BUSINESS

The Supply-Chain Breakdown

Some Quick Takes on the Impact to the Aftermarket as It Looks Toward Recovery

By Mike Imlay

While clogged shipping lanes have grabbed headlines, a lack of enough truckers has also slowed domestic movement of product. In fact, from ships to trucks to air freighters, all forms of transportation rose last year, sometimes up to 30% and even 80% for some destinations or routes. Photo credit: Shutterstock

Flotillas of cargo ships drifting aimlessly outside Los Angeles Harbor and other major American ports. Stockpiled warehouses and sidelined commercial trucks. Inflated costs for shipping and goods and, in many cases, depleted retail shelves. Those are just a few of the images conjured up by the massive breakdown of supply chains since the fall of 2021.

So what has been the ongoing impact of the supply-chain crisis on the specialty-equipment industry? And, just as important, when can aftermarket businesses expect the prolonged disruptions to ease?

Unfortunately, there are no simple answers to those questions, but SEMA Market Research recently conducted an in-depth “Future Trends” study of the situation, its continuing effects on the industry, and the prospects for a return to some sense of normalcy in the coming year. That research, along with the insights of industry veterans representing a variety of sectors, offers valuable information for how the aftermarket is weathering the crunch.

“Our research into the data specifically surrounding our industry and the impact of supply-chain disruptions is literally the only deep dive into the topic to date,” said SEMA Market Research Manager Kyle Cheng. “We looked into the impact on different kinds of aftermarket companies through a post-2021 SEMA Show survey, so the data is fresh. From parts manufacturers to distributors, retailers and even automakers, it’s clear that the impact has been pretty big across the board.”

The Overall Picture

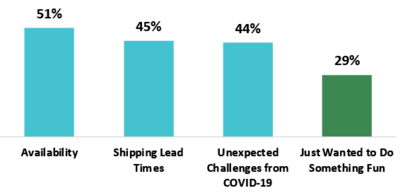

Why Consumers Shopped Earlier During the 2021 Holiday Season

Unexpected consumer demand helped create the supply-chain crisis, and that demand has scarcely waned. SEMA market research found that consumers are simply shifting their purchasing tactics to fulfill their thirst for goods when confronted with shortages or delays for the products they seek. Source: McKinsey and Company, “The Ship Has Sailed But Many U.S. Shoppers Won’t Wait.” November 26, 2021. Source: McKinsey and Company, “Early Birds Grab the Goods.” December 8, 2021.

First it might be best to review how we got here. By now, the complex web of disruptions slowing the world’s supply chains is well known, but to recap some highlights:

Over the past decade, many industries (including the aftermarket) increasingly turned toward just-in-time manufacturing and inventory models. Ironically, those best practices helped set the stage for the present crisis. When COVID-19 struck in 2020, lockdowns temporarily shut factories worldwide, especially in the Asian and South American nations that industrialized countries heavily rely on for manufacturing, computer chips and raw materials.

“During the pandemic, many companies anticipated that demand would wane in a recession,” Cheng explained. “But what we actually found is that it didn’t. Instead, it jumped in the United States because of stimulus programs. Consumers had a lot more money to spend, which increased demand, and companies weren’t ready for that.”

To catch up with that unexpected demand, many companies upped their shipping orders in late 2021, which clogged ports and distribution centers and tied up cargo ships.

“Usually, the ships are going back and forth at the same time, but now they’re all stuck in one place,” Cheng noted. “At Long Beach and Los Angeles, California, which are among the world’s busiest ports, the backlog is still really high even now.”

But shipping lanes aren’t the only problem. Months after the initial slowdowns, containers, crew people, dockworkers and truckers remained in short supply. That, in turn, caused costs for warehouse space and containers to soar. In fact, intense bidding wars for containers had broken out by the 2021 holiday season.

“We know for a fact that we’ve had cargo containers of ours that have been bumped further back because there are other companies willing to pay a higher price for a container to get in,” said Troy Wirtz, director of aftermarket sales for Des Moines-based Dee Zee Inc. and chair of the SEMA Truck & Off-Road Alliance (TORA).

Dee Zee wasn’t alone. According to one The Wall Street Journal report, the bidding wars caused container prices to surge 53.5% at the height of the supply-chain bottleneck before easing somewhat going into 2022. Further adding to the industry’s woes, OEMs have had to slow production lines due to chip shortages, with detrimental effects on several key aftermarket segments. Add in rising labor, fuel and raw materials costs, and the inflationary pressures are obvious.

Assessing the Impact

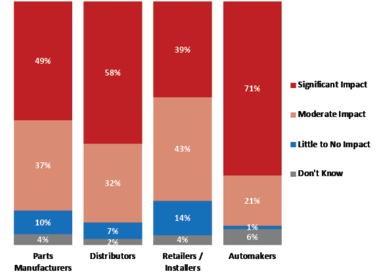

Impact of Supply-Chain Disruption on Specialty-Equipment Industry

From suppliers to the retail level, all sectors of the aftermarket report feeling the squeeze of the supply-chain breakdown. However, SEMA market research also indicates across-the-board optimism that disruptions will continue to diminish over the next several months. Source: SEMA Survey Conducted in Late 2021 Among SEMA Show Attendees and Exhibitors. Over the last six months, have supply chain challenges impacted your company’s operations?

“Almost 90% of the parts manufacturers responding to our survey said that they were impacted by some kind of supply-chain issue either moderately or significantly, and the responses from distributors and retailers were similar,” Cheng said. “However, the biggest impact has been on automakers and dealerships, which probably isn’t a surprise.”

In fact, market research shows that auto sales saw a strong rebound as COVID-19’s initial economic shock dissipated. In early 2021, new-vehicle sales were expected to reach pre-recession levels by the end of 2022. However, demand for new vehicles skyrocketed faster than manufacturers and dealers could supply them, pushing vehicle prices to historic highs.

Consumers at first seemed undeterred and willing to absorb the increased costs. Entering 2022, however, prospective buyers became discouraged, and the pace of new-vehicle sales slowed. (SEMA expects that sales will continue to recover as the supply-chain bottlenecks ease.)

The squeeze on automakers naturally unleashed a trickle-down effect on a variety of specialty-equipment businesses. One notable example is restylers.

“A local dealership that used to have maybe 300 cars on its lot and sold 150 a month now has less than a dozen cars on its lot, which has both hurt and helped us,” said Josh Poulson, general manager of Auto Additions Inc. and chair of SEMA’s Professional Restylers Organization (PRO).

“It hurts because we used to be able to pick out a few of those vehicles and dress them up and make packages for the dealership to resell and mark [the vehicles] up a little. We’re obviously not able to do that now because they can’t give us anything right now.”

But necessity being the mother of invention, many restylers have changed tactics to become what Poulson described as “gap fillers.” For example, a customer may be set on a brand-new truck, but because supply is limited, a dealership may not be able to deliver a model in the desired trim level. In such cases, the dealer can offer the customer a lesser model upgraded with a restyler package boasting leather, remote start and all the higher-line comfort and convenience items that the customer

is seeking.

“That’s given us the opportunity to fill some of those gaps when manufacturers just don’t have the inventory,” Poulson said, adding that restylers are also confronting a range of price hikes. For now, they’ve been able to pass on increased costs to their customers.

“Of course, when you’re dealing with local car dealers, they’re used to a certain price and they don’t like price increases, but we’ve had little pushback when we’ve had to raise prices the last year,” he said.

That acceptance of price increases has been one of the ironies of the current disruptions. While supply-chain slowdowns and inflation may have curtailed consumer demand for some products such as new vehicles, they haven’t yet curbed overall consumer enthusiasm for specialty products, according to Cheng.

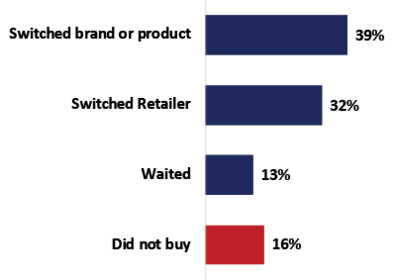

“Most consumers have faced some kind of supply-chain issue,” he said. “Almost two-thirds of consumers surveyed said that they experienced an inventory problem when they wanted to buy something. But the interesting thing is that when they couldn’t get something, they weren’t going to wait for it from a company. When it comes to our industry, they’re switching brands and switching retailers, and that’s another impact.”

Behind the Demand

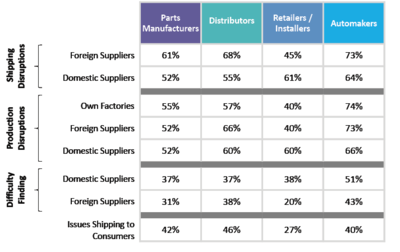

Types of Supply-Chain Issues Experienced

The recent disruptions have impacted industry businesses in a wide variety of ways. Interestingly, retailers reported more difficulty finding domestic suppliers over foreign suppliers, which reflects the North American trucking slowdown. Meanwhile, OEMs seem to have taken the brunt of the supply-chain crisis. Source: SEMA Survey Conducted in Late 2021 Among SEMA Show Attendees and Exhibitors. Has your company experienced any of the following in the past 6 months?

Stimulus checks weren’t the only factors fueling the rise in consumer demand. Stuck with nothing to do during lockdowns, many consumers decided to take on automotive restorations and related projects, creating a significant thirst for aftermarket products. Others opted to accessorize their vehicles for outdoor adventuring—one of the few pursuits they could enjoy in a pandemic world. From late 2020 through 2021, many aftermarket suppliers reported record profits as even newcomers rushed to embrace the automotive lifestyle. The open question is how long that phenomenon might continue.

From his vantage point, Wirtz predicted that Dee Zee’s typical truck enthusiast, who tends to be a well-established male in his mid 40s to upper 60s, will likely continue spending despite inflation.

“With these guys, a truck is a priority, and they’re going to make sure they drive a nice one,” he said. “I think people who are dialed in to accessories are going to spend money on accessories, regardless.”

On the other hand, Camaro and Firebird Central CEO Ben Tucker, who chairs the SEMA Automotive Restoration Marketplace Organization (ARMO), believes that the number of new enthusiasts coming into the restoration market has plateaued.

“I’d say 2020 was the peak of new people,” Tucker observed. “So many new projects got started during COVID. Whether for overlanding, restoration, racing or simple repairs—an insane amount of people started these projects. I would say we’ve got another year to a year and a half of those guys staying in the market. Then, eventually, it will creep back down to where we were in 2018 to 2019.”

While suppliers have largely been able to ride out the supply-chain disruptions, other aftermarket businesses in the segment have suffered tremendously, Tucker added.

“Some of the harder-hit people would be the builders,” he said. “They’re the guys who are waiting on an item that’s holding up a whole project. That can be devastating.”

Sabra Johnson, owner of City Classic Cars in Spring, Texas, can speak to the many difficulties faced by builders.

“From a builder perspective, the pandemic is crippling business, and we did not experience the record-breaking year the retailers and wholesalers experienced—we survived or died,” he said.

“The supply-chain delays dead-end at the restoration shop, and we are the ones who have to explain and apologize on behalf of the industry.

“Delays [also] mean work stoppage, which in turn means no cash flow on that project and no way to get new projects into the pipeline. The lack of aftermarket products creates cash-flow, shop-flow and even work-scheduling problems. A supplier can sell a different product, but the restoration shop has only one product to sell.”

Johnson said that many builders he knows have coped by deepening product inventories when they can, stockpiling wiring harnesses, air products, engines and other parts to maintain their supplies. Meanwhile, he said, “the consumer gets a false impression of product availability based on the online presence of products. The reality is that parts are missing or are on backorder when you order them, so the builder is feeling the [shortages] in a special way.”

Poulson noted that he sees some accessories moving again, but electronics remain especially hard to come by.

“Radios, navigation systems, anything 12-volt is very difficult because of the chip shortage,” he said. “I used to keep a multitude of different types of radios in stock, but now I can barely keep anything.”

Labor is also in short supply. This past December, the American economy added just 199,000 new jobs—far short of the 400,000-worker gain that economists had hoped for. While the unemployment rate did drop to 3.9%, the labor-force participation rate remained unchanged at 61.9%, signaling a continued struggle for businesses to fill positions. That in itself presents a huge hurdle for suppliers trying to keep up with orders and get product out the door.

“Workforces have gone down to working only one shift, and it takes a long time to get normal orders out,” Tucker explained. “Even in 2020, you could get a lot of orders sent out on a weekly rotation. Now that same order is taking eight to 10 weeks.”

Rising Costs

Rising materials costs have also made headlines recently, and the pain there is real as well.

“Input prices are another thing that’s really concerning SEMA members,” Cheng said. “It’s not just that they can’t get stuff, but that it’s really expensive. We looked at several key inputs that fall into our industry’s manufacturing in order to do some forecasting. For example, copper prices jumped due to the pandemic, and we anticipate that they’ll probably stay high for the next year. Same thing with aluminum—we’ll see a little drop-off, but it will remain elevated. Steel also saw a huge jump, and while it’s working itself down, it’s still above its pre-pandemic levels.”

Meanwhile, Cheng said that the price of oil is of special concern for the industry, not only because of its impact on manufacturing and transportation but on consumers as well.

“When gas prices are high, people tend to drive less, and that impacts our industry,” he said. “And all of these price increases are caused by supply-chain issues. When we look at shipping and transportation, even air freight is expensive now. Throughout the transportation industry, prices are up sometimes 30% to 80% in some places, depending on the routes.”

Retail Advice

While the impact of supply-chain slowdowns has fallen disproportionately on smaller aftermarket businesses, there are some steps that the retail level can take to minimize the damage. In a recent Forbes article, ProTexting.com founder and CEO Kalin Kassabov recommended: (1) monitoring stock closely, using cloud-based supply-chain and inventory tracking software if possible; (2) increasing inventory whenever possible, taking advantage of discounted items and even gaining financing to invest in more inventory when practical; (3) broadening suppliers and being creative in offering alternative options to customers, and; (4) remaining honest and transparent with customers. Kassabov’s advice echoes that of other retail experts who say that, given the forecasts for continuing disruptions, those who haven’t yet implemented such measures should do so now.

The good news is that specialty-equipment companies were reporting some improvement in the flow of goods and raw materials as of press time. Current indications are that supply chains are inching toward recovery, but there will be hiccups along the way. (In January, for example, China announced renewed lockdowns of several manufacturing centers due to a sudden rise in Omicron cases.)

“In our survey, we asked companies about their expectations beyond this year and into the next,” Cheng said. “By and large, most companies expect some disruption to remain or get better. Few believe it’s going to get worse, so it appears that we’ve bottomed out in terms of the worst of the supply-chain breakdown, barring any unforeseen circumstances.”

Get the Report

For a free, downloadable copy of the SEMA Market Research “Future Trends” report, go to www.sema.org/market-research.