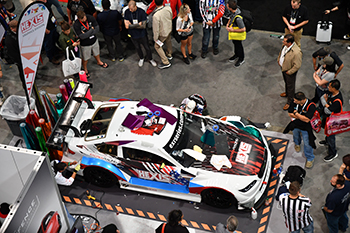

At the annual SEMA Show, the restyling category is grouped with car care in the North Hall of the Las Vegas Convention Center, where the growth trends can be clearly seen. Car care includes maintenance and cleaning products that help keep vehicles looking like new. SEMA research indicated that manufacturer revenue from appearance chemicals is $144.10 million. The market size for wax and cleaning products was estimated at $1.17 billion, while paint and body finishing products (including decals, wraps and window tint films) was thought to be $1.13 billion. At the 2016 SEMA Show, the total exhibit space sprawled across more than 90,000 net sq. ft.

Josh Poulson, principal of restyling company Auto Additions, noted a few popular upgrades for both the exteriors and interiors of vehicles.

“For a little while, we have been doing a lot of lifted truck and Jeep packages,” he said. “Those have been extremely popular over the last two years and probably will be for another year or so. And when I say packages, I’m talking about usually a 4- to 6-in. lift, new wheels, new tires, fender flares, step bars, grilles and leather. We also do a lot of blackout packages—meaning we’re blacking out the emblems and parts of the vehicle that are chrome or body painted.”

Electronic accessories are commonly requested by customers inside. Although backup cameras are highly regulated and will be mandatory as standard in all vehicles in 2019, fewer than half of the new cars on dealer lots today include the technology, according to Poulson. That has created an opportunity for installers as owners of new and older cars look to add the feature. And Poulson said that dash cams and DVRs that have been popular in Europe are also taking off in the U.S. market.

“When you look up close calls [near collisions] on YouTube videos and wonder where the pictures are from, well, they’re coming from people’s video recorders in their cars,” he said. “It’s kind of a safety thing: If you get in an accident, now you have proof of whose fault it was. But dash cams have become a lot less expensive, and they’re starting to become popular.”

Some other popular restyling choices require more careful consideration for upkeep.

Wrap Films

Vinyl wraps allow for a temporary color change to a vehicle and can be custom printed with designs or marketing messages. |

|

“There’s a personalization megatrend happening in the world, and print wrap film fits right into that,” said Tim Boxeth, marketing manager for 3M’s Commercial Solutions Division. “Design options are infinite due to the wide range of films and laminates available. Between white, clear, metallic and reflective films, you can have a unique vehicle that doesn’t look like anything else on the road. A design can be changed any time, and you can remove a wrap without damaging your vehicle.”

Among 3M’s most popular wrap colors and finishes are shade-shifting colors, which appear to change colors from different angles and lighting environments. Additionally, 3M offers overlaminate films that can be layered over top solid colors to give different depths and finishes such as metallic, brushed or carbon fiber.

“While all of our wrap films are highly durable, there are steps you can take to keep them looking their best,” added Janelle Pizzi, U.S. product marketer for 3M Commercial Solutions.

“For example, when washing your vehicle, we recommend using a wet, non-abrasive detergent such as 3M Car Wash Soap 39000 or Meguiar’s NXT Generation Car Wash or Deep Crystal Car Wash and a soft, clean cloth or sponge.”

While one of the benefits of using a wrap film is the ability to temporarily change the color of a vehicle, it also comes with a few challenges. It’s a time-consuming installation process, and intricate details can be quite difficult, if not impossible, to wrap. Autodip, a new type of wrap in a liquid form, is designed to alleviate those limitations. The product is applied like paint, but it cures into a vinyl that is peelable when the time comes for removal. The finish also incorporates self-healing technology to guard against scratches and minor damage. The product is available in 32 colors and three finishes: high gloss, frozen (a satin finish) and metallic. A clear coat is laid over top of the color layer.

“The vinyl wrap industry is massive, and it keeps getting bigger and bigger,” said Alex Hamilton, vice president of marketing for Autodip. “Our product shifts the market from people who have expertise in tinting and in doing details and lettering on cars to paint shops.”

The product works with any regular spray gun, and the company asserts that there’s little to no learning curve for painters.

Autodip is available in an aerosol line for DIYers, which is intended for wheels and other small parts of the vehicle. Hamilton said that a set of wheels can be color-changed for under $100. There is also a professional line of Autodip, which painters can use on the whole vehicle, and it lasts for three to five years. The consumer base for the professional line goes all the way to the other end of the spectrum—enthusiasts who have purchased an exotic or luxury car and want to change the look without compromising resale value.

“They can go to a body shop and just change the color of the car for a price that is typically $2,000–$4,000, depending on the car and the finish and the shop that you go to, but that isn’t much when you look at the value of the new car,” Hamilton said. “Because it lasts three to five years, it really does make sense.”

The company offers its own line of care products to go along with the wraps, and the gloss finishes can be wet-sanded and polished. The company will also soon be releasing Auto Guard, a paint-protection film that is basically a clear version of Autodip. Auto Guard can be used on the whole vehicle or only part of it, and it features the self-healing technology of Autodip that corrects itself when exposed

to heat.

Paint Protection

The “WTC Wheel Care Guide” outlines what types of cleaners to use with each of the common wheel finishes. |

|

Auto Additions fields a high request volume for clear mask installations, particularly for new and high-end vehicles. Like Autodip, other manufacturers are making use of self-healing technology for paint-protection films (PPF).

“That’s becoming more of a consumer-awareness product, where people are understanding what it is,” said Poulson. “When we show people the self-healing feature, it’s amazing how excited they get to see the new technology behind it.”

According to Mike Beaver, 3M’s national sales manager for paint-protection film, it’s a care trend that first became popular among luxury vehicle owners but is now growing in other segments. Vehicle owners are also beginning to cover more surface area with PPFs.

“Customers are opting to wrap whole panels, like whole hoods and fenders, as the price gap between partial and whole panels shrinks,” Beaver said. “In addition, customers are becoming more aware of new film technologies that offer features such as non-yellowing, self-healing and maintaining high clarity (low orange peel). We see that trend in shops as well as in our wider sales.”

Wayne Loomis, owner of car-care retailer Dr. Detail, also made some recommendations about protective films, saying that he uses them on his own show car.

“Chip guard usually needs to be changed once every three to five years, which can be an expensive process,” he said. “But if the appearance of the car is everything—like it’s a show car—it can be well worth the money. You definitely want to protect an expensive paint job that is hard to rematch, such as pearls or special effects, because matching that again is probably going to be as bad as a chip.”

Loomis said that he’s seeing a lot of cars coming from the dealership with the film already installed behind the wheels. In his opinion, covering the entire vehicle isn’t necessary, but it’s a smart investment for high-impact areas such as fenders and front bumpers.

Poulson added that care for the films is easy. “We just tell people soap and water, and part of the reason that they are so popular is that it’s pretty much user friendly,” he said. “There isn’t anything special that they have to buy to maintain it, so that helps with the sales process.”

Window Tint Films

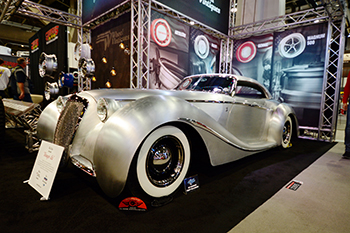

It’s important to consider the finish of a vehicle before selecting care products. Paint, wraps, polished metal and other special finishes may require special care. |

|

Window tinting is another popular upgrade among consumers.

“We’re seeing more and more of the ceramic film to keep the heat out,” Poulson said. “Instead of just looking better, the film cuts UV rays, so that actually

cuts heat.”

He added that those types of new features and designs make accessorization more attractive to consumers.

“It seems that a lot of the manufacturers have improved quite a lot of their products,” he said. “They’ve made them quite a bit better, such as the clear masks, which are now self-healing, or the window tint, which now is heat rejecting. All those things have revitalized a lot of the products that we’re already selling, and that’s led to a boost in sales.”

Sheng Lee Tomar, 3M’s U.S. channel and digital marketing manager for window films, concurred that heat-blocking technologies such as infrared (IR) rejection are currently hot in the segment.

“We find that more and more consumers are looking for performance films that will reject a significant amount of heat to keep their cars cool,” she said. “Typical films reject heat by blocking visible light, which means that the darker the film, the more heat it will block. Films with IR-rejection technology will block infrared light in addition to visible light. Specifically, 3M’s Automotive Window Film Crystalline Series features a proprietary, multilayer optical film technology that combines more than 200 layers in a film that is thinner than a Post-it note.”

According to 3M, the layered design allows even lighter shades of the company’s Crystalline series to reject more heat than darker films in its other lines. Building on consumer demand, 3M recently added Crystalline 20, the darkest shade of window film with the highest level of heat rejection in the product line. The films typically last throughout the lifetime of a vehicle operated in normal conditions and do not require special care, Lee Tomar said.

Dr. Detail’s Loomis recommended that his customers watch out for window cleaners that contain ammonia, which can harm some window films. Most automotive and alcohol-based glass cleaners should be fine for cleaning tinted windows, he said.

Washes, Waxes, Sealants and Coatings

Naturally, the retail side of car care provides insights into consumer demands.

“You see more and more dealerships offering [detail] services to their customers as well,” Loomis said. “I think we’re in a robust industry, and with the advent in the industry of the mobile detailer, as new as that is, I think we’ve got a long growth period coming up.”

Roger Chartier, sales manager at DetailBest.com, likened his customers’ car-care buying habits to the way music is now purchased by the song instead of by the album. “They are curating their detail collection with products they like or wish to try from different vendors,” he said.

In the last couple of years, Chartier has noticed the usage of sealant becoming more common among his customer base. It’s a type of man-made wax that typically lasts a year or two. He explained that there is a difference in appearance between sealant and traditional waxes and said that there’s a growing trend of consumers using both types of products together for a different look.

“One thing people will do if they’re going to a car show is get the best of both worlds,” he said. “We’re seeing people using sealants where they can get the longevity, but they’ll top it with a wax so that they can also get the wet look too. That’s an approach that we have found customers have figured out for themselves by experimenting. We’ve been reading that more professionals are getting into that technique, but it seems that customers were ahead of these gurus and had figured out that approach themselves.”

Regardless of whether consumers choose a sealant, a wax or both, Chartier always advises them to spend some time on preparation. Cleaning the finish and correcting the paintwork is a vital step to getting the desired end result, and so is making sure that you have enough supplies to finish the job.

Loomis also pointed to ceramic coatings as a new advance in appearance chemicals and said they typically last two to five years. Ceramic coatings contain powdered silicon dioxide—better known as sand. The coating gives the vehicle a clarity along with durable protection.

“You usually follow up with a sealant over the top of that for extra gloss and water repellency,” Loomis explained. “And that gets renewed normally, like a sealant would, but the coating under it perfectly protects the paint except for hard impact.”

As with ceramic window tints, many ceramic paint coatings protect against UV rays as well as chemicals. Vehicles treated with a matte finish or vinyl wrap require a different approach. If users aren’t careful, they can ruin specialized finishes with the care products they select. Because of that, some manufacturers such as McKee’s 37 are adapting new products.

“Matte finishes are more prevalent than ever, and they have unique cleaning requirements,” said Nick Rutter, general manager and surface enhancement expert for McKee’s 37. “You cannot use conventional cleaners and waxes on them. That’s why McKee’s 37 Matte Finish Cleaner and Protectant was developed.”

McKee’s 37 said that its matte product is safe for matte vinyl, matte paint, decals, PPFs and clear bras, and it is designed to help prolong the appearance of the finish with a shell of UVA and UVB light absorbers. The spray-and-wipe formula is clear in order to avoid making the vehicle finish appear blotchy or hazy.

Custom Wheel Care

An electronic version of the “WTC Wheel Care Guide” can be downloaded now at www.sema.org/wtc. |

|

Along the same lines, there are a number of customization options for wheels, each requiring its own special touch. Over the last year, SEMA’s Wheel and Tire Council (WTC) developed the “WTC Wheel Care Guide,” intended to educate consumers and industry members about proper care techniques for various wheel

surface finishes.

Joe Findeis, president of Wheel Consultants Inc. and the Wheel & Tire Council’s chair, explained that the main goal is to help consumers avoid damaging their new or existing wheels by accidentally using an incorrect cleaning product or method.

“Our goal is to help eliminate a bad experience, which will in turn eliminate dissatisfied customers,” Findeis said. “Happy customers will continue to buy more wheels. When a consumer makes a purchase, it’s a really, really big investment, whether it’s just a standard set of wheels or a complete, hand-built custom set. The main purpose of their purchase of a wheel-and-tire package is usually to enhance the appearance of the vehicle—it’s a fashion industry. In other words, they want to make the car look cool. A damaged, discolored wheel is not cool.”

Inside the “WTC Wheel Care Guide” is a listing of the most common wheel finishes, along with information about appropriate cleaners for each as well as care tips and frequently asked questions. The guide specifically addresses chrome, painted, anodized, plastic and clad, multi-finish and polished or uncoated wheels. The content was compiled by the WTC select committee, comprised of manufacturers, distributors and retailers specializing in the wheel and tire markets. The group also sought the advice of colleagues in the automotive chemical and

cleaning niches.

The “WTC Wheel Care Guide” is not only aimed at consumers but is also designed to educate sales staffs as they field questions from their customers. Ultimately, the WTC hopes that the resource will be available to consumers at the retail counter while they are browsing and will also be provided with their wheels at the time of purchase.

Manufacturers, retailers, distributors, installers, detailers and other wheel-industry professionals can download the free electronic version of the “WTC Wheel Care Guide” online now at www.sema.org/wtc.

The Save the Salt Coalition and Utah Alliance are working with government officials and adjoining mine owners to replenish the Bonneville Salt Flats through a comprehensive salt-brine pumping program.

The Save the Salt Coalition and Utah Alliance are working with government officials and adjoining mine owners to replenish the Bonneville Salt Flats through a comprehensive salt-brine pumping program.