SEMA News—September 2019

EVENTS

Buyers: Explore These Early SEMA Show Leads

More Than 250 First-Time Exhibitors Now Registered!

Discovering new products and business contacts is a key buyer aim at the SEMA Show. This list of first-time exhibitors is the ideal starting point. |

If you’re a buyer destined for the 2019 SEMA Show, now is the time to strategize a successful Show itinerary. First-time exhibitors are of particular interest because they bring never-before-seen products and services to the Show. As of June, more than 250 first-time exhibitors were already on the floorplan, and that data is offered here so you can get busy preparing a list of leads well before your Las Vegas arrival. Seasoned buyers will tell you that this is one of the best ways to hit the ground running and take full advantage of an active Show week.

The following list is organized by Show category for easy research. Note that many new exhibitors are clustered in the Show’s expansion areas—the Performance Pavilion, the Racing Annex, the Upper South Hall or the Westgate Las Vegas Resort & Casino—so you’ll especially want to target those areas. While these listings are accurate as of press time, the full, up-to-date exhibitor roster that resides online at www.SEMAShow.com/floorplan will always provide the most current status for all exhibitors.

Now is also the time to secure Show credentials and book hotel rooms. Registration is open at www.SEMAShow.com/register. Approved domestic buyers who register online prior to October 12 will pay the lowest price of $40 and will have their badges mailed to them before the Show, thus avoiding lines onsite. Meanwhile, hotel deals can be found at www.SEMAShow.com/travel, courtesy of OnPeak, the SEMA Show’s official housing partner.

List as of 7/8/19

Business Services

Acumatica

www.pcbennett.com

Booth #31240

APA Engineering

www.apaengineering.com

Booth #32226

Bay-masteR Shop Management

www.bay-master.com

Booth #51309

BFM Group

www.bfmgroupinc.com

Booth #33321

Family Business USA

www.familybusinessusa.com

Booth #50402

Kornerstone Credit

www.kornerstonecredit.com

Booth #33245

Lands’ End Business

https://business.landsend.com

Booth #51130

RENA By Neopost

www.renausa.com

Booth #34303

Shanghai Bobang Signage Co. Ltd.

www.bobangsignage.com

Booth #38238

Shopmonkey.io

www.shopmonkey.io

Booth #31227

Son of a Fink Kustoms

www.sonofafink.com

Booth #51001

Surf & Turf Instant Shelters Inc.

www.gosurfturf.com

Booth #31333

Uber for Business

www.uber.com

Booth #50130

Ware2Go

www.ware2go.co

Booth #31335

Weave

www.getweave.com

Booth #51202

Collision Repair & Refinish

BAOSTC

www.baostc.com

Booth #50633

EMM Specialties N.A.

www.emm.com

Booth #50126

Herkules Truck System

www.herkules-sc.pl

Booth #50401

Jiujiang Lida Technology Co. Ltd.

www.lidapetfilm.com

Booth #32273

Johns 360 Coatings

www.johns360coatings.com

Booth #50201

Karshall Industry Co. Ltd.

www.karshall.com

Booth #16624

Kristal Coatings Netherlands

www.kristalcoatings.nl

Booth #50400

Meiji Air Compressor

www.meijiair.co.jp/en

Booth #50803

Mobile Tech RX

www.mobiletechrx.com

Booth #50227

Polimax Eskim

www.polimaxeskim.com

Booth #50731

PREPitX

www.prepitx.net

Booth #38245

RockOz

www.rockoz.com

Booth #50200

SB3 Coatings

www.sb3coating.com

Booth #71011

Spray Booth Services

www.sprayboothservices.net

Booth #50503

Static Solutions

www.prostatdc.com

Booth #50622

Summit Industrial Group Ltd.

www.summitindusgroup.com

Booth #51311

Superpads

www.cztaiyu.com

Booth #50426

Whirlwind Tools Co. Ltd.

www.whirlwindtools.com

Booth #33336

Zibo Riken MT Coated Abrasives Co. Ltd.

en.rikenmt.com

Booth #51200

Global Tire Expo—Powered by TIA

Bush Specialty Vehicles

www.bushspecialtyvehicles.com

Booth #44298

Fitment Group

www.fitmentgroup.com

Booth #42332

4JET Technologies GmbH

www.4jet.de/en

Booth #44322

Knight Tyre

www.knightyres.com

Booth #42325

Land Golden Tires

www.landgolden.com

Booth #44305

QingDao Hengda Tyres Co. Ltd.

www.hengdatyre.com

Booth #41329

Shandong Taishan Tyre Co. Ltd.

www.taishantyre.com

Booth #51328

Shandong Wideway Tire Co. Ltd.

www.widewaytire.com

Booth #42318

Sichuan Yuanxing Rubber Co. Ltd.

www.cn-yuanxing.com.cn

Booth #42315

TMA International Tyres

www.tmatyres.com

Booth #40336

TRAC Tire Rotation Assistance Cart

www.liftwithtrac.com

Booth #43336

Triton Valves

www.tritonvalves.com

Booth #40122

US Tire Outlet Inc.

www.ustireoutlet.com

Booth #42314

More than 250 first-time exhibitors have already found a place on the 2019 SEMA Show floorplan, promising a Show packed with fresh opportunities for buyers. |

Hot Rod Alley

Hearn Automotive Re-Design

Booth #50707

MotorEx/Summernats

www.motorex.com.au

Booth #51124

Rapid Hot Rods

www.rapidhotrods.com

Booth #38203

Mobile Electronics & Technology

American Bass USA

www.americanbassusa.com

Booth #50231

CTK Ltd.

www.ctk.world

Booth #50732

Guangzhou KingEagle Auto Parts Co. Ltd.

www.ke-car.com

Booth #50428

GU Auto Tech Inc.

www.guautotech.com

Booth #32338

Haining Huagao Import & Export Co. Ltd.

www.icedriver.net

Booth #34345

J&M Corp.

www.jmcorp.com

Booth #51333

Moorechip Technologies Co. Ltd.

www.facebook.com/pg/moorechipVala

Booth #32321

Promata

www.promata.com.au

Booth #34337

Revo Range

www.arirobot.com

Booth #51129

Shenzhen Cartizan Technology Co. Ltd.

www.icartizan.com

Booth #51232

Shenzhen Maustor Science & Technology Co. Ltd.

www.maustor.com

Booth #50107

Shenzhen Proinno Technology Co. Ltd.

www.pro-ele.com

Booth #33329

Shenzhen Windrunner Technology Co. Ltd.

www.szwindrunner.com

Booth #50800

Shenzhen Wins Novelty Technology Co. Ltd.

www.wins-novelty.com

Booth #50430

TFVC (Shanghai) Co. Ltd.

www.tfvcsh.com

Booth #34328

VAIS Technology

www.vaistech.com

Booth #31315

Powersports & Utility Vehicles

Accelerated Systems Inc.

www.accelerated-systems.com

Booth #38007

ACCEL Technology Corp.

www.accel123.com.tw

Booth #36003

Fribest Industry Group Co. Ltd.

www.chinamotorcyclepart.com

Booth #36027

Full Spectrum Power

www.fullspectrumpower.com

Booth #38031

High Desert Motorsports

www.highdesertmotorsports.com

Booth #38034

Jiangsu FMOL Machinery Technology Co. Ltd.

www.fmolmachinery.com

Booth #36025

Nikola Motor Co.

www.nikolamotor.com

Booth #36005

RBO

www.razorbackoffroad.com

Booth #37003

Servis Tyres-Pakistan

www.servistyres.com

Booth #37031

TrailMaster/BV Powersports

www.gopowersports.com

Booth #37008

TYCA Technologies

www.tycatech.com

Booth #38030

Racing & Performance

bFlash by BCConsulting

www.bcconsulting.lu

Booth #22728

Cam Motion Inc.

www.cammotion.com

Booth #72000

ChampCar Endurance Series

www.champcar.org

Booth #51228

Fiveomotorsport

www.fiveomotorsport.com

Booth #50106

GAB Suspension

www.gabsuspension.com

Booth #51029

GXP Performance

www.gxpperformance.com

Booth #51307

IDI Motor Sports USA

www.idijp.com

Booth #50025

Integrated Engineering

www.performancebyie.com

Booth #32335

Keep It Klean

https://keep-it-klean.net

Booth #35345

KPI Performance

www.kingperformanceparts.com

Booth #51303

Marco Italy/Mate USA

www.marco.it

Booth #71005

Meizhou Kamlung Auto Parts Co. Ltd.

www.kamlungint.com

Booth #33331

Modern Driveline

www.moderndriveline.com

Booth #50323

Namyang Nexmo Co. Ltd.

www.nynexmo.com

Booth #51226

Neotech Suspension & Brakes

www.neosus.co.kr

Booth #50129

Ningbo Aegeus Exhaust System Co. Ltd.

www.aegeusexhaust.com

Booth #50900

Noble Industries Inc. & Madsen Wire Products

www.nobleindustries.com

Booth #50931

OBD Solutions LLC

www.obdsol.com

Booth #34314

Power Plus Lubricants

www.powerpluslubricants.com

Booth #44301

PRAZIS Auto Parts Inc.

www.prazis-airsus.com

Booth #34300

Promaxx Performance Products

www.promaxxperformance.com

Booth #34312

Racingline

www.racingline.com

Booth #50205

Raemco Red Wood Co. Inc.

www.redwood.com.tw

Booth #50206

REDSTAR Exhaust

www.redstarexhaust.com

Booth #50432

Remark Inc.

www.remark-usa.com

Booth #72011

RUSH Auto Works Inc.

www.rushautoworks.com

Booth #30345

SF Racing Co. Ltd.

www.sf-racing.com

Booth #34335

Shandong Stopart Brake Materials Co. Ltd.

www.stopartcn.com

Booth #30318

Sullivan Performance Products

www.sullivanperformance.com

Booth #72002

TPI Arcade Inc.

www.tpicast.com

Booth #50528

Turnkey Industries

www.tkind.com

Booth #61020

XING Mobility

www.xingmobility.com

Booth #50904

Restoration Marketplace

Retro-Fit USA

www.spiralindustries.com

Booth #50628

Turbostart

www.turbostart.com

Booth #73009

Restyling & Car Care Accessories

AeroCatch

www.aerocatch.com

Booth #50329

The Bracketeer

www.thebracketeer.com

Booth #71000

Changzhou Wenye Auto Lamp Co. Ltd.

www.wyautolamp.com

Booth #51426

Changzhou Yizhao Auto Exterior Parts Co. Ltd.

www.autotuning-china.com

Booth #51325

Conergies Laminating & Coating

www.onerpro.com.cn

Booth #38231

Cynosura International Co. Ltd.

www.j2e-auto.com

Booth #30344

DefenderN

www.defendern.com

Booth #51222

DeOdorPro

www.clo2deliverysystems.com

Booth #50124

EAS40-1000 Rollover Inlet Check Valve Fuel Tank Repair

www.ellisautomationsurplus.com

Booth #33319

Eclipse Sunshades

www.eclipsesunshades.net

Booth #51204

Element 119

www.element119.com

Booth #50105

Flamingo Car Care Tech Co. Ltd.

www.flamingocarcare.com

Booth #48233

Guangdong Carbonss Tuning Co. Ltd.

www.carbonss.com

Booth #74005

Guangzhou Joesong New Materials Technology Co. Ltd.

www.gzjoesong.com

Booth #34344

Guangzhou Wanlong Automotive Products Co. Ltd.

www.wl-auto.com

Booth #35344

Guangzhou Yagai Trade Co. Ltd.

www.dcrtuning.com

Booth #48227

Hyperformance Glass Products LLC

www.hyperformanceglassproducts.com

Booth #30289

I.M Technology Co. Ltd.

www.twim.com.tw

Booth #34292

Koch-Chemie

www.koch-chemie.de/en

Booth #32317

KOLCHUGA

www.kolchuga-group.com

Booth #50730

Legendz Carbon Auto Parts LLC

www.legendzcarbon.com

Booth #32332

MFR Engineering Inc.

www.mfrengineering.com

Booth #40296

Moso Natural

www.mosonatural.com

Booth #50404

NuVinAir Global

www.nuvinair.com

Booth #51301

Olein Refinery & Lubricants

www.oleinrefinery.com

Booth #50406

Padxpress

www.padxpress.fr

Booth #34331

REV Auto

www.rev-automotive.com

Booth #32322

Rhino Films & Detailing

www.rhinowash.net

Booth #34339

Rustkote Corrosion Prevention

www.rustkote.com

Booth #31323

Sam’s Detailing

www.samsdetailing.co.uk

Booth #33317

SeatbeltPlanet.com

www.seatbeltplanet.com

Booth #50326

Shanghai Sepna Chemical Technology Co. Ltd.

www.sepna.cc

Booth #50301

Shenzhen i-Like Fine Chemical Co. Ltd.

www.ilikegroup.com

Booth #48229

Sideways Fab

www.sidewaysfab.com

Booth #50304

SLIPLO Universal Skid Plates

www.sliplo.com

Booth #70011

Three Hundred

www.threehundred.jp

Booth #30299

3W Auto Accessory

www.3wliners.com

Booth #32325

TUXMAT The Ulitmate Car Mat

www.tuxmat.ca

Booth #33316

Waxedshine

www.waxedshine.com

Booth #51206

Zhejiang Purple Light Technology Co. Ltd.

www.uv400.cn

Booth #33345

Tools & Equipment

Airworks Compressors Corp.

www.airworkscompressors.com

Booth #51133

Alltrade Tools

www.alltradetools.com

Booth #51107

American Sweeping

www.firmhorn.com

Booth #50902

Auto-Grip

www.autogrip.com

Booth #51331

Bengbu City Wanglin Manufacturing Co. Ltd.

Booth #38233

The Cut N Go

www.thecutngo.com

Booth #32336

Dalian Newstar Automobile Equipment Co. Ltd.

www.nsttool.com

Booth #34346

Dedeco International Inc.

www.dedeco.com

Booth #44336

DJ Products

www.djproducts.com

Booth #51101

Easy Kleen Pressure Systems Ltd.

www.easykleen.com

Booth #31344

Eco-Plug-System LLC

www.ecoplugsystem.com

Booth #51003

FactoryCat Industrial Cleaning Equipment

www.factorycat.com

Booth #50601

Forecast 3D

www.forecast3d.com

Booth #50925

Fumoto USA

www.fumotousa.com

Booth #34308

GD CARE Inc.

www.gdcareinc.com

Booth #50626

GEDORE Tools Inc.

www.gedoretools.com

Booth #15007

Hangzhou Scantech Co. Ltd.

www.3d-scantech.com

Booth #33325

Hangzhou Xunchi Tools Co. Ltd.

https://xunchigongju.1688.com

Booth #34310

Harbor Freight Tools

www.harborfreight.com

Booth #15307

IDUTEX Technology Co. Ltd.

www.idutex.com

Booth #43323

International Surface Technologies

www.istsurface.com

Booth #34313

Lanair

www.lanair.com

Booth #51128

MAKEiT Inc.

www.makeit-3d.com

Booth #31337

MatterHackers Inc.

www.matterhackers.com

Booth #51332

Midwest Innovative Products

www.twistandseal.com

Booth #33339

Milton Industries

www.miltonindustries.com

Booth #50405

Milwaukee Tool

www.milwaukeetool.com

Booth #30319

Mosmatic Corp.

www.mosmatic.com

Booth #42324

Next Generation Power

www.nextgenerationpower.com

Booth #50202

No-Spill Systems Inc.

www.nospillsystems.com

Booth #34316

NuVant Systems Inc.

www.nuvant.com

Booth #32331

PEM Inc.

www.pemequip.com

Booth #30307

PipeKnife

www.PipeKnife.com

Booth #50532

Plastica Panaro Srl

www.plasticapanaro.it

Booth #50805

Powertac USA Inc.

www.powertac.com

Booth #50802

Qingdao PLR Electric Co. Ltd.

www.plrcn.com

Booth #50801

SGCB Autocare

www.sgcbautocare.com

Booth #51205

Shenzhen Hong Xuntong Electronic Technology Co. Ltd.

www.onsu-cable.com

Booth #34332

Soartec Industrial Corp.

www.soartec.com.tw

Booth #51402

SpliSeal

www.spliseal.com

Booth #50530

SP Tools USA

www.sptools-usa.com

Booth #10176

SPXFLOW Stone Hydraulics Powerteam Hydraulics

www.spxhydraulictech.com

Booth #51233

TeraPump

www.terapump.net

Booth #50303

Thexton Manufacturing Co. Inc.

www.thexton.com

Booth #42322

Top One Machinery Co. Ltd.

www.topone-m.com

Booth #35336

Triumph Twist Drill

www.triumphtwistdrill.com

Booth #50631

Tsugami/Rem Sales

www.remsales.com

Booth #50726

Vessel Tools

www.vesseltoolsusa.com

Booth #50700

Wiha Tools

www.wihatools.com

Booth #41305

Wright CNC

www.wrightcnc.com

Booth #50007

Yamada America

www.yamadapump.com

Booth #16424

Zünd

www.zund.com

Booth #50823

Trucks, SUVs & Off-Road

Airbag Man

www.airbagman.com.au

Booth #31339

ALL-TOP 4X4

www.alltop4x4.com

Booth #31341

Alpha Rex

www.alpharexusa.com

Booth #30267

Anhui Aggeus Auto-tech Co. Ltd.

www.woden.net.cn

Booth #30312

Bedder Covers

www.beddercovers.com

Booth #34289

EVO Manufacturing

www.evomfg.com

Booth #33277

Flat Out Autos

www.flatoutautos.com

Booth #32303

FlexTread

www.flextreadmats.com

Booth #35324

FOA

www.f-o-a.com

Booth #32345

Foshan Nanhai Hengyun Auto Accessory Co. Ltd.

www.everluck4x4.en.alibaba.com

Booth #38241

Foshan Shanshan Electric & Technology Co. Ltd.

www.fs-shanshan.com

Booth #51327

GEORGE4X4 Recovery Gear

www.george4x4.com.au

Booth #38248

Gladiator Cargo Nets

www.gladiatorcargonet.com

Booth #38201

Guangzhou Chiming Electronic Technology Co. Ltd.

https://cmled.en.china.cn

Booth #38222

Guangzhou Nic-light Electronic Products Co. Ltd.

www.nic-light.com

Booth #38237

Hollywood Accessories

https://davesautoacc.com

Booth #33340

MAG-BAR

www.magbar.com

Booth #38229

Malone Auto Racks

www.maloneautoracks.com

Booth #37227

MAXIMUS-3

www.maximus-3.com

Booth #30292

MENABO

www.menaboamerica.com

Booth #35284

Multy Rack Systems

www.multyrack.com

Booth #32309

Ningbo Goldy International

https://goldy.en.alibaba.com

Booth #32320

Ningbo Leise Outdoor Products Co. Ltd.

www.monster4wd.com

Booth #33283

Ningbo Salman International Trade Co. Ltd.

www.nbsalman.com

Booth #38227

Northern Lite Truck Campers/Off Grid Trailers

www.northern-lite.com

Booth #30275

Overland Vehicle Systems LLC

www.overlandvehiclesystems.com

Booth #30283

Paramount Impex

www.paramount-india.com

Booth #33338

Rapid Switch Systems

www.rapidswitchsystems.com

Booth #34319

Reliable Engineered Products LLC

www.beunruli.com

Booth #51404

Rocbilt Industries

www.rocbilt.com

Booth #35312

RockJock 4x4 by John Currie

www.currieenterprises.com

Booth #34285

Rotopax

www.rotopax.com

Booth #30313

RSI SmartCap

www.rsismartcanopy.com

Booth #30327

Shenzhen New Way Technology Co. Ltd.

www.newway-s.com

Booth #51132

Sunpie Technology Ltd. Co.

www.sunpie.co

Booth #34325

Supreme Suspensions

www.supremesuspensions.com

Booth #38219

TRE 4X4

www.tre4x4.com

Booth #51103

UBOX Offroad

www.ubox-offroad.com

Booth #32339

Wenling Haifeng Differential Gear Co. Ltd.

www.off-road.net.cn

Booth #50533

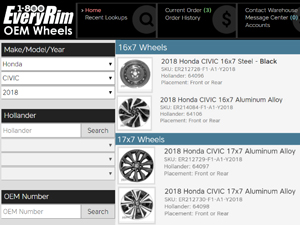

Wheels & Accessories

Chiping Xinfa Aluminous Product Co. Ltd.

www.xinfawheels.com

Booth #47239

4PLAY Wheels

www.4playwheels.com

Booth #47211

Impact Wheels

www.impactwheels.com

Booth #48133

Kompression Wheels

www.kompressionwheels.com

Booth #48193

New Light Wheel Engineering & Technology Co. Ltd.

www.jastoowheel.com/en/index.asp

Booth #45298

Ningbo Sanlishin Auto Parts Co. Ltd.

https://sanlishin.en.ecplaza.net

Booth #34330

Shanghai Jihoo Import & Export Co. Ltd.

www.jihoosh.com

Booth #48187

Simbolo X Design

www.simbolox.design

Booth #47221

STREN

www.stren-composites.com

Booth #44314

3D Billet Products

www.3dbilletproducts.com

Booth #49235

Wheel-eez/Cork Industries

www.removesugly.com

Booth #44337

Zhongnan Aluminum Wheel (Guangdong) Co. Ltd.

www.znlwheel.com

Booth #44328