Parking-Assistance Technologies and the Aftermarket

Of all the emerging ADAS technologies, parking-assistance systems are proving the most popular among consumers. The National Highway Traffic Safety Administration estimates that equipping every vehicle with a rear camera alone can cut backup accidents by 46%—and the aftermarket can help make that a reality. |

In this sixth installment of an eight-part SEMA News series highlighting key “SEMA Advanced Vehicle Technology Report” findings, we take a look at parking-assistance technologies and the aftermarket trends surrounding them. An interview with SEMA Vice President of Technology John Waraniak further explaining these technologies and their implications for the aftermarket can be found on p. 100. Readers are also encouraged to download the full report at www.sema.org/avt-opportunities.

Automated PAS exhibits a higher degree of vehicle integration than passive systems, helping to steer a car into parking spaces. Autonomous valet takes things even further, essentially autopiloting the vehicle. Expensive and complex, such systems will almost certainly remain in OEM hands for the foreseeable future. |

Utilizing radar, rear cross-traffic alert warns a driver if there’s a moving vehicle or object entering the backup zone. Utilizing radar, rear cross-traffic alert warns a driver if there’s a moving vehicle or object entering the backup zone. |

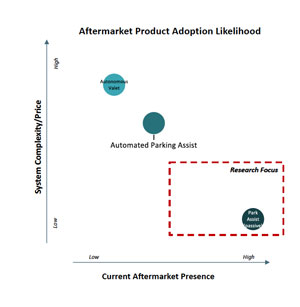

Thanks to their simplicity and lower cost, passive PAS products are ideally suited to the aftermarket. There is presently a wide range of suppliers competing in that space. |

Parking-assistance systems (PAS) help drivers to park their vehicles in high traffic, close quarters or otherwise difficult situations. Like other ADAS technologies, these systems range in functionality from providing a better view of parking spots to completely taking control of vehicles and self-piloting them into parking spaces. (See illustration: “Active Parking Assistance.”) From lowest to highest complexity they include:

- Passive PAS: The simplest systems, these alert a driver to a vehicle’s proximity to other objects while parking. They may include a rear or 360-degree camera as well as electromagnetic or ultrasonic sensors. Radar-based systems can also alert the driver to changing distances of objects within their range. Rear cross-traffic alert is sometimes an added feature that also uses radar to alert drivers to unseen vehicles or objects moving into their paths as they back up. (See illustration: “Rear Cross-Traffic Alert.”)

- Automated PAS: These systems engage a vehicle’s steering to help a driver park, but they still require driver monitoring. They integrate camera and radar sensors with the steering controls but, in most cases, require the driver to apply all necessary braking and acceleration.

- Autonomous Valet (Self-Parking Vehicle): These systems take complete control of a vehicle’s steering, acceleration and braking to move the car from a traffic lane into a parking slot. Typically, the driver is prompted to a certain location shown on the car’s navigation screen to properly position the vehicle to begin the parking process.

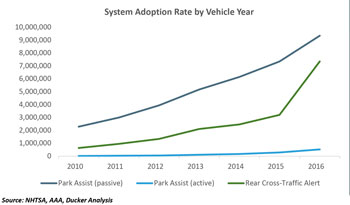

PAS technologies are becoming fairly standard on a wide range of OEM vehicle types and segments, due largely to a continued decrease in camera and radar prices. Rear cross-traffic alerts are showing a similar adoption trend, since they share many of same components. Safety data also reveals another major reason OEMs are rapidly deploying PAS on new vehicles: The National Highway Traffic Safety Administration estimates that drivers backing into other vehicles cause 25% of all parking-lot accidents. The agency further estimates that equipping every vehicle with a simple rear camera could reduce backup accidents by 46%. Consequently, there’s little wonder that we’ve seen a dramatic increase in OEM rollouts of passive PAS and rear cross-traffic alert systems since the ’10 model year. By comparison, the adoption rates for more complicated and expensive active PAS technologies have barely climbed. (See chart: “System Adoption Rates by Vehicle Year.”)

Aftermarket Drivers and Barriers

All in all, consumers readily see the advantages of PAS to help avoid accidents while backing out of parking spaces or attempting parallel and angled parking maneuvers. It seems that drivers distrust their rearview mirrors, especially when parking in adverse conditions or exiting spaces blinded by flanking vehicles. On the other hand, hesitancy to hand over vehicle control to sensors and computerized gizmos remains a barrier to greater adoption of the more advanced systems.

For the aftermarket, several factors can fuel growth in the PAS marketplace. First, backup cameras are already an established aftermarket product widely available for both professional and DIY installation. Second, with consumers now used to these conveniences on their newer cars, they will likely upgrade older vehicles as well. Consumers in large cities, where parking is especially tight, have even more incentive to seek PAS solutions.

There are, of course, some barriers to adoption that both OEMs and the aftermarket must overcome. While finding these systems desirable, many consumers still do not consider them a necessity, and some lack confidence in their safety and convenience altogether. Moreover, the process of correctly positioning a vehicle in order for the autopilot to take over with the most advanced systems can prove frustrating for some consumers.

With each passing year, OEMs have accelerated adoption rates for both passive PAS and rear cross-traffic alert to the point where consumers now virtually expect those technologies on their new-vehicle purchases. By contrast, active PAS still has a slow adoption rate. |

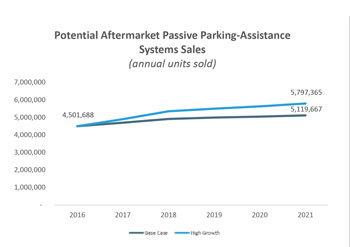

SEMA research suggests that aftermarket passive PAS sales will steadily increase through 2021, possibly reaching 5,797,365 units. |

Aftermarket Presence

With their higher price points and installation issues, active PAS products enjoy no aftermarket presence at the moment. By contrast, passive aftermarket PAS products are fairly common and comprise a segment boasting many market participants. (See chart: “Aftermarket Product Adoption Likelihood.”) If anything, current price levels perceived as slightly too high have discouraged even more rapid penetration. That said, the emergence of 360-degree vision systems and other passive products tailored to niche markets (such as tow vehicles) could drive higher-margin opportunities. For example, off-road enthusiasts will especially appreciate the ability to switch between multiple camera views of vehicle clearance and the planting of each individual tire. Considering all these trends, SEMA research forecasts growth of passive PAS to possibly reach 5,797,365 units annually by 2021. (See chart: “Potential Aftermarket Passive Parking-Assistance Systems Sales.”)

Supplier Landscape

The supplier landscape for passive PAS is highly fragmented. In fact, passive PAS products currently form the most prevalent ADAS aftermarket niche due to their widely accessible technology and ease of opportunity. Backup camera systems in particular have been available in the aftermarket for more than five years. Their list of suppliers includes a multitude of players of varying backgrounds, including manufacturers of other ADAS equipment, GPS and navigational products as well as other vehicle electronics, camera and infotainment systems.

These suppliers are vying for market share at varying price points and finding new and innovative ways to install and utilize rearview cameras. Examples include displays on mobile phones and devices, auxiliary view screens and dashboard integration. Market leaders in this niche are primarily early-entrant specialty-product manufacturers and infotainment suppliers. The secondary level is composed mainly of various other infotainment, navigation and vehicle electronics manufacturers. Right now the market leaders account for just under 20% of the supplier landscape and take about 30% of the niche’s revenue share. In other words, companies identified as secondary participants have found ample space to compete.

With passive PAS systems so prevalent in the aftermarket and demand only growing, there is little to deter new market participants, especially on the retail and installer end. The systems make an ideal entry point to ADAS technologies—an emerging market that is now beginning to explode. These technologies will affect every level of the aftermarket in very short order, so now is the time to embrace the ADAS evolution.

| Stay Informed! |

The tremendous potential ahead for the specialty-equipment industry is detailed in the “SEMA Advanced Vehicle Technology Opportunities Report.” To download your copy, go to www.sema.org/avt-opportunities. For additional information about ADAS technologies and how they may impact your business, visit the SEMA Garage Vehicle Technology webpage at www.semagarage.com/services/vehicletechnology. |