BUSINESS

Tire and Wheel Trends

Can Sales Keep Rolling as the World Enters a “New Normal”?

By Mike Imlay

Increasing regulation, rapidly changing consumer purchasing habits and other market forces stand to impact independent tire retailers the most. Broadening accessory offerings, staying ahead of trends and adopting the latest tools and training will be more vital than ever. Photo courtesy: Shutterstock.com

Traditionally, wheels and tires are among the first upgrades that vehicle owners make to their cars or trucks. In fact, SEMA Market Research has identified them as “gateway drugs” to further vehicle modification, making them key products driving consumer engagement with the aftermarket.

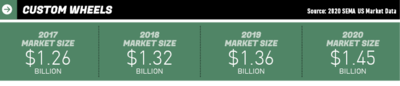

According to the “2021 SEMA Market Report,” the market size for performance and special-purpose tires, off-road and oversize tires and custom wheels grew to $2.64 billion, $2 billion and $1.45 billion, respectively, through 2020. While those numbers imply that the wheel and tire category stayed largely buoyant through the pandemic, some market observers caution that challenging undercurrents may lay ahead—especially for the tire industry.

The Tire Market: Grappling With Uncertainties

A recently released “Insider’s Guide to the Tire Industry in 2021” report from Tire Industry Research (TIR) painted a picture of a global tire market in post-pandemic recovery but “still facing multiple crises.”

“Those largely relate to upstream forces such as transport logistics, materials availability and currency exchange rates,” TIR said in its analysis. “Energy costs, raw materials costs and logistics costs are rising fast. There are shortages of truck drivers in many parts of the world. Some tire factories—especially in the first quarter—have had to close or go on short-time working due to shortages of raw materials. Currently, high absentee rates have started to limit output.”

While not characterizing the situation as a crisis, Jackson Marketing Group Director of Business Development Todd Steen, who chairs SEMA’s Wheel & Tire Council, agreed that the industry is confronting materials challenges and inflationary

pressures.

“A lot of people forget that tires are oil-based products and utilize steel at multiple levels, from the bead to the actual radial,” he explained. “Those two components alone—much less getting into natural rubber or the other type of oils that go into building tires—mean that from a supply-chain standpoint, some manufacturers have seen as many as four price increases over the past 12 months.”

SEMA market research indicates that specialty wheels and tires were continuing an upward trend going into the pandemic. According to industry sources, stimulus checks, growing savings and increased recreational travel also spurred many consumers to upgrade their wheels and tires during last year’s lockdowns.

Tire Industry Association (TIA) Senior Vice President of Training Kevin Rohlwing noted that manufacturing interruptions coupled with a sudden rebound in consumer demand have put additional pressures on markets.

“When the tire manufacturers shut down their plants because of COVID, tire inventories went down,” Rohlwing observed. “Then the return to work and the ‘new

normal’ came faster than expected, so you’re in a situation right now where there are some backlogs. Tires aren’t something that you can just build on demand. It’s not one-size-fits-all manufacturing.”

Rohlwing also underscored the global nature of tire manufacturing. Sourcing raw materials from Southeast Asia, South America and Europe puts multiple constraints even on U.S.-based tire makers. Then there’s also the labor shortage and related costs

to consider.

“From the manufacturing side of things, it’s probably going to be a little while before we get out [of this situation],” he said. “I’ve heard some people say it could be a year or even two before they get caught up, and if they can’t solve all these other problems, it’s even harder to get caught up.”

According to Joe Podlovits, vice president of marketing and product development for The Wheel Group, political and financial instabilities in source countries have further roiled the tire market. But the greatest challenge for tire makers has been simply moving inventory through U.S. ports.

“Although we’ve got a lot of tires, a good chunk of them is sitting off the coast like many other tire companies that import,” he said. “I think once that settles down in the beginning or middle part of next year, we’ll be in a better inventory position on tires.”

According to Steen, another trend to watch in the coming year will be the increasing number of companies and equity groups consolidating house brands to gain capital or leverage buying power.

“There’s a demand to grow,” he explained. “I truly believe that you’re just going to continue seeing mergers and acquisitions happening as those demands keep going so the growth can be there.”

Changing Buying Habits

Despite mergers, acquisitions and a high degree of manufacturer competition, the wheel space still allows innovative entrepreneurs to carve a niche for themselves. At the 2021 SEMA Show, Litespeed Racing CEO Patrick Warren proudly accepted a Best New Product award for his company’s Carbon One carbon-fiber wheel.

Meanwhile, as manufacturers wrestle with global challenges, retailers will be facing many of their own here at home.

“The buying habits of the tire industry are antiquated because tire sizes are kind of a mystery to some people,” Steen said. “Even if we can increase sales growth, it’s still a small percentage in comparison to what the market is, because if somebody orders a tire, they still have to get it mounted somewhere. The hurdle is connecting the dots between the buying experience and ease of understanding what they’re buying, getting the wheels and tires mounted, and enjoying

the product.”

Podlovits sees that phenomenon playing out in the growth of online purchasing, which offers consumers a greater sense of convenience.

“In my opinion, COVID really accelerated that, and I think that the industry would agree it has taught people a new way to buy,” he observed. “They’ve become very comfortable with the idea of buying online. I think there’s also that Amazon men-

tality of ‘I want my products and I want them today.’”

Jared Kugel, founder and CEO of Tire Agent, is among the growing number of entrepreneurs who have entered that online retail space. His company offers consumers major-brand tires at a savings and then ships those tires within two to four business days directly to their homes or to an installer of their choice. In addition, the company recently began partnering with local tire shops and technicians to create a nationwide network of mobile installers.

“Tires are a big purchase for people, and I think that’s why online has picked up some momentum, especially over the past three years,” Kugel said. “People like to take their time to do research and then purchase what they feel fits their lifestyle.”

Tire Agent includes protection plans and flexible payment options for consumers as well as expert training for its service people, but Kugel doesn’t foresee his business model rendering traditional retail outlets obsolete.

“I think brick-and-mortar will always have a dominant space,” he explained. “Mobile is supplementary, but it’s not a replacement. Brick-and-mortar will always have a place because people will always need it, whether they want to get oil changes or they want to get wheel alignments or mechanical work.”

Nevertheless, Rohlwing sees current supply-chain issues as well as the growth of direct-to-consumer sales and a rising tide of government regulation putting a squeeze on tire retailers. He cites California’s move to mandate low-rolling-resistance replacement tires as a prime example. That alone will have devastating effects on the small dealers while severely limiting consumer options, he said.

“Big-box retailers and the multi-chain national retailers and the warehouse clubs will gain a distinct price advantage over small dealers,” he explained, adding that modernizing operations, broadening products and services, and taking advantage of ongoing training will become more important than ever to remaining competitive.

Meanwhile, on the technology side, industry sources expect further improvements in tire-pressure monitoring systems and continued evolution toward “intelligent tires” that can track wear and other tire metrics. As electric vehicles become more ubiquitous, tire design and compounds will undoubtedly morph to match their unique grip and low-rolling-resistance requirements as well. In fact, Steen foresees a future where tires and wheels become integrated, consumable units.

As for more immediate market trends, with OEMs upping their small-truck lineups, larger-diameter wheels and tires are a sure bet, along with the lifting, accessorizing and suspension work that goes with them. Meanwhile, the popularity of overlanding is driving a market for suitable upgrades for CUVs and Sprinter vans as well, and recent stimulus checks have ensured that consumers have cash in hand for vehicle improvements.

“I’m definitely seeing people buy more Tier 1 and Tier 2 [product] than I’ve ever seen,” Kugel observed. “I think what’s interesting is with more people buying vehicles today, they’re taking a lot more pride in their vehicles.”

The Wheel Market: Ready to Roll?

Throughout 2020 and 2021, both off-roading and overlanding surged in popularity, raising demand for trail- and road-capable wheels and tires for trucks, Jeeps, SUVs, and even some CUV and van applications.

Although facing its own supply-chain issues, the wheel market appears relatively stable compared with the tire segment. In fact, like many aftermarket categories, wheels seem to have gotten a boost from pandemic-weary consumers seeking escape from their isolation.

“There was this sweeping movement of people getting back outdoors,” Podlovits said. “That’s probably been one of the most enjoyable things to watch: families getting together, buying products, going out, camping—even people who just hadn’t done that before. There’s been that itch to vacation.”

Reflecting this trend, Podlovits said that The Wheel Group has seen increased demand for its low-pressure cast wheels in 15- and 17-in. diameters.

“That indicates more of what we would consider outdoors, overland or adventure-type builds,” he explained. “We’re seeing a huge increase in SUV applications—namely Subaru. I would even include Sprinter vans, where you’ve got these off-road and overland-style builds, and I don’t see that backing down in the near future.”

However, wheel purchasers can also expect some price hikes in the coming year, market conditions being what they are.

“I think the immediate concern, obviously, is that we’ve been plagued with supply-chain issues—namely freight costs,” Podlovits said. “Along with that has come some recent shortages with electricity in factories. They’re throttling power in a lot of the factories overseas, which has really been a challenge to get your production prioritized and factories to stay on schedule. It increases costs locally in the Asian countries that are producing, and that’s going to increase raw material costs.”

Dan Lezotte, vice president of Custom Wheel Solutions, a private-label wheel manufacturer, said that his company has recently shifted some production to South America to lessen the impact of tariffs, electricity issues and rising commodity prices.

“Globally, it’s been a crazy mess,” he said. “To stay as far ahead of things as possible, we’ve been encouraging our customers to put orders in earlier, knowing that lead times will be longer. But the hardest part has been managing capacities and aluminum prices. And then with logistics, the price of containers has gone through the roof.”

Lezotte said that Custom Wheel Solutions has also partnered with customers to absorb cost hikes.

“The larger customers completely understand. They’re not happy, but they understand and they need product,” he explained. “They don’t want to be without inventory. We’ve [also] tried to find other avenues to deliver the product with higher volumes, more containers, direct containers, but it’s been very challenging because the costs are high everywhere.”

In the end, Lezotte said that price hikes might dampen end-consumer sales.

“But I think the direct-to-customer companies are going to be more flexible and will be able to either absorb or manage their prices and not have to deal with step-up jobbers, brokers, distributors and warehouses,” he added.

Finding an Edge

Wheel manufacturing has become more and more competitive over the past decade. However, smaller wheel makers are still finding niches of opportunity, even amid the chaos wreaked by the recent pandemic. Take the example of Litespeed Racing, whose carbon-fiber Carbon One wheel won the Best New Wheel Product award at the recent 2021 SEMA Show.

“We all know that when you modify a car, you modify a wheel, which makes it a very competitive market to be in,” said Litespeed Racing CEO Patrick Warren. “There’s a lot of marketing money being put out there and a lot of wheels being sold solely based on brand awareness. It’s been a great thing for us to win the New Product Award, because Litespeed Racing is a smaller company that really focuses on the product but doesn’t have as much financing for big marketing compared to the other really big names in the wheel industry.”

Warren said that his company is committed to bringing innovations in carbon fiber and forged-magnesium to the performance wheel market. However, carbon-fiber wheels were proving a difficult sell until recently.

“There were a lot of stories about carbon fiber shattering or whatever, but you’ve seen a number of OEMs come out with their full carbon-fiber wheels over these past few years,” Warren explained. “Now it’s proven, customers trust it, and that ties in to us releasing our full carbon-fiber wheels to the aftermarket. The aftermarket is seeing that if the OEMs are doing this, it must be safe.”

Warren hopes to show that Litespeed’s forged magnesium wheels offer similar technological gains in safety and weight savings. The company’s target audience is high-end sports car owners and restomodders who have made engine swaps.

“The people who buy our wheels are people who really care about performance,” he said.

Richard Pinela, owner and CEO of LD97 Forged, had barely begun making a name for his bespoke wheel business when the COVID-19 pandemic hit. Still, he said, the lockdowns and stimulus checks of the past year ironically kept his venture busy.

“The pandemic actually helped in our branding the company,” he said. “The biggest thing for me is social media right now, because I go online and I answer every customer and I talk to them.”

He added that his customer base appreciates the personal attention.

“They’re like, ‘I can’t believe I’m talking to the owner and not just a number on a paper,’” he said.

CAD software, access to manufacturing and a creative eye have allowed Pinela to deliver highly customized wheels to high-end consumers.

“I came from the cast-wheel world, so honestly it was new to me when I started this,” he said. “It’s pretty fun, because going from cast wheels to 3-D, I can do almost anything now. The crazy thing is that the biggest things I do are Lamborghinis, GT-Rs, Ferraris and Dodges. I think the whole world underestimates the Dodge guys, but they’re the ones who pay without any questions, and they’re the guys who are working the front lines—the heart, you know, the blue-collar guys who were doing everything during the pandemic.”

After being swamped with orders throughout 2020 and early 2021, Pinela also felt the sudden squeeze as manufacturing and supply chains ground to a near halt. However, his customers remain patient with order delays—something Pinela attributes to his honest and personal approach to business.

Industry experts believe that backed-up supply chains will continue to afflict the tire industry—and to a lesser degree the wheel market—throughout 2022. The question is how much soaring costs of materials, production, shipping, warehousing and labor will ultimately impact retailers and end consumers. Photo courtesy: Shutterstock.com

“When I started this company, I said that I’m not going to lie—I’m always going to say the truth. If we’re delayed, we’re delayed,” he said, adding that his customers are very loyal.

Meanwhile, Podlovits said that the wheel market can expect to see further innovations and manufacturing refinements in the coming years, especially in the area of flow-forming, which he believes will become the predominant production style for mid- and larger-size wheels. But the real challenge will be in the retail space, where brick-and-mortar shops will have to become more nimble to keep up with the changing consumer landscape.

“If you’re a traditional wheel and tire shop, you’ve got to look at easy bolt-on accessories for installations,” he advised. “Customers are doing more to their vehicles quicker than ever today, so if a customer is buying a wheel and tire package—and bumper, truck-rack and storage solutions—they want that done in one place and one trip. If a shop is not offering that, they’re going to lose a customer to a competitor.”

Staying on top of wheel and tire trends, technologies and new products will be just as vital.

“Customers have that information at their fingertips today and are very aware of what’s new and what’s coming out,” Podlovits explained. “If a dealer is not aware of what customers are seeing and asking for, they’re going to be left behind.”