By Douglas McColloch

Experience”—a debut exhibit showcasing dozens of vehicles

built expressly for overlanding. Besides raising the activity’s

public profile, the exhibit also provided a platform for

companies that are serving this growing market segment and

networking opportunities for others looking to expand into the

market.

There’s something about a pickup that sets it apart. No, we’re not talking about the obvious—the bed in back that lets you carry lots of stuff, or the solid axle that lets you tow a trailer. We’re talking about intangibles.

Perhaps it’s the pickup’s uniquely American heritage among automobiles. Devised from necessity to help farmers deliver their goods to market in the ’20s and ’30s, it liberated them from the burden of livestock, and it gave them the ability to expand their market reach.

Or maybe it’s the allure of freedom that a pickup holds: Throw some camp gear in the bed with supplies for the weekend, and you can head into the backcountry. And, of course, the pickup lends itself to social functions as a rolling tailgate party—just add a cooler, some food and a few friends.

Whatever the reason, the enduring popularity of pickups—and, more recently, their latter-day sibling sport-utility vehicles (SUVs) and crossover utility vehicles (CUVs)—remains a constant in the ever-changing automotive landscape. In this survey, we’ll examine the current state of the truck and off-road marketplaces, examine some of the trends that are moving the market and, hopefully, provide a glimpse into the future with the help of some knowledgeable industry insiders.

A highlight of the 2019 SEMA Show was “The SEMA Overland Experience”—a debut exhibit showcasing dozens of vehicles built expressly for overlanding. Besides raising the activity’s public profile, the exhibit also provided a platform for companies that are serving this growing market segment and networking opportunities for others looking to expand into the market. The SEMA Overland Experience is set to return to the 2021 SEMA Show in the Las Vegas Convention Center West Hall, booth #62234.

Emerging From the Recession

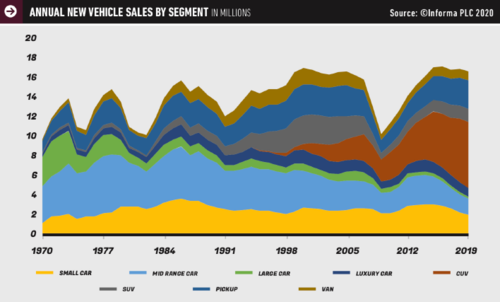

According to the most recent issue of “SEMA Future Trends,” the light-truck segment—which includes pickups, vans, SUVs and CUVs—is forecast to account for nearly 70% of all new-vehicle sales by 2025. Pickups alone constitute more than 20% of all vehicles currently in operation in the United States.

Not surprisingly, given the COVID-19 disruption, new-car sales declined in 2020 from the previous year, with roughly 14.5 millions units sold, or a 14.8% decline from 2019, according to a recent report from J.D. Power & Associates. However, General Motors and Toyota reported fourth-quarter sales gains over the previous year, and new-car retail deliveries increased by a modest 1% overall in December from the previous year, suggesting that the gradual turnaround in new-car sales would carry over into 2021.

While new-car sales lagged overall, pickup and SUV sales remained relatively strong in 2020. New-truck sales constituted 20% of all new-vehicle sales last year, up from 18% in 2019, and so-called utility vehicles—a category including SUVs, CUVs, minivans and Jeeps—comprised nearly 50% of all new vehicles sold, according to a recent study from market-research firm IHS Markit. Additionally, a number of trucks saw sales sharply rebound in Q4 2020 over the previous year. The Chevrolet Colorado, Ford Ranger, GMC Canyon and Sierra, Jeep Gladiator and Toyota Tundra and Tacoma all registered quarterly sales gains of 10% or better year-over-year, suggesting that 2021 could witness healthy gains in truck sales.

In a similar vein, aftermarket parts sales for trucks remained relatively healthy as well. According to the most recent “SEMA Market Report,” pickups make up the largest share of specialty-equipment spending, accounting for approximately 30% of the market, with $14.3 billion in sales in 2020. Additionally, according to the latest “SEMA Accessory Opportunity Report,” eight of the top 10 vehicles most likely to be accessorized are either pickups, SUVs or Jeeps.

Moreover, key aftermarket drivers of growth in the truck segment—suspension products, pickup bed accessories, towing-related products, and off-road/plus-size tires—were forecast to register respectable year-over-year sales gains in 2020, according to the latest SEMA “State of the Industry” report, suggesting that the combination of federal stimulus money and government stay-at-home orders may have encouraged truck and Jeep enthusiasts to invest their extra money and time into working on their favorite

projects.

Jim Flowers, president of Bubba Rope, put it this way: “Enthusiasts are redirecting their discretionary income from entertainment and dining out and doubling down on buying auto accessories.”

overlanding continues to represent a growth market in the

truck/SUV sector, and our panel of industry experts expected

consumer interest to remain strong in the coming years.

Courtesy: Shutterstock.com

What’s New and Notable for 2022

A number of new trucks, SUVs and crossovers are set to hit the market within the next 12 months. Among them are:

GMC: Hummer EV. General Motors’ first all-electric pickup comes to market sporting either two- or three-motor-drive configurations. Cruising range is said to be approximately 350 mi., and max power output is estimated in the 1,000hp range. The truck will utilize four-wheel independent suspension with locking differentials, the rear being a “virtual” unit that’s capable of torque vectoring. Also of note is the truck’s 18-camera Ultravision system, which will include underbody cameras to enable more precise navigation on the trail. Upgraded models will feature air suspension and CrabWalk—essentially a version of four-wheel steering to improve the truck’s maneuverability on tight and rocky trails.

Ford: F-150 Electric. On the heels of the ’21 F-150 gas-electric hybrid, America’s best-selling vehicle will offer an all-electric version for the first time in 2022. The truck’s dual-motor propulsion system is said to provide quicker acceleration and more peak power and torque than any other F-150 currently available (including the Raptor). Despite its partnership with Rivian, Ford is not thought likely to use the same electric powertrain as Rivian’s upcoming R1T pickup due to differences in chassis architecture and performance requirements. Some elements of the Mustang Mach-E’s propulsion system may find their way into the pickup instead.

Ford: Maverick. Slotting below the Ranger in the Blue Oval pickup line, the four-door Maverick rides on the same unibody chassis as the Bronco Sport and Escape and will utilize a four-wheel independent suspension à la the Honda Ridgeline. Front-wheel drive is said to be standard, with all-wheel drive possibly offered at a later date. Engine options are likely to include the 1.5L three-cylinder or 2.0L I4. A turbocharged version of the 2.3L found in the Focus ST may be in the powertrain mix as well.

Jeep: Grand Wagoneer. Jeep’s first fullsize luxury SUV in over 30 years arrives for the ’22 model year to compete with the likes of the Cadillac Escalade and the Lincoln Navigator. Based off the Ram 1500 platform, the new Jeep will incorporate the truck’s chassis and suspension, with a five-way-adjustable QuadraLift air suspension an available option. Three four-wheel-drive systems will be offered, and engine choices are said to include naturally aspirated or eTorque Hemi 5.7L engines or a PHEV 3.6L similar to that found in the powertrain of the Pacifica minivan. An eight-speed automatic is standard.

Jeep: Wrangler 4xe. Jeep updates the Wrangler for 2022 with a plug-in hybrid version with a claimed combined cruising range of 400 miles while returning an estimated 50 mpg-e. A 2.4L direct-injection turbocharged engine is paired to a sealed and waterproof 16-watt battery pack to produce a peak 375 hp and 470 lb.-ft. of torque. The Jeep can be run in electric mode alone for near-silent operation in the backcountry, and claimed water fording depth is still rated at up to 30 in. Jeep has partnered with Amazon to offer a Jeep-branded, 24-volt, Level 2 car charger that’s said to be up to 5.5 times faster than the factory cord set.

Toyota: Tundra. Essentially unchanged since its introduction in 2007, an all-new Tundra emerges for ’22 riding on Toyota’s new TNGA-F global truck architecture, with coil springs supplanting leaf springs for enhanced ride quality. The truck’s V8 engines are said to be discontinued in favor of smaller, more-efficient powerplants such as the 416hp 3.4L V6 sourced from the Lexus LS500 or the 278hp 3.5L found in the current-version Tacoma. A gas-electric hybrid version is expected to be offered in the future.

Other pickups that may be available within the next 12 months include all-electric models from Bollinger, Rivian and Tesla, suggesting that the transition toward electrification may be gaining steam within this vehicle segment.

and a number of our experts expect the segment to grow over

time as tow ratings for fullsize trucks continue to increase and

more enthusiasts head for the open road to recreate outdoors.

Courtesy: Shutterstock.com

The View Looking Forward: Guarded Optimism

Our sources generally agreed that the state of the truck and off-road market is relatively healthy now, though some added cautionary notes about the ongoing COVID crisis and the potential long-term economic impacts of a lengthier pandemic.

“Things look pretty good right now,” said Ted Wentz III, CEO of Quadratec. “The industry in general is experiencing healthy growth.” He added that “there’s a high degree of uncertainty about the future.”

“Consumers found safety and solace in 2020 with anything to do with off-roading and outdoor activities,” Flowers said. “The result was a surprisingly large demand for off-road accessories, creating a tremendous growth year in consumer sales.”

“The off-road aftermarket saw a big lift during the pandemic,” said Kathryn Reinhardt, senior marketing manager at 4-Wheel Parts. “Suggestions of social distancing gave consumers the idea to get off the grid and go outdoors, and consumers purchased aftermarket parts that allowed their vehicles to go where the road ends.”

With so many consumers stuck at home for months at a time over the past year, many of them took advantage of the time to maintain their vehicles rather than modify them.

“Since COVID, there’s definitely been a large increase in replacement parts and not so much accessories,” Wentz noted. “When we were deep into this thing, I think everybody was just trying to keep their vehicles on the road, and that led to increases in replaceable ball joints and axle parts and things like that.”

He added that, although the market has mostly normalized since spring 2020, “we’re still seeing much higher growth in replacement parts than has been typical over the past 10 years or so.”

Still, consumer demand for truck accessories remains robust.

“We’re actually seeing steady growth across the majority of our truck and off-road categories,” said Sean Marks, executive vice president of marketing at Truck Hero. In particular, “bed covers, side steps, floor liners, lift kits and bumpers continue to see healthy increases in sales for us.”

While mobile-electronics sales took a big hit last year, some sources saw a continued strong demand for mobile products with automotive applications.

“One of the biggest trends we see is the desire for mobile-friendly electronic products,” said Stephanie Pohnl, channel marketing manager at Curt Group. “Because of this trend, we created a device that plugs into your OBD-II port that measures real-time vehicle trailer weights for safer, easier towing and hauling.”

Towing-related products also appear to be a fairly resilient sector.

“We are seeing towing capacities continue to get higher, and the demand for heavy-duty towing is growing,” Pohnl noted. “Keeping up with the demand of these increased capacities can be a challenge, but we continue to innovate to meet the needs of this market.”

The coming electrification of the truck market was also cited as a potential future driver of OE and aftermarket sales. Speaking on that subject, Kyle Shimanski, vice president and general manager at Warn Industries, noted that “weight, power requirements, interactivity and duration are critical factors to be addressed. But when accomplished, we will be able to realize the environmental benefit while not having to compromise on key attributes that enthusiasts’ rigs need in order to head off-road for periods of time and into terrain that may test the vehicle for durability and maneuverability.”

“I think electrification is going to pull a lot of folks in who wouldn’t consider these vehicles before,” Wentz said. “It will still be a niche, but I think definitely it’s going to be an area for growth for the industry.”

production and an electric Ford F-150 waiting in the wings,

electrification of the truck and SUV market is a trend for the

aftermarket to watch for in the more-distant future. Courtesy:

GMC

Overlanding: Still a Driver of Segment Growth

Another trend mentioned by nearly all of our sources was overlanding, which was covered last year in the pages of the April 2020 SEMA News. Generally, it’s the practice of exploring the backcountry in a purpose-built vehicle—usually a high-clearance four-wheel drive—that’s equipped to allow its occupants to remain self-sufficient for extended periods. The activity originated in Australia, but its popularity in North America has exploded over the past decade and a half.

Given that distancing has now become a part of the new normal of social intercourse, it’s little surprise that most of our sources expected overlanding to grow in popularity in the coming years.

“With people not being able to travel and go on trips as originally planned, they’re instead opting to up-fit their trucks for their next camping adventure, whether it is adding new steps and other accessories or updating their towing equipment,” Pohnl noted. “We anticipate this segment to continue to grow in 2021.”

Sean Beaulaurier, vice president of RSI North America, agreed: “The pandemic has brought about many challenges for manufacturers worldwide, but with vacation travel brought to a near standstill, consumers are getting into camping and overlanding like never before, investing in their vehicles and outdoor recreation gear. This has been very good for the aftermarket.”

“We saw a lot of overland and camping products fly off the shelves,” Reinhardt said. “Rooftop tents, awnings, folding chairs and winches as well as a lot of wheel, tire and suspension packages.”

Wentz concurred, adding that overlanding appears to be exercising a stronger pull with a customer base that skews younger than average, a sentiment echoed by Nick Jaynes, communications director for Overland Expo.

“Overlanding is no longer an old man’s hobby,” Jaynes said. “Millennials are flocking to the pastime in droves.”

Shimanski also noted the recent growth in the RV industry, which “links closely to our customers because it means getting away, exploring and spending time with family and/or close friends.” The Recreational Vehicle Industry Association estimated a 4.5% growth in sales for 2020, despite the pandemic and its economic slowdown.

The growth in overlanding has been accompanied by the expansion of organized events and expositions, led by Overland Expo, the first public exhibition series dedicated to promoting the activity, and by Overland Experience, which made its debut at the 2019 SEMA Show. While Overland Experience was postponed in 2020, along with the SEMA Show, Overland Expo held a pair of virtual events in 2020. Promisingly, it attracted the interest of many new enthusiasts.

“Overland Expo saw tremendous growth in interest from fans,” Jaynes said. “More than 80% of visitors to our website and more than two-thirds of the attendees of our Virtual Overland Expo events in 2020 were new, meaning that a majority of our new fans prior to 2020 had not visited our website or attended one of our shows before.”

The influx of new enthusiasts is also influencing buying habits in the segment.

“Starter overlanding gear was most popular with our fans in 2020,” Jaynes said. “From overlanding awnings to fridges to recovery gear, novice overlanders were keen to get outfitted and get going.”

Flowers is also bullish on overlanding and on the off-road sector in general.

“More people are discovering the thrill of self-driven off-road adventures,” he said. “Popularity for overlanding, off-road trail riding and desert excursions has exploded, with new participants coming into the market daily.”

fastest-growing automotive segment of the ’00s has been

crossover utility vehicles (CUVs). A nonexistent market segment

30 years ago, it now accounts for an 18% market share, trailing

only pickups in that regard.

Challenges and Opportunities

All of our experts agreed that COVID-19 was the single greatest immediate challenge confronting the industry in 2020 but that the industry had managed to weather the storm while remaining relatively healthy with the implementation of new workplace safety and sales protocols.

“We learned a lot about our company, our team and our ability to push through during difficult times,” Reinhardt recalled. “We had to drive through a lot of obstacles in 2020, and we specifically created new plans and processes to prepare for the unexpected. Our company has always been focused on providing expert advice, professional services and first-rate products, but COVID made us add a safety element that hit all of our stores differently.”

Most of our sources cited ongoing international supply-chain issues as a current and potential future source of disruption in the industry.

“We’ve seen some significant disruption,” Wentz observed. “It started two or three years ago, and it’s not getting any easier to deal with. It’s hitting everybody in the industry, and I don’t see that getting any better in the immediate near future.”

Flowers additionally mentioned the need to attract skilled workers to the industry.

“Addressing and overcoming these challenges will be crucial to our continued success,” he said.

The onset of the pandemic and the accompanying economic downturn emphasized the need for companies to be willing to adapt to rapidly changing circumstances and to develop new business models on the fly.

“Always follow the consumer,” Marks added, noting the changes in consumer buying habits that have evolved out of the pandemic. “Consumers have grown accustomed to ordering online and utilizing curbside service, and there is a belief among retailers that this type of service may very well be here to stay.”

On a similar note, Beaulaurier called out the difficulties of “meeting consumer expectations for fast product delivery in an age where shipping logistics and supply-chain management face unprecedented challenges. Customers want it now, and when they don’t get it, they immediately get on social media and raise hell. Managing those expectations is one of the most significant challenges we face.”

“Being flexible and offering more than a single service has become essential to survival in the modern overlanding truck and off-road market,” Jaynes said. “A brand can’t simply practice one discipline anymore. It must master many disciplines.”

Simply keeping up with the flurry of new OE product offerings—and their ever-more-sophisticated technologies—poses its own unique challenges.

“The greatest change in the truck and off-road market over the past few years has been the sophistication of vehicles, from collision-avoidance systems to computer technology interfaces and even the journey to electrification of trucks and ORVs,” Shimanski said. “These changes can be significant in certain platforms, and the accessories that people like to install must not interfere with the systems.”

“The aftermarket’s relationships with the OEMs is ever-evolving and has been both an opportunity and a challenge,” Reinhardt added. “New vehicles are hitting the dealerships with new platforms and innovative features, yet the aftermarket is always finding ways to modify and improve each vehicle.”

Other challenges mentioned included market consolidation, which, as Wentz explained, “created demand for very-low-priced goods, which in turn drives down margins, which in turn drives down the ability to invest in R&D to create new products for customers. I think as an industry, we’re not still quite sure how to address that question.”

Still, with the economy continuing gradually to recover and the OE manufacturers producing ever-more-capable trucks and SUVs, most of our sources remained optimistic for 2021 and beyond.

Flowers summed it up: “If the economy continues to recover in 2021, solid growth in outdoor activities such as off-roading will also continue, and the introduction of exciting new multiuse vehicles such as the Ford Bronco and others will help bring in new consumers to off-road activities. New consumers and new vehicles will fuel more opportunities for auto accessories.”

Truck Market Trends: Stay Up-to-Date

SEMA offers numerous resources that can help members stay abreast of changes in the light-truck aftermarket. To download a free copy of the “SEMA Pickup Report,” the “SEMA Accessory Opportunity Report” or the latest copies of “SEMA Market Report” and “SEMA Future Trends,” visit

www.sema.org/market-research.