By Ashley Reyes

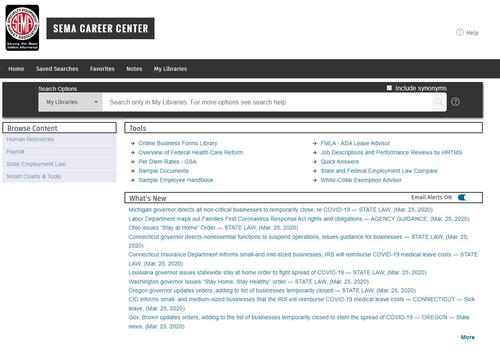

Human resource professionals in the automotive aftermarket are discovering the latest HR news and information related to the Coronavirus at the SEMA HR Hub, an online resource designed to help industry professionals stay up-to-date on the latest policies and information on human resource and employee matters.

As updates on COVID-19 are released daily, the HR Hub is an essential tool that provides labor- and employment-related coverage of pandemics and emergency or changing Federal state laws. As updates on COVID-19 are released daily, the HR Hub is an essential tool that provides labor- and employment-related coverage of pandemics and emergency or changing Federal state laws. |

As updates on COVID-19 are released daily, the HR Hub is an essential tool that provides labor- and employment-related coverage of pandemics and emergency or changing Federal state laws.

Written and organized by the expert Wolters Kluwer team of employment law editors, the SEMA HR Hub also includes a variety of business tools, new trends and best practices aimed to assist companies comply with HR federal and state requirements.

Policies, forms, bookmarks and e-mail alerts are just some of the features included that help guide users in the following areas:

- Benefits and compensation

- Discrimination and retaliation

- Employee development and retention

- Employee relations

- Federal and state employment laws

- HR management and strategy

- Risk management and compliance

- Talent acquisition and staffing

- Workplace safety and security

- And more…

Additional features include comprehensive state law summaries, custom job description and performance review modules, dynamic state law lookup, and a unique search process that looks for related industry terms.

SEMA members can access the HR Hub for free.

For questions or additional information, contact AJ Carney, senior manager of education, at andreac@sema.org.