The Basics of Driver Vision Augmentation Technologies

The driver vision augmentation category encompasses adaptive and dynamic headlights, night-vision technologies and head-up displays. The latter currently hold the most aftermarket potential. |

SEMA research indicates that the U.S. aftermarket for advanced driver assistance systems (ADAS) and connected vehicle technologies (CVT), though still in its infancy, can be expected to grow into a $1.5 billion industry within the next five years. With so much at stake in these rapidly emerging technologies, SEMA has made identifying ADAS/CVT opportunities for association members a key priority.

In this seventh installment of our eight-part SEMA News series highlighting key “SEMA Advanced Vehicle Technology Report” findings, we take a look at driver vision augmentation (DVA) technologies, along with the aftermarket trends surrounding them. An interview with SEMA Vice President of Technology John Waraniak further explaining these technologies and their implications for the aftermarket can be found on p. 322. Readers are also encouraged to download the full report at www.sema.org/avt-opportunities.

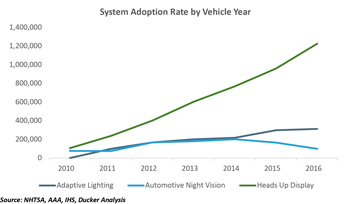

Thanks to their relative simplicity, the OEM adoption rate for HUDs has soared compared to more complex adaptive lighting and night-vision systems. |

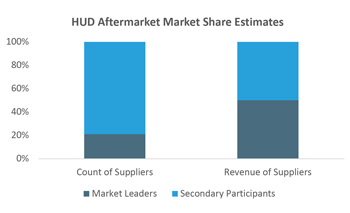

In the aftermarket HUD niche, a small percentage of market leaders account for roughly half the market share, but SEMA expects secondary suppliers to capture more market share in coming years. |

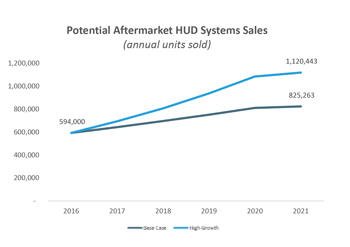

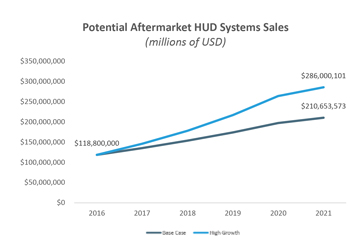

Of all DVA systems, HUD units show the most aftermarket growth potential, with sales projected to possibly double by 2021. |

Product Segmentation

DVA systems provide enhanced views of the road ahead to help reduce collision risks. The systems fall into four basic categories. Going from lowest to highest level of functionality, they include:

- Adaptive headlights, which use sensors to detect vehicle speed, steering-wheel position and yaw rate to angle headlights optimally for driver vision. The result is not only improved vision for the equipped vehicle’s driver but for oncoming vehicles as well.

- Dynamic responsive headlights, which utilize the same hardware as adaptive headlights but go further by adjusting headlight brightness for varying conditions. The systems can engage high beams in low-visibility situations and/or dim them for oncoming traffic.

- Night-vision displays (NVD), which use thermographic cameras to “see” objects in a vehicle’s path. Active NVD systems use an infrared light source to help illumine the road ahead for the cameras. By contrast, passive systems capture thermal radiation from objects ahead. NVD systems are especially useful during fog, rainfall and heavy snowfall. NVD systems can also display their information in three different manners. Instrument-cluster displays incorporate dash-mounted LCD screens. An existing navigation screen can also be called into service. The third option is a head-up display (described next).

- Head-up displays (HUD), which project critical instrumentation onto dashboard-mounted screens or glass combiners on the windshields themselves, helping drivers keep their eyes on the road. Typically, the instrumentation includes speedometer, tachometer and navigation readouts. As noted above, HUDs can be used to display night-vision data, but not all HUDs are so equipped. Current systems mostly monitor vehicle functions, but HUDs can integrate with other connected-vehicle applications with additional components. Those could include monitoring vehicles and driving conditions, identifying pedestrians stepping into traffic lanes and so forth.

OEM Market Adoption

Outside of HUD, the rate of DVA adoption among OEMs is low, due mainly to the relatively small population of target end users and high price points. Presently, automotive night-vision systems are offered only as optional add-ons in premium brands such as Audi, Mercedes-Benz or BMW. Moreover, it was those three German OEMs that first introduced adaptive lighting, with Ford recently developing a similar system, all for high-end models and trims.

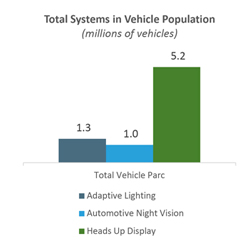

Meanwhile, HUD systems originated in the early ’90s but were limited to projecting vehicle speed onto windshields. Now OEM HUDs are growing in popularity, thanks to highly evolved visual effects and functionality, and they are featured on approximately 5%–10% of all vehicles produced in 2016. (See charts: System Adoption Rate by Vehicle Year; Total Systems in Vehicle Population.)

Market Drivers and Barriers

SEMA research suggests strong aftermarket potential for DVA systems, but their quality and functionality will have to improve to truly gain market traction. Liability remains a further concern, since aftermarket manufacturers would be held responsible for safety defects resulting from system mishaps.

There are currently an estimated 5.2 million HUD-equipped vehicles on the roads, which again demonstrates the category’s strong aftermarket potential. |

Consumers have welcomed aftermarket HUDs, but those products still have their limitations, including system lags, temperature difficulties relating to dashboard placement, and poor alignment with driver fields of vision. Adaptive headlights face challenges such as loss of sensor function due to debris and dirt. They also rely on highly complex (and sometimes inconsistent) technology inputs, and their benefits are often confined to suburban or rural areas with more winding roads. Integrating adaptive/dynamic headlights with wheel speed and yaw-rate sensors are further barriers discouraging aftermarket adoption. Meanwhile, NVD applications have met with low aftermarket success to date.

However, there are several compelling factors that can drive aftermarket demand for these systems. Consumers can readily appreciate improved vision at night or in inclement weather, especially on hilly or twisting roads with poor lines of sight. And HUDs, in particular, boast a variety of price points, increasing their appeal for a wide range of consumers.

The HUD category is further projected to become a $200-million-plus market by 2021. |

Aftermarket Presence

Thanks to their relatively lower cost and complexity, HUD products are the only DVA systems to thus far meet with success in the aftermarket. In fact, HUD applications have become increasingly popular offerings from such manufacturers as Brandmotion, Garmin, Mpow and Navdy, with systems ranging from $30–$400. Indeed, Continental is among the largest producers of HUD displays and recently started production in its Guadalajara plant.

Across the board, aftermarket HUDs often feature screens 3 to 5 in. wide and detached from windshields in ways that do not require shifts in driver concentration from the road. By comparison, other automotive night-vision systems often require drivers to take their eyes off the road and have seen limited aftermarket acceptance.

Brandmotion, Garmin and Navdy were believed to account for approximately 50% of the supplier landscape as recently as 2017. Representing more traditional GPS participants, they entered the space through the integration of GPS and HUD systems. (We should note that Navdy announced it was liquidating assets at the start of 2018, however, signaling a possible company sale, reorganization or shutdown.) By contrast, secondary aftermarket participants have been more ADAS-focused and include such manufacturers as Boyo and Sonic Electronix, which plan to eventually integrate HUDs with other ADAS features beyond GPS and navigation. (See chart: HUD Aftermarket Market Share Estimates.)

| Stay Informed! |

The tremendous potential ahead for the specialty-equipment industry is detailed in the “SEMA Advanced Vehicle Technology Opportunities Report.” To download your copy, go to www.sema.org/avt-opportunities. For additional information about ADAS technologies and how they may impact your business, visit the SEMA Garage Vehicle Technology webpage at www.semagarage.com/services/VehicleADAS. |

HUD Aftermarket Penetration

Over the past few years, HUD systems have sustained a strong compound annual growth rate of about 12% due to increased consumer interest amid historically low OEM adoption rates. What’s more, aftermarket HUDs are often easy to install across multiple vehicle makes and models, further making them attractive to end users.

SEMA predicts that demand for aftermarket solutions will continue to grow, albeit at slower rates by 2020 as HUDs become standard OEM features for all vehicle types. The HUD aftermarket will not disappear beyond 2020, however. Instead, the aftermarket can expect ongoing consumer demand for upgrades to their non- or under-equipped vehicles as HUD functionality increasingly integrates with other ADAS technologies. (See charts: Potential Aftermarket HUD Systems Sales in Annual Units and Millions of USD.)