SEMA News—October 2019

BUSINESS

ADAS at the SEMA Show

See the Latest Tech on Full Display in Las Vegas

A perennial SEMA Show exhibitor, Brandmotion is one of many aftermarket ADAS technology suppliers slated to display their innovations at the 2019 Show. The trade event is a premier venue for spotting new products and trends in the rapidly growing ADAS category. |

Staying atop the unprecedented explosion of new technologies transforming the automotive world is a crucial yet constant challenge for today’s aftermarket businesses. This is especially true of advanced driver-assistance systems (ADAS), which are already having a major impact on the ways that vehicles are repaired, customized and serviced. In fact, experts maintain that there will be virtually no specialty-equipment segment left untouched by these safety-performance technologies within a few short years. Traditionally, the SEMA Show is the premier venue for aftermarket trend-spotting, so it should be no surprise that the many opportunities and challenges of the ADAS category will be on full display at this year’s trade event, November 5–8, in Las Vegas.

Three years ago, the Show saw the announcement of a SEMA-led “Advanced Vehicle Technology Opportunities” report conducted with Ducker Worldwide and the Center for Automotive Research. The groundbreaking report was designed to alert the aftermarket to the tremendous potential of ADAS products. At the study’s unveiling, the value of the ADAS aftermarket was estimated at just under $1 billion, with a projected 9%–10% compound annual growth rate through 2021.

Since that report, SEMA researchers have continued to track sales channels and consumer buying habits for ADAS products. According to the “2019 SEMA Market Report,” 67% of aftermarket manufacturers supplying such technologies confirmed sales growth in 2018. While new-vehicle dealerships accounted for a 27% share of sales dollars, physical and online aftermarket sales channels accounted for a combined 67% share. The report shows consumers purchasing safety-performance products in near-equal dollar shares across virtually every vehicle segment, from small cars to CUVs, SUVs and pickups. SEMA research further indicates that passive parking-assistance products make up the bulk of present aftermarket offerings, but other yet-untapped areas can be expected to grow as well, driven by several key factors:

- The lower cost of aftermarket ADAS alternatives to OEM products, which are often bundled into higher-trim and option packages.

- The potential for aftermarket brands to “fill the gap” with ADAS products that lack sufficient annual take-rates for OEMs to offer.

- The aftermarket’s ability to retrofit older vehicles and lower new-model trim levels.

- The improvement and simplification in aftermarket systems, such as passive parking assistance, that allow for easier self-installations.

- The increasing consumer interest in the “safety and awareness” that ADAS delivers.

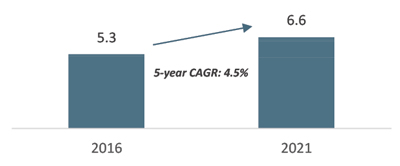

SEMA research projects immediate aftermarket opportunity in retrofitting newer ADAS technologies into vehicles that lack them. This chart represents the estimated compound annual growth rate of aftermarket ADAS-product upfitments in millions over the current five-year term. |

“ADAS is a vehicle technology that will eventually affect all of us in the SEMA community,” confirmed John Waraniak, SEMA vice president of vehicle technology. “Consumer demand for these safety-performance systems, products and technologies is growing rapidly. Automakers are integrating passive and active ADAS technologies into new cars, and these systems are bringing significant real-world benefits by reducing automotive injuries and accidents. Today, more than 60 million vehicles in the United States are already equipped with ADAS technologies, including blind-spot detection, lane-departure warning, adaptive cruise control and forward collision-avoidance systems, according to a recent report from Frost

& Sullivan.

“In the next five to 10 years, nearly 80% of all vehicles in operation in the United States will have some level of ADAS technology onboard. ADAS technologies are the gateway to automated driving systems being developed by automakers and creating new kinds of vehicles and business models and product development for both OEMs and aftermarket companies. Our Vehicle Technology Forums at the SEMA Show—along with additional SEMA-sponsored seminars and vehicle reviews throughout the year—are helping our members customize with confidence as they modify vehicles equipped with the latest factory-installed ADAS technologies as well as updating and retrofitting existing cars not originally equipped with ADAS.”

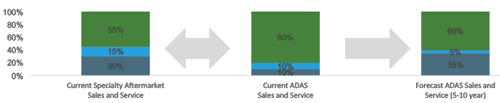

According to SEMA research, while independent repair and specialty businesses currently take the lion’s share of ADAS sales and servicing, parts chains will gain significant footing by 2022. |

In addition to the 2019 SEMA Show technology forums, Show attendees can deepen their understanding of the ADAS category by visiting the increasing number of suppliers bringing their innovations to the Show floor.

Supply and Demand

Although more and more manufacturers jump into the category each year, ADAS is still very much a growth channel, said Ittai Racine, co-founder of Castel Technologies, a Miramar, Florida-based manufacturer planning to exhibit at this year’s Show.

“I do not know if competition is on the rise or not, [but] the market is so huge and the supply is so varied that I do not think that there is really a question of strong competition. The products available offer different solutions at different price levels and for different applications. In applications such as [car audio], one has many products to choose from, and the same with ADAS. Cameras, radar, night vision, with or without screens… There is room for everybody.”

Gentex Corp. hopes to educate 2019 SEMA Show attendees about its next-generation Full Display Mirror (FDM), among other products. FDM is an intelligent rear-vision system utilizing a custom camera and mirror-integrated video display for optimized, panoramic rearward views. |

For its part, Castel Technologies offers an Enicar Universal Kit to combine infotainment, camera and navigation, security and connected-car technologies into a single head unit so that all of those features can be controlled and viewed from one location.

“We decided on the development of our product not in order to differentiate it and our company from others but because we wanted the best solution for the driver,” Racine said. “In this case, it was clear to us that it is best to use one platform, one piece of hardware, and a kit with one touch screen for safety of the driving experience, for efficiency and for cost effectiveness.”

Racine currently sees “limitless and endless opportunities for innovation” for ADAS suppliers, although he conceded that retailers have yet to fully grasp the opportunities.

“Their behavior is a normal one, described in statistics as ‘normal distribution,’” he said. “Some are more skeptical and require more education; some are less skeptical and easier to convince and sell; but the majority need education, incentives and hard work to acquire their support.”

Right now, cameras represent the most ubiquitous ADAS product lines hitting retailer shelves. Known as a passive technology because they alert a driver to impending dangers rather than engage vehicle systems to automatically take action, cameras range from single backup units to multi-camera 360-degree view systems. The latter can help protect drivers from ill-advised lane changes as well as unseen rear and cross-traffic hazards. The question is where to safely display all that visual information, and differing manufacturers offer a host of solutions.

Based in Michigan, returning SEMA Show exhibitor Gentex Corp. recently launched its next-generation Full Display Mirror (FDM), an intelligent rear-vision system utilizing a custom camera and mirror-integrated video display for an optimized, panoramic rearward view. A simple flip of a lever alternates between the actual mirror view and a clear, bright, LCD display appearing through the mirror’s reflective surface. The FDM is also central to the company’s camera monitoring system (CMS), which uses three discretely mounted cameras to provide comprehensive views of a vehicle’s sides and rear. A roof-mounted camera adds to the composite views that stream to the FDM, and the entire ensemble can create a platform for additional rearward-facing ADAS functionality.

“When it comes to automotive rear and side vision, our goal is to help the auto industry transition from analog to digital technology, “ said Steve Downing, Gentex president and CEO. “We have solutions ready for immediate OEM adoption, the aftermarket, and future solutions in development with customers. Moving forward, digital vision solutions will play a critical role in driver information delivery as the industry moves through the stages of autonomous driving.”

Hunter Engineering is one of several SEMA Show tool and equipment suppliers bringing new ADAS calibration solutions to market. It offers a camera kit to integrate Hawkeye Elite aligners with the Autel MaxiSys ADAS Aftermarket Calibration Kit, streamlining calibration times by 50% or more. |

Meeting the Challenges

Although ADAS promises many new opportunities for the aftermarket, they won’t come without growing pains. Perhaps no one knows that better than representatives of the collision-repair industry, which has been a sort of canary in the coal mine for impending ADAS challenges.

OEMs now embed factory ADAS cameras as well as radar and lidar sensors throughout their vehicles, sometimes in the most unexpected places such as windshields and taillights. Replacing and straightening parts can throw the sensors off, sometimes without triggering a trouble code. Moreover, changes in vehicle weight, ride heights, suspension systems, wheels and tires or even bumper materials can also hinder the safety of ADAS equipment.

The lessons collision repairers are learning, along with the tools and equipment they’re developing to cope with these potential liabilities, will likely prove a boon for parts manufacturers and retail installers as well.

“The reality is that ADAS is an industry-invented category,” said Ben Johnson, director of product management for Mitchell1, a provider of information solutions and scanning/recalibration tools for automotive professionals. “It includes all those things that help keep vehicles safe on the nation’s highways. Blind-spot monitoring, pedestrian detection, adaptive cruise control and emergency braking are just a few features that fit into that category.

“Those features and the ADAS category have been evolving for more than 10 years. In fact, by 2008, considered to be the older end of the ‘aftermarket sweet spot,’ ADAS-related features were found on some mainstream as well as luxury models from 18 manufacturers. Those systems are already being attributed with having saved tens of thousands of lives through accident avoidance, and consumers generally really like them.”

The good news is that, despite all this diversity, a scan tool that supports ADAS and some time are all you need to calibrate many vehicles on the road today, Johnson said. To address that need, Mitchell1 will showcase its ProDemand repair-information software designed to make diagnosing, calibrating and repairing ADAS-equipped vehicles quick and easy.

“Our ADAS quick-reference feature has been so well received that we’ve ramped up our development cycles to get information into our ProDemand product more rapidly,” Johnson said. “At Mitchell1, we pride ourselves on being first to market with quick service information such as lube capacities, tire fitment and other items that are done while vehicles are still in warranty. Because the ADAS calibrations may need to be done as a result of maintenance items such as alignments, we’ve now added ADAS to our quick service development categories, so ADAS-related information will be in ProDemand within a few months of a vehicle being introduced to market.”

Among the advanced collision-repair tools for ADAS at the SEMA Show will be Mitchell1’s ProDemand repair information software, an application designed to make diagnosing, calibrating and repairing ADAS-equipped vehicles quicker and easier. |

Another improvement Mitchell1 will be touting at the SEMA Show is ProDemand’s access to wiring diagrams.

“While that doesn’t seem immediately to be an ADAS feature, and it’s certainly not limited to ADAS, when a technician is diagnosing these newer technologies, many times it will be his or her first time dealing with these complex systems,” Johnson explained. “We wanted to make it easier to navigate the many wiring diagrams available to help with troubleshooting.”

Mitchell1 will not be alone at the Show. Other diagnostics suppliers such as AirPro Diagnostics, asTech and Hunter Engineering also stand ready to highlight and explain the latest strides they are making with ADAS-capable products. Kaleb Silver, Hunter Engineering’s director of product management for systems technology, said that the Show is the ideal venue for tool and equipment companies to not only exhibit their state-of-the-art technologies but also participate in industry education initiatives.

“The SEMA Show is the place to see and experience the latest technology in the industry,” he said. “Training classes provide great content on current topics, and SEMA members demonstrate solutions to address vehicle maintenance, repair and customization needs. Hunter Engineering will be participating in both training classes and in booth demonstrations for wheel service, alignment and ADAS-related topics.”

Rearview and sideview cameras are popular items, along with systems that can integrate them and other safety-performance technologies into a single package. Enicar is bringing its universal kit for infotainment and connected-car technologies to this year’s Show. |

According to SEMA market research, the mobile-electronics category as a whole has slowed somewhat in recent years, partly as a result of the stepped-up sound packages now offered by OEMs. That has led a number of audio companies to expand their product-development efforts into the ADAS category—a natural fit that they believe will bring renewed growth to their market. For now, those companies are vying for an edge with passive ADAS technologies such as head-up displays and other devices that give audible, visual or tactile warnings to help drivers avoid accidents. However, Scosche Industries Manager of Automotive Product Development Shane Condon recently told SEMA News that he expects that to rapidly change as more and more suppliers crack the early barriers to more advanced technologies. (See “Advanced Driver Assistance Systems,” SEMA News, April 2019, p. 26.)

“While there are many segments of the driver-assist categories that appear to be impacted, there is still plenty of room for innovation to create new and improved solutions,” Condon said. “For example, backup cameras come to mind, especially with the average vehicle on the road in the United States being 11 years old. Connected devices or driver-assist devices augmented by now-common tech in smartphones are a definite target area, especially with the anticipated emergence of 5G. As technology and electronics continue to mature and evolve, we expect to see more opportunities around OEM integration and add-ons of both passive and active ADAS systems.”

Staying Current

In the end, regardless of a Show attendee’s place in the industry, ADAS technologies represent a segment you want to get up to speed on, Waraniak advised.

“Nearly 70% of automotive service is performed outside the OEM dealer network, so independent repair shops as well as SEMA-shop organizations must be just as diligent and vigilant about staying on top of this rapidly changing safety performance technology,” he said. “In addition to everything attendees can see and learn on this topic at the SEMA Show, our association has created the “ADAS Resource Guide” on the SEMA Garage website to help members stay on top of ADAS by providing the latest information on ADAS technologies and business opportunities as well as the SEMA Advanced Vehicle Technology Opportunity Study [found at www.semagarage.com/services/vehicleadas].”

ADAS Suppliers at the 2019 SEMA Show

The following are 2019 SEMA Show exhibitors that have specifically announced they offer ADAS-related products. Listings were accurate as of press time (August 21, 2019), so be sure to consult the full list of exhibitors at www.SEMAShow.com for the most up-to-date information.

AAMP Global

Booths #V21, #V22

www.echomaster.com

- Echo Master products; rearview cameras, blind-spot sensors, front cameras, 360-degree cameras and more.

Accele Electronics

Booth #11817

www.accele.com

- Rear cameras and rearview mirror displays.

AirPro Diagnostics

Booth #15116

www.airprodiagnostics.com

- Subaru diagnostic scan tool for calibrating ADAS repairs.

asTech

Booth #15525

www.collisiondiagnosticservices.com

- ADAS-capable post-repair calibration equipment, including a remote diagnostic tool.

BlackVue

Booth #11961

www.blackvue.com

- Mobile Eye recording dash cameras.

Boyo

Booth #11729

(See also Vision Tech America)

Brandmotion

Booth #11733

www.brandmotion.com

Radar blind-spot detection, 360-degree camera and OEM rear-vision systems.

Car Mate USA/RAZO

Booths #V252, #20627

www.carmate-usa.com

- Dash cameras and parking sensors.

Cyber Concept Technology Co. Ltd./Cybcar America Drive Assist

Technology

Booth #11627

www.cybcar.us

- Blind-spot detection systems.

Dynavin GmbH

Booth #12010

www.dynavin.com

- Reverse cameras.

Gentex Corp.

Booth #12071

www.gentex.com

- Auto-dimming mirrors, displays, camera systems, lighting, blind-side alerts and other driver-assist technologies.

JpanVista/JPP

Booth #11810

www.jpanvista.com

- Backup cameras and rearview mirror displays.

LinksWell Automotive/Integration Electronic (Sintegrate)

Booth #11681

www.linkswellinc.com

- Multi-camera interfaces.

Mitchell1, aka Mitchell Repair Information Co. LLC

Booth #16607

www.mitchell1.com

- ProDemand OEM repair information software with ADAS capabilities.

MITO Corp.

Booth #11661

www.mito-auto.com

- OE-grade automotive electronics, including Gentex auto-dimming rearview mirrors available with a rear camera and HomeLink displays.

Rostra Accessories

Booth #11617

www.rostra.com

- Customized and universal electronic aftermarket cruise-control systems and automotive parking assists.

Rockford Fosgate

Booth #11839

www.rockfordcorp.com

- Backup cameras, license-plate cameras, tailgate cameras, wireless backup cameras, blind-spot monitors and park assist systems.

Scosche Industries

Booth #11717

www.scosche.com

- Smart dash and backup cameras, rearview-mirror and head-up displays.

Toppking Electronics Ltd.

Booth #11711

www.blindspotsolution.com

- Blind-spot detection systems, parking sensors and car security integration.

Ultronix Products Ltd.

Booth #11828

www.ultronix.cn/en/index.asp

- Parking sensor systems and cameras.

Ventra Technology

Booth #33297

www.ventrainc.com

- HD vehicle video recorders and backup cameras.

Vision Tech America Inc.

Booth #11729

www.visiontechamerica.com

- Rearview camera systems, backup cameras and monitors, mirror monitors and head-up displays.

VOXX Electronics Corp.

Booth #12017

www.voxxelectronics.com

- Blind-spot detection, wireless cameras, smart rearview mirrors and backup cameras.

Whistler Group

Booth #11917

www.whistlergroup.com

- Radar dash cameras with built-in GPS and Wi-Fi.