards for small, mid-range, upscale, sports, CUV, SUV, pickup and alternative-power vehicle-related products. The report’s consumer profiles also include tie-ins to preferred vehicles and the purchasing habits surrounding them.

For example, the report found that pickup upgrades continue to make up the largest sector of the specialty-equipment industry, accounting for 31% of 2019 retail sales. Mid-range cars, CUVs and SUVs (including Jeep Wranglers) are also major market mainstays. (Not surprisingly, the trends also correlate somewhat with the general population of vehicles on the road.)

While some vehicles are more likely to be modified or modified more heavily than others (i.e., Jeeps), the aftermarket industry remains as diverse as the vehicle population, with products manufactured for virtually everything OEMs produce.

The report contains an extensive section of “scorecards” that break down every conceivable product category. The scorecards illustrate market sizing, growth trends since 2016, sales channels in share of dollars, and vehicle segmentation in terms of dollar shares. |

Industry Optimism

The “2020 SEMA Market Report” lands at a time when the industry seems more determined than ever to rebound. The association’s surveys indicate that the industry’s people remain somewhat optimistic for 2020 despite the market’s slowing of growth. If the current situation continues to improve, 45% of manufacturers, 42% of retailers and 39% of distributors said that they expect their 2020 sales to be higher than or the same as their 2019 figures.

“There is a passionate market of auto enthusiasts who love their cars and a great group of SEMA-member companies who love providing them with cool parts and accessories,” Knapp said. “Though this year has brought changes, there are many enthusiasts who embraced their lockdown time to do what they love: work on their cars. Most people are looking forward to getting back to driving as restrictions ease, and about one-fourth of U.S. drivers purchase parts from our industry each year. The ‘2020 SEMA Market Report’ can help remind us all of the size, scope and diversity of that industry.”

Get the Report—And More

For your free download of the “2020 SEMA Market Report,” complete with market sizing, consumer profiles and 2020 industry indicators, visit the SEMA market research webpage at www.sema.org/market-research.

While there, you can also download SEMA’s new “State of the Consumer” snapshot report, which offers insights into current consumer sentiment.

SEMA also has a report for economic metrics that are changing quickly. Check out the monthly “SEMA Economic Indicators Report” at the same link for regular updates on trends affecting the industry.