By Mike Imlay

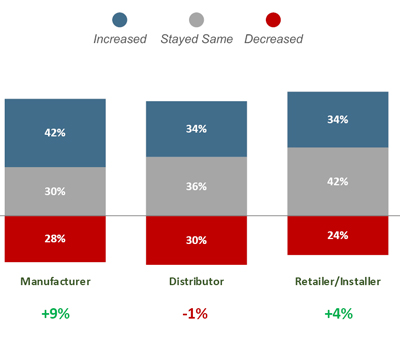

The specialty-equipment industry’s record-high sales growth over the past two years has begun to level off and possibly subside, according to the latest SEMA market research. Still, despite ongoing economic uncertainty, supply-chain issues, and rising costs, companies remain optimistic as sales remain solid and above pre-pandemic levels.

“Businesses experienced record-high growth the past two years,” said Gavin Knapp, SEMA director of market research. “We saw growth that was above the industry’s norm, so it makes sense that we’re returning to more normal levels. It’s great to see that most companies are up from 2019 levels.”

Conducted every six months since 2021, the “SEMA State of the Industry” studies are designed to give companies clarity about the overall market during an uncertain time. The disruption from the pandemic made it difficult for SEMA members to understand what the market was going through—and nearly impossible to forecast. Based on data from the automotive specialty-equipment industry, the reports give readers a barometer to gauge how they are currently doing and make predictions about what’s to come.

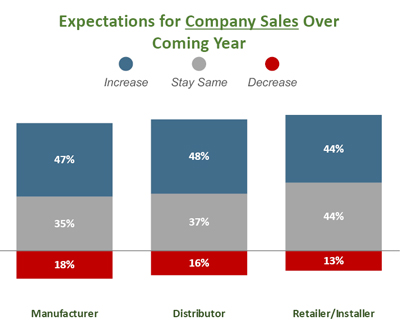

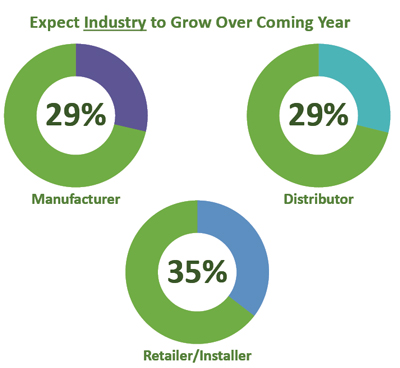

Available for free download at www.sema.org/research, the fall 2022 version finds that 47% of manufacturers, 48% of distributors, and 44% of retailers expect sales to increase in the coming year. Additional findings include:

- Supply-chain issues continue to be disruptive for the industry. More than 90% of companies say that they are having a moderate or significant impact on operations.

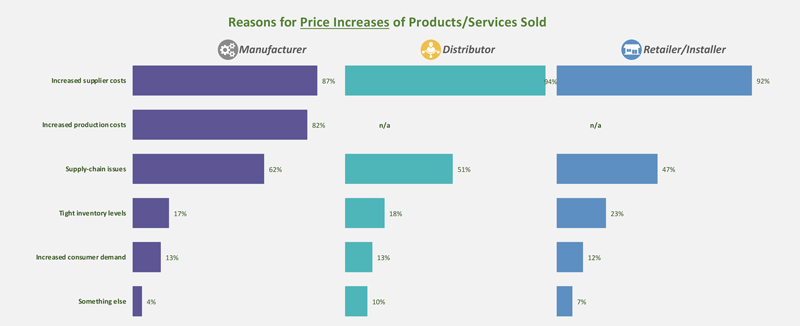

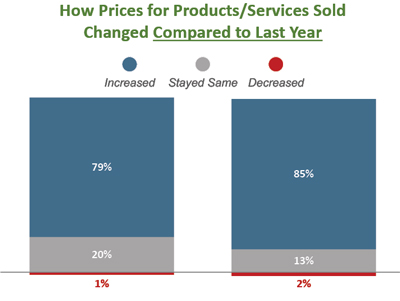

- Inflation and supply-chain issues are resulting in higher costs for businesses. More than 90% of companies reported an increase in supplier or production costs; most (around 80%) are compensating for the high costs by increasing their prices. Despite this, consumer demand and revenue remain strong.

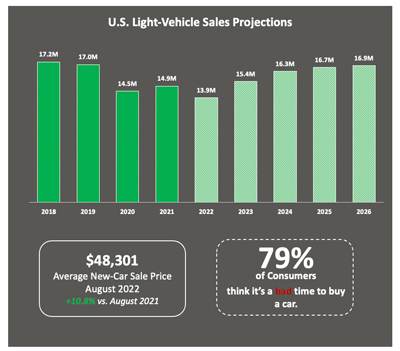

- Ongoing supply-chain issues and high prices are slowing new-vehicle sales. Sales are not expected to return to pre-pandemic levels until 2024 or 2025. Sales for 2022 are expected to fall about a million vehicles short of 2021, at 13.9 million total units. The average price of a new vehicle reached $48,301 in August 2022, a record high. The average price of an electric is even higher, at more than $66,000.

Market Gains

“The purpose of this report is to provide specialty equipment businesses with the data they need to make better, more informed business decisions,” said Knapp. “If you think back to the start of the pandemic, you would never have predicted what has happened to our industry over the last two years. Even with all the weirdness affecting retail and in-person sales, and even with the supply-chain issues, our industry has done really well. It has seen incredible sales growth.”

Reporting from specialty-equipment companies indicates that industry sales had begun to normalize in 2022 after the record sales seen in the prior year. Despite ongoing economic uncertainty, companies also were generally optimistic about sales going into 2023.

“But the reality is this sales growth was never sustainable,” he continued. “We can’t expect an industry with a history of 4% or 5% per-year growth to suddenly see a new reality of 10%–20% annual growth.”

According to Knapp, the slowdown in industry sales is indicative of a return to a more normalized growth curve. Barring any major shakeups, the overall aftermarket will continue its upward climb, but along a trendline that’s much less steep.

When asked about pricing increases, manufacturers, distributors and retailer/installers cited increased supplier and production costs as well as ongoing supply-chain issues as the greatest contributing factors.

That’s not to say that there won’t be headwinds. “Our in industry is definitely optimistic, but there are challenges that we are keeping an eye on,” said SEMA Market Research Manager Kyle Cheng. “Auto sales are down from where they usually are, and our industry thrives on the timeframe around an initial sale for adding parts. Also, while we didn’t really talk about gas prices in this report, that’s also something we’re monitoring. And then inflation is not just affecting consumers, it’s affecting our industry’s businesses as well. With a lot of economists projecting a potential recession, that’s a concern.”

However, as of the report’s release, consumers were still in a spending mood, despite rising costs. This was allowing manufacturers and retailers to deal with upward price pressures by passing them on to end purchasers.

“It was a little surprising to see how many companies raised prices, because at the beginning of the pandemic, companies said that things were getting more expensive, but they weren’t going to pass their costs to consumers. They weren’t at that point then, but now they are,” said Cheng. “Yet, even with all this, the companies we surveyed were still feeling pretty confident in terms of maintaining or even growing their business in 2023,” said Cheng.

Retail Rebound

While hit early on by pandemic lockdowns, industry retailers also appear to have weathered the past two years surprisingly well. Although larger retailers reported comparatively stronger sales, most smaller retailers said they managed to maintain or grow their sales too. In fact, similar to the optimism expressed by industry manufacturers, “retailers are feeling in a much better place now in terms of their customer bases and sales,” said Knapp.

“I think back to a time during the pandemic when manufacturers were doing great, and retailers were asking, ‘Wait, what about us? How do we get people back in our stores?,’” recalled Knapp. “Now we’ve gotten to that place where most people are getting back into stores, out in the public and utilizing traditional retail.”

Across the board, retailers increased their prices in 2022, and expect to continue raising them this year as well.

Cheng added that progress in addressing supply-chain issues has helped buoy retailers. At the height of the pandemic, severe shortages drove many consumers away from brick-and-mortar outlets and toward manufacturer-direct sales channels. Now, however, retailers are sensing a return to more traditional shopping and purchasing patterns.

Moreover, although many aftermarket businesses report that they’re still feeling moderate to severe supply-chain disruptions, overall inventories have improved. “Retailers are finding they do have products to sell and are definitely reaping the benefits of that,” Cheng noted.

Large or small, most of the retailers surveyed expected inventories to stay the same or grow in 2023, even as they expected supplier costs to continue to rise. Most also forecasted that their revenues and customer bases would remain stable or increase.

Growth Across Channels

Interestingly, even as retailers regained their footing, manufacturers grew their sales across many channels over the past year. Most manufacturers now sell through a mix of online and in-person channels, with specialty retailer and direct-to-consumer sales making up their biggest sales shares. In terms of online sales, 37% of manufacturers reported an increase in direct-to-consumer sales, compared with 16% saying they increased their online specialty-retailer sales. Just over 20% of manufacturers also said they increased their general online-only retail sales. As for in-store channels, 29% said they grew their sales through independent specialty retailers.

Ongoing supply-chain issues and rising prices are slowing new-vehicle sales. Since vehicle accessorization is often tied to new purchases, this impacts the aftermarket.

This touches upon a hot-button issue of late. Spurred by lockdowns and supply-chain breakdowns, the growth in direct-to-consumer sales has generated some concern among brick-and-mortar retailers who fear a potential loss of business. But SEMA market research indicates that the “threat” to traditional sales channels is likely overstated.

“We consistently find that only around 30% of manufacturers say they sell direct-to-consumer, either through their own website, through some other channel, or in person,” explained Cheng. “Such sales are definitely growing, but the vast majority of sales are still going through other channels, such as distribution networks, wholesalers or straight to the retailers themselves.”

While many companies expressed optimism about their own growth in 2023, their expectations for overall industry growth were more muted given the current economic climate.

Ironically, the bigger a company is, the less likely it is to offer direct-to-consumer sales, added Cheng. Larger manufacturers, with sales of $5 million or more annually, tend to enjoy well-established distribution chains and a healthy presence in retail stores. Only 19% reported utilizing direct-to-consumer channels. By contrast, 39% of companies posting sales under $5 million a year included direct-to-consumer channels in their marketing mix.

“Companies with established brands tend to be our industry’s bigger companies,” explained Knapp. “They have distribution networks and retail knows them, their customers and their brands, and therefore they’ll carry those brands because they know they can sell them.”

“It’s the newer brands or startups and smaller brands fighting to get that name-brand recognition that typically go direct-to-consumer,” Knapp continued. “A lot of times it’s more beneficial for them to try and develop that brand reputation directly with the consumer rather than drive

consumers to general retail where they don’t have the same distribution network set up.”

On the retail side, many businesses saw sales increases over the past year through their company websites (16%), car and truck shows (16%), brick-and-mortar storefronts or shops (18%). Moreover, while online sales may have accelerated during the pandemic, retailers on the whole still report selling more through physical channels (59% of sales) than they do through online channels (41% of sales).

Consumer Sentiment

Of course, the big question now is how much a struggling economy (including a possible recession) might slow future growth. According to Knapp, a lot will ride on the job market and consumer tolerance for inflation.

“For now, the job market is still really good,” he observed. “And if you look at the consumer side, you know there was sort of a feeding frenzy during the pandemic. The attitude seemed to be, ‘We have less things we can do, so let’s focus on the things available to us.’ And even then, consumers saw a lot of price inflation due to long waits and scarcity. So in that regard, I think consumers have gotten used to inflation a lot more than economists have assumed.”

“If you’re a consumer, what the economy means to you is whether you’re taking money in. Are you getting a paycheck every month? So from that standpoint, consumers may not feel a reason to stop buying because they’re not feeling personally in danger. The individual decisions that consumers make are often much different than what economists look at on a global, macro scale.”

For now, there’s every expectation that aftermarket sales will experience some adjustment as they return to pre-pandemic patterns, albeit at higher sales volumes. And even if a recession should take hold, most experts agree it won’t be as deep as the Great Recession just over a decade ago.

“The bottom is not likely to drop out,” concluded Knapp. “The reality is that only about a third of the companies we surveyed said they were slowing down. Two-thirds said they were still maintaining their sales levels or even growing somewhat.”

“That’s really encouraging to see in this time where there are all these headwinds, whether they be related to supply chains, the economy, or even just a sort of backlash after all the tremendous growth we experienced that never could be reasonably sustained for long. In the end, we were always going to have to slow down a little. But with the majority of our companies saying they’re still doing pretty good—and expecting to do well again this year—the industry as a whole is remaining pretty confident.”

Stay Up-to-Date

The complete “State of the Industry—Fall 2022” report is available to download for free at www.sema.org/research. It was also the subject of an in-depth 2022 SEMA Show seminar titled “State of the Specialty-Equipment Industry: Trends and Directions,” now available on demand.