By SEMA News Editors

President Donald Trump has agreed to exempt goods and services that comply with the 2020 U.S.-Mexico-Canada Agreement (USMCA)from the previously announced 25% tariffs on Canada and Mexico for one month. Following a call with top executives from General Motors, Ford and Stellantis, the administration first agreed to exempt auto imports that complied with USMCA from the tariffs imposed on March 4 before expanding the exemption to USMCA compliant products from Mexico and Canada. Click here for the White House fact sheet on tariff adjustments to minimize disruptions to the U.S. automotive industry.

"We are going to give a one-month exemption on any autos coming through USMCA... so they are not at a disadvantage," White House press secretary Karoline Leavitt told reporters. "Reciprocal tariffs will still go into effect on April 2."

More positive news for the automotive aftermarket: U.S. Commerce Secretary Howard Lutnick previewed the exemption covering all USMCA-compliant goods and services.

"If you lived under Donald Trump's USMCA agreement, you will get a reprieve from these tariffs now. If you chose to go outside of that, you did so at your own risk, and today is when that reckoning comes," he told CNBC.

SEMA, in its recent "SEMA 2025 Future Trends Report" market research study, noted that tariffs have the potential to increase costs for OEMs, part manufacturers and consumers. The report notes that:

- Most of the tariff exposure is likely to small- and mid-sized parts manufacturers, particularly those who rely on international supply chains for some of their components and materials.

- Tariffs disproportionately impact businesses that pay upfront for goods and services, with small- and medium-sized companies potentially experiencing cash-flow issues, delayed payments, and reduced capacity and inventory.

- Competition to secure supplies of domestic steel, and thus lower costs, may be intense.

Read more about the SEMA 2025 Future Trends Report here. Questions? Contact Eric Snyder at erics@sema.org.

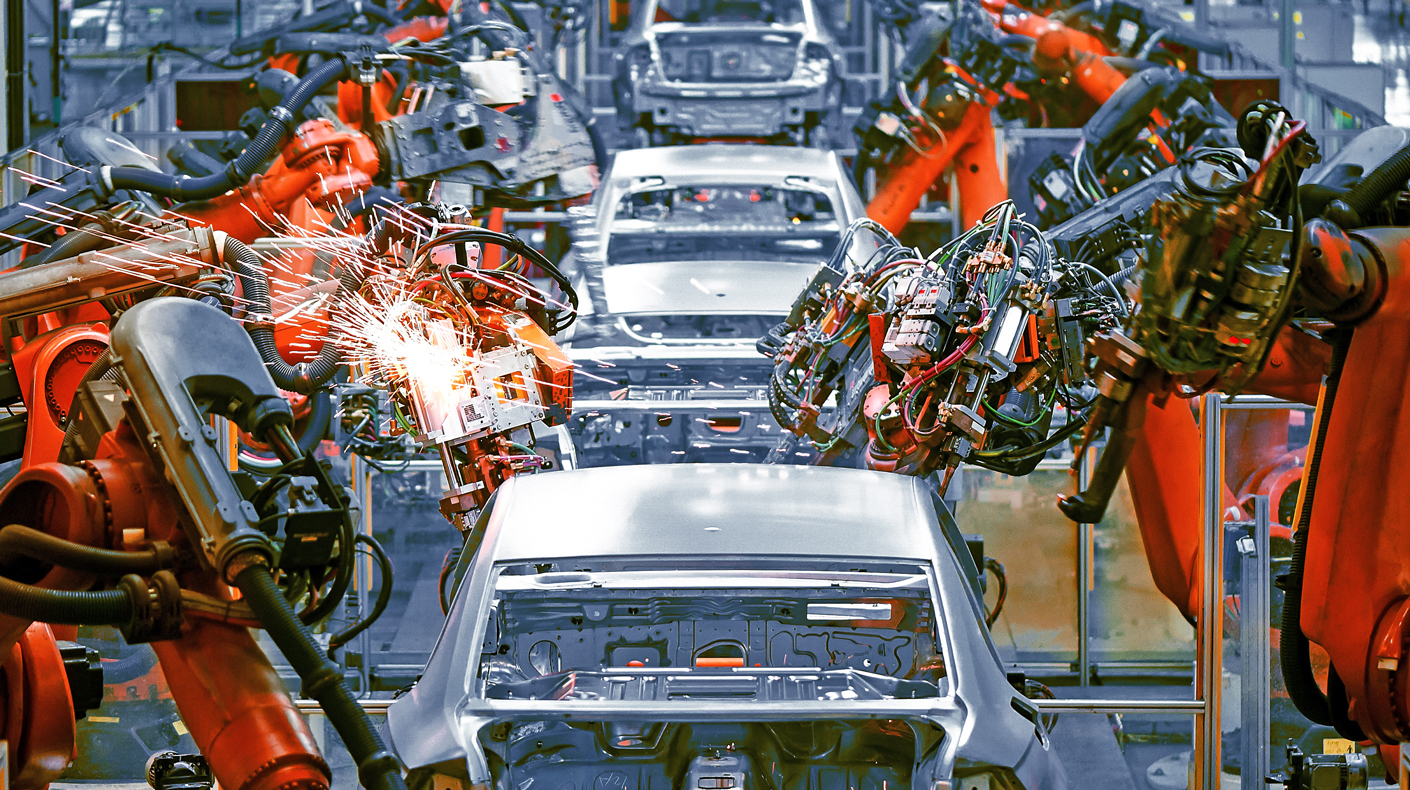

Photo courtesy of Shutterstock