SEMA News—April 2019

BUSINESS

The Truck Resurgence

Powerful Innovation, Technology—and Competition

A strong economy, lower fuel prices and advancing technologies have consumers reigniting their passion for trucks of all kinds, making the category increasingly competitive for OEMs and the aftermarket alike. While the recently debuted Jeep Gladiator truck is particularly exciting for the specialty-equipment industry, virtually all of the major OEMs are churning out fresh platforms for modification. A strong economy, lower fuel prices and advancing technologies have consumers reigniting their passion for trucks of all kinds, making the category increasingly competitive for OEMs and the aftermarket alike. While the recently debuted Jeep Gladiator truck is particularly exciting for the specialty-equipment industry, virtually all of the major OEMs are churning out fresh platforms for modification. |

What vehicle can be more American than a truck? Ever since Henry Ford introduced his first Model T in 1908, light trucks have been the vehicles of the masses, both at home and abroad. Powerful, sturdy, versatile and capable of almost anything, wherever they go, we work with them, play with them and return to them again and again when times are good. And right now, it seems, times are very good indeed.

According to recently released “SEMA Future Trends” research, the light-truck category—which includes pickups, vans, sport utility vehicles (SUVs) and crossover utility vehicles (CUVs)—accounted for 64% of all light vehicles sold in 2017. That figure is expected to hit 69% by 2025, with CUV sales driving most of the growth. In fact, from 2012 to 2017, CUVs already comprised 67% of light-truck sales growth.

Truck engine configurations are changing along with that market mix. Since 2010, manufacturers have turned to “turbo-downsized” engines to meet fuel-efficiency standards. Currently, 17.3% of four-cylinder trucks are turbocharged, and the number is 13.2% in six-cylinder trucks. By contrast, turbocharging is now found in only 0.6% of eight-cylinder powerplants, whose numbers are quickly diminishing.

“Looking forward, it’s going to be smaller engines and fewer cylinders,” said SEMA Market Research Director Gavin Knapp. “We’re already seeing a lot of that even in fullsize pickups, in which there are a growing number of six-cylinder engines.”

Despite the downsizing, new trucks have only gotten better. Average truck horsepower has increased 7% over the last decade, and average fleetwide fuel economy has risen by an astounding 20%. The result is that consumers can now enjoy the style and work/play utility of their pickups, SUVs and CUVs with little or no compromise in performance, fuel economy, 0–60 acceleration times, or payload and capacity. All of that, combined with a leveling of gas and diesel prices, has Americans reigniting their natural affinity for those vehicles.

That, in turn, has both the OEMs and the aftermarket racing to bring new and improved products to an already fiercely competitive segment. As proof, one has only to look at the 2018 SEMA Show or Detroit’s more recent 2019 North American International Auto Show (NAIAS), where trucks and SUVs continued to dominate. The NAIAS, in particular, saw the unveiling of several all-new OEM models ripe for aftermarket accessorization. The following are some noteworthy players:

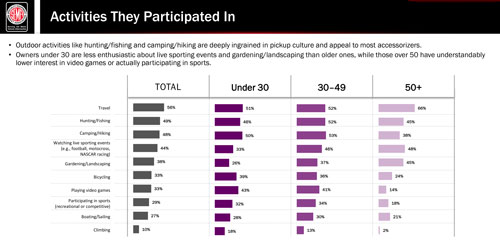

The above is a SEMA Market Research breakdown of popular activities among key truck accessorizer demographics. These activities make great jumping-off points for cross marketing and sales opportunities. |

Dodge

Dodge hopes to capture light-truck consumers with its new ’19 RAM 1500, especially the heavy-duty iteration, which now claims to be the segment’s most powerful and capable pickup. Equipped with a Cummins engine, an improved exhaust manifold and turbocharger, the truck boasts a towing capacity of up to 35,100 lbs. and 1,000 lb.-ft. of torque at 1,800 rpm. In addition, the automaker has introduced a new ’19 RAM Power Wagon with a 410hp 6.4L Hemi V8.

Ford

Ford’s ’19 Ranger targets the returning midsize pickup market with excellent payload and towing. Its 2.3L EcoBoost four-cylinder engine produces 270 hp and 310 lb.-ft. of torque and achieves a combined fuel rating of 23 mpg.

Ford has also debuted the all-new ’20 Explorer ST. The 2.3L EcoBoost is standard here too, alongside an optional 3.0L turbocharged EcoBoost V6 that churns out 365 hp and 380 lb.-ft. of torque on 93-octane gas. An SRT version offers a 400hp twin-turbocharged 3.0L V6.

Chevrolet

Chevrolet claims that its ’19 Colorado is the most capable off-road truck in its class. Power comes from a standard 3.6L V6 or

a 2.8L turbodiesel option.

Meanwhile, Chevrolet’s all-new ’19 Silverado struts its versatility with a variety of lifestyle packages, including an LT Trail Boss version for off-roaders and a new RST version for street performers.

Jeep

Finally, Jeep has created a huge stir among consumers and the motor press with its ’20 Gladiator JT. Sharing many components with the Wrangler, the crew-cab truck offers a 5-ft. steel bed, best-in-class towing and a 16,000-lb. payload capacity. Power comes from a 3.6L Pentastar V6 delivering 285 hp and 260 lb.-ft. of torque.

According to Omix-ADA/Rugged Ridge Director of Marketing Henk Van Dongen, the Gladiator is the vehicle that Jeep enthusiasts—and the aftermarket—have long awaited.

“Most of them will be incremental unit sales, and we do not believe that the vehicle will cannibalize much or any of the regular Wrangler sales,” Van Dongen said. “That means more consumers who will be looking for accessories. The truck-bed platform will open up new product ideas that may not have been seen before, as they will address more the Jeep need than specifically truck needs.”

Jeep applications have always formed a solid backbone for the specialty-equipment industry, and the Gladiator beefs up an already strong Jeep line that saw the introduction of the all-new JL Wrangler in 2018. With an improved balance between off-road and street capabilities, the JL was designed to appeal to a broader range of consumers, including the less-hardcore commuter set with a yearning to tackle easy trails from time to time.

“The category is highly competitive and continues to bring in more competitors both domestically as well as internationally,” Van Dongen said. “With an increase in competition and the fragmentation of the consumer market, it is even more diverse and challenging to rise above the noise.

“With the new JL out, almost all JL-related aftermarket products will find an audience with that consumer market. You will see a significant offering of bumpers, suspension systems and wheels from a variety of manufacturers. We saw the consumer market already changing when the previous JK model came out and the four-door version took a 70% market share. The additional segments made the market more fragmented and were outside the traditional off-road Jeeper market.

“You can see that FCA Jeep realized this as well, so the new JL is significantly more refined than the previous model, without losing its capability. What this means for the aftermarket is that those consumers expect a different level of fit, finish and quality of products.”

To adjust to this evolving market, Omix-ADA launched a rebranding campaign for its Rugged Ridge line in January.

“After 10 years of being in the accessory market, the introduction of the new JL Wrangler was a perfect time to reevaluate our positioning,” Van Dongen observed. “You will see several completely redesigned products using design and manufacturing techniques that will elevate the type of accessories offered in the market.”

At Currie Enterprises, where Jeep applications already comprise half the company’s business, the Gladiator’s debut also has owner Ray Currie eyeing yet another revenue stream.

“They’re looking to classify it more as a truck than an off-road vehicle, so we’re looking for some different directions to go with the new JT coming down the line,” he said. “We’re actually going to be able to participate in the sport-truck market.”

Even so, previous Jeep iterations continue to be lucrative staples for the manufacturer.

“In general, we’re in a position where we can barely supply the stuff that we’ve built for the JK fast enough, and we’ve had to delay our offerings for the JL for the same reason,” Curry said. “Our suppliers just stepped up and increased the production of sway bars and steering systems and even some of the rear-axle housing components that are common between the JL and the JK, so it’s good times and bad times.”

Although the JL model promises to usher a fresh wave of enthusiasts into the market, Currie believes that it will be a few years before the industry reaps the new Wrangler’s full potential. Plus he sees MOPAR’s decision to sell through Amazon as a new barrier in an already crowded aftermarket.

“There’s nobody looking to really step into their JL projects—at least among our customers. A lot of guys are buying JLs off the dealership with a MOPAR 2-in. lift kit and 35-in.-tall tires, and those Jeeps are going to have a long street life before they ever get to a second owner who is going to take them to the next level.”

Competition Everywhere

According to Erika Marquez, Warn Industries’ OEM sales manager and chair-elect of the SEMA Truck and Off-Road Alliance council, the entire light-truck aftermarket may soon feel the increased pressure of OEM competition.

“The OEMs realize that there is a market for aftermarket accessories, and we therefore see a trend toward more of them offering dealer-installed packages that include their own products to improve the performance and accessorize their vehicles from the get-go,” she said. “This trend could affect SEMA-member companies in the long run, but there is also research showing that only a portion of consumers make purchases at the dealerships. Our council is addressing that issue through increased dialogue with OEMs as well as encouraging SEMA members to design and release products for new models through exclusive vehicle measuring sessions sponsored by the SEMA Garage.”

Still, like many other light-truck industry watchers, Marquez remains upbeat.

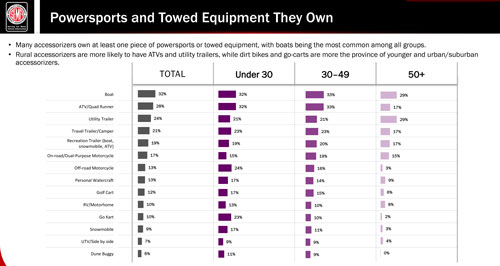

“Gas prices continue to be low nationwide; truck and Jeep sales are up; and the consumer confidence index is above 100, signaling a boost in consumer optimism about the economy’s future,” she explained. “The light-truck and off-road industries are benefitting from those trends, especially since 29% of vehicle purchases in 2018 were pickups. Off-roading is also an increasing trend, with 31% of the total U.S. population owning at least one sports/recreational-equipment vehicle. That is a huge number and a great opportunity for SEMA members—especially since most of those vehicles are towed by trucks. The market is getting competitive, however, so new technologies and product innovation are key to succeeding in

the marketplace.”

What are truck drivers doing with their vehicles? The answer, as evidenced by this SEMA Market Research, is a lot of towing and hauling, mainly of recreation-related equipment. |

Demanding Market

Sinister Diesel is one example of a SEMA-member company seeking to innovate in the small but mighty diesel niche. Brian George, the company’s CEO, noted that the segment’s consumers can be especially demanding in their needs for towing, capacity, vehicle longevity and fuel consumption for both the job site and the great outdoors.

“We cater to the people who are using their trucks to tow a boat to the lake on the weekend and then also use the truck to go to a construction site,” he explained. “It’s the guy’s one vehicle, and he needs it to perform every time he turns that key. Some of these guys have 10,000 lbs. that they’re carrying as a service body bed on their truck all day, every day.”

A maker of a variety of intake, exhaust, cooler and other heavy-duty diesel engine components, Sinister has seen some major shifts in the market over the past decade.

“I would say that one of the biggest trends right now is making parts that gain performance from a vehicle but that still conform to federal emissions regulations,” George said. “Three or four years ago, that was still pretty much a nonexistent worry for most people in the industry, but now it’s a big factor. In fact, you even have customers requesting it.

“When we started in 2009, the industry as a whole was pretty small and fairly crude. Fast forward to 2019, and it’s way more competitive, and much more expensive to enter the market and stay competitive. When we started, you could do pretty well. I think our website was literally a $5,000 website. To be competitive now, you need a $100,000 website. And that’s just a website. We’re not even talking about pay-per-click advertising, marketing, magazine ads or anything like that. So it has gotten substantially more expensive, and a lot of that is because there are now more people trying to get a piece of the same pie.”

George agreed that innovation is essential in today’s marketplace, especially against toughened competition from the OEMs themselves.

“We have multiple trucks from different manufacturers every year,” he said, “and it seems that every time you get into a new truck, you think, ‘Man, that thing is just perfect. How can they make it any better?’ But even with the best truck out there, there are still things that the manufacturer falls short on. That’s where we’ve made our niche in the industry. We find those parts, design them to be better and more efficient parts for the customer, and then sell them that way.”

Whether they fall into the general pickup, Jeep, diesel or SUV/CUV niches, truck consumers intent on accessorizing all share a number of traits.

In 2016, SEMA Marketing Research released its “SEMA Pickup Report,” which remains the benchmark for profiling the category’s demographics. The research found that a full 56% of pickup accessorizers tend to fall into the 30–49 age bracket, although the under-30 and 50-plus age groups remain sizable at 22% each. Overall, half are married or living with a significant other and children. Those factors heavily influence how their vehicles are employed.

Not surprisingly, accessorizers rank recreation and road trips high among their truck pursuits, along with hauling people and gear. More than 70% said that they frequently haul bikes, kayaks, skis and jet skis, small trailers, campers, boats and pets. Favorite pastimes include day or weekend trips and recreational driving (97%); family vacationing and pleasure driving (92%); boating, fishing or other outdoor activities (87%); and off-roading in dirt, gravel, mud and rocks (71%).

When it comes to actual accessorizing, truck owners under 30 are more likely to attempt more complex or ambitious projects. However, older, rural and less-engaged consumers still make up a large market for parts that improve a truck’s convenience or reliability.

While more than half of all modifiers have purchased some parts online, brick-and-mortar stores are still their largest single source of upgrades and accessories. Side steps and running boards, bedliners, bed covers and engine chemicals are most commonly viewed as key purchases. More serious aftermarket consumers also opt for off-road wheel and tire packages and lift kits. GPS navigation systems, transmission-performance upgrades and exhaust components round out the list of top purchases.

Obviously, an outdoors-friendly crowd also offers retailers a wide range of cross-selling opportunities. Camping and sporting gear and lifestyle merchandizing make exemplary upsells. Currie especially noted the growing enthusiasm for overlanding experiences.

“Just in the last couple years, you’re seeing more overland-outfitted vehicles of all types,” he said. “It’s a whole attitude of camping out self-sustained over long distances. They’ve got the tent on the roof, three spare tires, gas cans mounted down the side, and they’re going from beach spot to beach spot, hiking the trails and living out of their vehicles, both trucks and Jeeps.”

In addition, Van Dongen advises businesses catering primarily to pickup and powersports enthusiasts to consider expanding into the Jeep segment as well.

“If you are not actively pursuing the Jeep enthusiast, you are missing a great opportunity,” he said. “The Jeep consumer can be a steadily recurring customer with a high lifetime value.”

| Get the Research | |

| SEMA offers several research tools that can help you better understand the light-truck aftermarket. To get your copy of the “2016 SEMA Pickup Report,” “Fall 2018 SEMA Future Trends Report” and “2018 SEMA Market Report,” go to www.sema.org/market-research. The webpage offers streamlined access to all of SEMA’s current research, and members no longer have to log in. Downloads are free. |

But the greatest success will come from grasping the specific characteristics of customers in any given sales region. For all their commonalities, truck owners are also a diverse group. As Sinister Diesel Research and Development Lead Michael Penfield observed of diesel customers: “You go up north, and you have to worry about the cold weather. You go down south, and it’s not a concern anymore. You go to different areas, and they don’t really tow or have mountains and [related] concerns with overheating. Understanding the direct customer base, whether that be e-commerce or walk-in, storefront retail, is a big part of it.”

That’s smart advice, and it applies equally to every niche of the truck specialty-equipment market.