SEMA News—December 2016

RESEARCH

The “2016 SEMA Pickup Report”

Taking a Deep Dive Into the Light-Truck Consumer Mindset

The “2016 SEMA Market Report” noted the continued growth and vibrancy of the light-truck niche. Now a new, follow-up “2016 SEMA Pickup Report” takes a deep dive into the consumers that make up this category, along with how and what they buy when it comes to aftermarket accessories. |

Fueled by 2.5 million new-pickup sales last year, there are now more than 51 million pickups on U.S. roadways. But how much do aftermarket businesses really know about pickup consumers, their shopping habits and, ultimately, the parts they purchase? Assumptions are one thing, but manufacturers and resellers who truly want marketplace facts to drive their efforts will be interested in the newly released “2016 SEMA Pickup Report” from the association’s market research department.

According to Gavin Knapp, SEMA director of market research, the report profiles owners of ’10–’16 pickups who have recently purchased upgrade parts and accessories. It’s designed specifically to help aftermarket businesses understand target consumers, expand their customer base, develop new products, and tailor messaging and marketing to key demographic groups. Knapp believes that the research is especially timely right now.

|

“Pickups are historically a very large chunk of the SEMA market,” he explained. “The last time we looked at this segment was around 2011, which was quite a different time in terms of the marketplace. We had come through the recession, and pickup sales had dropped off, so it seemed likely that people’s usage of and interest in pickups was different then than it is now. For example, we saw for a while the OEM pickup advertising the idea that you’re driving your truck to the opera. Then we had the recession and soaring gas prices, leading us back to perhaps a more utilitarian idea of pickups.”

The report’s main goal was a completely fresh look at the marketplace, Knapp said. To help ensure that the study met the needs of SEMA members, the market research department consulted with the association’s Truck and Off-Road Alliance (TORA) council.

“Particularly given that there’s been a big upswing in pickup sales over the last five to six years, we focused our research on newer trucks to really try to keep it from getting muddled between the needs of, say, a ’75-model owner and a ’15-model consumer, whose needs are likely very different,” he explained.

“The idea here is really to help our industry understand the owner of a recent-model pickup. We looked at things that are very straightforward in terms of which parts they are buying to get an idea of where the demand is. But we also looked at where they are buying and the retail channels they are visiting. We wanted to know how they are shopping and how they are researching.”

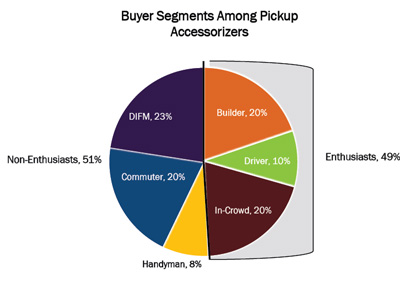

The marketing report contains a wealth of consumer demographic information, including breakdowns into segments based upon buying habits and comparisons of consumers’ relative participation in the marketplace. The report found that enthusiasts and non-enthusiasts spend equally on accessorization overall. |

The report focuses on four truck groups, based largely upon sales volume: the Ford F-Series, Chevrolet and GM fullsize pickups, RAM fullsize trucks, and a last group encompassing the remainder of mid- to fullsize pickups with smaller sales volume.

“For research purposes, it wasn’t feasible for us to attack all of the smaller individual brands separately,” Knapp said.

Behind the Report

Where Pickup Accessorizers Shop

|

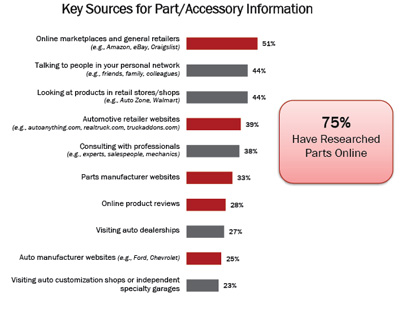

Not surprisingly, the pickup study confirms the trend toward online shopping, with a huge 59% of pickup accessory consumers surveyed saying that they’ve purchased that way. This underscores the need for sellers to have rich product data on the internet. |

To build its comprehensive picture of the pickup aftermarket and its consumers, SEMA commissioned Ipsos RDA to develop and field a quantitative survey of more than 800 light-truck owners who have accessorized their ’10–’16 vehicles. The study reached out to a broad national sampling of respondents who were asked a range of questions about their vehicles, their usage, parts purchases and other interests. The result is a richly detailed understanding of the pickup aftermarket customer and his or her lifestyle motivations.

“We went out essentially to the general population to find people who own pickup trucks,” Knapp said. “Next, we qualified them as having purchased parts within our industry. It could have been a turbocharger; it could have been a lift kit; it could have been a bedliner. It’s the whole broad spectrum of parts that went into this. So we’re not just talking the hardcore enthusiast; we’re not just talking off-roaders. We’re looking at everyone who accessorizes or modifies their truck.”

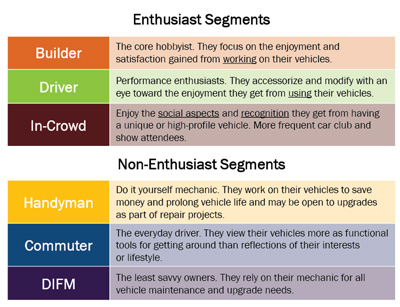

In fact, the study sifts consumers into easy-to-reference buyer segments that reflect their levels of engagement with their vehicles and the aftermarket. These segments include Enthusiasts (composed of Builders, Drivers and the In-Crowd) and Non-Enthusiasts (composed of Handymen, Commuters and Do-It-For-Me’s [DIFMs]).

By breaking consumers down in this manner, the study was able to discern not only differing buying habits but also the distinct activities each segment enjoys along with the marketing themes that might appeal to them. For example, Builders are the most savvy and engaged accessorizers and thrive on customizing project vehicles. The products and messages that appeal to them are therefore significantly different from those motivating DIFMs, who are by contrast the least savvy pickup owners. DIFMs rely on their mechanic for all vehicle maintenance and upgrade needs.

In between, the other segments run the gamut of engagement levels. Drivers are performance enthusiasts, while the In-Crowd enjoys the social rewards that come from owning a unique, high-profile pickup. (They’re more likely found at clubs and shows.) Among Non-Enthusiasts, Handymen work on their vehicles chiefly to save money and may be open to upgrades as part of repair projects. Commuters are everyday drivers who are focused almost exclusively on vehicle function and utility.

The report also looks into differences between urban and rural consumers. The former tend to be younger and more into modifying their trucks for performance and appearance. They shop at a wider variety of locations than their rural counterparts, who are less likely to modify their trucks in ways that might detract from utility. Dependability and longevity of products that enhance a light truck’s durability resonate with rural buyers.

Testing Assumptions

With pickups continuing to comprise a major industry segment—26% of aftermarket accessory sales in 2015 alone—a true picture of the category is vital. Consequently, researchers put some traditional “common wisdom” about light-truck owners to the test. While verifying several boilerplate assumptions, the survey also debunks a few widely held notions and brings new insights into consumer thinking.

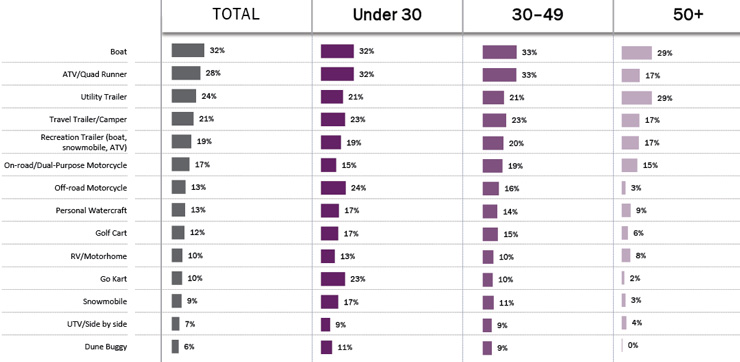

Powersports and Towed Equipment They Own

|

“In terms of data, there are lots of specifics in the report,” Knapp said. “In a broader sense, however, what we saw with this pickup study—and we’re seeing across the industry—is that the future is not bleak in terms of age. There’s been a lot of talk about our industry graying, and there are perceptions that a truck is more of an older person’s vehicle. What we’re finding is that younger people are actually accessorizing more than older people, which is the way it has always been. In fact, people under 30 are more likely to accessorize, and they are more likely to buy more and do more upgrades than older consumers.”

Another takeaway is the extent to which internet research and shopping have permeated every buyer demographic.

“Most people have heard it by now, but online product data and sales channels have become basically indispensable,” Knapp emphasized. “Light-truck consumers may have been perceived as a group that would come online later, but pretty much everyone is using the internet now. When they’re thinking about doing an upgrade, they look for it online, whether through a routine Google search, going to specialty forums or even going to retailers to search. Even if it’s only to find the cheapest price, they’re online, they’re looking, and they’re researching.”

The report also found a common mindset among pickup buyers, regardless of brand loyalties.

“Whether it’s a Ford, a Chevy or a Toyota, there is a huge number of similarities in what people want from their vehicles, how they are using their vehicles and the types of parts they are purchasing,” according to Knapp. “That is something to keep in mind as companies look to what’s next. They may want to evaluate the opportunities in applying their products across different brands.”

And while it will be no surprise that truck owners love the outdoors, the report highlights specific lifestyle cues that grab buyer attention across demographics.

“Whether it’s hunting, fishing, camping or towing recreational vehicles, their hobbies cross over and really do go hand in hand,” Knapp observed. “That offers great possibilities for connecting through messaging.”

Ultimately, Knapp said, the “2016 SEMA Pickup Report” fits into an overall research program aimed at helping SEMA members grow their businesses.

“If you look at what we produce,” he said, “we have our yearly ‘Market Report,’ which is largely focused on what’s selling and how much of it. When we do these other category-focused reports, we still do some of that. But what we really want is to get into the mind of the consumer, because that’s where, ultimately, you have to make a connection. It’s nice to know what they’re buying, but in the end, that helps you sell only so much. With these reports, we really do want to help our industry service these consumers and sell more.

Download the Report!

As with other SEMA market studies, the “2016 SEMA Pickup Report” is available free for member download at www.sema.org/semapickupreport. The price for non-members is $499.