SEMA News—June 2020

RETAIL BEST PRACTICES

Business Survival Tips

Advice for Retailers on Preparing for and Responding to Disaster

Titan Speed burned to the ground during the Thomas Fire in December 2017. What was left of the 3,000-sq.-ft. shop was molten aluminum. Titan Speed burned to the ground during the Thomas Fire in December 2017. What was left of the 3,000-sq.-ft. shop was molten aluminum. |

Businesses seem to increasingly find themselves at the mercy of some sort of natural disaster, whether it’s a hurricane, an earthquake, a flood or a wild fire. As a result, it’s crucial for business owners to be prepared and have a response plan in place in the event the unthinkable happens.

The Small Business Administration’s (SBA) disaster loan assistance program is designed to respond to a variety of emergencies—particularly natural disasters and especially flooding. A large number of businesses don’t carry enough insurance, so they have losses that are either uninsured or underinsured, according to Alex Contreras, director of preparedness, communication and coordination for the SBA’s Office of Disaster Assistance. He is tasked with helping to coordinate outreach to external and internal partners focusing on three main areas: preparedness, recovery and mitigation.

Don’t Break the Supply Chain

The SBA offers economic injury disaster loan assistance or working capital that businesses can utilize even if they don’t have physical damages. This benefit enables businesses with a solid supply chain to avoid disruptions.

Contreras recommended that businesses compile an updated list of their customers, employees and vendors in preparation. Establish a solid supply chain so that even if some of your vendors are affected, you are still able to resume operations

immediately.

“Your vendors may be fortunate to have not been affected, but they might have a vendor who has been, and that could cause supply-chain disruptions, so you want to have backups for them,” Contreras said.

Open Lines of Communication

Contreras advised business owners to start with a communications plan before disaster strikes that identifies each employee’s role and responsibilities. Designate a spokesperson to reach out to customers and inform them of your status, whether you’re still in operation or if you’ve moved to an alternative site that offers limited products and services. Utilize social media to communicate the status of your business to avoid the spread

of rumors.

Assess your insurance policy and vulnerabilities and make necessary adjustments to ensure that you are fully covered. Create a response plan and practice it on an annual basis so it’s not new to your employees.

“We deal with large and small businesses,” Contreras said. “Large businesses are more likely to have a plan and even a person dedicated to working on disaster response, because they have the resources. Small businesses might think they don’t have the time and resources to address it.”

Location, Location, Location

Look into temporary sites that are accessible, and relocate your equipment, inventory and supplies. In some areas, access may be limited for a long time. For instance, if you are close to a river or are in an area where waters can intrude, infrastructure, water, power and utilities may be disrupted, which can limit a business’ recovery.

In determining which type of disaster to prepare for, take a close look at where you’re located and the hazards that are most likely to affect you, then customize your preparation plans to the specific disaster for which you are most prone. For instance, businesses located in the Midwest shouldn’t be concerned about earthquakes; instead, they should focus on flooding, tornados and winter storms, while states on the East Coast should prepare

for hurricanes.

“It’s good practice for businesses to stay tuned to alerts from local emergency managers,” Contreras said. “Going beyond whether you have to evacuate or shelter in place, local alerts can provide good information for businesses about which areas will have flooding, if there’s a tornado warning or an active shooter, and the impact on supply chains, customers

and employees.”

The Aftermath

First ensure that your employees are safe, then communicate your plans to customers and vendors. Once in recovery mode, business owners must provide documentation, whether they’re filing an insurance claim or applying for disaster assistance. Financial records should be accessible; electronic versions are ideal. When documenting your damages, take photos or video during a walkthrough of your facility and narrate over the video describing the damages. This information will be helpful later on when you have to apply for programs and explain your losses.

“To get back to business as usual as quickly as possible, apply to or inquire about as many programs as possible,” Contreras recommended. “Every disaster is different, and sometimes no local programs are available. Federal programs such as the SBA Disaster Loan Program have partnerships with small-business development centers, SCORE business counselors, women’s business centers and veteran’s business outreach centers, all of which provide free business counseling and technical assistance to small businesses.”

While the SBA’s program provides assistance to help with repairs, rebuilding of physical losses and working capital, the above-mentioned resource partners help companies establish a plan moving forward.

Business interruption insurance is another form of insurance that companies either don’t have or are underinsured for, according to Contreras. In addition to physical losses, there may be an indirect impact where businesses are now experiencing a loss of revenue due to an

interruption.

“The disaster loan program is the only direct-loan program the SBA offers,” Contreras said. “So, the SBA is actually the lender, and we provide low-interest disaster loans to not just businesses of all sizes but also private nonprofit organizations as well as homeowners and renters. We find that the majority of our assistance ends up going toward homeowners and renters, just because they’re disproportionately affected.”

The SBA is currently providing disaster loans for working capital to small businesses affected by COVID-19 (coronavirus). The organization is authorized to provide companies up to $2 million for any combination of physical damage or economic injury. For home loans, the SBA can offer up to $200,000 for repair or replacement of the primary residence and up to $40,000 for replacement of a business’s personal property. In some cases, the SBA can go above $2 million if the company is considered a major source of local employment.

SBA disaster loans can also be used for mitigation or protective measures. For example, if a business is in a high-risk flood area and there’s a flood, a structure can be elevated during rebuilding mode so that it doesn’t flood again.

Since 1976, Titan Speed had survived numerous wild fires; however, it became one of more than 1,000 structures that burned in the 2017 Thomas Fire. Since 1976, Titan Speed had survived numerous wild fires; however, it became one of more than 1,000 structures that burned in the 2017 Thomas Fire. |

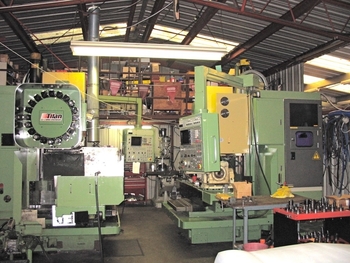

Titan Speed’s Bob Sanders was able to save some equipment from his shop, but most of the big machines, such as this CNC machine, were also lost to the Thomas Fire. Titan Speed’s Bob Sanders was able to save some equipment from his shop, but most of the big machines, such as this CNC machine, were also lost to the Thomas Fire. |

The Case of Titan Speed

Bob Sanders, president of Titan Speed, lives in the mountains between the towns of Ojai and Santa Paula, California. In December 2017, his home and

3,000-sq.-ft. shop were two of the more than 1,000 structures that were lost during the Thomas Fire.

“It was just a firestorm,” Sanders said. “Let’s just say what was left of the shop was molten aluminum running out of all four sides of the building. We had never evacuated before, but it was just plain scary that night. We’ve been up here since 1976, and we’ve seen numerous other fires go by, but we’ve never seen anything quite like this.”

According to Sanders, faulty electrical wires caused the fire, and when telephone poles fell, a transformer blew up, causing the fire to rage out of control and burn 550 houses in Ventura County the first night alone.

“You could see the flames,” Sanders said. “This end of the fire started less than a mile from where we live, and it was supercharged by the wind. We loaded up and took off with burning balls of fire following our motorhome as we drove away.”

Sanders said that he frequently cleared brush away from his home and shop; however, the wind would always blow anything that was combustible his way because he was located so close to the Los Padres National Forest. He also said that he had an evacuation plan in place, but there was no water or electricity on the night of the fire.

“We were just devastated,” he said. “There was nothing left. Both our employees were up here working, trying to help us. We did save a lot of stuff from the house and the shop, but most of the big machines were gone, and there was nothing we could do.”

Because Titan Speed was not located in a commercial zone, Sanders had no commercial business insurance. “Thankfully, we had a really good policy on our house, but I’m here to tell you that nobody has enough insurance on their house.”

The race car and trailer of Titan Speed’s Bob Sanders were also lost to the Thomas Fire. The race car and trailer of Titan Speed’s Bob Sanders were also lost to the Thomas Fire. |

According to Sanders, the company was shut down for about three or four months before he decided to give what was left of the business to a friend of his in Atascadero, California, and Sanders continues to serve as a technical consultant.

“The business is just minuscule compared to what we were,” Sanders said. “[The new owner’s] sales are probably 20% of what we were doing, but even after two and a half years, we’re doing our best to pick up the pieces.”

It took Sanders a year to get a building permit through the county of Ventura for his house, which has since been rebuilt, and six months to get a building permit for his garage.

“These metal buildings are all engineered up the wazoo, and to get that through the county is difficult and very expensive,” Sanders said. “For example, when we built our first facility back in 1976, it was 960 sq. ft., and it only cost about $5,000. It had 14 cubic yards of cement in the floor. This new building is 1,600 sq. ft., but it has 57 cubic yards of concrete. I mean, it’s like freeway construction.”

After the fire, Sanders’ neighbors created an online GoFundMe page on his behalf, and he also received a donation from the Automotive Aftermarket Charitable Foundation. But Sanders has some regrets looking back.

“I might have stayed and tried to fight the fire, but that’s water under the bridge,” he said.

| Natural Disaster Impact | |

Source: www.ready.gov/business |

| Average Daily Loss of Businesses That Close Due to Disaster | |

Source: www.ready.gov/business |

| Additional Resources | |

| U.S. Small Business Administration (SBA): www.sba.gov |