The RPM Act of 2017 needs your support. Even if you wrote to Congress in 2016, SEMA urges all race fans and businesses to take action again. Go to www.sema.org/RPM to support the RPM Act of 2017 and secure the future of racing today!

The RPM Act of 2017 needs your support. Even if you wrote to Congress in 2016, SEMA urges all race fans and businesses to take action again. Go to www.sema.org/RPM to support the RPM Act of 2017 and secure the future of racing today!

The RPM Act of 2017 needs your support. Even if you wrote to Congress in 2016, SEMA urges all race fans and businesses to take action again. Go to www.sema.org/RPM to support the RPM Act of 2017 and secure the future of racing today!

By Juan Torres

Meet one-on-one with up to 42 executives from top motorsports parts manufacturers in the industry during the 2018 MPMC Media Trade Conference. |

Journalists who want to receive the best possible schedule at the 2018 MPMC Media Trade Conference and obtain their schedules in early January are encouraged to register before December 21. Those who register afterward will receive their schedules on-site.

The 2018 MPMC Media Trade Conference, held January 23–25, 2018, at the Embassy Suites by Hilton in Santa Ana, California, gives editors and reporters the opportunity to take part in up to 42 private, uninterrupted meetings with executives from top motorsports parts manufacturers in the industry.

Media participation is free to all editorial representatives, making it the most affordable and efficient way for reporters to get detailed information specific to their audience needs and interests and gather a year’s worth of editorial content.

Meetings are scheduled based on the companies that journalists select on their applications, so participants are encouraged to pay close attention to the companies they select. Journalists should also mark “Do Not Meet” for the companies outside of their editorial needs.

Editors can register now for the three-day exclusive event.

For questions, visit www.sema.org/mtc or contact Juan Torres at juant@sema.org or 909-978-6722.

By Juan Torres

Meet one-on-one with up to 42 executives from top motorsports parts manufacturers in the industry during the 2018 MPMC Media Trade Conference. |

Journalists who want to receive the best possible schedule at the 2018 MPMC Media Trade Conference and obtain their schedules in early January are encouraged to register before December 21. Those who register afterward will receive their schedules on-site.

The 2018 MPMC Media Trade Conference, held January 23–25, 2018, at the Embassy Suites by Hilton in Santa Ana, California, gives editors and reporters the opportunity to take part in up to 42 private, uninterrupted meetings with executives from top motorsports parts manufacturers in the industry.

Media participation is free to all editorial representatives, making it the most affordable and efficient way for reporters to get detailed information specific to their audience needs and interests and gather a year’s worth of editorial content.

Meetings are scheduled based on the companies that journalists select on their applications, so participants are encouraged to pay close attention to the companies they select. Journalists should also mark “Do Not Meet” for the companies outside of their editorial needs.

Editors can register now for the three-day exclusive event.

For questions, visit www.sema.org/mtc or contact Juan Torres at juant@sema.org or 909-978-6722.

By SEMA Washington, D.C, Staff

The U.S. House of Representatives and Senate have passed different tax reform bills that must be reconciled into a single measure. A House/Senate conference committee has begun that process. Their goal is to have both houses of Congress pass a consensus bill and have the president sign it into law by the end of the year so that the tax law changes take effect January 1.

SEMA published a story November 23 that compared the House and Senate bills. Although the Senate bill was subsequently modified, the big question is which House and Senate provisions will be included and which will be dropped from the final bill.

Here are several key differences between the House and Senate bill:

- While the new 20% corporate rate would be permanent, it would not begin until 2019 under the Senate bill (2018 under the House bill).

- The House and Senate bills double the estate tax exemption to $11 million per person. The House bill repeals the estate tax entirely in 2024.

- The Senate bill maintains the current mortgage interest deduction of $1 million. The House bill cut it in half to $500,000.

- The House bill repeals the alternative minimum tax while the Senate bill maintains it.

- The Senate bill has seven tax brackets while the House has four.

For more information, contact Eric Snyder at erics@sema.org.

By SEMA Washington, D.C, Staff

The U.S. House of Representatives and Senate have passed different tax reform bills that must be reconciled into a single measure. A House/Senate conference committee has begun that process. Their goal is to have both houses of Congress pass a consensus bill and have the president sign it into law by the end of the year so that the tax law changes take effect January 1.

SEMA published a story November 23 that compared the House and Senate bills. Although the Senate bill was subsequently modified, the big question is which House and Senate provisions will be included and which will be dropped from the final bill.

Here are several key differences between the House and Senate bill:

- While the new 20% corporate rate would be permanent, it would not begin until 2019 under the Senate bill (2018 under the House bill).

- The House and Senate bills double the estate tax exemption to $11 million per person. The House bill repeals the estate tax entirely in 2024.

- The Senate bill maintains the current mortgage interest deduction of $1 million. The House bill cut it in half to $500,000.

- The House bill repeals the alternative minimum tax while the Senate bill maintains it.

- The Senate bill has seven tax brackets while the House has four.

For more information, contact Eric Snyder at erics@sema.org.

By SEMA Washington, D.C, Staff

The U.S. House of Representatives and Senate have passed different tax reform bills that must be reconciled into a single measure. A House/Senate conference committee has begun that process. Their goal is to have both houses of Congress pass a consensus bill and have the president sign it into law by the end of the year so that the tax law changes take effect January 1.

SEMA published a story November 23 that compared the House and Senate bills. Although the Senate bill was subsequently modified, the big question is which House and Senate provisions will be included and which will be dropped from the final bill.

Here are several key differences between the House and Senate bill:

- While the new 20% corporate rate would be permanent, it would not begin until 2019 under the Senate bill (2018 under the House bill).

- The House and Senate bills double the estate tax exemption to $11 million per person. The House bill repeals the estate tax entirely in 2024.

- The Senate bill maintains the current mortgage interest deduction of $1 million. The House bill cut it in half to $500,000.

- The House bill repeals the alternative minimum tax while the Senate bill maintains it.

- The Senate bill has seven tax brackets while the House has four.

For more information, contact Eric Snyder at erics@sema.org.

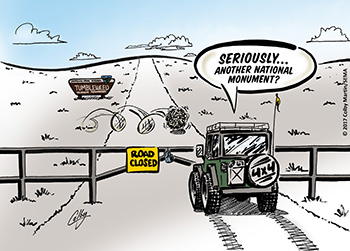

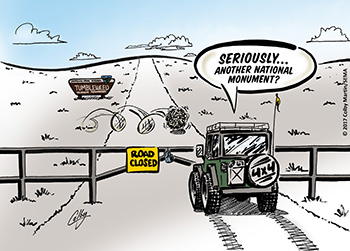

By SEMA Washington, D.C., Staff

SEMA supports legislation in the U.S. Congress to curtail the President’s power to unilaterally designate national monuments by requiring their approval by Congress and the impacted state legislature(s). |

President Trump traveled to Salt Lake City earlier this week, where he signed proclamations to reduce the size of two Utah-based national monuments by more than 2 million acres. The President’s action reduces the borders of the Bears Ears National Monument, which was created in the final days of President Obama’s term, from 1.35 million-acres to 202,000 acres. The proclamation also slashed the size of the 1.9-million-acre Grand Staircase-Escalante National Monument, which dates back to 1996, to just over 1 million acres. U.S. Department of Interior Secretary Ryan Zinke also announced plans to make changes to the boundaries of the Gold Butte National Monument in Nevada, the Castle Mountains National Monument in California and the Cascade-Siskiyou National Monument along the border of Oregon and California.

In response to President Trump’s proclamation, environmental and Native American groups have filed lawsuits to prohibit reductions to the monuments. While U.S. presidents have reduced the size of national monuments 18 times, this marks the first time that the decisions will be subject to judicial review.

The 110-year-old Antiquities Act provides the president authority to preserve land with significant natural, cultural or scientific features. It has resulted in hundreds of millions of acres being set aside over the decades leading many to question whether the footprints are larger than necessary. The issue is consequential for off-road recreation enthusiasts since national monuments automatically prohibit new roads or trails for motorized vehicles and require a new land management plan be drafted that could lead to more road closures. SEMA supports legislation in the U.S. Congress to curtail the President’s power to unilaterally designate national monuments by requiring their approval by Congress and the impacted state legislature(s).

For more information, contact Eric Snyder at erics@sema.org.

By SEMA Washington, D.C., Staff

SEMA supports legislation in the U.S. Congress to curtail the President’s power to unilaterally designate national monuments by requiring their approval by Congress and the impacted state legislature(s). |

President Trump traveled to Salt Lake City earlier this week, where he signed proclamations to reduce the size of two Utah-based national monuments by more than 2 million acres. The President’s action reduces the borders of the Bears Ears National Monument, which was created in the final days of President Obama’s term, from 1.35 million-acres to 202,000 acres. The proclamation also slashed the size of the 1.9-million-acre Grand Staircase-Escalante National Monument, which dates back to 1996, to just over 1 million acres. U.S. Department of Interior Secretary Ryan Zinke also announced plans to make changes to the boundaries of the Gold Butte National Monument in Nevada, the Castle Mountains National Monument in California and the Cascade-Siskiyou National Monument along the border of Oregon and California.

In response to President Trump’s proclamation, environmental and Native American groups have filed lawsuits to prohibit reductions to the monuments. While U.S. presidents have reduced the size of national monuments 18 times, this marks the first time that the decisions will be subject to judicial review.

The 110-year-old Antiquities Act provides the president authority to preserve land with significant natural, cultural or scientific features. It has resulted in hundreds of millions of acres being set aside over the decades leading many to question whether the footprints are larger than necessary. The issue is consequential for off-road recreation enthusiasts since national monuments automatically prohibit new roads or trails for motorized vehicles and require a new land management plan be drafted that could lead to more road closures. SEMA supports legislation in the U.S. Congress to curtail the President’s power to unilaterally designate national monuments by requiring their approval by Congress and the impacted state legislature(s).

For more information, contact Eric Snyder at erics@sema.org.