SEMA News—April 2020

BUSINESS

2020 Truck & Off-Road Market Trends

Pickups, Jeeps, SUVs and Crossovers Remain Strong; Overlanding Emerges as a Market Mover

A highlight of the 2019 SEMA Show was “The SEMA Overland Experience”—a debut exhibit showcasing dozens of vehicles built expressly for overlanding. Besides raising the activity’s public profile, the exhibit also provided a platform for companies that are serving this growing market segment and networking opportunities for others looking to expand into the market. |

The face of the automotive marketplace has changed many times over the decades, but one feature has remained constant: the popularity of pickups and, more recently, their sibling SUVs and CUVs. Unlike certain makes and models of passenger cars, trucks never go out of style. They’re the ideal multipurpose vehicles that are equally functional as daily commuters, jobsite workhorses or recreational trail machines. For sheer versatility, on the road and off, nothing compares to them, and that’s probably why the bestselling vehicle in the United States for more than 40 years running has been a pickup.

Better Mileage, Bigger Market Share

That trend doesn’t figure to change anytime soon. According to the most recent issue of a report entitled “SEMA Future Trends,” the light-truck segment—which includes pickups, vans, SUVs and CUVs—is forecast to account for 69% of all new-vehicle sales by 2025. From 2019–2025, new-truck sales are estimated to rise 10% overall. By contrast, sales of small and midsize cars are forecast to decline by 3% and 13% respectively over the same period.

New-car sales slowed in 2019 from the previous year, but the light-truck market remained a relative bright spot, with 12.3 million units sold, according to data from the National Automobile Dealers Association. Ford continued to hold the top spot in the fullsize pickup segment, while the Ram truck posted sales gains of 18% en route to passing the Chevrolet Silverado to become the second-best-selling fullsize truck in the United States. Midsize truck sales were also healthy, as two new players staked their claims in the segment: The relaunched Ford Ranger sold 90,000 units in its first year, and the upstart Jeep Gladiator JT logged more than 40,000 unit sales despite an initial spate of dealer markups that pushed the average purchase price above $50,000.

One factor that’s likely continuing to drive consumers to trucks and SUVs is their noticeable improvements in fuel economy in recent years. Truck manufacturers have come to rely on smaller-displacement four- and six-cylinder engines and less on conventional eight-cylinder powerplants. That’s in part to meet more stringent federal fuel-economy standards but also because recent advances in engine technology (lighter-weight alloys, direct injection, turbocharging and cylinder deactivation) allow small engines to produce high levels of horsepower while remaining reasonably fuel efficient.

According to “SEMA Future Trends,” average truck horsepower has increased 7% over the last decade while average fleetwide fuel economy has increased 20%, making pickup truck and SUV ownership a more attractive option for consumers. Another factor: fuel prices nationwide have remained effectively flat since 2010.

Healthy new-truck sales translate into healthy aftermarket parts sales as well. According to the most recent “SEMA Market Report,” pickups make up the largest share of specialty-equipment spending, accounting for approximately 27% of the market. Additionally, according to the latest “SEMA Accessory Opportunity Report,” eight of the top 10 vehicles most likely to be accessorized are either pickup trucks, SUVs or Jeeps.

Consumers spent more than $12 billion on aftermarket upgrades and accessories for their trucks in calendar year 2018, and roughly two-thirds of manufacturers reported sales growth within the category. Key sales drivers in the light-truck segment included exterior and interior accessories, suspension components, and wheels and tires. According to the “2019 SEMA Industry Perspectives” report, 73% of businesses expect sales to increase in 2020.

“The current state of the truck and off-road market is on a boil,” said Ken Brubaker, editor of Four Wheeler magazine. “A good indicator of that is a look at shops that install aftermarket products. I speak with shop owners regularly, and recently, most have said that they’re super-busy with a constant workload.”

Sean Holman, Motor Trend Group content director and co-host of the weekly podcast, “The Truck Show Podcast,” said that the truck market “will remain strong for the foreseeable future, with several high-profile and hotly anticipated models expected out in the next 12–18 months.”

While there may not be a single new-for-’21 OE truck offering with as much universal aftermarket appeal as last year’s Gladiator pickup, there are a number of new pickups and SUVs set to enter production over the next 12 months, including some time-honored marques that present new opportunities for aftermarket manufacturers and accessorizers. The following is a brief overview:

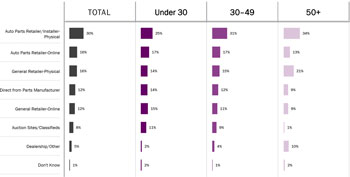

According to the most recent “SEMA Pickup Report,” when it comes to purchasing parts for their trucks, roughly half of truck owners still prefer conventional retailers, though online sales now comprise nearly 25% of the total. According to the most recent “SEMA Pickup Report,” when it comes to purchasing parts for their trucks, roughly half of truck owners still prefer conventional retailers, though online sales now comprise nearly 25% of the total. |

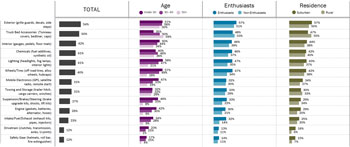

Among truck owners, exterior components are the most-purchased aftermarket parts, with suburban buyers tending to prefer bolt-on items such as side steps and grille guards, and rural buyers opting for bed-related accessories such as caps and covers. |

Pickups and SUVs: New and Notable

Ford

Bronco: On the heels of the Ranger pickup, Ford’s new midsize SUV revives the Bronco marque after 25 years. It will share its chassis with the Ranger and be built at the same Michigan assembly plant. The Bronco will offer the 2.3L I4 that’s rated at 270 hp in the Ranger, and a V6 may be an option. A smaller “baby Bronco” will share componentry with the Ford Escape and offer a 1.5L EcoBoost engine rated at 180 hp. Hybrid versions of both vehicles will be produced.

F-150: Also from Ford, an all-new 14th-generation F-150 will roll out for the ’21 model year and will feature a new 420hp 4.8L V8 to replace the current 5.0L. A gas-electric hybrid will also be available, with an all-electric version slated to arrive at a later date. Ford recently patented a rear-wheel steering system for the F-Series, though it’s not known if it will be offered on this model.

General Motors

Tahoe/Yukon/Suburban: From GM, the 12th-generation Suburban and fifth-generation Tahoe/Yukon adopt the new T1 chassis architecture (first introduced on ’19 Silverado/Sierra pickup trucks) along with an independent rear suspension in place of a solid rear axle. Base V8 engines carry over from the previous year. A 3.0L Duramax diesel is a new option, and a 10-speed automatic is now the standard transmission.

Jeep

Grand Cherokee: For model-year ’21, the fifth-generation Grand Cherokee transitions to the Alfa-Romeo “Giorgio” chassis architecture that underpins the Giulia sedan and Stelvio SUV. A 2.0L turbocharged I4 may be the base engine, with the 3.6L Pentastar V6 and Hemi V8 as options. A version of the Ram pickup’s eTorque hybrid system may be offered. A longer-wheelbase three-row variant—possibly named Grand Commander—is said to be in the works.

Wagoneer/Grand Wagoneer: Not to be outdone by the reintroduction of the Bronco, Jeep is reviving the Wagoneer and Grand Wagoneer for the first time since 1991. For model-year ’21, they’re represented by a pair of three-row SUVs sporting two different wheelbases on the fifth-generation Ram 1500 chassis with an independent rear suspension. Powertrains should be similar to those for the Ram 1500, and a plug-in hybrid version is planned for the future.

Nissan

Frontier: Essentially unchanged since 2005, the Frontier re-emerges for ’21 with an all-new exterior and a new 300hp 3.8L V6 engine partnered with a nine-speed automatic transmission. A hybrid version is under consideration.

Ram

Dakota: Fiat Chrysler returns to the midsize truck segment after a 10-year hiatus with the Dakota fourth gen. The truck will be built in the same Ohio assembly plant as the Jeep Gladiator JT and will likely share a modified version of the Jeep’s chassis. The 3.6L Pentastar V6 should be the standard powerplant, with an eight-speed automatic transmission. A turbocharged I4 could be an available option.

Rebel TRX: Also new from Ram for ’21 is a Raptor-fighter 6.2L Hellcat-powered pickup—the Ram Rebel TRX. Originally unveiled as a concept at the Texas State Fair in 2016, the TRX will be powered by a version of the 707hp supercharged Hemi V8 sourced from the Challenger SRT Hellcat. The concept Rebel TRX sported 37-in. tires, but the production tire and wheel package will likely be more modest.

In addition, no fewer than three manufacturers—Tesla, Rivian and Bollinger—have pledged to bring EV pickup trucks to market for model-year ’21, with General Motors slated to launch one the following year. So looking forward, the North American truck market looks poised to become even more diverse, and more competitive, in the coming decade.

Combining off-road driving with backcountry lifestyle activities, such as camping, hiking and mountain biking, overlanding has created a new niche in the truck and SUV segment for enthusiasts and manufacturers alike. This VW Touareg overlander was displayed at Overland Experience at the 2019 SEMA Show. |

Looking Ahead: Jeeps Lead the Way

Many of the industry sources we contacted for this article expected Jeeps—and the JL Wrangler and JT Gladiator pickup in particular—to continue as prime movers in the truck and off-road aftermarket in the coming year.

“The Jeep Wrangler JL has a strong pull for new products at all levels,” said Henk Van Dongen, director of marketing for Omix-ADA/Rugged Ridge.

Nick Gramelspacher, vice president of marketing at Meyer Distributing, agreed: “The Gladiator and JL platforms are strong, and consumer confidence is driving growth in the Jeep and off-road market.”

The addition of the Gladiator to the Jeep model line has also given manufacturers—and particularly Jeep specialists—an opportunity to diversify their product lines, as Van Dongen noted.

“The Gladiator is adding another dimension to possible accessories that we’ve not had in the past, like bed covers, bed racks and other bed solutions,” he said.

A number of our sources also expressed an interest in the upcoming Bronco, with Van Dongen predicting “another influx of enthusiasts” into the off-road segment when the new SUV hits dealer showrooms. Brubaker also noted renewed consumer interest in midsize trucks as having a potential impact on the aftermarket, and Holman mentioned ¾- and 1-ton pickup trucks as ongoing market influencers.

“I don’t see an end to the HD capability wars,” he said.

The Jeep Gladiator JT is expected to be a strong driver of aftermarket off-road parts sales in the coming year, and its out-of-the-box trail readiness makes it an attractive platform for overlanding accessories as well. |

The Ascent of Overlanding

Another growing trend mentioned by our sources is the increased level of product diversification in the truck aftermarket as manufacturers and retailers become more invested in the burgeoning adventure-travel sector. While the new Jeeps may be exerting some influence, another factor that’s likely driving the trend is the growing popularity of overlanding.

Loosely defined, overlanding is the practice of exploring the backcountry in a purpose-built vehicle—generally, a high-clearance four-wheel drive—that is equipped to allow its occupants to remain self-sufficient for periods of time ranging from a few days to several weeks. The activity originated in Australia (the term “overlanding” was at first used there to refer to cattle droving) and has been popular in South America and sub-Saharan Africa for a number of years, but its popularity in North America has grown appreciably over the past decade.

Due to its overlap with numerous outdoor lifestyle activities, it’s difficult to measure overlanding’s market growth precisely in dollars and cents, but the global adventure tourism market—which includes camping, hiking, mountain biking, kayaking, rafting and other pursuits that are closely associated with overlanding—enjoyed a boom in the last decade and is forecast to grow in value from $586 billion in 2019 to $1.63 trillion in 2026, according to a recent report by Allied Global Insights. A 2019 industry survey published by the Adventure Travel Trade Association stated that 83% of member companies reported higher year-over-year revenues in 2018, with 59% forecasting a net profit increase for 2019 from the previous year.

Scott Brady, publisher and chairman of Overland Journal, said that overlanding slowly gained a following throughout the 2010s, but momentum really increased in 2016.

“A simple Google search of popular terms reveals that ‘overlanding’ eclipsed both ‘off-roading’ and ‘four-wheeling’ for search popularity around that time,” he said.

Brady also pointed to overlanding’s crossover appeal to the U.S. outdoor recreation market—which generates an estimated $770 billion in gross economic output, according to the U.S. Commerce Department’s Bureau of Economic Analysis—as a contributing factor to its stateside success.

Other reasons cited for overlanding’s popularity included a relatively strong economy; advances in mapping software that can enable more accurate backcountry trip planning; the proliferation of wireless networks that improve remote communications; and the emergence of an affluent Boomer buyer demographic that is entering its retirement years with the requisite time and disposable income to pursue the activity. In that regard, a survey conducted at Overland Expo in 2017 said that 60% of attendees who responded claimed annual incomes more than $80,000, and 30% claimed annual incomes more than $150,000.

New Events and Exhibitions

Sean Angues, president of Overland Vehicle Systems, said that overlanding is “exploding in all directions. We’re seeing Millennials and Baby Boomers jumping in with both feet to install our product on traditional and nontraditional vehicles,” adding that renewed interest in the midsize truck segment is also helping attract new overlanding devotees.

“Overlanding is much bigger and stronger in the last one to two years,” Gramelspacher observed. “Lots of tents, traction boards, fuel packs and fridge/freezers have found their way into the Jeep and Tacoma market.”

He said that he expects overlanding to be a growth segment for the next two to four years, and Angues agreed, mentioning that his business is seeing “a lot of growth in recovery gear and onboard air management” in addition to tents and awnings.

Brubaker also concurred, adding that overlanding has spawned “a monsoon of products,” such as portable solar panels, that are new to the truck aftermarket.

This growth in popularity was reflected at the 2019 SEMA Show, which hosted “The SEMA Overland Experience,” a standalone exhibit featuring dozens of customized vehicles that included portable kitchen and shower systems, tents and awnings, roof racks and storage units, and all manner of onboard survival gear for living in off-the-grid conditions. Also at the exhibit, overlanding experts conducted educational sessions, technical demonstrations and business seminars that explained how overlanding is impacting the truck and off-road aftermarket.

“The Overland Experience area was an impressive sight,” Brady recalled. “Nearly every session was filled to capacity. The aftermarket is genuinely interested and excited by the opportunity—particularly the influx of new customers from other outdoor pursuits. SEMA’s strength has always been to facilitate networking and the collection of ideas, and that was evident with the new Experience area.”

The growth in overlanding has been accompanied by the expansion of organized overlanding events and expositions, led by Overland Expo, the first open-to-the-public exhibition dedicated to promoting the activity. Now a decade old, the event—known since 2014 as Overland Expo West—attracted more than 22,000 visitors and 400 exhibitors in 2019. (By contrast, some 900 people attended the initial event in 2009.)

As overlanding’s public profile has grown more pronounced, a new generation of enthusiasts has entered the niche, many of whom would not consider themselves “off-roaders” as the term has been traditionally understood. That, in turn, is driving the aftermarket in new directions.

As Overland Expo Communications Director Nick Jaynes explained: “We are seeing huge growth in the number of products geared toward non-expert-level overlanders. Traction, recovery, armor, storage and tents—all of those segments are seeing new and exciting entrants all the time. Overlanding accessories for everyday utility vehicles—not just hardcore 4x4s—is the most promising growth segment.”

Challenges and Opportunities

As with any budding market niche, overlanding has endured its share of growing pains, and one recent challenge facing the aftermarket has been the limits of field experience within manufacturer engineering and product planning teams.

“As a result, we see roof loads that are too heavy, with accessories that push the payload limits of Jeeps and compact pickups,” Brady explained. “Overlanding often takes the traveler well outside of cell coverage, so durability, reliability and weight are major design considerations but are at times overlooked. Fortunately, there are companies such as American Expedition Vehicles, ARB and others that set the bar for best practices that many other companies are benchmarking toward. Overall, the industry has done an exceptional job of transitioning, and we are observing long-standing four-wheel-drive brands adapt and adjust their offerings to the needs of a growing audience.”

Another challenge has been the difficulties faced by some overlanding companies—some of them recent startups—in keeping up with a consumer demand that has quickly gone global.

“The growth in the category is outstripping supply, and some brands in this space do not have a national distribution plan, so access to name-brand products has been limited,” Angues explained. “Having strategic partners in this space is critical to capitalize on making sure every jobber and consumer can get the product delivered most efficiently and with the quickest delivery times.”

Proactive marketing at the reseller level is also crucial to raising brand awareness.

“If jobbers put a focused effort on developing this category within their stores and let consumers know they’re in the business of overlanding, I feel our brands are in a position to help them grow that category,” Angues said.

One challenge facing the overall truck aftermarket that’s affecting many other industries now is a tight labor market.

“Labor continues to be our biggest challenge,” Dee Zee Director of Aftermarket Sales Troy Wirtz noted, “so we have launched some creative ways to attract talent and have increased benefits to our existing team members.”

Other potential challenges mentioned by our sources included the ongoing U.S.-China trade dispute as well as the need to continue developing products that are compatible with OE advanced driver-assistance systems.

Still, opportunities for growth in the aftermarket abound. Van Dongen saw Jeeps as continued new-product engines, and the Wrangler JL in particular “pushes us to develop new accessories at a higher quality level due to the fit and finish of this model compared to the previous model.”

Brubaker saw additional openings for suspension manufacturers as OE truck designs “get lower to the ground to improve fuel mileage,” and he and Holman both pointed to the coming wave of electric trucks as potential aftermarket movers.

All of our sources agreed, however, that overlanding will continue to be a major driver of new-product development for the foreseeable future.

“Almost all segments of the aftermarket can benefit from addressing the needs of overlanders,” Brady concluded. “Suspension companies can make shorter lifts that address the increased payload requirements, and tire companies can make hybrid tires that are suitable for a wide range of conditions.

“Opportunities that exist for innovation are vehicle solutions that weigh less and allow for improved performance. For example, aluminum rock sliders, lighter roof racks and suspensions that perform equally well at highway speeds or while traversing technical terrain. For roof tents, there will be a rapid migration toward hard-shell solutions, which are far easier to deploy in camp. And we will continue to see integration occur within systems, like combining a camp kitchen into a truck shell.”

New-car sales may have slowed, but the truck and off-road market remains robust—and the future of overlanding has never looked brighter.

Truck Market Trends: Stay Up-to-Date

SEMA offers numerous resources that can help members stay abreast of changes in the light-truck aftermarket. To download a free copy of the “2016 SEMA Pickup Report,” “2019 Accessory Opportunity Report” or the latest copies of “SEMA Market Report” and “SEMA Future Trends,” visit www.sema.org/market-research.