RESEARCH

The “2021 SEMA Market Report”

Despite the Pandemic, Automotive Specialty-Equipment Sales Grew to $47.89 Billion

By Chad Simon

SEMA Market Report” was an increase in online purchasing.

COVID-19 forced people to shop online, but not exclusively by

any means.

Even in the face of a pandemic that ravaged livelihoods and economies globally, the automotive specialty-equipment market somehow managed to continue its steady growth trend, up to $47.89 billion in 2020—a 4% increase over 2019, according to the recently released “2021 SEMA Market Report.” Slower growth is expected to continue into 2022 as more businesses reopen and compete for consumer dollars before taking off again in late 2022 or early 2023.

The COVID Effect

While some businesses felt pain, the COVID-19 pandemic didn’t hurt the automotive specialty-equipment industry as much as one would have thought. The market was expected to contract to some degree with the economic disruption that took place in 2020, according to Gavin Knapp, SEMA director of market research, but many businesses reported record sales in 2020.

“March and April were a big shock to the entire economy, but a lot of businesses were able to adapt and find ways to keep selling products,” said Matt Kennedy, SEMA market research manager. “At the end of the year, we finished with strong growth that rebounded quickly and continued forward from that initial shutdown period.”

Despite layoffs and high unemployment, consumers still spent money on the items that were available to them because certain things were considered out of bounds, according to Knapp. They couldn’t spend money on entertainment, travel, food and hospitality, but they could spend it on their cars, so a lot of people started engaging in their hobby.

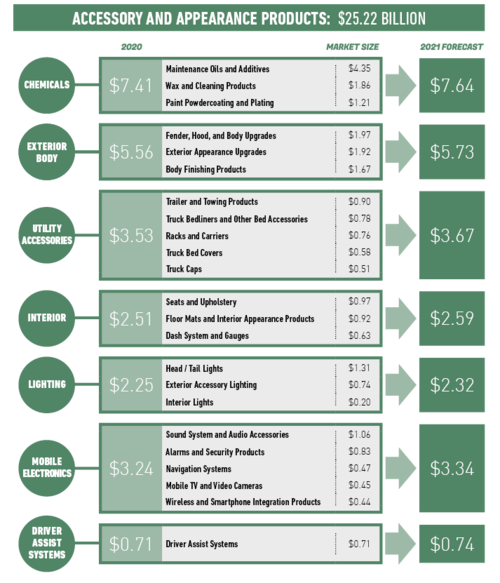

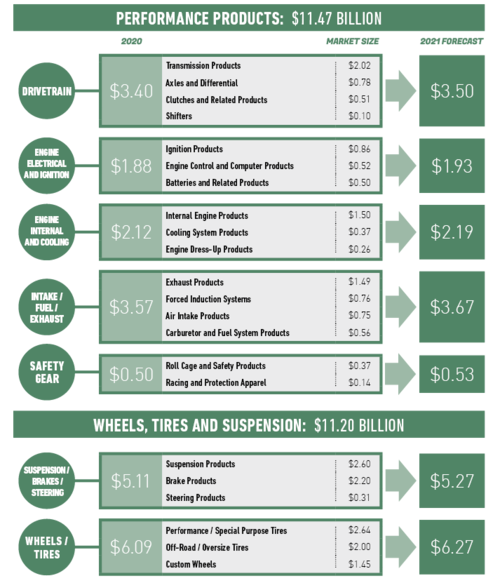

One such instance was performance-related products, which did well last year at $11.47 billion.

“We began to see people be of the mindset that, ‘I don’t have to drive my car every day if it’s a daily driver,’ or ‘I’ve got this project, and now I have the time to work on it, so I can do more intricate, even more expensive upgrades,’” Knapp said.

Industry-wide, sales were up around 4% last year. In 2019, the industry reached $46.2 billion in retail sales. In 2020, that number increased to $47.89 billion, and sales are forecast to reach $57.16 billion by 2024.

“When you take the disruption—and some companies did have poor years—it all balanced out by those that saw record growth,” Knapp said. “Ultimately, the overall industry stayed close to what’s been our growth trend over the last five years.”

Specialty-Equipment Retail Sales $ Billions

$47.89 billion. Sales are projected to reach nearly $57.16 billion

by 2024. Source: 2020 SEMA U.S. Market Data

Industry Segments That Took a Hit

As with the entire economy, the second quarter into the middle of 2020 was a challenging time for the automotive specialty-equipment industry due to supply-chain disruptions and also because some businesses had to close their doors while the rest were required to comply with social-distancing policies, according to Knapp.

The repair-and-replacement side took somewhat of a hit because shutdowns forced people to stay home. However, it also gave consumers an opportunity to have both time and disposable income that they weren’t using on things such as vacations to spend on their cars, even though they weren’t necessarily wearing out parts by driving a lot.

“Sometimes when people need to replace a part, they upgrade, and that’s part of our industry,” Kennedy said. “That was offset by how people suddenly had disposable income but fewer things to throw it at, so working on their cars or trucks remained an option for them. There were competing and odd dynamics in play.”

Mobile electronics was another segment where sales were flat at $3.24 billion—not due to COVID-19 but largely because cars now come with a quality sound system or an integrated system that you can’t swap out anymore, according to Knapp. Advanced driver-assistance systems (ADAS) are still growing, but not nearly as fast as they’ve grown on the OEM side, where all new cars have multiple ADAS products installed, so there’s less of a need for add-on products.

Because new-vehicle sales were down last year, sales of utilitarian products such as racks that consumers add on at the dealership dropped a bit from $0.80 billion in 2019 to $0.76 billion in 2020, according to Kennedy. Apart from a few isolated cases that are tied to the decline in vehicle sales, everything else has been following the consistent upswing seen over the past several years.

2020 Consumer Purchase Estimates by Sales Channel % of Sales

channels—an increase from 35% to 40% in previous years.

Source: 2020 SEMA U.S. Market Data

Online Sales Increase

One trend that stood out when analyzing data from the “2021 SEMA Market Report” was an increase in online purchasing. COVID forced people to shop online, but not exclusively by any means, according to Kennedy. In fact, a sizable share of sales came from retail stores because many auto-parts businesses were considered essential during the pandemic. As a result, they weren’t forced to shut down as much as some other retail businesses, and that allowed the industry to continue with in-person sales. However, those who weren’t comfortable entering to a store turned to online sales channels.

“It wasn’t a drastic increase in online sales, but we’ve been ahead of the curve for a while, so when sales tip over to a little more than half online, that’s an increase from about 35% to 40% previously,” Kennedy said.

Parts sales channels vary by vehicle segment, but it’s often more related to the part than anything else. For instance, motor oil is easy to buy online and ship, but it’s one of those things that people buy in a store when they need it.

“Certain parts really lend themselves to online purchases,” Knapp said. “Are they easy to ship? Are they easy to install? Does it make much more sense for you to know what you want and purchase it online? Other products may require a more complicated installation or they’re heavy, so they are difficult and expensive to ship.”

It used to be true that hardcore enthusiasts who had an understanding of what they were looking for preferred to shop in stores versus online, but that’s all changed.

“When I first started in the industry, people used to say, ‘Our guys don’t go online; they’re just in the garage,’” Knapp said. “Obviously, that’s not true at this point. Our guys are doing their research and shopping online—especially the most hardcore guys, because they have the most understanding of what they want. Although they may not buy online, they go there to look up specs and prices.”

As for the general market, if customers are going after a big purchase, they’ll probably take a somewhat similar path. They are usually armed with less internal knowledge, so they may be more likely to go into a store and talk to salespeople. However, many of their purchases are also going to be on a whim, according to Knapp.

2020 Consumer Purchase Estimates by Vehicle Segment % of Sales

SEMA U.S. Market Data

Non-Enthusiasts vs. Enthusiasts

The SEMA Market Research team continues to see that younger consumers are the more dynamic and daring participants in the automotive specialty-equipment industry. For a hobby that transcends generations, the data indicates that people tend to slow down as they get older. Among accessorizers, about 60% are under the age of 40.

In addition, while non-enthusiasts still hold the upper hand in terms of sales, enthusiast purchases are catching up.

“The population didn’t really shift regarding who made changes to their vehicles; it’s still a narrow split in favor of non-enthusiasts,” Kennedy said. “But if you analyze who is actually spending money, enthusiasts spend more dollars, but non-enthusiasts didn’t drop out of the market all of a sudden.”

With the pandemic keeping people in their homes and doing more do-it-yourself projects, a larger shift toward enthusiast purchases was expected, especially in the amount of purchases made. However, the SEMA Market Research team expects non-enthusiast sales to accelerate in 2021 and beyond as those consumers get back into their cars and start thinking about the things they’d like to do to personalize them.

2020 consumer purchase estimates $ Billions

billion in 2020, of which chemicals represented $7.41 billion.

Source: 2020 SEMA U.S. Market Data

Motivation Behind Customization

The SEMA Market Research team found three motivating factors behind vehicle customization. The first is appearance and utility. Next is lifestyle (those who are in car clubs and post their vehicles on social media). Finally, there are the classic upgraders or hobbyists who enjoy wrenching on their cars in their garages.

People will customize or modify any type of vehicle up to a point, but pickups are a huge slice of the market, representing 28% of dollars spent in 2020 among both enthusiasts and non-enthusiasts. SUVs (13%) and CUVs (16%) are also popular targets for customization. On the other end of the spectrum, electric and alternative-power vehicles make up only a small fraction of total vehicles on the road and represent just 1% of automotive specialty-equipment market sales.

“There are certain vehicles that really lend themselves more to the aftermarket, either because of their type or a lifestyle or culture around them,” Knapp said. “Pickups are the ultimate platform, because you can do anything to them. On the off-road and utility side, you’ve got SUVs and CUVs. You’re going to see a lot of customization in any vehicle that’s considered off-road-capable, starting with the Jeep Wrangler. On the traditional car side, we see some of the smaller compact cars still getting accessorized, but the key ones right now are the ones you might consider the new musclecars—Mustang, Camaro and Challenger. Then there’s a whole range of classics, which are always going to be a good spot for our industry.”

Wheels and tires have long been considered the “gateway drug” into the automotive specialty-equipment industry, according to Knapp. Whether performance tires or off-road, oversized tires are a large piece of the market.

“They are among the things you can do right away, and they’re very simple,” Knapp said. “They give you a lot of bang for your buck in terms of changing the look and even performance. From there, people tend to take a couple different paths. One might be aesthetics and changing the look of your vehicle. The other is performance—for example, suspension parts or lift kits, which are big for the truck category.”

2020 Consumer Purchase Estimates $ Billions

make up a large chunk of the industry at $11.47 billion and

$11.20 billion, respectively. Source: 2020 SEMA U.S. Market

Data

What the Future Holds

Despite all the doom and gloom, 2020 actually turned out to be a profitable year for many companies, according to Knapp. However, he expects slowed growth over the next couple of years.

“As the economy begins to reopen and there are more options regarding where people can spend their money, will we see a little pullback in spending on our industry? I think the answer will be yes, but I don’t think it’ll be an overwhelming yes,” Knapp said. “People will actually expand their spending due to the fact that the rate of savings in this country is greater, so they’ll say, ‘What I’m doing here is still cool, but I also have this savings that I’m going to use to go on a vacation.’ So our expectation is that we’ll see some slower growth, flattening a little in late 2021 into 2022, and then we’ll ramp back up to our normal level.”

Even with consumer spending higher at this time than it was in 2019, there are still some areas to watch. For instance, despite high unemployment, more companies are looking to hire, which Knapp said indicates a labor shortage. In addition, supply-chain disruptions and the availability of raw inputs and input parts have led to price inflation.

“Because we also have high savings rates, consumers will have even more money to spend going forward, as they will typically spend down their savings somewhat, so we could also see the economy take fire here in the second half of the year,” Knapp said.

“2021 SEMA Market Report” Fast Facts

- In 2020, the automotive specialty-equipment market hit a new high of $47.89 billion in total parts sales.

- Sales are projected to increase to nearly $57.16 billion by 2024.

- Among accessorizers, 60% are under the age of 40.

- Pickups once again make up the largest vehicle segment with a 28% market share.

- Just over half of dollars spent in 2020 went through online channels. n

Source

Source

The “2021 SEMA Market Report” is free and a benefit of SEMA membership. Along with a host of other free industry reports, it can be found at www.sema.org/market-research. The SEMA Market Research team is also available to help the industry directly. If you have any specific questions, contact SEMA Market Research Manager Matt Kennedy at mattk@sema.org or 909-978-6730.