SEMA News—November 2020

INDUSTRY NEWS

|

SEMA360 Online E-Marketplace Announced for November

SEMA announced an online marketplace to allow manufacturers and resellers in the specialty-automotive segment to connect and conduct business. Taking place November 2–6, SEMA360 was created after industry members expressed a need for a viable marketplace solution in the absence of the 2020 SEMA Show.

“Creating a platform where the industry can gather and discover new products and trends has always been a SEMA priority,” said Chris Kersting, SEMA president and CEO. “SEMA360 is the ideal solution to bring the industry together at a time when we’ve all been kept apart. The platform allows qualified buyers to interact with manufacturers, see innovative new products, check out top SEMA Show builds, and take in industry-leading educational offerings.”

Key features of SEMA360 include:

- A simplified platform for manufacturers to showcase their new products and innovations.

- Efficient interaction between manufacturers and resellers for quality business exchange.

- SEMA vehicle reveals from world-class builders.

- Industry-leading education focused on professional development and new strategies.

- SEMA’s unrivaled media contacts that amplify news, products and innovations to a worldwide audience.

More information about SEMA360 is contained in this issue starting on p. 40. To learn more about SEMA360 or to register, visit www.SEMA360.com.

According to the latest report from SEMA market research, nearly half of all aftermarket companies believed that their 2020 sales would be roughly equal to or better than sales for the previous year. Only 20% of companies expressed that same sentiment in April. |

SEMA Survey: Industry Outlook and Sales Projections Continue to Improve

Since the beginning of April, SEMA market research has been tracking how businesses within the specialty-equipment industry have navigated the disruption over the past few months. Overall, the industry continues to return to more normal operations and is increasingly more optimistic about its sales going into 2021.

In a recent survey conducted July 24–30, approximately 95% of all companies said that they were mostly business as usual or were only impacted in the short term. Nearly half (45%) stated that they were doing business as usual, compared to only 17% back in April. The number of companies reporting more severe disruptions has continued to decrease over the past few months as well.

Companies are growing equally optimistic about their sales. Today, nearly half of all companies expect higher or at least the same amount of sales as last year. That is a significant jump from April, when only 20% of companies said that.

Want the latest data and trends in the specialty-equipment industry? Check out the newest SEMA market research reports, available for free download, at www.sema.org/research.

The automotive aftermarket industry’s first active safety performance study and test program for Pedestrian Automatic Emergency Braking are documented in “Advanced Driver Assistance Systems and Aftermarket-Modified Vehicle Compliance,” which is available for download at www.semagarage.com. |

Download the Latest ADAS White Paper

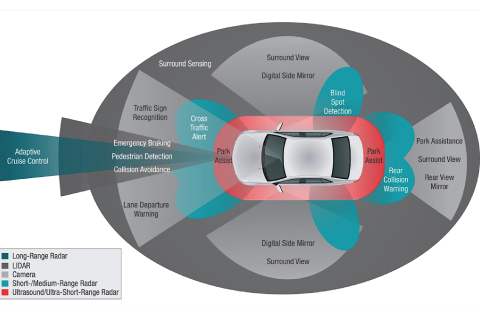

The automotive aftermarket industry’s first active safety performance study and test program for Pedestrian Automatic Emergency Braking (P-AEB) are documented in a new white paper entitled “Advanced Driver Assistance Systems and Aftermarket-Modified Vehicle Compliance.” P-AEB is an advanced driver-assistance system (ADAS) designed to help mitigate or prevent certain collisions with vehicles and pedestrians.

SEMA, the SCA Performance Group division of Fox Factory, Transportation Research Center Inc., asTech and the Equipment and Tool Institute conducted the joint study and test program. The white paper is the first in a series designed to help automotive performance aftermarket manufacturers with the resources to ensure that their products can be successfully integrated with the latest factory-installed ADAS technologies.

ADAS technologies are the gateway and foundation to many of the advanced vehicle technologies being deployed by automakers today, according to John Waraniak, SEMA vice president of vehicle technology.

“Understanding how ADAS technologies, software and sensors function is an integral component for the future of successful, complete and safe aftermarket modifications, installations and vehicle builds,” he said.

Download a copy of the “Advanced Driver Assistance Systems and Aftermarket-Modified Vehicle Compliance” white paper at www.semagarage.com/assets/pdf/adasforumresources/resource-doc-aug-15-adas-white-paper.pdf.

|

2020 SEMA Market Report: Pickup Products Top $14 Billion in Sales

While 2020 has been a challenging year for vehicle sales, pickups seem to be weathering the storm better than other platforms. According to data from Informa PLC, sales of new pickups took the smallest hit among passenger vehicle segments during March and April. Year-to-date sales of pickups are down just 10% from 2019, versus a 22% drop for overall passenger vehicle sales. According to Experian Automotive, there were roughly 56 million pickups on the road at the end 2019, and another 1.5 million new pickups have been added to the mix in the first half of this year.

Continued pickup sales are good for the specialty-equipment industry, as pickup parts accounted for 31% of all specialty auto aftermarket sales in 2019. The “2020 SEMA Market Report” details how the $14.28 billion spent modifying pickups breaks out by product type and sales channel. As vehicle sales continue to recover and consumers use the opportunity to work on their trucks, the market report can help businesses understand what those consumers will likely be looking for during the rest of the year and beyond.

To learn more, visit www.sema.org/research and download the “2020 SEMA Market Report” for free today.