By Mike Imlay

In concept, wheels and tires seem simple enough. They’re round, grip the road, spin on their axles, bear the load of a car or truck, and take a vehicle where it needs to go. What more can be said?

For the aftermarket, plenty more. The right wheels and tires enhance a vehicle’s performance, but more than that, they also make a statement. Plus, they continue to advance in complexity and design year after year. These and other factors have made them a favored category for the aftermarket.

As vehicles and their technologies evolve, so do wheels and tires. And the specialty automotive industry continues to play a leading role in bringing new solutions to these popular market segments.

In fact, wheels and tires, along with suspension components, rank among the industry’s healthiest product segments, according to SEMA Market Research Director Gavin Knapp. “We often say the wheel and tire segments are the ‘gateway drugs’ to our industry. They are great categories to be in because when consumers are spending, that’s their starting point. It’s a place where they can get the most bang for the buck in terms of customizing and personalizing their vehicles,” he said.

That spending is especially strong among pickup owners, he added. “Whatever you’re going to do with your pickup or 4x4, you’re going to get the wheels and tires for it. And if you’re going to lift it, you’re definitely getting new wheels and tires to go with that lift kit.”

Younger consumers with a penchant for sportier cars also find wheel and tire upgrades irresistible. “Whether you have a true performance vehicle and want its outside look to match what’s under the hood, or if you just want your Camry to look like it’s a performance vehicle, wheels and tires offer an ideal way to do it,” explained Knapp.

No wonder that—despite some initial worries in 2020—wheels and tires managed to not only ride out the pandemic but grow in sales. (Of course, tires had the added advantage of being a perishable necessity. “No matter what kind of car you have, whether it’s a gas car, an electric car, a truck, a van, or whatever, there’s always a need for tires,” Knapp observed.)

Sizing the Market

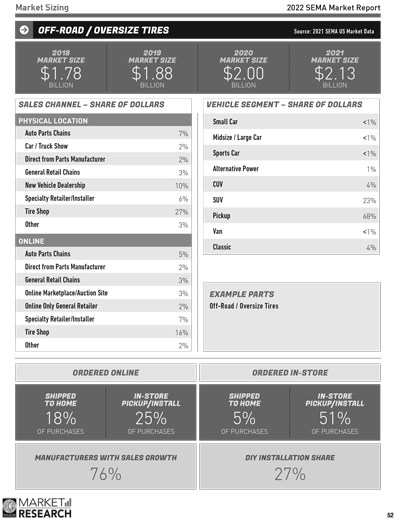

Pickups comprise one of the aftermarket’s largest segments, so it’s no surprise that they also represent the bulk of off-road and oversize tire sales, with SUVs a distant second. The explosion of interest in overlanding and off-roading during COVID lockdowns has no doubt contributed to market growth.

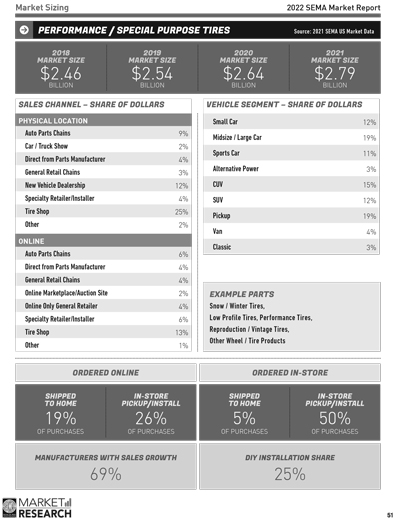

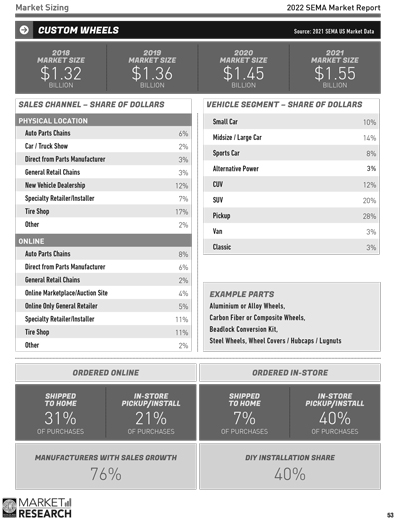

Just how big are wheels and tires with consumers? According to the “2022 SEMA Market Report,” the wheels, tires and suspension category accounted for $11.94 billion in sales, with wheels and tires contributing $6.60 billion to that total. Breaking down the figures further, the performance and special-purpose tire market was sized at $2.79 billion, off-road and oversized tires at $2.13 billion, and custom wheels at $1.55 billion. All these figures represent robust growth over prior years.

In terms of tire sales, performance and specialty categories do well across nearly every vehicle segment. Not surprisingly, pickup applications comprise 68% of off-road and oversize tire sales, with SUVs coming in a distant second at 23% of sales. The bulk of purchasing for all tire types is done in-store, although DIY installations account for 27% of off-road and oversize tire buys, and 25% for performance and specialty tires.

Pickup applications also make up the highest percentage of custom wheel sales (28%), followed by SUVs (20%), midsize and large cars (14%), CUVs (12%), small cars (10%) and sports cars (8%). Nearly half (40%) of all wheel purchases are made for in-store pickup and install. Online ship-to-home orders account for 31% of purchases, and online orders for in-store pickup and installation comprise 21% of purchasing.

Trend Watching

As with tires, sales of custom wheels also continue to trend upward, with pickup and SUV applications leading the way. Wheels have traditionally ranked among the first appearance modifications that vehicle purchasers make to their car or truck, and often prime the pump for additional aftermarket sales.

Moreover, with a few caveats, the future continues to look bright for wheel and tire businesses. “Based on input from [our] members, we see many positive wheel and tire trends going into 2023. In general, supply-chain issues seem to finally be resolving. Losses for 2022 seem to have stabilized, and our RTO customers are increasing,” said Mike Lusso, SEMA Wheel & Tire Council (WTC) chair-elect.

“Also, there has been development in electric vehicle (EV) technology across all major brands, along with the tires and wheels that support those vehicles. The development of non-pneumatic tires continues as well. With supply-chain issues somewhat easing, we are also seeing overseas brands that had issues fulfilling demand during the pandemic starting to flood the market,”

However, Lusso added, “for industry businesses, challenges remain. For instance, parts for testing machinery are up to 200 days out in some cases, and materials testing delays can be up to five months. Plus, with inflation, consumers are starting to stretch their dollars. We are seeing an ‘emptying out’ of demand in the Tier-2 space with more consumers seeking Tier-3 supply.”

Beyond 2023, industry experts say they’ll also be keeping their eyes on the following market trends:

- As pickups—and especially CUVs—come to dominate the American market over the next decade, wheel and tire offerings in the light-truck category will likewise proliferate.

- With off-roading, overlanding and powersports also growing in popularity, consumer demand for applications aimed specifically at those pursuits will only rise.

- Increasing competition among China, India, Thailand and Vietnam will likely help manufacturers contain costs while expanding production.

- Advancing technology and logistics will allow manufacturers to make and move product faster and more efficiently.

- The rise of EVs will spur wheel and tire makers to address issues associated with higher torque, increased wear and tear, rolling resistance, weight and quiet operation.

- Additionally, as EVs go mainstream, their owners will likely become more open to vehicle modification than they typically are now, increasing wheel and tire sales in this space.

- Green and sustainability regulations and initiatives will undoubtedly also exert greater influences on the choice and sourcing of raw materials as well as manufacturing processes.

With these trends taking shape, competition is already heating up, especially among tire makers. And that competition has made marketing more important than ever, said Roman Racela, marketing director for the Venom Power and Predator Tire brands, subsidiaries of Transamerica Tire based in Memphis, Tennessee. Both the brands target the coveted truck demographic.

“Obviously, there are many tire companies [and] other brands that we have to compete with,” he explained. “We need to make sure that we have a good product and that people know about the brand.”

For Racela, that has meant strong print and social-media campaigns with a heavy dose of influencer endorsements and consumer education.

“The selection for tires on any vehicle is really important,” he observed. “It really boils down to philosophy of use. If you’re going to use it for a specific purpose, you have to match your tools to accomplish your goals to reach your destination.”

Fortunately, in today’s tire market there’s something for everyone. Aided by advanced technologies, tire designs and compounds continue to evolve, delivering constantly improved handling, grip and wet traction, plus improved rock and debris ejection to boot.

And Racela sees additional industry opportunities in the expanding EV segment, where consumers are looking for both weight reduction and silent rides. “Having an electric motor, there’s no sound. But when you’re on the road using the wrong tire, you hear road noise or the harmonics of the tire. That kind of defeats the purpose of having an electric motor,” he said.

Of course, there is more to the tire market than the rubber itself. For tire sellers, ancillary products that can increase margins include TPMS replacement units and intelligent tire-mount sensors capable of providing a wide variety of tire-life, pressure and safety data. Needless to say, there is also a large market for shop and consumer tools, including powerful, compact compressors for airing up on the road or trail.

Flashy Wheels

Last year, this magazine reported that while pandemic lockdowns and supply-chain issues had briefly roiled the wheel market, the segment was proving resilient and poised for growth. If anything, the 2022 SEMA Show confirmed that. Wheel exhibitors showed up en masse, and the big trends were aggressive new spoke patterns and dazzling wheel finishes for trucks as well as street performance cars.

“Obviously following a lot of adjustments in the market with performance parts, customers are looking for safe, reliable modifications, and rims and tires have proven to be that,” said Nicolas Nazzaro, CEO of Subimods, a Bloomfield, Connecticut, online retailer specializing in the Subaru sport compact aftermarket. “In terms of style, it’s across the board. Six spoke, five spoke, flashy colors. Very popular in 2022 [were] yellows, blues, oranges, whites, just nonstandard colors and designs. We find that the consumer base that we cater to likes to know that their money delivers a flashy design. They want to stand out.”

Chrome wheels also remain highly prized, which brought Superior Industries to the 2022 SEMA Show as a first-time exhibitor. Based in Southfield, Michigan, the company has been in the OEM wheel business since 1957, and believes its OEM-level technology is now a good fit for the aftermarket.

“We’re able to offer superior powdercoating and acrylics,” said Jim Kruse, the company’s senior account manager for aftermarket wheels. “As far as finishes go, we offer any color you can imagine in the rainbow.”

According to Kruse, Superior Industries also boasts the only OEM-approved PVD chroming process in the industry. “We’ve learned there’s a lot of interest in coming back to bright chrome, and the PVD option is very environmentally friendly,” he said.

The company further specializes in a laser-etching process that can reach down through different color layers applied to a wheel to create daring, intricate line patterns in the finish.

In regards to the wheels themselves, “flow-forged” products appear to be gaining in popularity due to their weight savings compared with cast wheels and their lower price points compared to forged wheels.

“Flow-forging technically is one of the most up-and-coming [manufacturing techniques] that we see,” said Nazzaro. “There are a lot of new brands coming out of the Asian Pacific sector that are doing flow-forging, taking that path and kind of rolling the wheel out. That is probably the most advanced product that’s coming out because forged wheels were usually on the highest end of spectrum on price, with your cast, flow-form stuff on the bottom. So bridging that gap is going to be key to success in 2023, because end users get a really well-put-together product for a mid-level price.”

Meanwhile, the wheel accessories market is also looking up, said Chris Buck, owner of Custom Wheel Accessories. Based in Murrieta, California, the family-run wholesale distributor is celebrating its 40th year of supplying a full line of lug nuts, spacers, valve stems, wheel weights, and all the hardware needed to mount and balance wheels. Buck said that after a year of sputters, supply-chain issues are notably improving.

“Shipping costs from overseas are coming down—they’re about half of what they were a year ago,” he said. “Where we got hit was fuel costs and shipping costs from Asia to the Americas. It seems like material costs are starting to settle down.”

Asked what the current big sellers are, Buck replied: “OEM, Ford and GM lug nuts are very hot, but probably our hottest commodity are aluminum spacers. Whether you’re spacing the wheels out for a more aggressive look, or if you have a set of wheels you want to put on a vehicle of a different bolt pattern, we offer almost 400 SKUs of just spacers and adapters alone.”

“Some of the old vintage stuff has definitely been dying off—hubcaps, knockoff spinners, things of that nature,” he continued. “But we’re trying to bring that stuff back because they’ve been phased out over time and there is still a demand for older vehicle stuff [like] wire wheels and spinners.”

“In recent years, it’s been hard to get that product for a lot of people because the minimums are so high to bring in that kind of product. But we’re changing our philosophy because there’s a market for it. We’re going to lay out the capital to get the molds going again and bring in some of that old-school stuff to take care of the guys with cars that are 30, 40, 50 years old.”

The Road Ahead

Although generally optimistic about the coming year, industry sources do see some challenges ahead. Inflation and a threat of recession top the list of concerns. In addition, with new-vehicle purchases often driving aftermarket wheel sales, slacking OEM dealership sales may negatively impact the wheel market. Current used-car prices may also hinder the transfer of older vehicles to new owners who might be inclined to dress up their purchases with striking new wheels. Fresh business models like mobile installation may further upend traditional brick-and-mortar operations.

Longer term, Lusso sees increasing challenges for the industry from advancing vehicle trends like electrification and advanced driver assistance systems (ADAS). New technologies are driven by market consumption, he said, “and shop owners need education to support the vehicles they see in the shop.”

“Wheels and tires are the first things to hit the road, so we need good education around the effects they bring to the vehicle,” he added. “There will also be new challenges in wheel and tire manufacturing, pricing, training and staffing. In fact, training and retention of front-line personnel is still a major opportunity.”

While conceding that keeping up with change and emerging technologies can be costly—especially in the current economy—Lusso believes investments now will benefit individual companies and the entire industry at large. “We need to push forward,” he said.