BUSINESS

2023 Mobile-Electronics Trends

By Douglas McColloch

As cars increase their reliance on electronics, the market is poised to grow.

North Hall at the 2022 SEMA Show was ground zero for mobile-electronics exhibitors, with companies that manufacture information, entertainment and onboard safety systems all represented.

It's often said that today's cars are, effectively, computers that come equipped with four wheels. And there's certainly some truth to that, as onboard electronic safety and driver-assistance systems proliferate and as cars edge ever closer to full autonomous operation. Mercedes-Benz made news earlier in the year with the announcement that it had produced the first SAE Level 3 autonomous driving system that was capable of state certification. The state of Nevada has already okayed the use of the M-B system on its roads, California may soon follow suit, and it is only a matter of time before other OE manufacturers roll out vehicles with similar state-certified AI drive systems in place.

In any event, the mobile-electronics market continues to diversify and grow as consumers demand more onboard content for their purchasing dollars and as automobiles continue to grow more technologically complex in response. Electronic componentry already accounted for some 35% of a new vehicle's cost in 2020, and that number is forecast to reach close to 50% by 2030, according to a recent survey published by Grandview Research.

For this article, we consulted more than a dozen industry experts. What follows is a summation of their insights, edited for clarity and length.

The State of The Industry

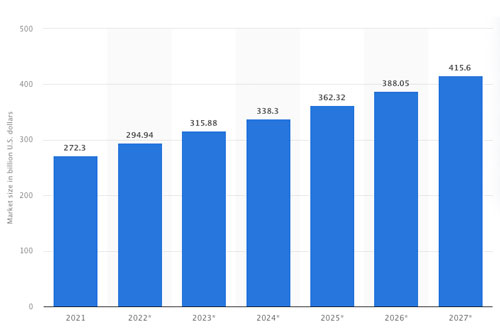

The mobile-electronics industry took a hit during the first year of the COVID-19 pandemic, with a 5% decline in sales worldwide in 2020, according to Fortune Business Insights, as supply-chain disruptions and a steep decline in new-vehicle sales both inhibited market activation. Since then, the industry has rebounded despite continued sluggish new-car sales, with a global market valuation of $295 billion in 2022 and a forecast to reach $415 billion by 2028, with a compound annual growth rate (CAGR) of around 7%, according to a 2022 survey published by Statista.

Globally, the mobile electronics market is primed for future growth, reaching an estimated $415 billion in sales by 2028. (Chart courtesy Statista.)

"We are coming out of a time where initial uncertainty yielded unforeseen opportunity," said Zach Luke, national sales manager for Rockford Fosgate. "The market flourished, and companies that were able to adapt and pivot found success, growth, and a resurgence of consumer interest. Consumers' spending options were narrowed, which focused them to engage and prioritize discretionary spending to categories that were maybe once not priority on the 'wants' list but which had now become in demand as an edifying option."

"The market is, I think, kind of flat," said Jeff Varick, founder and director of business development and connected vehicle services for BrandMotion Solutions, adding that the market appears to be fragmenting into more granular niche segments. "You really have to know your customer and the particular use cases that customer has."

Emerging Trends AND Technologies

The pandemic-related surge in off-road motorized recreation, including overlanding, impacted the mobile-electronics sector as well. "The absolutely insane growth in the off-road space during the pandemic was surprising to us," said Brian Sherman, vice president of product and marketing at Maxxsonics USA. "We exceeded forecast in aftermarket and OEM sales during this period by double digits. This has allowed us to hire additional engineering and support staff to fuel future growth and develop new applications more aggressively."

"It's an advantageous time to be in the aftermarket performance business," added Zach Luke.

Onboard safety systems are set to proliferate as ADAS, LIDAR and other driver-assistance technologies become more universal. This FullVue mirror from BrandMotion gives truck owners three distinct rear views for monitoring the truck’s bed or a towed load.

Consumer demand for more advanced safety systems—which already constitutes some 30% of the automotive mobile-electronics market—continues to drive new product innovation. "On the powersports and off-road side of our business, we're seeing more advanced technologies used," Sherman noted. "We recently completed a dual camera setup for one OEM customer and have added multi-camera inputs to most of our marine and powersports source units."

The need for onboard safety has never been greater. Auto-related fatalities rose again in 2022 to an estimated 46,000 deaths, according to the National Safety Council. That represents a 22% increase since 2019, even though total vehicle miles traveled in 2022 were still below pre-pandemic levels.

"We have big problems on our nation's roads, a big national public health problem," Varick said. "A lot of it's due to speeding, drugs or drinking, and then cell-phone distraction. So solutions for those things are where I see the most activity right now in the safety end of the mobile-electronics market." Navigation systems and mobile TV and video cameras for automotive applications currently constitute a North American market size of nearly $1 billion, according to the most recent SEMA Market Report.

The explosive growth in recent years of off-roading and powersports has reverberated (pun intended) into the mobile electronics marketplace, with audio systems such as this all-in-one MB Quart from Maxxsonics registering strong sales.

Sales of premium audio systems have also shown signs of growth. "We have seen an uptick in sales of higher-priced, higher-end car audio amps and speakers in our Hifonics and MB Quart brands," said Sherman.

Consumer demand for higher-end audio has forced companies to continue to innovate. "Our continual development of upgraded in-car solutions keeps us on the cutting edge of technology as consumer expectations of performance, reliability, and overall integration, and fit-and-finish are high," said Luke. "This allows us to 'push' our propriety technologies into the platforms where we're seeing our customers engage."

Looking at future trends, Varick sees electrification as the most likely new growth market. "I'm bullish on fleet and EVs, which are coming faster than shared mobility and faster than V2X. Electric vehicles aren't that different—it's just a different powertrain—so it creates another segment of the market to look at for opportunities."

Challenges and Opportunities

Economic headwinds can also present opportunities for secondary markets. "Rising interest rates and manufacturing costs will force OEMs to be more frugal with development and sourcing," Sherman said, adding that "this can provide more opportunities for upgrades from the aftermarket."

"Today we find ourselves in a position where we need to elevate our business strategies and offerings, both where B2B and B2C are involved, with better service, support, and product," said Luke. "We're once again competing with an expanded list of items and events that consumers can spend their money on."

Varick doesn't see any "one-size-fits-all solutions anymore, like a backup camera. I think you really have to come up with custom solutions and niche applications."

Higher-end niche applications have gained market share in the mobile space. This all-in-one Rockford Fosgate ST audio system for the Harley-Davidson Low Rider series provides an example of the type.

As an example, Varick explains, "We have a pretty successful digital rear-view mirror that gives you a full video screen on the mirror. You push a button, and it goes back to being a regular mirror. But when it's a video screen, it's seeing behind you. Even if you have people in the back seat, it's just a camera pointing backward. So we just added a version of that that has a wireless trailer camera for RVs or for a trailer that you're towing, and a custom third brake-light bezel that watches the bed of your pickup."

Our sources unanimously agreed on the need to maintain a robust presence across numerous social-media channels to optimize marketing.

"Most of our brands' ad dollars go to social now as it's the most targeted way to reach consumers," said Sherman. "Niche products require niche marketing, and this provides a clean way for us to market direct to the consumer and drive business to our retail and distribution partners."

Looking Ahead

Sherman echoed the sentiments of our panel with his near-term forecast. "We feel that business will be up in all segments, but not without challenges."

"Our objective is to continue creating demand by delivering industry-leading product and service," said Luke, "which enables us to continue capturing consumers open to buy."

The market is more fragmented now," Varick concludes, "so you need to find a market that isn't getting served by the OEMs or the general aftermarket."

SOURCES

Brandmotion

41100 Bridge St.

Novi, MI 48375

734-619-1250

Maxxsonics USA

8561 E. Park Ave.

Libertyvllle, IL 60048

847-540-7700

Rockford Fosgate

600 S. Rockford Dr.

Tempe, AZ 85281

480-967-3565