SEMA News—April 2018

BUSINESS

Jeeps and Side-by-Sides

Expanding the Off-Road Market

The big news for off-roading is the introduction of the all-new ’18 Jeep Wrangler JL, which aims to blaze trails among a newer range of consumers yearning for a taste of the outdoors. |

It’s no secret that off-roading—especially Jeeping—drives one of the specialty-equipment industry’s largest segments. With roots to the post-World-War-II era when returning servicemen began discovering American backroads with their trusted surplus Jeeps, the off-road category remains a wildly diverse playground for specialty-equipment parts, accessories and lifestyle products. What’s more, Jeeping and recreational off-roading have spread to emerging international markets in the last decade, notably China and the Middle East. The mainstreaming of off-road motorsports is in part responsible for this vigorous segment’s growth, but the real race nowadays is among OEMs to win the attention of consumers who have never blazed a trail but would like to.

The New Jeep JL

Of course, the biggest news in the off-roading segment is the all-new ’18 Jeep JL Wrangler. In fact, to whet appetites for the vehicle’s recent debut, MOPAR rolled out more than 200 new Jeep accessories at the 2017 SEMA Show in advance of the official launch of the JL.

In general, the aftermarket has plenty of reason to welcome the JL, which the motor press is hailing as the best Jeep yet. The two-door Wrangler is available in three different trim configurations: Sport, Sport S and Rubicon. A Sahara version is available for four-door models.

Every Wrangler receives a Trail Rated badge and includes the Command-Trac 4x4 system with a 2.72:1 crawl ratio standard on Sport and Sahara models. There is also a Rock-Trac 4x4 system with a “4LO” ratio of 4:1 and Tru-Lok locking differentials standard on Rubicon models. The new Wrangler is good for up to 30 in. of water fording and offers a 3,500-lb. towing capacity.

The 3.0L EcoDiesel V6 and the all-new 2.0L turbocharged inline four-cylinder engines join the Wrangler lineup, while the 3.6L Pentastar V6 engine is upgraded for 2018. A six-speed manual transmission is standard on all models, with an eight-speed automatic option also available.

Jeep says that customers will experience off-road performance improvements from all iterations, but the manufacturer also has addressed consumers’ desire for better street and highway performance. A 4.41 ratio spread offers improved fuel efficiency at faster speeds and delivers quick acceleration with smooth, precise shift quality.

Meanwhile, the exterior design stays true to the Jeep roots but with a wider stance, a lowered beltline, larger windows and a seven-slot grille paying homage to the famous CJ. The windshield’s rake is optimized for improved aerodynamics, and a new header bar now connects the A-pillars, allowing the rearview mirror to remain in place even when the windshield is folded down.

Inside, a pushbutton starter makes its debut featuring a weatherproof surround. The instrument cluster features a 3.5- or an available 7-in. thin-film transistor information LED display. Integrated buttons on the steering wheel control audio, voice and speed functions. A central 7- or an available 8.4-in. touchscreen houses the fourth-generation Uconnect system. (A 5-in. touchscreen is standard on the Wrangler Sport.) Especially noteworthy, Wrangler now offers more than 75 available active and passive safety and security features, including blind-spot monitoring and rear cross-path detection, a ParkView rear backup camera with dynamic grid lines, and electronic stability control with electronic roll mitigation.

“I’d say that the launch of the Jeep JL is going to be huge for the enthusiast market,” said Craig Perronne, editor and publisher of Off-Road Adventures magazine. “I’ve driven it, and it really gets rid of all the flaws of the JK. With the JK, you always had to make some sacrifices for an off-road vehicle—the interior, the ride, the highway noise and such. The JL interior is much nicer, more comfortable, and rides better and quieter. I think that’s going to open the Jeep up to a whole new group of people and bring a lot more people into the off-road world. A hardcore off-roader might not care about all that, but if you’re trying to convince a significant other to buy it as an only vehicle, what might have been a bit of a stretch with a JK will not be with a JL.”

| The TJ/JK ’97–’17 Wrangler Market |

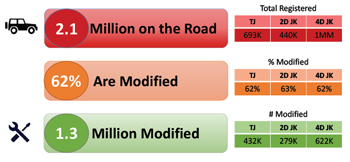

The count of total registered TJ and JK Wranglers is based on Experian Auto Counts estimates based on U.S. vehicle registrations as of 6/30/17. |

| Parts Purchases and Installed |

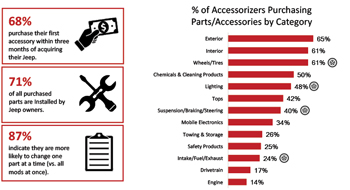

Jeep accessorizers typically begin modifying quickly after purchase, making changes piecemeal rather than in batches. Of course, off-road enthusiasts add parts that make tackling trails and difficult terrain easier. |

By the Numbers

If past is prologue, the JL stands to inherit a large following. SEMA market research estimates that there are a combined 2.1 million TJ and JK Wrangler models on the road—literally. More than 80% of TJ and JK owners use their Wranglers as daily drivers, with roughly half of them (54%) actually venturing off-road as well. Interestingly, 12% also own a second Jeep other than a TJ or JK. In addition, 52% of Jeep owners describe themselves as true automotive enthusiasts—a higher share than accessorizers in other aftermarket categories. Like the vehicle itself, owners are a stalwart, robust demographic:

- The outdoor lifestyle resonates deeply with Jeep accessorizers. Nearly two-thirds of them (71%) take their Jeeps to trailheads or camp sites, and 60% report that they regularly engage in hiking, climbing and other outdoors activities.

- As auto enthusiasts, Jeep owners often enjoy installing their own parts. More than half (52%) say that they like to wrench, want to maximize driving performance, or seek to make their TJs or JKs stand out. Handy with tools, 62% say that they manage moderate to complex installations themselves.

- Most owners (82%) like to upgrade their vehicles in stages, focusing on specific needs project by project. Appearance and functional modifications are more common than engine upgrades.

- While not every Jeep owner is hardcore, many seek products to improve their vehicles’ off-road readiness. Common upgrades include off-road/plus-size tires (36%), lift kits (67% total; 25% for self installations) as well as side steps, rock sliders and other body accessories (25%). In addition, off-roaders are also prone to investing in lighting and intake products, soft tops, recovery gear and a lot of polish, wax and cleaning products.

Jeep consumers are also research-savvy, doing stacks of investigation before opening their wallets. They rate online search engines, product reviews, parts manufacturer websites and videos as their primary resources. They also like to network, with 80% reporting that they consult friends or professional contacts as part of their decision-making processes. When it’s time to buy, 69% say they’ll do so from both online and brick-and-mortar retailers, although 35% prefer buying in person after researching online.

“Not a lot of people keep their Jeeps stock, so JL owners will soon start tinkering with them,” Perronne said. “From a media standpoint, I like to look at what you can do to bring new people into the fold. I think the JL is one of the big things. Another [trend] is an overland influence. It’s not like people are driving to the tip of Argentina, but more people are getting into four-wheeling to enjoy camping and getting out of town for the weekend.”

Perronne emphasized that legacy manufacturers and retailers need to grasp this trend and talk differently to this broadening enthusiast base.

“You’re seeing those two worlds merge, and that’s a good entry point for new people,” he said. “They’re probably not hardcore ‘wheelers. They don’t really want to do the gnarly trails. They just want to get out of town, enjoy the great outdoors and spend some time with their families outside the stress of their jobs or a weekend at home. So how do you capture and market to a wider audience without being intimidating?

BRP’s Can-Am Maverick Trail UTV is another contender in an increasingly competitive segment. Side-by-sides such as this recent SEMA Show display vehicle have become price-conscious alternatives to Jeeping. |

“A lot of the marketing you see from companies features the hardest-core off-roader you can build,” Perronne continued. “You see it all the time. I have a friend who just bought a JK who’s asking what he can do with it. How do you talk to the guy who just wants to add a little lift and make his vehicle work a little better? Not just retailing to people like him, but marketing is also going to get a lot more important. You can’t just keep talking to the same hardcore group of people over and over.”

One company already looking to cater to this broadened consumer demographic is Australia-based Pedders. Founded in 1950, the suspension manufacturer has stuck mainly to late-model muscle for its home market up to now. However, Pedders Brand Manager Angel Robles said that the new JL seemed like the perfect opportunity to enter the worldwide off-road scene.

“In most cases, our biggest emerging markets in export—those outside our traditional Australian home market—are largely being pushed forward by 4x4 product, including in Malaysia, Indonesia, India and China,” Robles aid. “Just looking at the Jeep market in particular, it’s such a huge market here in the States that even if you get a small niche, it’s a big sales hit when compared to something in the traditional performance market like, let’s say, a Ford Focus RS, of which they only make a couple thousand units. They sell more than that in a weekend for Jeeps, so if you can get only a little sliver of that, it’s a success for a company of our size.”

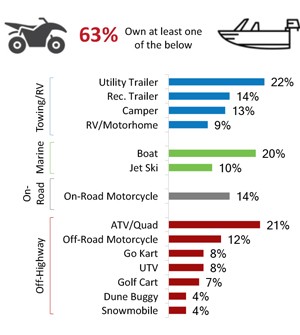

| Jeep Owners Other Equipment |

Roughly a third of Jeep accessorizers have other vehicles, most commonly another Jeep (not a TJ or JK) or a pickup. This audience also has plenty of powersports and towed equipment such as ATVs, boats, motorcycles, campers, etc. |

Pedders’ new two- and four-door JL suspension kits are designed to deliver better ride and handling both on and off the road for modestly modified Jeeps. A heavy-duty version is aimed at fully loaded Jeeps.

“When you drive it, it’s going to drive as you expect,” Robles said. “Because our home market is tight regulation-wise, we can’t bring a lift kit to market that would result in anything less than OE handling or better while keeping the stability management and other systems happy. We’re trying to reach the more average user who uses a vehicle off-road in a real setting like overlanding and getting into a few trails, but he drives it every day and wants something that allows him to run a bigger tire, get the lift he wants, but not suffer for it.”

HPS Performance Products is another manufacturer designing new products for the JL and expanding its other off-road offerings to keep pace with the booming segment. Based in City of Industry, California, the company is known for intakes, coolant and diesel-specific hoses, clamps and couplers, and markets its Jeep and 4x4 products as ideal upgrades for hardcore enthusiasts seeking rugged durability.

“We have lots of hose kits for Jeeps, especially for the older models going back to the old CJ series,” said Part Developer Austin Sager. “Jeep is obviously a big market; everyone crawls with them. We also know that the Jeep market is a lot bigger than what we’ve been doing. It can cover 50% of everything we sell total, so we would like to get into more of it. We also recently got a new ’18 Duramax, so we’ll be making [new] products for that. We just did a Silverado, a GMC Sierra and other diesels, so it’s time to expand.”

Side-by-Sides

Although Jeeps continue to dominate the off-road scene, side-by-sides (also known as UTVs) have emerged in recent years as enticing rivals.

“The Jeep market is huge,” said off-road journalist Matt Emery, a principal at Applied Arts Productions. “But side-by-side guys tend not to want Jeeps. They have ridden dirt bikes in the past, and now that they’re a little older, they want a little more stability and will take their families with them. It’s funny, but the demographics you’re looking at are primarily guys 35 to 40 years old and up to 65-year-olds—an older demographic.

Camping and other outdoors lifestyle items, such as these Yakima products displayed at the 2017 SEMA Show, offer strong crossover marketing cues for retailers in the segment. |

“From a racing aspect, side-by-sides are the fastest growing class and have been for several years, because it’s easy to get racing. Purpose-built race cars can be a little finicky as far as keeping things running and going, but side-by-sides are basically get in and turn the key, and everybody’s making something for them. You can outfit any of the side-by-sides not just for racing but also for recreation. You can take your family and go putting around, and they’re very reliable—they’ll get you back.”

On the OE side, the UTV market is becoming fiercely competitive in the race to supply consumers with tough, agile, trail-ready side-by-sides. In October 2016, RZR manufacturer Polaris acquired retail giant Transamerican Auto Parts, owner of off-road retail chain 4Wheel Parts. Soon after, multi-industry Textron entered the UTV/off-road fray by acquiring Arctic Cat. For 2018, American Honda heavily upgraded its flagship Pioneer 1000 UTV, calling it “the most technologically advanced side-by-side on the market.” Not to be outdone, BRP countered with its highly anticipated Can-Am ’18 Maverick Trail model and a slick “Meet You Out There” marketing campaign.

One of the major appeals of UTVs for consumers has been an entry cost as low as $11,000. But that, too, is rapidly changing, along with a growing hunger to take vehicle off-roading abilities to a higher level.

“Over the past few years, the price point on a new model has crept up,” noted Emery. “However, they are extremely capable vehicles for what you’re spending. You can get one, throw a couple lights at it, throw some other stuff on it, and have something to go out and have a good time in. But guys being guys, they’re buying different shocks or different spring kits for the shocks they have. Eibach, for example, makes a spring kit for just about everything. You can keep the stock shocks, put their progressive springs on, and it really helps even out the suspension.”

And, as with Jeeps and 4x4 trucks, wheel and tire packages are especially popular.

“Stock tire designs and diameters work pretty well overall, which, of course, is what the OEs are trying to do—throw a wide net,” Emery said. “But you can buy tires and wheels all day long for those things and get different sizes and tread patterns. For example, BFGoodrich is making tires for side-by-sides that are virtually the same designs as on trucks.”

| Get the Research |

| The “SEMA Jeep Wrangler Report,” covering the demographics and purchasing habits of TJ and JK owners, is available for download at www.sema.org/sema-wrangler-report. |

With developments like the new Jeep JL and the mushrooming array of side-by-sides, it’s easy to see why aftermarket manufacturers are beefing up their presence in the off-road category. And if OEMs succeed in their quest to attract an even wider range of off-roading newbies into dealer showrooms, the aftermarket can expect an even greater boon and opportunities in 2018 and beyond.