RESEARCH

Charting Growth and Headwinds

The “SEMA Future Trends 2023” Report Can Help Make Sense of a Shifting Market

By Mike Imlay

The “SEMA Future Trends 2023” report bundles key economic and industry metrics to assist companies with their planning and decision-making.

Shifts in the automotive industry and the overall U.S. economy greatly impact the specialty-equipment industry. To stay competitive, aftermarket businesses need to know what’s trending now and where markets are headed. The latest “SEMA Future Trends 2023” report provides industry planners a detailed analysis of key metrics for 2023 and beyond.

Released in the first quarter of 2023, and available at www.sema.org/research, the report is the most recent installment in an ongoing series of SEMA Market Research forecasts designed to help specialty-equipment businesses plan not just for the year ahead but for the longer haul.

“Our ‘SEMA Future Trends’ reports are designed to help aftermarket companies of all types make informed decisions,” said SEMA Market Research Director Gavin Knapp. “Like others in the series, this report presents an industry outlook while taking a look at the economic factors, vehicle trends and emerging technologies that are driving short- and longer-term market shifts.”

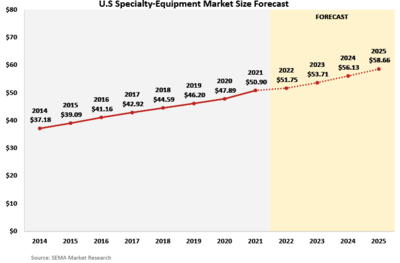

U.S. specialty-equipment market size forecast

Over the course of the pandemic, the aftermarket not only recovered but thrived, with specialty-equipment sales reaching a record high of $50.9 billion—a growth of 6% over 2020. Projected growth into 2025 is less sharp, but positive nonetheless.

Industry Outlook

According to the report, the specialty automotive industry found itself well positioned going into 2023. Despite the early shock of the pandemic, most aftermarket businesses managed to thrive. Bolstered by stimulus money and left idle from lockdowns, consumers embraced all the freedoms their automobiles could offer. Many turned—or returned—to wrenching, while others went recreating, off-roading, or off the grid altogether through overlanding. The result was a tremendous spike in industry sales, which reached a record $50.9 billion.

“In 2021, we saw a gigantic jump of 6%, thanks to a lot of the continued spending,” observed SEMA Market Research Manager Kyle Cheng. “But a lot of the extra stimulus and spending money that was out there has now dried up, so we estimate that spending on our industry will only grow about 2% this year. Typically, we see about 3% to 4% growth each year, and after 2023 we anticipate things will move back toward our normal range of about 4% in 2024.”

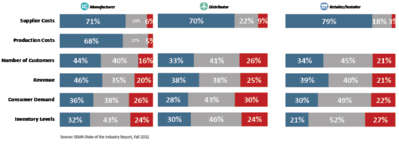

The report’s survey of industry businesses found general optimism for 2023. Among manufacturers, 47% predicted growth, with 35% expecting their growth to remain about the same. Those figures are roughly similar for industry distributors, while most retailer/installers remaining equally split in their predictions of growing (44%) or holding steady (44%). While acknowledging the increased costs of doing business, all industry sectors reported that demand for their products remained solid overall.

business metric expectations for 2023

Industry companies expect revenue, number of customers and customer demand to remain solid this year. However, business and production costs are expected to be expensive. Concerns around inventory and supply chains also linger.

Economic Forces

Of course, the industry doesn’t operate in a vacuum, so the “SEMA Future Trends 2023” report also takes a look at key indicators in the wider U.S. economy. “There are a number of forecasts in our report,” said Knapp. “We should mention that the forecasts we share are not our own, but forecasts sourced from some of the nation’s leading banks and institutions.”

“Basically, the data we sourced reveals a lot of strength right now,” added Cheng. “We have good signs that the labor force is tight. The unemployment report that came out in early 2023 showed an unemployment rate at its lowest point since 1969. So we have a lot of things going for us, but there are some obvious headwinds.”

With the Federal Reserve continuing to raise interest rates, a potential recession remains top of mind. While the report delves into economic data that might signal a recession, it stops short of making any definitive pronouncements. As of press time, the recessionary tea leaves were still too difficult to read with any precision.

“Forecasting is always more art than science, and it’s really difficult to predict what’s going to happen in the future,” said Knapp. “Again, we aren’t trying to be economic prognosticators with this report. Instead, we’re gathering the relevant information that is out there and bundling it together into the metrics that we think are germane to our industry. We’re presenting the data to help our industry understand what’s trending for their businesses.”

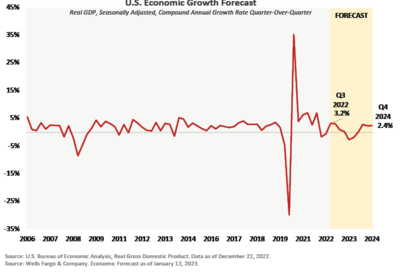

U.S. economic growth forecast

Despite uncertainty, the U.S. economy entered 2023 with momentum. At press time, however, economic indicators were still mixed, with a dip in growth projected into 2024.

Take for example U.S. consumer spending, which held solid into 2023 despite any concerns consumers might be harboring over a recession. In fact, going into last year’s fourth quarter, consumer spending had hit $45.2 trillion—its highest level in U.S. history. In large part, this was due to stimulus-built savings and disposable income.

Consequently, U.S. retail sales saw strong growth in 2021 and 2022, which also reached a record high of $2.05 trillion by the third quarter 2022. However, by November 2022, with stimulus money waning, consumer spending fell back toward normal levels. So far, spending on goods and services has remained resilient, but moving forward, retail sales will likely fall further in the later half of 2023. After this leveling off, they are expected to resume their upward trajectory in 2024. (It’s worth noting that despite any temporary dip, sales still end up exceeding their pre-pandemic levels.)

“Again, the overall takeaway is that some of these indicators are really good,” observed Knapp. “For example, low unemployment would traditionally be considered a really good indicator for the economy. But the economy is giving off mixed signals right now. We had a big jump in inflation, although it’s coming down.”

Cheng added, “We think that inflation has peaked and is still going down. But a drop from 9% to 7% still means that prices are up about 7% versus last year. So that’s also something to keep an eye on.” Plus, he added, data shows consumers increasingly turning to their credit cards for purchases.

“At this point, the most favorable factor is that consumers are still spending money,” said Knapp. “When you think about the Great Recession from about 2007 to 2009, there was a real scare put into consumers, and people stopped spending. That’s not happening right now. They’re not feeling the need to pull back.”

The pandemic also left other lingering headwinds for specialty-automotive businesses. According to the report, more than 90% of specialty-automotive companies say that supply-chain issues had a moderate to significant impact on their operations in 2022. The good news is the vexing bottlenecks have largely dissipated. American ports—especially those of Los Angeles and Long Beach, California—are now less congested. The nationwide trucking situation has also noticeably eased, albeit with an ongoing driver shortage. Costs associated with shipping have dropped as well. In general, economists expect world supply chains to continue their recovery this year. Still, it will likely take time for all the creases to iron out.

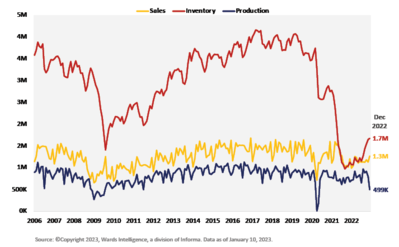

Among those creases is the semiconductor or “chip” shortage. While average lead times for chips have fallen, they remained high at 25.5 weeks as late as the fourth quarter of 2022. This in turn has slowed new-vehicle production and sales—a situation that’s likely to continue for some time.

“Even if we had as many chips as we did in 2019, we would still not have enough to meet the demand because the cars today actually require more chips than they did back then. It’s something of a challenge that the automotive industry is working to overcome,” observed Cheng.

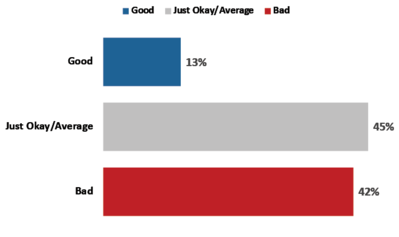

how industry companies view U.S. Economy and business climate

Going into this year, the industry expressed concerns about the U.S. economy even as they continued to report solid sales numbers. Most (60%) viewed the economy as either good or just average.

Vehicle Trends

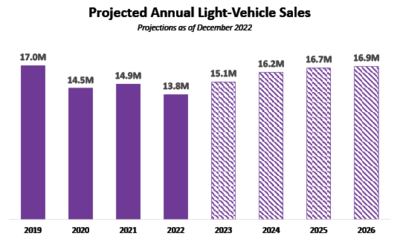

Meanwhile, the rapid rollouts of new vehicle technologies and platforms continue to reshape every level of the aftermarket. To help industry businesses better understand their implications, the “SEMA Future Trends 2023” report pays considerable attention to new and used vehicle sales trends, developing OEM platforms, and advances in vehicle electrification and advanced driver-assistance systems (ADAS).

“We talk at great length about numerous trends, starting with how sales have been affected since the pandemic,” said Cheng.

The research suggests that U.S. automotive sales are still in a post-pandemic recovery, and probably won’t normalize until 2025. By late 2022, record-high vehicle costs, rising interest rates and supply-chain issues had all contributed to a sales slowdown. In fact, for the first time since early 2021, new light-vehicle inventory has significantly outpaced sales. As a result, OEMs are now tapping the brakes on production.

With an average new-vehicle price tag hitting $49,507 without applied consumer incentives, it’s no surprise that 77% of consumers now think it’s a bad time to buy new. But those turning to the used-vehicle market aren’t finding much solace. Now that owners are keeping their cars longer, used inventory has also tightened, driving up prices. What’s more, interest rates for used-vehicle loans are almost double those of new vehicles (at 9.34% versus 5.16%). Like the new-vehicle market, SEMA market research projects that it will take until 2025 for used sales to return to pre-pandemic levels of 40 million units

per year.

Those sales trends present both challenges and opportunities for the aftermarket. On one hand, owners are most likely to modify their new or used vehicle within the first several months of purchase. On the other, owners who are now holding onto their vehicles longer may be more inclined to freshen up their car’s or truck’s looks and performance.

Even as sales recover, OEMs are making dramatic changes to their platform offerings. Notably, they are abandoning traditional sedan models in favor of light trucks, mainly in the form of crossover utility vehicles (CUVs).

“Twenty years ago, an SUV or a crossover almost didn’t exist,” said Knapp. “Today they are the biggest vehicle segment on the road. For, example, if I were to say that Volkswagen is primarily a truck company, I think that would surprise most people. But 80% of their current sales are in the light-truck space.”

In fact, throughout today’s car market, light trucks outsell cars four to one, but Knapp hastened to add that the statistic doesn’t mean that pickups outsell cars four to one. “Light trucks include pickups, vans, SUVs and CUVs,” he explained.

U.S. New Light-Vehicle Sales, Inventory and production

For the first time since early 2021, new light-vehicle inventory outpaced sales by a significant margin. Thanks to their high cost, rising interest rates and limited availability, vehicle sales slowed in the latter half of 2022.

Meanwhile, automakers are aggressively electrifying their vehicle fleets in a drive to meet government goals and reduce manufacturing costs. (Electric vehicles [EVs] require fewer supply chains and parts to produce, increasing their profit potential.)

However, the road to gold isn’t necessarily paved with lithium—EVs bring their own set of conundrums. Consumers still have reservations about the technology, especially when it comes to vehicle cost, range and charging convenience. Plus, there are hidden costs to the environment, including the mining of toxic heavy metals and the disposal of spent battery waste. Charging infrastructure and EV production capacity are also a far cry from what will be required to meet ambitious government and OEM electrification goals.

“Despite all the recent EV mandates, including the vehicle sales mandate in California, we still anticipate that, by 2035, total EV sales will be about 39% of the market, with the entire alternative-power segment being just over half of all new-vehicle sales,” said Cheng. “That’s a lot more conservative than some other sources are saying, but given the challenges and the production levels they’re at right now, we think that there are still a lot of barriers to entry that prevent more aggressive adoption.”

Meanwhile, the aftermarket is still assessing what it can do for EVs, and vice versa. Only 15% of manufacturers and 12% of retailer/installers surveyed see electrification as a high-level opportunity. In contrast, 37% of both manufacturers and retailer/installers characterize the opportunity as low, with sizable numbers saying they simply don’t know enough to make an evaluation (24% and 31%, respectively).

The bottom line? Yes, the march toward EVs is real. But with 300 million gas-powered vehicles currently in use, internal combustion engines will dominate American roadways for decades to come.

What’s also real is the rapid deployment of advanced driver assistance systems (ADAS) in new vehicles—and their broad implications for the aftermarket. More than 80% of ’21 vehicles featured collision-warning or speed-reduction/mitigation systems. Lane-departure warning, blindspot alert and pedestrian detection systems are also increasingly becoming standard features, along with adaptive cruise control and other safety-performance technologies. Such systems are already impacting aftermarket and collision repairs, services and modifications, from wheel and tire combos, to suspension, lift and bumper upgrades, as well as other appearance items.

Going forward, the report also identifies several areas of expanding opportunity for the aftermarket. “Many companies are seeing some pretty strong opportunity in our traditional base categories like off-roading, muscle cars, sporty cars, classics and hot rods,” said Knapp, adding that the overlanding and powersports markets continue to grow as well. “Some companies are also coming around to EVs, but overall they’re expecting opportunity in many categories, which is always a good thing.”

Download Your Report

Download your free copy of the latest “SEMA Future Trends Report 2023” at www.sema.org/market-research. While there, be sure to check out the many other SEMA Market Research reports relevant to your business.

View the “SEMA Future Trends” Webinar

An in-depth discussion of the “SEMA Future Trends Report 2023” and its findings can also be viewed as on-demand video, titled “SEMA Future Trends: Outlook 2023 and Beyond,” at https://learning.sema.org/products/sema-future-trends-outlook-for-2023-and-beyond.

The National Hot Rod Association (NHRA) and the Bandimere family have jointly announced that the 2023 Dodge Power Brokers NHRA Mile-High Nationals (July 14-16) will be the last NHRA national event at Bandimere Speedway just outside of Denver. The Bandimere family has agreed to sell the current property and land in Morrison, Colorado, but plans to relocate the historic NHRA-sanctioned drag strip to another location in the Denver area, officials said.

The National Hot Rod Association (NHRA) and the Bandimere family have jointly announced that the 2023 Dodge Power Brokers NHRA Mile-High Nationals (July 14-16) will be the last NHRA national event at Bandimere Speedway just outside of Denver. The Bandimere family has agreed to sell the current property and land in Morrison, Colorado, but plans to relocate the historic NHRA-sanctioned drag strip to another location in the Denver area, officials said.

Motion Industries has announced the promotion of Patrick Cummings to senior vice president and CFO. Cummings first joined Motion in 2012 as AVP of corporate compliance. He held the position of U.S. controller from 2014-2019, before becoming vice president of financial planning and analysis, until he was asked to serve as interim CFO after Greg Cook, Motion's previous CFO, moved to the U.S. Automotive Group at Genuine Parts Company (GPC). Cummings will report to Breaux and will also work closely with Bert Nappier, executive vice president and CFO of GPC.

Motion Industries has announced the promotion of Patrick Cummings to senior vice president and CFO. Cummings first joined Motion in 2012 as AVP of corporate compliance. He held the position of U.S. controller from 2014-2019, before becoming vice president of financial planning and analysis, until he was asked to serve as interim CFO after Greg Cook, Motion's previous CFO, moved to the U.S. Automotive Group at Genuine Parts Company (GPC). Cummings will report to Breaux and will also work closely with Bert Nappier, executive vice president and CFO of GPC.

STA-BIL and 303, two automotive aftermarket brands manufactured by Gold Eagle Co., have announced the company's second annual Cars & Coffee. This free public event will showcase a large collection of luxury, classic and sports cars combined with coffee and light refreshments. Scheduled for Saturday, May 6, from 9:00 a.m. until 12:00 p.m., the event is being held at the company's headquarters in Chicago.

STA-BIL and 303, two automotive aftermarket brands manufactured by Gold Eagle Co., have announced the company's second annual Cars & Coffee. This free public event will showcase a large collection of luxury, classic and sports cars combined with coffee and light refreshments. Scheduled for Saturday, May 6, from 9:00 a.m. until 12:00 p.m., the event is being held at the company's headquarters in Chicago.

European Top Fuel record holder Ida Zetterström has announced a new global partnership between Edelbrock Group and KW Parts to support her efforts in winning the FIA Championship driving for RF Motorsport. Edelbrock Group helped Zetterström in her successful first FIA Top Fuel season in 2022, where the team became the first to clock a 3.7-second pass in Europe and picked up their first FIA event win together at Tierp Arena in Sweden. For 2023, Edelbrock is expanding its commitment to become a primary partner on her dragster alongside new sponsor KW Parts.

European Top Fuel record holder Ida Zetterström has announced a new global partnership between Edelbrock Group and KW Parts to support her efforts in winning the FIA Championship driving for RF Motorsport. Edelbrock Group helped Zetterström in her successful first FIA Top Fuel season in 2022, where the team became the first to clock a 3.7-second pass in Europe and picked up their first FIA event win together at Tierp Arena in Sweden. For 2023, Edelbrock is expanding its commitment to become a primary partner on her dragster alongside new sponsor KW Parts.

Polaris Inc. has announced the first shipments of its all-new electric RANGER XP Kinetic vehicles are headed to dealers this week for customer pickup. Polaris manufactures its fully electric RANGER XP Kinetic off-road vehicles at the company's more than 900,000-sq.-ft. manufacturing facility in Huntsville, Alabama. Polaris plans to take additional orders on the RANGER XP Kinetic this summer. The RANGER XP Kinetic features an all-electric powertrain, engineered for off-road use through Polaris' exclusive 10-year partnership with Zero Motorcycles.

Polaris Inc. has announced the first shipments of its all-new electric RANGER XP Kinetic vehicles are headed to dealers this week for customer pickup. Polaris manufactures its fully electric RANGER XP Kinetic off-road vehicles at the company's more than 900,000-sq.-ft. manufacturing facility in Huntsville, Alabama. Polaris plans to take additional orders on the RANGER XP Kinetic this summer. The RANGER XP Kinetic features an all-electric powertrain, engineered for off-road use through Polaris' exclusive 10-year partnership with Zero Motorcycles.

To celebrate HEMI Day on April 26, the Dodge brand launched a 22-minute video,

To celebrate HEMI Day on April 26, the Dodge brand launched a 22-minute video,