BUSINESS

The State of the Industry

Five Things to Know From SEMA’s Latest Market Research

As automotive specialty-equipment businesses draw up their business plans for 2021, many undoubtedly face some degree of uncertainty. Will the pandemic fade into the rearview mirror? What was the economic impact on the industry? Will this year’s gains extend into 2021? To help answer those questions and more, SEMA Market Research has released an extensive and timely Fall 2020 “State of the Industry Report.”

“Over the past several months, we’ve done a lot of research into consumers and how they’ve handled the pandemic,” said SEMA Research Manager Kyle Cheng, the report’s lead analyst. “But a real question a lot of our members are asking is how the industry is doing. As we enter 2021, they’re looking for benchmarks and forecasts useful to their business planning

“We’ve heard anecdotally that many companies are doing better than last year. When we dive into the data, something that pops out is that there are definitely some companies doing well and others not as well. It’s kind of mixed, but across the board, things are not as bad as they looked early in the pandemic.”

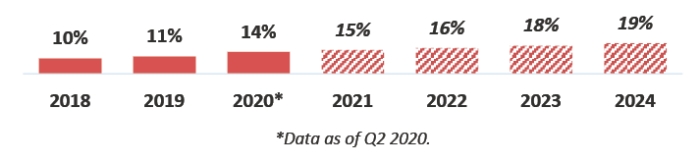

E-commerce Sales As A Share Of All U.S. Retail Sales

The report is based on a statistical survey of aftermarket manufacturers, distributors and retailers/installers who were asked a series of questions surrounding their overall economic health in 2020 as well as their projections for 2021. Government data encompassing broader American e-commerce and business trends were also included for comparison with industry benchmarks. While the full report offers extensive details for planning, its five basic takeaways can be summarized as follows.

The Industry Is Already Rebounding

Like many sectors of the American economy, the automotive specialty-equipment industry experienced appreciable sales disruptions due to COVID-19.

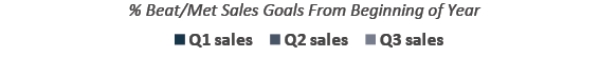

Company Sales Performance During COVID-19 Outbreak

Nevertheless, the industry is showing overall resilience, with data indicating that a rebound is already taking place. Despite Q2 sales declines, most aftermarket companies met or exceeded both the first- and third-quarter goals they set at the beginning of 2020.

“Obviously, COVID-19 had an impact, particularly around March, April and May when the country wasn’t sure where things were going and everything locked down,” Cheng explained. “However, more than 90% of the aftermarket companies we surveyed reported that they were now seeing either business as usual or experiencing only short-term impacts from the pandemic. In fact, 55% of companies expect their 2020 sales to finish higher or at least the same as in 2019, and no companies said they have any plans of closing. When we look at government data, retail spending at motor vehicle part dealers is now at its highest point ever. Those are all positive indicators we expect to continue.”

In-Store Purchasing Remains Healthy

Nationwide growth in online shopping has received a lot of media attention throughout the pandemic, but it appears to be overly hyped. The data shows that specialty-equipment retail transactions remain mostly in-person affairs, and with many of the industry’s retailers designated as “essential businesses” during the shutdowns, they saw only modest increases in online purchasing.

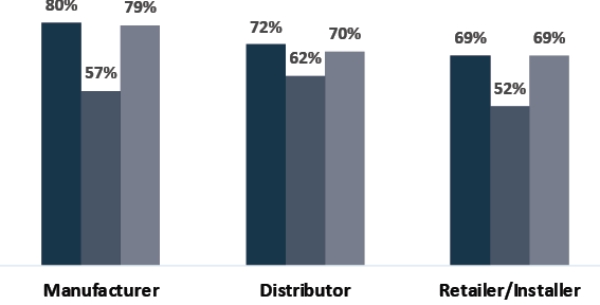

Share Of Specialty Equipment Industry Sales By Channel

“Despite shifting consumer habits during the lockdowns, our industry and the retail sector across the country as a whole continues to be driven by in-store and physical-channel sales,” Cheng said. “Overall, e-commerce makes up only a small share of retail in the United States, and it’s projected to remain that way for the future. Companies in our industry report that 57% of sales this year still came from in-store and physical channels, only slightly down from the previous year.

“The bottom line for our industry is that people still want to touch and see our products. You can’t experience online what you can in a store while getting someone’s expertise.”

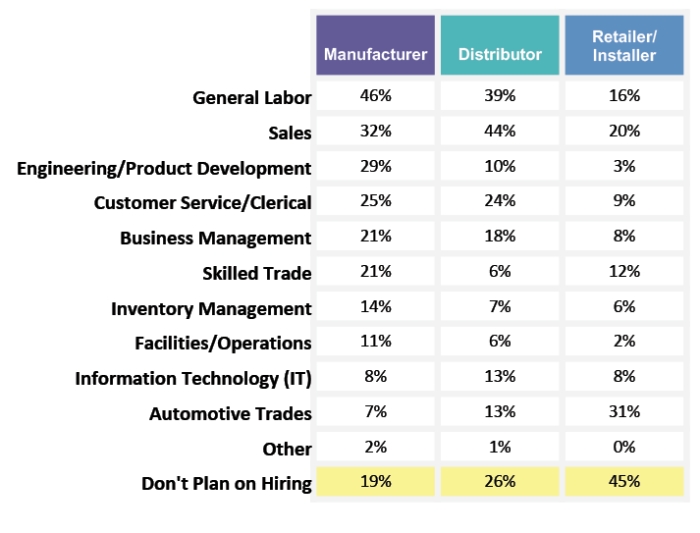

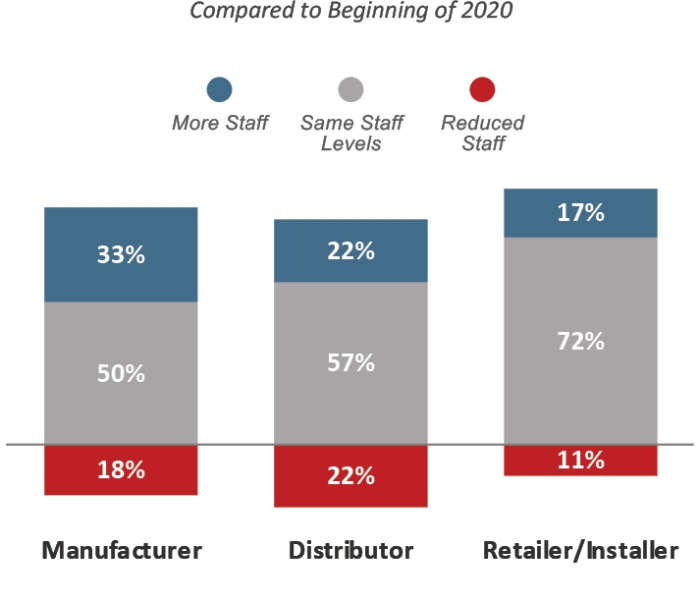

Staffing Is Holding Mostly Stable

While other American industries have suffered marked layoffs, most automotive aftermarket businesses have managed to avoid widespread staffing disruptions. In fact, the majority of companies surveyed either maintained or increased staff over the last year, and most plan on hiring over the next 12 months. Additionally, despite taking the brunt of the recent economic downturn, retailers/installers have held notably steady with their workforces.

Jobs Planning To Hire Within The Next 12 Months

This makes sense, considering that large manufacturing and distribution facilities faced a number of initial safety hurdles for maintaining capacity in the early days of the pandemic, resulting in temporary closures or worker furloughs for some. Being smaller operations and almost universally recognized as essential businesses, retail and installation operations had a slight advantage in that regard.

“What we found was that the larger a manufacturer in terms of annual sales, the more likely it was to change its staffing,” Cheng said. “But even with that, almost 90% of manufacturers and most of the industry plan on bringing back the staff they laid off.”

How Staffing Will Look At The End Of 2020

Aftermarket Businesses Are Feeling Bullish

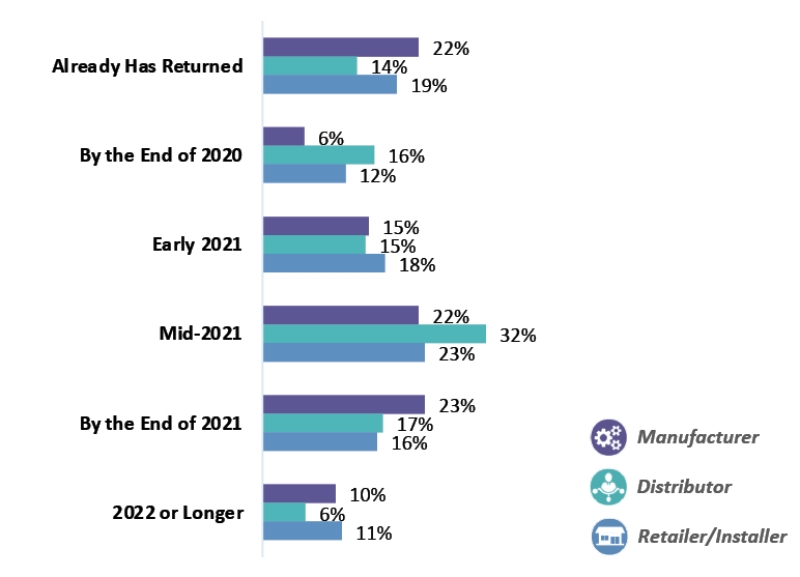

As a whole, the industry shares a positive outlook for the coming year. Most businesses surveyed anticipate strong sales growth and a quick rebound for the entire aftermarket. In fact, nearly 70% think that the industry will bounce back to pre-pandemic levels by mid-2021, with 90% seeing recovery by the end of 2021.

“This wasn’t a recession about economics, lower demand or a contraction in desire for what we do,” noted SEMA Director of Market Research Gavin Knapp. “This was really about structure and whether or not you were able to have people in your facility to make or sell parts. So long as people are allowed to have their employees make their parts and sell them in stores, our industry is doing well.”

The Aftermarket Is Poised for 2021 Growth

Is the industry being overly optimistic? Not when you look at the economic numbers found in the “State of the Industry Report.” They show every indication that the industry is primed to resume the growth that was interrupted in late 2020.

When The Industry Will Return To Pre-Pandemic Levels

“Overall, our industry appears in good shape,” Cheng said. “Once the country reopens and effective vaccines are distributed, it appears that our industry will be able to readily bounce back and continue to grow.”

“That’s part of the reason companies are so optimistic,” Knapp added. “Once things open up and people are allowed to get back some normalcy, they’re going to want to go places. They didn’t stop working on their vehicles during this time, and they’re going to want to enjoy them again.”

Get All the Latest Research

For your free download of the 65-page Fall 2020 “State of the Industry Report,” visit www.sema.org/market-research. While there, you can also download SEMA’s “State of the American Consumer” snapshot report, which offers insights into current consumer sentiment.

SEMA also has a report about the quickly changing economic metrics. Check out the monthly “SEMA Industry Indicators Report” at the same link for regular updates on economic trends affecting the aftermarket.