By Market Research

Vehicle Sales Slowing, But Specialty-Equipment Industry Demand Remains Solid

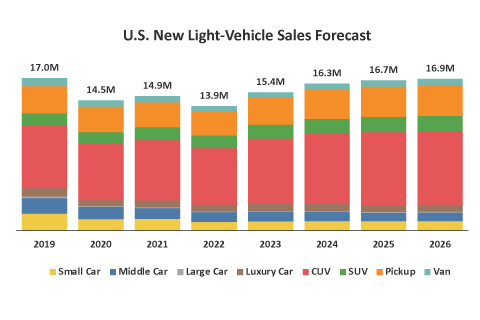

Thanks to supply-chain restrictions and high prices, new-vehicle sales have slowed and are projected to finish 2022 at around 13.9 million—about a million short of 2021 levels. As a result, new-vehicle sales are unlikely to return to pre-pandemic levels until 2025.

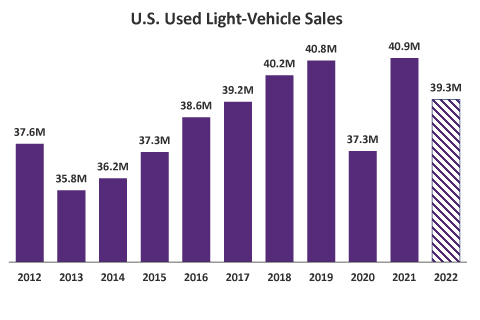

While some supply-chain issues have improved, disruptions remain ongoing, especially for chips, and a significant backlog in production means it will take a while for automakers to catch up. And it’s not just new vehicles; used-car sales have also slowed for similar reasons and are expected to finish more than a million units below 2021. Rising interest rates are also making purchasing a vehicle unattractive right now. Despite this, demand for specialty aftermarket parts remains solid, as consumers hold onto their vehicles longer.

New-vehicle sales are unlikely to return to pre-pandemic levels until 2025 and are expected to finish around a million units short of 2021 at 13.9 million.

Used-vehicle sales are also expected to finish below 2021 levels. Because of high prices for vehicles, consumers have opted to stay with their current vehicles longer.

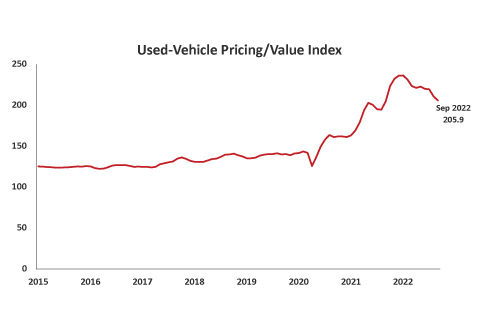

Used-vehicle prices in September 2022 were 47% higher than in September 2019 . The average price of a new vehicle skyrocketed to a record $48,301 in August 2022.

To learn more about the specialty-equipment and broader automotive industries, download the “Fall 2022 SEMA State of the Industry” report today at www.sema.org/research.