SEMA News—June 2019

BUSINESS

By Mike Imlay

Do Young People Still Love Cars?

Yes, Says a New SEMA Report—Just Differently

Cars and their accessorization are still very much a youthful passion, according to the newly released “SEMA Young Accessorizers Report,” which separates fact from media hype about the demographic’s automotive habits. Cars and their accessorization are still very much a youthful passion, according to the newly released “SEMA Young Accessorizers Report,” which separates fact from media hype about the demographic’s automotive habits. |

Is today’s younger generation giving up on driving, shunning car culture and turning away from vehicle accessorization? Far from it, says a new consumer study by SEMA’s Marketing Research department. In fact, the recently released “SEMA Young Accessorizers Report” suggests that this demographic is still as car crazy as ever—just in a different way.

Two years in the making, SEMA’s research initiative encompassed an online quantitative survey of more than 1,000 young accessorizers, followed by an online qualitative deep dive into the behaviors and attitudes of a representative subset. To be considered a “young accessorizer,” subjects had to fall within a specific age range; have a valid driver’s license; drive or own at least one vehicle and use it in some capacity; be at least somewhat involved in its maintenance, repair or modification; and have modified or upgraded it in the past year.

“For this study, we wanted to look at emerging drivers and emerging adults, so we focused specifically on 16- to 24-year-olds,” said Gavin Knapp, SEMA director of market research. “What we found is that most 16-year-olds don’t have a driver’s license. It’s hard for them. They have to worry about insurance and all the hoops of getting a license. There’s not free drivers’ education anymore, and so they wait. But they only wait until they’re 17, 18 or 19. Once they have their license and start driving—and especially once they get into their 20s—they need a car for work, school and socializing, and they want to make that car their own.”

Urban Myth-Busting

But what about all the news reports saying kids are no longer into cars, care only about their phones and digital devices, and would rather take Uber or Lyft than drive? According to Knapp, such reporting is likely based on the urban bias of the major media outlets doing the coverage.

“A lot of what’s coming out about vehicles in general comes from media and analysts who live in places like Manhattan and think the whole world is following the trends found there,” he explained. “One example is the idea that college-age kids in highly condensed urban areas aren’t owning cars. But that’s nothing new. If you look back 10 or 20 years, that same demographic also didn’t own cars. And just because someone may fit into that box now doesn’t mean that they’re going to act the same when they’re 30 or 35 and their life is completely changed.”

In fact, SEMA research indicates that young drivers actually accessorize at greater rates than the average aftermarket consumer.

“When we look at the broad spectrum of people, we find that only a quarter of drivers participate in our industry,” Knapp said. “With this young group, even when we factor in the 16- and 17-year-olds, it’s still a higher percentage that participates in our industry by accessorizing and modifying their vehicles. So this is actually a highly engaged group.”

The truth is that an estimated 7.9 million young people accessorize their vehicles, spending roughly $7.2 billion on upgrades and accessories last year and representing a sizable share of the $43 billion industry marketplace. Those teen and young-adult accessorizers say they derive a number of key personal benefits from their purchases, including a better-looking vehicle (39%), a sense of pride (37%), enhanced vehicle performance (34%), and greater automotive knowledge (33%). Moreover, today’s youth continue to see the automobile as a primary means to overcome isolation and explore new adventures with friends. Contrary to stereotypes, accesorizers in that demographic say they would rather give up their phones for a week than

their vehicles.

The vast majority of young accessorizers are males, who are influenced by exotic cars, trucks and SUVs. Female accesorizers skew more heavily toward trucks, SUVs and vehicles evoking utility and outdoor activities. But small/midrange vehicles and classics are the cars that each gender within this age group can love.

Whatever their dream car, males and females alike aim for a blend of performance and style. They seek convenience, reliability and environmental friendliness without skimping on looks, speed and safety. Yet despite all that, only 23% of male and 17% of female customizers say they can identify with the wider car culture.

Redefining Coolness

As teens age into their 20s, they are more likely to get a driver’s license, modify their vehicles and increase their spending on aftermarket parts and accessories. As teens age into their 20s, they are more likely to get a driver’s license, modify their vehicles and increase their spending on aftermarket parts and accessories. |

“They’re creating their own car culture,” Knapp explained, adding that the ways the industry has traditionally defined car culture may actually be alienating these budding customizers. “One of the overriding themes of our report is that young people are social, no matter what they’re into. So if you’re marketing to the guy who sneaks off to the garage to have his alone time away from family, that’s not working for this group. This group is all about inclusion, friends, showing off and collaboration.”

| Compared to Other Age Groups, Young Drivers Modify at a Very High Rate* | |

Age 16–24 33% *Among those with access to a vehicle. Source: 2017 SEMA Market Data |

“It’s about taking pictures of your car and putting them on Instagram,” echoed Kyle Cheng, the lead SEMA research manager for the report. “But money is also an issue for this group. Only half of this 16–24 age group would be considered hardcore enthusiasts. The types of big upgrades that our market associates with car culture are beyond them.”

According to Cheng, “nuts and bolts don’t speak to this demographic,” which grows into the hobby gradually over time. They see their cars less as projects and more as a means to connect with friends. If they do take on projects, they involve their peers, and most feel that they can handle only light to moderate upgrades.

“One thing that popped up when we were doing interviews was that young people have the idea that they want to get from A to B, but it’s a little more nuanced,” Cheng said. “It’s about getting from A to B in a safe way, not necessarily loading a vehicle with a ton of features. Also, while they’re more technically advanced than other groups, they aren’t necessarily looking for a lot of advanced technology like a lot of marketers think.”

“Given the types of [newer] cars they have available in which engine mods are not so easy to do, personalization is going to be key,” Knapp added. “We always find that wheels and tires are sort of the ‘gateway drug’ across all segments of modifiers, and they certainly are with this group, because wheels and tires deliver bang for the buck. This group wants to do something cool and get the picture up on social media. Even with engine mods, they want to do those they can take pictures of and look cool.”

Shopping Habits

Of course, all shopping starts with an inspiration, which for this generation begins online, usually via social-media platforms such as Instagram, Google images and YouTube. The images and videos they find there stir their emotions and encourage them to formulate dreams. Friends, family members (usually dad) and auto professionals are next in the line of major influencers—with an emphasis on friends.

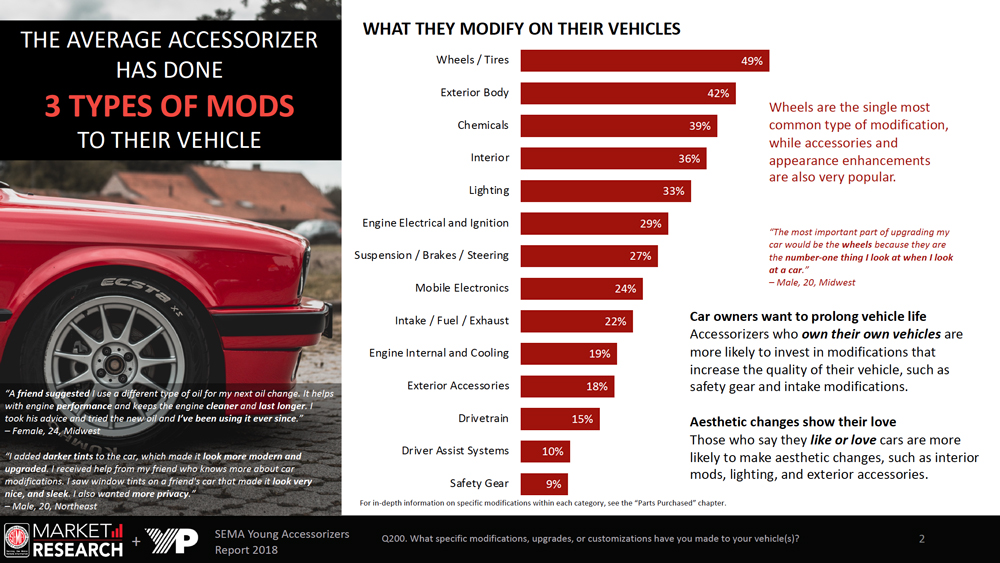

The average young accessorizer has performed three types of modifications to his or her vehicle, with wheels being the single most common upgrade. Other appearance mods are also highly popular. The average young accessorizer has performed three types of modifications to his or her vehicle, with wheels being the single most common upgrade. Other appearance mods are also highly popular. |

In the words of one 20-year-old survey participant, “I saw a friend driving with tints, and it made his car look sleek and modern. The older model no longer looked old, and it inspired me to make upgrades too.”

Another 24-year-old female respondent stated, “A friend posted pictures of her new covers on social media, and I thought I’d try it out.”

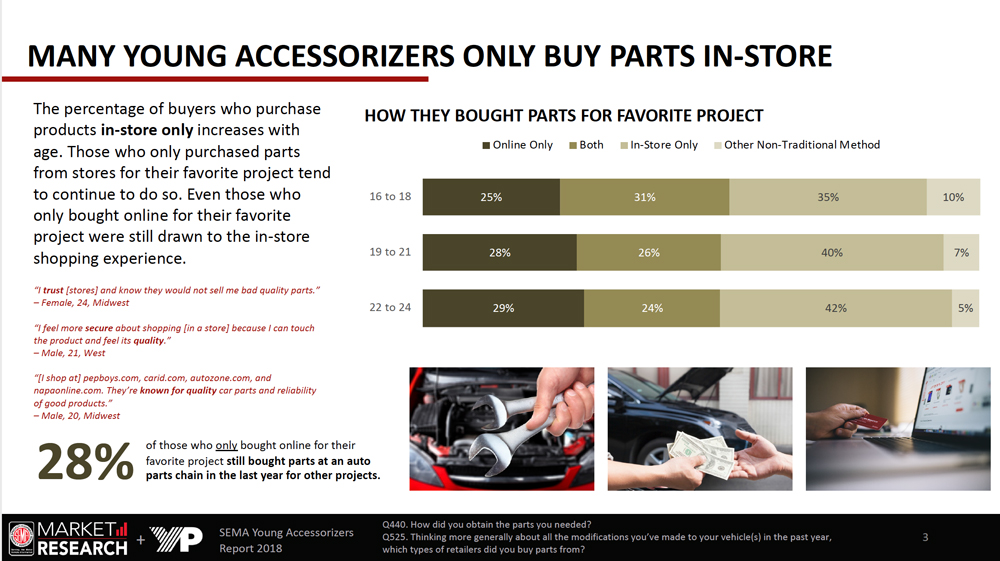

The percentage of buyers who purchase products only in stores increases with age. Just as noteworthy, young buyers who only purchase online still tend to visit brick-and-mortar locations as part of their shopping experience. The percentage of buyers who purchase products only in stores increases with age. Just as noteworthy, young buyers who only purchase online still tend to visit brick-and-mortar locations as part of their shopping experience. |

Ironically, even with all their reputation as voracious social-media users, the people in this age group are far less likely to venture into online forums or similar car-enthusiast sites for purchasing advice. Plus, according to Cheng, they have few inhibitions about brick-and-mortar stores.

“There’s the perception that people don’t shop in stores anymore, but if you look at how this group purchases parts, they are going into the shops,” he said. “People want to actually see and touch the stuff they’re going to put in their cars.”

In fact, about 66% of those canvassed for the SEMA market study reported buying at least some parts via brick-and-mortar stores, with 70% of store buyers picking their purchases up personally (as opposed to shipment to their home or another shop). That behavior changes somewhat when young enthusiasts become more immersed in the hobby and increasingly confident about making their parts decisions online. In those cases, 79% said they had their parts shipped to their homes.

“Obviously, some things are going to be easier in terms of shipping, others in terms of installation,” Knapp observed. “That said, the flip side, especially with products such as chemicals, is that we actually see more in-person purchases, because when you want it, you want it now.”

And although they’re budget conscious, they aren’t prone to fudge on quality. Whether doing a build themselves or having someone do it for them, the vast majority looks for the highest-quality, most reliable parts. What’s more, 82% say they have bought only new parts for their favorite automotive projects.

“We often hear people complain that young people don’t have any money, so therefore they’re not going to buy from our industry,” Knapp said. “We do see in this research that money is a barrier, but the flip side of that is that young people in that life stage spend whatever money they have. They’re not saving for retirement and probably aren’t paying a mortgage or supporting a family or spending extra on medical insurance. So if their hobby or passion is cars, that’s what they’re going to spend on.”

Key Purchases

When it comes to actual parts purchases, products with immediate visual appeal top the list. They include:

- Wheel and tire modifications (49%)

- Exterior and body mods (42%)

- Fluids, cleaners and synthetic oils (39%)

- Interior enhancements (36%)

- Lighting upgrades (33%)

- Tuning chips and electrical engine mods (29%)

- Suspension and brake upgrades (27%)

- Mobile-electronic products (24%)

- Internal engine mods (19%)

- Racks, truck shells, tonneau covers, hitches and winches (18%)

The above list may partially explain why so many industry veterans assume that younger modifiers have lost interest in car culture. Where are the ambitious build projects? Why aren’t they digging in under their hoods and getting their hands a little dirtier?

| Young Accessorizers Fast Facts | |

Contrary to media reports, young people remain highly engaged with automobiles and driving, and they accessorize their vehicles at significant rates. Here are some key findings from SEMA’s market research:

|

“When you compare them to past generations, you have to remember that the cars they deal with are totally different,” Knapp answered. “If you want to go back to the ’50s, ’60s and ’70s and talk performance, they’ve got way more performance coming right off the lot now than we ever had back then. Plus, when older generations were kids, cars weren’t as reliable. You didn’t have as many options to fix them, and they were easier to work on. All of those things have changed with the vehicles that are available to this generation. The idea of customization and personalization is still big for them, but the things they can do to their cars have naturally changed.”

“Older people in this industry often look back on car projects they shared with their dads,” Cheng added. “Some people still do that, but this generation is a little different in that they have social media and YouTube, where they can watch people build cars rather than rely on someone else to show them. Just because we don’t see the old way happening anymore doesn’t mean this generation doesn’t care about cars.”

Reaching Young Buyers

The “SEMA Young Accessorizers Report” offers a number of strategies for reaching the younger generation, and Knapp said that a good place to start is to drop the millennial moniker.

“The problem is that the Millennial label will go from ages 18 to 35, and I’m sorry, but 18- and 35-year-olds are nothing alike. So we want to get out of that labeling,” he asserted.

| Get the Full Report | |

| The “SEMA Young Accessorizers Report” is now available alongside all of the association’s latest research studies on the SEMA Market Research webpage at www.sema.org/market-research. No member login is required, and downloads are free. |

Given that only about one in five young accessorizers considers the auto industry something they fit into, helping them to see themselves in the community is crucial. Stores are ideal for creating that sense of community, because less-confident shoppers appreciate the knowledge that brick-and-mortar staffs provide. This is a generation ready to learn, so messaging, workshops and other outreaches that help them build their knowledge, confidence and empowerment can go a long way.

In regards to marketing, the report recommends pumping inspiration into social channels—notably YouTube, Facebook, Instagram, Snapchat and Reddit. Images and content should aim to show them possibilities while encouraging them to share their own mods with others.

Keep in mind also that this is an eco-friendly and budget-conscious demographic that defines performance beyond speed. For them, performance can also mean vehicle safety and efficiency enhancements.

Finally, demonstrate how modifications improve both enthusiast and non-enthusiast lifestyles with messaging that highlights the enjoyment derived from researching and executing their upgrades.

Ultimately, young people are like other specialty-equipment consumers in that they’re pursuing aspirations, just from a different angle. As Knapp summed up, “When they talk about what’s important for them socially, it’s about actually being with their friends. And how do you make that happen? You get in the car and you drive. And when they do get to the point of driving and having the car, suddenly all the cool activities and adventures you can do with cars, trucks and SUVs open up to them.”