BUSINESS

Transition Planning

Preparing Your Business to Successfully Transition on Your Terms

By Chris Shelton

What does your exit plan look like? If you’re like most of your peers, you’ve probably considered selling or transferring your business one day.

If you run a successful business, you know the power of planning. And if you started that business, you know that power intimately.

But what does your exit plan look like? If you’re like most of your peers, you’ve probably considered selling or transferring your business one day. And if you’ve done that, you’ve certainly dreamed about what you’d do with all the capital you’d reap.

Now for the sobering part: according to the Exit Planning Institute, only 20% to 30% of businesses that go to market will sell. Also, according to the institute, 66% of current American businesses belong to Baby Boomers, the majority of whom will sell or transfer their businesses within the next decade.

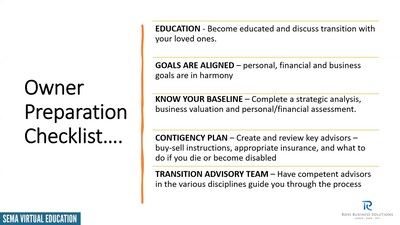

So, we’ll ask again…what does your exit plan look like? Recently, Gayle and Chuck Ross from Ross Business Solutions hosted a SEMA Virtual Education webinar. In “Preparing My Business to Successfully Transition on My Terms,” they explain how a well-coordinated exit plan looks.

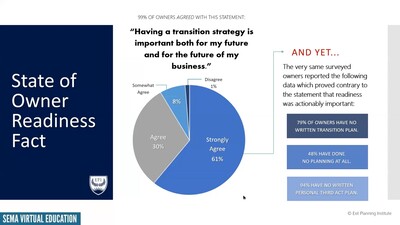

“We really don’t have a problem with business owners realizing the importance of having a good plan in place,” Gayle says. “But what are we doing about that? I mean, 79% of owners have no written plan. They may have thought about it. It might be in their head. But it’s not something that they have a strategy to pursue.” She says that approximately 40% have done no planning at all. “Those are pretty alarming statistics.”

According to the Exit Planning Institute, 91% of business owners either agree or strongly agree that a transition strategy makes sense. However, nearly half of business owners do no planning at all. Gayle and Chuck Ross point to the absence of a formal third-act plan as the leading cause of poor transition strategy.

Though alarming, statistics aren’t inevitable. In their webinar, the Rosses outline strategies to not only increase a business’ potential to transfer to new ownership, but also increase the value of that transaction. What follows is a summary of that

presentation.

Determine What You Want

According to Gayle and Chuck, a successful transition begins not with preparing the business for sale but preparing its operator. “[Most business owners] cannot imagine what life looks like if they don’t have their business to go to every day,” Gayle notes. “And if that’s the case, then there’s a lot of fear involved, and fear prevents us from doing a lot of things. So making sure that you have a plan in play to know what life looks like without your business is probably one of the most critical things.”

To do that, she recommends exploring what a future without the business could look like. “You do that by asking yourself ‘what do I value most?’ It’s got to be more than just, ‘well, I’m going to golf’ or ‘I’m going to work out more, spend time with the grandkids, or travel.’ I mean those are great things and a lot of fun. But there’s got to be some substance behind it that fuels your passion.

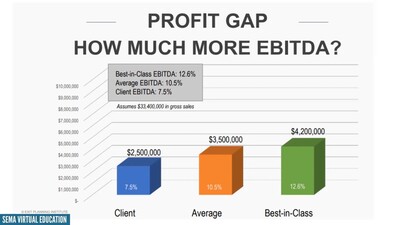

The profit gap has immediate implications for a business. Case in point: the swing among a hypothetical client’s earnings before interest, deductions and amortization (EBITDA) and the average and best-in-class represent a difference of a million to $1.7 million. That’s the plain benefit of bringing a business up to industry standards.

“Let’s say part of your dream is to buy a professional sports team, or maybe just a cabin in the woods that you can rent out on Airbnb or VRBO. You’re going to need money to do that. You may have funds already, but the big part of your investment is going to come from [the sale of] your business.”

More than mitigating the fear of unknown, developing a clear vision of your future life establishes a roadmap to transition. And Chuck defines three points on that map: the wealth gap, the profit gap and the multiplier.

“The wealth gap is the additional wealth that a business owner might need…to reach their goal for the next phase of their life,” he says, citing an example of John and Jane, a theoretical couple that has $36-million dreams but only $10 million in hand. The $26-million swing represents the wealth gap. “How do we bridge that gap?” he asks.

“To start, we’re going to go back to those profits and sales. We’re going to look at the profit gap, which is how much a business is sacrificing by not operating at a best-in-class level.

“So back to John and Jane. Their profit on $33 million in sales was $2.5 million [and] the average for their industry [for $33 million] is about a $3.5 million. But best-in-class in this example is about $4.2 million.

“Now, if we look at our present client at $2.5 [million] and we look at the best-in-class company, there’s a $1.7-million swing in profit [the profit gap]. Can you imagine what a business might be able to do if they had that additional $1.7 million?”

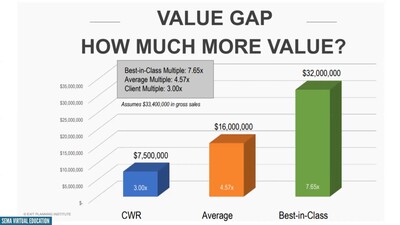

But improving a business’ profit gap pays greater dividends than increased annual income. Most markets formulate a business’ value by multiplying its EBITDA income by a multiplier. Better-run businesses tend to justify greater multipliers, and that combined with the increased EBITDA can make a profound difference in a business’ sale price.

But the profit gap represents more than just the difference in profit. It influences, among other things, industry multipliers.

Industry multipliers are factors used to establish a business’ true value based on its earnings before interest and taxes, depreciation and amortization (EBITDA). Grossly oversimplified, multipliers represent the financial integrity of a company. Higher numbers represent greater perceived integrity.

“The current client has $2.5 million in EBITDA or profits. And under these circumstances, a buyer might offer them three times earnings—that’s the multiplier,” Chuck says. “So they might expect to get an offer of $7.5 million.”

But remember the best-in-class operating at a $4.2 million profit? “[Based on] industry studies and historical data, we know that this best-in-class company would probably be offered seven to eight times that amount,” Chuck reveals. “When that’s extrapolated out, you can see the swing gets much bigger. John and Jane might expect a $7.5 million buyout, but a best-in-class company might possibly receive $32 million.”

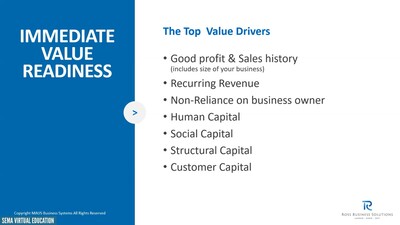

Gayle and Chuck listed an array of ways to improve the multiplier beyond maximizing profit. They referred to the first as the Four Cs of Capital: Human Capital, Social Capital, Structural Capital and Customer Capital.

“The first two have taken center stage with COVID,” Gayle notes. “Many of you can’t find people, right? And if you do, you are paying an exorbitant amount just to get them in the door.

“Social capital, it’s really about your brand. It’s the way the employees work together, the way you communicate. You have managers on board but are they really leaders? The other thing is, initially you were the business, you were what made that business run. If you are still in that place, then you need to…work toward relinquishing some of those operational roles and put people in place who can do them. That new buyer wants to make sure that business can run without you. So having a strong social capital is critical to differentiating your business from others in your industry. Your culture is what’s going to drive those core values. And it’s really the way that communication takes place.

Profit gap and efficiency aren’t the only things that influence multipliers. Things like repeat customers, the ability for a company to operate at its peak efficiency in the absence of its current owner, and ability to maintain a workforce and clientele make big differences.

“We talked about processes…but are those processes in your head or are they written down? If somebody comes in, could you give them a manual so they could jump right in and take care of those things? It takes a lot of effort to document [those processes], and someone must make sure that they’re up to date.

“But, you know, structural capital is more than that. It’s about your vision and your mission. And [does that] really play out in your business or is it just hanging up on the wall in the lobby?

“And then last is your customer capital. [Can your customers] imagine doing business without you being a part of it? Are your customers looking at you like that? If you were to leave and a new buyer stepped in, are [your customers] going to switch because someone could offer them a better price?

“So those things—human, social, structural and customer capital—add value and increase that multiplier.”

Gayle also underscores the significance of detractors. “We look at [these] as low-

hanging fruit because it takes a little bit of time to identify them, and the solutions are easy to implement.” She groups them as the five Ds: Divorce, Disagreement, Death, Disaster and Disability. “Obviously, we had disaster with the COVID thing, but what about a divorce or a partnership disagreement? What we encourage people to do is consider ‘what if my partner and I got into a dispute?’ or ‘what if one of us died?’ or ‘what would happen if one of us got a divorce from our spouse?’ What would happen?

“That’s when you [call] your insurance agent and you look at your buy-sell agreements. Dig those out, blow the dust off ’em, and say, ‘Okay, I’ve got to get these up to date.’ Because if we learned one thing over the last several years, it’s that nothing is off the table.

“The other things that I want to bring up is the financials,” Gayle continues. “What would happen if someone were to lift that hood, look at those books and have a full forensic audit done?” she asks. “What do you think they would find? I mean, are your agreements up-to-date? What about your contracts? What do your financials look like? Most business owners have not done the necessary steps to prepare their business. And that means that maybe sometimes we’re not spending as much attention to the financial side of things. We were working with a client at $70 million in revenue who had no idea what his break-even point was. If you’re not comfortable with your finances, get with your CPA to learn what ratios you need to track.”

Explore Transfer Options

“There may be as many as 10 or more different ways to transfer your business, but there are two general pathways: external and internal,” Chuck says. External can be a third party, a strategic competitor or an outside investor. Internal options oftentimes include family members, the employees or even an employee-stock-option plan. “They call that an ESOP. Your management, your leadership could buy you out. A lot of machine shops and engineering firms have partners, and partners get bought out and brought in on a regular basis.”

As part of their webinar and their consultancy, Gayle and Chuck Ross outline the tasks business owners face and their best-practice solutions. They also offer a list of resources including books that benefit any business owner looking to achieve maximum return on their investment.

Chuck recommends building a team of the value advisors, CPAs, attorneys and financial advisors who can get things done efficiently. He cites another list of professionals from family advisors to merger-and-acquisitions advisors. “These individuals come in as needed. They could be your insurance broker, an estate planner—some families even bring in a personal coach for family members. They all could all come in from time to time.

“Okay. Here’s the key takeaway that I’d like for you to have regarding your advisors: It’s really not a do-it-yourself project. We had a CPA recently tell us that he’s now required to have a hundred hours of continuing ed. And boy, that’s tough if you’re a business owner and you’re trying to stay up on every aspect of transitioning your business. And you’re still trying to run your business at the same time and work with your leadership team and your customers and your vendors.”

Gayle adds, “Regardless of where you are in the process, this is something that we always could have some additional information on. We always encourage people to become educated on the source. There is a wealth of information out there. We have a list of books that we’d be happy to share. You can brush up on that and learn from what others have experienced, really become a student of this because, you know, you have one chance to get this right. And knowing more about it just really helps you prepare for those things.”

Naturally this process won’t happen overnight. “That’s a question we get—how much time do I need to put a good plan together?” Gayle notes. “You really need about three to five years because that is necessary to establish the sales history and to improve profitability and to close that profit gap that Chuck talked about.”

But she says the results more than pay for themselves. “There’s going to be a lot of supply and demand is going to come into play as Baby Boomers look to exit at the same time. So, it’s more important than ever today, even if you’re not interested in transitioning out for another, you know, 10 or 15 years. There are things you can do to maximize your value, to become more appealing and to really stand out from all the others, not just in your industry, but from other businesses across industry that are going to be selling.

“There is a lot of money on the table right now with private-equity firms. And they’re really looking for well-run, well-managed businesses that they can invest in. Now’s the time to really get your business in shape and to have that planned so you can take advantage of those opportunities and exit when and how you want.”

Chuck and Gayle Ross of Ross Business Solutions have specialized in guiding businesses through all phases of existence, from initial startup to final exit planning, for more than 20 years. They can be contacted by calling 574-727-0641 or by visiting

www.rossbusinesssolutions.com.